| View previous topic :: View next topic |

| Author |

Overbought-Oversold Intraday Tradins Strategy |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #106  Posted: Mon Nov 07, 2011 5:52 pm Post subject: Posted: Mon Nov 07, 2011 5:52 pm Post subject: |

|

|

| rk_a2003 wrote: | "I have allowed the trades to run to next day which i feel is improper since by next day new value of DV has come into market and should form its effect. Pls advise if trades to be completed intraday only.I'll continue backtest based on fresh inputs."

You are right vinst . Let us stick to Intraday for intial backtest; carrying forward may not be right as per original strategy.

If possible you may test it for two situations.

1.With a stop loss of 50 points and a target of 30-35 points.

2.As per your proposal....... with a dyanmic SL(based on volatality) which comes around 30-35 points.

However, I expect ANS response in this regard.

RK |

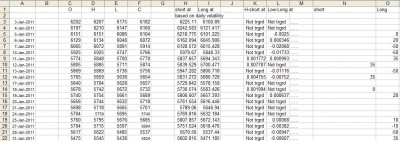

test in Jan'11 with 50 pt SL and 35 pt at profit booking tgt.

Net for Jan 2011 is -20 points (brokerage not accounted for).

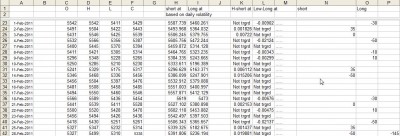

Feb'11 results given in the picture below:

| Description: |

|

| Filesize: |

127.95 KB |

| Viewed: |

522 Time(s) |

|

| Description: |

|

| Filesize: |

123.16 KB |

| Viewed: |

551 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #107  Posted: Mon Nov 07, 2011 6:36 pm Post subject: Posted: Mon Nov 07, 2011 6:36 pm Post subject: |

|

|

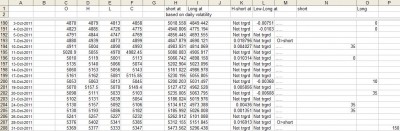

Oct'11 results given in the picture below: profit 150 pts

| Description: |

|

| Filesize: |

124.01 KB |

| Viewed: |

571 Time(s) |

|

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #108  Posted: Mon Nov 07, 2011 9:39 pm Post subject: Posted: Mon Nov 07, 2011 9:39 pm Post subject: |

|

|

Good job Vinst, you are outstanding! but kindly give me some time so that I can give you some more criteria to backtest which will increase the profitability , infact I am almost through. get back to you soon.

Trade for 8/11/tue-

sell @ 5393.95 (5390-5395) stoploss @ 5444

buy @ 5239.75 (5235-5240) stoploss @ 5189.

good night friends.

Wish all a day of profit ahead.

ANS.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #109  Posted: Mon Nov 07, 2011 11:10 pm Post subject: Posted: Mon Nov 07, 2011 11:10 pm Post subject: |

|

|

| rather than profitability, i am more concerned with large number of days when no trade occurs. this implies that DV needs to be scaled better for trades to occur.

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #110  Posted: Tue Nov 08, 2011 7:28 pm Post subject: Posted: Tue Nov 08, 2011 7:28 pm Post subject: |

|

|

| vinst wrote: | | rather than profitability, i am more concerned with large number of days when no trade occurs. this implies that DV needs to be scaled better for trades to occur. |

Dear VINST,

I am also concerned about the less number of trade made by this strategy.But then , though I am not in this trade for many days, still I found it s better to sit by the sideline rather than getting whipsawed or to make your broker, and only your broker rich.For me, patience is the name of the game.

Dear Vinst,If your time permits, can you please backtest the sep, 11 data by this strategy, we all will be grateful.

anyhow, it is evident that no trade triggered today.

trade for tomorrow-

sell@ 5389.95( 5385-5390) stoploss 5439

buy @ 5241.15( 5240-5245) stoploss 5191.

thanks and regards

ANS.

|

|

| Back to top |

|

|

ridinghood

Yellow Belt

Joined: 16 Apr 2009

Posts: 724

|

Post: #111  Posted: Tue Nov 08, 2011 9:52 pm Post subject: Posted: Tue Nov 08, 2011 9:52 pm Post subject: |

|

|

hi ans

i am in total agreement with u.less no. nd more profitable trades is the biggest virtue of the rare breed of successful traders!

while majority of traders suffer from this addiction of giving away too much by way of brokerages nd losses nd little gains due to too many unnecessary trades!

btw if we use the ob nd os levels to make entries as per the short term trend by following for example 12 ema closing i think profitabilty will be much higher. my opinion only!

regs

ridinghood

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #112  Posted: Tue Nov 08, 2011 11:06 pm Post subject: Posted: Tue Nov 08, 2011 11:06 pm Post subject: |

|

|

| ANS_KOL wrote: | | vinst wrote: | | rather than profitability, i am more concerned with large number of days when no trade occurs. this implies that DV needs to be scaled better for trades to occur. |

Dear VINST,

I am also concerned about the less number of trade made by this strategy.But then , though I am not in this trade for many days, still I found it s better to sit by the sideline rather than getting whipsawed or to make your broker, and only your broker rich.For me, patience is the name of the game.

Dear Vinst,If your time permits, can you please backtest the sep, 11 data by this strategy, we all will be grateful.

anyhow, it is evident that no trade triggered today.

trade for tomorrow-

sell@ 5389.95( 5385-5390) stoploss 5439

buy @ 5241.15( 5240-5245) stoploss 5191.

thanks and regards

ANS. |

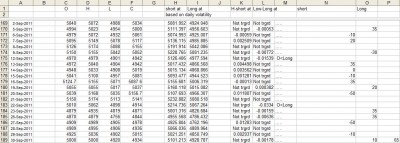

test results for Sept-2011, profit 65 points per lot (cost not accounted for). 15 trades

| Description: |

|

| Filesize: |

136.8 KB |

| Viewed: |

575 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #113  Posted: Wed Nov 09, 2011 3:12 pm Post subject: Posted: Wed Nov 09, 2011 3:12 pm Post subject: |

|

|

| Trade triggered at 5240 in the last 30 minutes.Time is less Chances of meeting the target for today is very less.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #114  Posted: Wed Nov 09, 2011 3:19 pm Post subject: Posted: Wed Nov 09, 2011 3:19 pm Post subject: |

|

|

| RK, why not carry it?

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #115  Posted: Wed Nov 09, 2011 3:28 pm Post subject: Posted: Wed Nov 09, 2011 3:28 pm Post subject: |

|

|

Yes! one can .....depends on risk taking ability.

| vinay28 wrote: | | RK, why not carry it? |

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #116  Posted: Wed Nov 09, 2011 9:47 pm Post subject: Posted: Wed Nov 09, 2011 9:47 pm Post subject: |

|

|

| vinst wrote: | | ANS_KOL wrote: | | vinst wrote: | | rather than profitability, i am more concerned with large number of days when no trade occurs. this implies that DV needs to be scaled better for trades to occur. |

Dear VINST,

I am also concerned about the less number of trade made by this strategy.But then , though I am not in this trade for many days, still I found it s better to sit by the sideline rather than getting whipsawed or to make your broker, and only your broker rich.For me, patience is the name of the game.

Dear Vinst,If your time permits, can you please backtest the sep, 11 data by this strategy, we all will be grateful.

anyhow, it is evident that no trade triggered today.

trade for tomorrow-

sell@ 5389.95( 5385-5390) stoploss 5439

buy @ 5241.15( 5240-5245) stoploss 5191.

thanks and regards

ANS. |

test results for Sept-2011, profit 65 points per lot (cost not accounted for). 15 trades |

65 points per lot per month in NIFTY is just tooooooooooooooo much

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #117  Posted: Wed Nov 09, 2011 10:13 pm Post subject: Posted: Wed Nov 09, 2011 10:13 pm Post subject: |

|

|

No trade triggered for today.

As we are working with other possibilities one may think of holding it for the day, but that is not the strategy, we should not take a trade after 3pm if we are intraday traders.

anyhow, trade for next day-

sell @ 5310.95( 5310-5315) stoploss 5361

buy @ 5163.25( 5160-5165) stoploss 5113

ANS.

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #118  Posted: Thu Nov 10, 2011 12:22 pm Post subject: Posted: Thu Nov 10, 2011 12:22 pm Post subject: |

|

|

| ANS, what if nifty opens much below 5163?

|

|

| Back to top |

|

|

sonila

Brown Belt

Joined: 04 Jun 2009

Posts: 1786

|

Post: #119  Posted: Thu Nov 10, 2011 5:17 pm Post subject: Posted: Thu Nov 10, 2011 5:17 pm Post subject: |

|

|

| Vinay28, in that case, then dont buy, as per the strategy.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #120  Posted: Fri Nov 11, 2011 1:19 pm Post subject: Posted: Fri Nov 11, 2011 1:19 pm Post subject: |

|

|

| ANS_KOL wrote: | No trade triggered for today.

As we are working with other possibilities one may think of holding it for the day, but that is not the strategy, we should not take a trade after 3pm if we are intraday traders.

anyhow, trade for next day-

sell @ 5310.95( 5310-5315) stoploss 5361

buy @ 5163.25( 5160-5165) stoploss 5113

ANS. |

paper trade: bot

|

|

| Back to top |

|

|

|