| View previous topic :: View next topic |

| Author |

Options trade ~ Welgro Corner |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #76  Posted: Mon Aug 11, 2014 10:00 am Post subject: Posted: Mon Aug 11, 2014 10:00 am Post subject: |

|

|

Due to some formula error in my sheet...

i will update my call after some time...

(last trade is short 7700ce and short 7500 pe,Short Strangle (Neutral)) still open ...

i will update my exit... |

|

| Back to top |

|

|

|

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #77  Posted: Mon Aug 11, 2014 12:13 pm Post subject: Posted: Mon Aug 11, 2014 12:13 pm Post subject: |

|

|

short strangle position closed...

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #78  Posted: Mon Aug 11, 2014 12:30 pm Post subject: Posted: Mon Aug 11, 2014 12:30 pm Post subject: |

|

|

Buy nifty 7600 call 4 lots only above 107.50

Stoploss : 103.00

Book profit 2 lot at : 112.00

Balance 2 lot hold smy next update... |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #79  Posted: Mon Aug 11, 2014 12:43 pm Post subject: Posted: Mon Aug 11, 2014 12:43 pm Post subject: |

|

|

| welgro wrote: | Buy nifty 7600 call 4 lots only above 107.50

Stoploss : 103.00

Book profit 2 lot at : 112.00

Balance 2 lot hold smy next update... |

Sl Hit |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #80  Posted: Mon Aug 11, 2014 3:11 pm Post subject: Posted: Mon Aug 11, 2014 3:11 pm Post subject: |

|

|

Good return, But i closed the position earlier...

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #81  Posted: Tue Aug 12, 2014 1:28 pm Post subject: Posted: Tue Aug 12, 2014 1:28 pm Post subject: |

|

|

----------------------

Last edited by welgro on Mon Nov 24, 2014 5:49 pm; edited 1 time in total |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #82  Posted: Tue Aug 12, 2014 2:50 pm Post subject: Posted: Tue Aug 12, 2014 2:50 pm Post subject: |

|

|

|

|

| Back to top |

|

|

vaishuu82

White Belt

Joined: 04 Sep 2013

Posts: 155

|

Post: #83  Posted: Tue Aug 12, 2014 3:14 pm Post subject: Posted: Tue Aug 12, 2014 3:14 pm Post subject: |

|

|

| welgro wrote: |  |

Good suggestion,7700 call from 70 to 100,gsift rally  |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #84  Posted: Sat Nov 22, 2014 1:36 pm Post subject: Posted: Sat Nov 22, 2014 1:36 pm Post subject: |

|

|

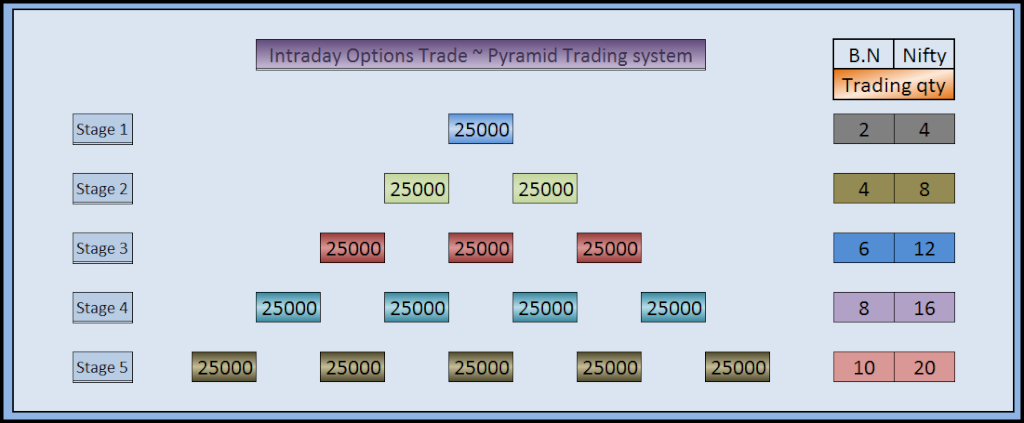

25K is starting capital. (for testing purpose)

First stage : You can take Banknifty options 2 lots .Nifty options 4 lots.

In first stage Expected return 25K. You will go next stage when you get every 25K profits.

----------------------------------------------------------

It's possible or not ?

Kindly give your valuable suggestions. and feed backs. |

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #85  Posted: Sat Nov 22, 2014 7:11 pm Post subject: Posted: Sat Nov 22, 2014 7:11 pm Post subject: |

|

|

| Timeframe for each stage? |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #86  Posted: Sat Nov 22, 2014 9:24 pm Post subject: Posted: Sat Nov 22, 2014 9:24 pm Post subject: |

|

|

| amitagg wrote: | | Timeframe for each stage? |

Time frame is depending on market condition.. It's possible or not ?

Any one tried this method before...

Or need any alternation on this money management system... |

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #87  Posted: Sat Nov 22, 2014 11:43 pm Post subject: Posted: Sat Nov 22, 2014 11:43 pm Post subject: |

|

|

| welgro wrote: | | amitagg wrote: | | Timeframe for each stage? |

Time frame is depending on market condition.. It's possible or not ?

Any one tried this method before...

Or need any alternation on this money management system... |

Since u asked and people have different methods and can be successful, while u know best, I can only mention that both with this and crude oil or any other instrument, the most successful hedge fund managers, floor traders, etc. surveyed and interviewed would have one instinct - waiting waiting and going full flow in their set ups......and not necessarily having a "same" fund utilization approach. So one cannot or should not place equal bets on all trades in any given time period, like in your case where it is also discretionary like patterns, etc. as u mentioned before.......having that 'market sensing ability'.

especially with options, it has to be 10x returns sometimes or whatever and 2x on other times etc....so difficult to divide the total 'trade' capital on particular proportion.....(I do not trade options but have heard this from actual traders trading 10K lots most times......)

It is certainly possible. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #88  Posted: Mon Nov 24, 2014 9:46 am Post subject: Posted: Mon Nov 24, 2014 9:46 am Post subject: |

|

|

Lets try....

First entry :-

NIFTY14NOV8400CE, Buy 4 lots above : 134.15, Stoploss : 125, Book 50% qty @ 143.3, Hold Balance Qty., TOTAL RISK Rs:915.00

Note : Price once if trade below our stoploss...Cancel the order..Entry is invalid... |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #89  Posted: Mon Nov 24, 2014 11:17 am Post subject: Posted: Mon Nov 24, 2014 11:17 am Post subject: |

|

|

BANKNIFTY14NOV18100CE, Buy 2 lots above : 191.5, Stoploss : 178.65, Book 50% qty @ 204.35, Hold Balance Qty., TOTAL RISK Rs: 642.5

Note : Price once if trade below our stoploss...Cancel the order..Entry is invalid...

Net slow . sorry for some tick late update |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #90  Posted: Mon Nov 24, 2014 11:43 am Post subject: Posted: Mon Nov 24, 2014 11:43 am Post subject: |

|

|

| welgro wrote: | BANKNIFTY14NOV18100CE, Buy 2 lots above : 191.5, Stoploss : 178.65, Book 50% qty @ 204.35, Hold Balance Qty., TOTAL RISK Rs: 642.5

Note : Price once if trade below our stoploss...Cancel the order..Entry is invalid...

Net slow . sorry for some tick late update |

Booked 1 lot (50% qty at 204.35 ).Hold balance qty with same stoploss.. TSL update Later.."Now we are in Risk free Zone"

i am using 15 min chart ..and using TSL calculation..

Top = Sum(High, 7) / 7;

Bottom = Sum(Low, 7) / 7;

TRP =(Top+Bottom)/2;

Trail stoploss = TRP > 15 min Close ; (Candle low is TSL) |

|

| Back to top |

|

|

|