| View previous topic :: View next topic |

| Author |

Option writing with assured Gain on investments |

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #1  Posted: Mon Jul 02, 2012 12:09 pm Post subject: Option writing with assured Gain on investments Posted: Mon Jul 02, 2012 12:09 pm Post subject: Option writing with assured Gain on investments |

|

|

Dear Friends

I’m constantly watching and reading discussion of SB about pro and cons of Option Writing.

Here I am discussing a strategy to get it proper and eliminate fear of writing the same.

This is with due respect to INTRA-DAY traders who are earning very fine with their intra-day trading plans.

First of all in this strategy, we write on NIFTY INDEX options as they are most liquid in all stock and index options.

Following are tools and indicator I suggest for taking decision for writing the options.

1. Charts of NIFTY spot (as options expire @ of spot price on settlement day).

2. Bollinger Band @ 20 values.

3. EMA 5 /24 @ their crossovers.

4. Option Pain

5. DMI 24 and its crossover

6. MACD @ default

7. RSI @ default.

A. Charts of NIFTY Spot:- It is used to get real prices of option at which they are going to expire. It is irrespective of fact that option prices are valued in contrast with NIFTY future prices.

B. Bollinger Band @ 20:- The BB 20 is used for reason that in a month usually there is 20-25 trading days.

C. EMA 5 /24 @ their crossovers:- for same reason above that there are 20-25 trading days in a month.

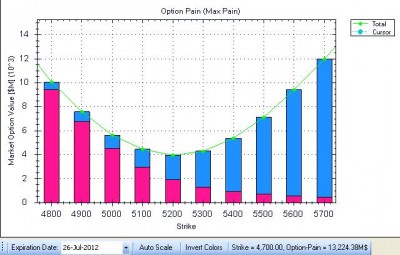

D. Option Pain:- Option Pain is a concept which identify with study of all options write at all strike prices and value of liability at each strike price. At the lowest option pain, the options at market vide expires at lowed liability

E. DMI 24/24:- for same reason above that there are 20-25 trading days in a month.

F. MACD @ default:- : for identifying divergences.

G. RSI @ default: for identifying divergences.

Rest in next post

Regards

Arnav

|

|

| Back to top |

|

|

|

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #2  Posted: Mon Jul 02, 2012 2:14 pm Post subject: Posted: Mon Jul 02, 2012 2:14 pm Post subject: |

|

|

Friends: Please remember one thing most important.

Option writer's liability potentially UNLIMITED.

(Eg if you sold 4500 call just before NF rise from 4600 to 5600 and did not square it off, please calculate your liability)

Option buyer's liability restricted to initial premium paid

Regards, Prakash Holla

|

|

| Back to top |

|

|

pattiboy02

White Belt

Joined: 16 Mar 2009

Posts: 220

|

Post: #3  Posted: Mon Jul 02, 2012 7:59 pm Post subject: Posted: Mon Jul 02, 2012 7:59 pm Post subject: |

|

|

| pkholla wrote: | Friends: Please remember one thing most important.

Option writer's liability potentially UNLIMITED.

(Eg if you sold 4500 call just before NF rise from 4600 to 5600 and did not square it off, please calculate your liability)

Option buyer's liability restricted to initial premium paid

Regards, Prakash Holla |

Dear Prakash

One thing you are missing that if anybody sold NIFTY future@4500 just before NF rise from 4500 to 5600 and did not square it of, than Option sellers has less loss as compared with NF seller.

Kindly give a just thought on it otherwise postion in both cases are same.

Option writing are for professional and me too think shall be avoided by other traders

Thanks

Pattiboy02

|

|

| Back to top |

|

|

bhalchandra7117

White Belt

Joined: 16 Jan 2010

Posts: 71

|

Post: #4  Posted: Mon Jul 02, 2012 9:17 pm Post subject: Posted: Mon Jul 02, 2012 9:17 pm Post subject: |

|

|

Dear Pattiboy,

I have also observed that most of the time Option Writing is profitable than Option Buying. Only concren is high margin is required to take the position.

Please tell me how to take trade according to your strategy.

--------- Bhalchandra

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #5  Posted: Mon Jul 02, 2012 10:56 pm Post subject: Posted: Mon Jul 02, 2012 10:56 pm Post subject: |

|

|

@Arnav

Waiting for your next post.

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #6  Posted: Mon Jul 02, 2012 11:00 pm Post subject: Posted: Mon Jul 02, 2012 11:00 pm Post subject: |

|

|

@Pattiboy

I think all traders are professional and hence there is no reason why one should avoid selling options.

And remember selling options is not much riskier than you sell NF. When NF can move from 4600 to 5600 your loss will be less than selling NF had you sold options. Just try to calculate.

But its not your fault. All so called experts always say like this. Options are just an instrument should be viewed like that and without any fear you can always short sell them too.

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #7  Posted: Tue Jul 03, 2012 12:18 am Post subject: Posted: Tue Jul 03, 2012 12:18 am Post subject: |

|

|

Dear Friends

Let’s start with certain understandings:-

1. Capital requirements: for starting with Nifity-50 1 lot total reserve capital of Rs.2.5 lac.

2. One should be like stubborn in squaring and shifting positions.

3. One should have patience irrespective of market movement.

4. There are no exceptions to the rules.

5. Options are just like selling Insurance, all things are not going to happen at once, means, your liability is limited to residual in money options at expiry.

6. For option trading consider following five types of trends:-

a. Strong upward trend

b. Creeping upward trend

c. Consolidating trend

d. Creeping downward trend

e. Strong downward trend

Following is Chart showing these trends to be used for writing options

Also find attached current Option Pain Graph for Nifty as on 02-07-2012 @5200

Rest in Next post

Regards

Arnav

| Description: |

|

| Filesize: |

158.48 KB |

| Viewed: |

894 Time(s) |

|

| Description: |

|

| Filesize: |

48.81 KB |

| Viewed: |

623 Time(s) |

|

|

|

| Back to top |

|

|

anand_2012

White Belt

Joined: 06 Feb 2012

Posts: 84

|

Post: #8  Posted: Tue Jul 03, 2012 10:31 am Post subject: Posted: Tue Jul 03, 2012 10:31 am Post subject: |

|

|

Dear arnav

what is the time frame for this spot nifty

ema 5/24 cross over

5 or 15 or 30 mins ???

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #9  Posted: Tue Jul 03, 2012 12:20 pm Post subject: Posted: Tue Jul 03, 2012 12:20 pm Post subject: |

|

|

| anand_2012 wrote: | Dear arnav

what is the time frame for this spot nifty

ema 5/24 cross over

5 or 15 or 30 mins ??? |

Dear

All on EOD basis.

Thanks

Arnav

|

|

| Back to top |

|

|

anand_2012

White Belt

Joined: 06 Feb 2012

Posts: 84

|

Post: #10  Posted: Tue Jul 03, 2012 12:35 pm Post subject: Posted: Tue Jul 03, 2012 12:35 pm Post subject: |

|

|

| arnav2007 wrote: | | anand_2012 wrote: | Dear arnav

what is the time frame for this spot nifty

ema 5/24 cross over

5 or 15 or 30 mins ??? |

Dear

All on EOD basis.

Thanks

Arnav |

thanks G

|

|

| Back to top |

|

|

bhalchandra7117

White Belt

Joined: 16 Jan 2010

Posts: 71

|

Post: #11  Posted: Tue Jul 03, 2012 6:37 pm Post subject: Posted: Tue Jul 03, 2012 6:37 pm Post subject: |

|

|

How to take Trade by seeing chart? Which strike price option is to sell?

---------Bhalchandra

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #12  Posted: Wed Jul 04, 2012 5:04 pm Post subject: Posted: Wed Jul 04, 2012 5:04 pm Post subject: |

|

|

Lets Start with assuming zero positions:-

Kindly refer to attached Option Pain Graph

1. Option Pain is tilting towards 5300 from 5200 level previously

2. Closing EOD Candle failed to breach BB-20 @ 5300 but touching the same depicting creeping uptrend.

3. There is Positive crossover 5/24 EOD and Positive MACD & DMI..

To start with from here,

a. we short 5200 put @ 45 as it is at Option Pain and

b. we short 5300 call @ 96 as market is tilting towards 5300 but failed to breach BB-20.

Rest I explain on live market basis.

Regards

Arnav

| Description: |

|

| Filesize: |

42.14 KB |

| Viewed: |

571 Time(s) |

|

|

|

| Back to top |

|

|

arnav2007

White Belt

Joined: 29 Jun 2009

Posts: 46

|

Post: #13  Posted: Fri Jul 06, 2012 6:21 pm Post subject: Posted: Fri Jul 06, 2012 6:21 pm Post subject: |

|

|

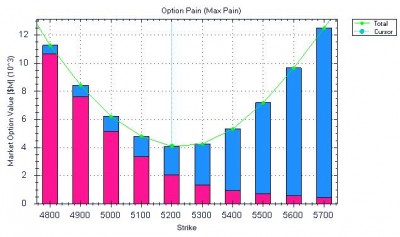

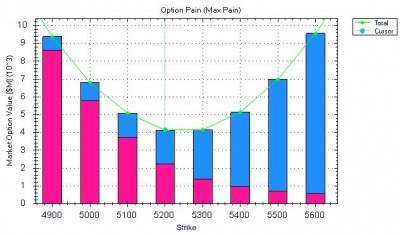

Refer to attached Option Pain Graph

1. Option Pain is now equal between 5200 & 5300 strick prices

2. Closing EOD Candle below upper BB-20 @ 5350.

3. There is Positive crossover 5/24 EOD and Positive MACD & DMI.

So maintaining same position @ short 5200 put @ 45 and short 5300 call @ 96 totalling 141 points, no loss between 5059 to 5441.

best wishes

Arnav

| Description: |

|

| Filesize: |

42.71 KB |

| Viewed: |

524 Time(s) |

|

|

|

| Back to top |

|

|

rishu

White Belt

Joined: 08 Dec 2009

Posts: 38

|

Post: #14  Posted: Fri Jul 06, 2012 7:04 pm Post subject: Posted: Fri Jul 06, 2012 7:04 pm Post subject: |

|

|

| Lot of thanks for adding to our knowledge...please tell me from where to get option pain calculator....pl. suggest some link, if you can, for further study of option pain calculator

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #15  Posted: Fri Jul 06, 2012 7:52 pm Post subject: Posted: Fri Jul 06, 2012 7:52 pm Post subject: |

|

|

| arnav, midpoint of 5059 and 5441 is 5250 so if one had shorted as you had advised the apx profit at today's close of 5316 would be about 11.40. Am I right?

|

|

| Back to top |

|

|

|