| View previous topic :: View next topic |

| Author |

Overbought-Oversold Intraday Tradins Strategy |

anand512

White Belt

Joined: 26 Jun 2009

Posts: 109

|

Post: #91  Posted: Sat Nov 05, 2011 8:11 pm Post subject: Re: commodity daily volatility Posted: Sat Nov 05, 2011 8:11 pm Post subject: Re: commodity daily volatility |

|

|

| infinity wrote: | | anand512 wrote: | [Sir,

As per your strategy i today trade in nifty and infosys. and earn 6000

Pl. guide me from where the value of daily volatility of commodity will be available ?[/b] |

anand512

Good that you are benefited from this system. I think your question of "Pl. guide me from where the value of daily volatility of commodity will be available ?" is still unanswered. For this please go to http://www.mediafire.com/?twwjminymze for step by step pictorial demo.

Disclaimer: PT/ST please pardon me if I have violated rules of this forum; which I have absolutely no intention of doing so. |

I need the value of daily volatility of commodities like , copper, crude, nickel etc...

|

|

| Back to top |

|

|

|

|

|

anand512

White Belt

Joined: 26 Jun 2009

Posts: 109

|

Post: #92  Posted: Sat Nov 05, 2011 8:40 pm Post subject: Re: commodity daily volatility Posted: Sat Nov 05, 2011 8:40 pm Post subject: Re: commodity daily volatility |

|

|

on 3 rd nov. infy closed at 2862. the daily volatility was 2.11 %.

which means o/b level is 2862+70 =2932

and o/s level 2862 - 70 = 2792. I bot infy at 2791 and put s.l. at 2781. The low of infy was 2788. and it made high of 2838 after low of 2788. I booked infy at 2824.

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #93  Posted: Sat Nov 05, 2011 8:45 pm Post subject: Posted: Sat Nov 05, 2011 8:45 pm Post subject: |

|

|

| vinst wrote: | | ANS_KOL wrote: | | ridinghood wrote: | HI ALL

nf close 5280.2 daily volatilty 1.53%

o/b level 5280.2+80.8=5361

o/s level 5280.2-80.8= 5199.4

regs

ridinghood |

Good job Ridinghood,

unfortunately no trade triggered on the second trading day of November.

for 3/11/2011

sell @ 5361( 5360-5365) stoploss 5411

buy @ 5199.4( 5195- 5200) stoploss 5149.

regards

ANS. |

Hi ANS_KOL

The daily volatility is completely based on closing prices. High/low of previous days are not involved in calculation of daily volatility (DV).

Therefore, i feel, the DV should represent the expected change in closing price for the next day and not the next day's high/low.

Now suppose the market is going to close higher ==> the high of the day is going to be still higher than the level predicted based on daily volatility.

similarly, suppose the market is going to close lower ==> the low of the day is going to be still lower than the level predicted based on daily volatility.

So short/long at predicted high/low based on DV Should involve SL which takes into account the high-close and close-low distances. |

Dear Vinst,

good contribution. But I always applied this without getting much into theory, and found good result in day trading.As I said earlier, if I had the guts or risk appetite I might hold the position for 2-3 days for better gain.Anyhow, I will definitely think over it and let you know how your input can be used for betterment of our trading .

Thanks friend.

ANS.

|

|

| Back to top |

|

|

anand512

White Belt

Joined: 26 Jun 2009

Posts: 109

|

Post: #94  Posted: Sat Nov 05, 2011 8:51 pm Post subject: Re: commodity daily volatility Posted: Sat Nov 05, 2011 8:51 pm Post subject: Re: commodity daily volatility |

|

|

Sir ,

can we use ATR (14) instead of value of daily volatlity for calculating over bought and oversold level? Pl. guide me.

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #95  Posted: Sat Nov 05, 2011 9:00 pm Post subject: Posted: Sat Nov 05, 2011 9:00 pm Post subject: |

|

|

| ridinghood wrote: | HI VINST

nf hlc on 4/11 5354/5284/5317 dv 1.44%

now keeping ur suggestion in mind for 8/11

sell at 5394 sl 5431 and

buy at 5240 sl 5208

am i right sir?

regs

ridinghood |

dear ridinghood,

you rock man! You need so less time to take up cues and to calculate and even to start giving call on that. I sincerely think that the way you have made the call it is going to do wonder in intraday because you gave a stoploss also which is reasonable, I mean very less than 50 points. We should also apply that in practice.

one kind request, is there any way you think to arrive some kind of target.

waiting for your reply.

thanks ridinghood.

ANS

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #96  Posted: Sat Nov 05, 2011 9:12 pm Post subject: Posted: Sat Nov 05, 2011 9:12 pm Post subject: |

|

|

| ridinghood wrote: | HI VINST

nf hlc on 4/11 5354/5284/5317 dv 1.44%

now keeping ur suggestion in mind for 8/11

sell at 5394 sl 5431 and

buy at 5240 sl 5208

am i right sir?

regs

ridinghood |

I forgot the value of speed of light, but this should be quite close to it !!

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #97  Posted: Sat Nov 05, 2011 10:06 pm Post subject: Re: commodity daily volatility Posted: Sat Nov 05, 2011 10:06 pm Post subject: Re: commodity daily volatility |

|

|

A splendid job Anannd. Have you backtested it?.Any data.

ANS! You provided a deadly weapon to Ichartians.

Some one... Some one.... who are equiped with soft ware..... please backtest it on Nifty and few Nifty scrips and provide the data.

| anand512 wrote: | on 3 rd nov. infy closed at 2862. the daily volatility was 2.11 %.

which means o/b level is 2862+70 =2932

and o/s level 2862 - 70 = 2792. I bot infy at 2791 and put s.l. at 2781. The low of infy was 2788. and it made high of 2838 after low of 2788. I booked infy at 2824. |

|

|

| Back to top |

|

|

ridinghood

Yellow Belt

Joined: 16 Apr 2009

Posts: 724

|

Post: #98  Posted: Sun Nov 06, 2011 11:16 am Post subject: Posted: Sun Nov 06, 2011 11:16 am Post subject: |

|

|

HI ANS nd VINST

sorry for delayed response as am not able to access computer too frequently due to family nd job constraints .

all the credit goes to the author of the thread ans sir for giving such a simple yet effective tool. i am just an humble follower hoping to benefit from it. i have done nothing more but easiest of calculations!

btw just to analyse the first nf call.

nf buy triggers at 5261 on 1/11 with sl of 5211.

since then it hit low of 5221 on 3/11 10 pts off the sl and a high of 5354 on

4/11 so a maxm gain of 5354-5261=93 pts without hitting the original sl nd in just 3 days as suggested by mr ans .

what more one should ask?

regs

ridinghood

|

|

| Back to top |

|

|

maooliservice

White Belt

Joined: 04 Aug 2010

Posts: 93

|

Post: #99  Posted: Sun Nov 06, 2011 12:36 pm Post subject: Posted: Sun Nov 06, 2011 12:36 pm Post subject: |

|

|

Dear ANS,

will u pls explain with chart how to trade with 7ema+34ema and

overbought/oversold strategy u hv explain to Mr Vinay

Regards

Mohan

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #100  Posted: Sun Nov 06, 2011 3:55 pm Post subject: Re: commodity daily volatility Posted: Sun Nov 06, 2011 3:55 pm Post subject: Re: commodity daily volatility |

|

|

| rk_a2003 wrote: | A splendid job Anannd. Have you backtested it?.Any data.

|

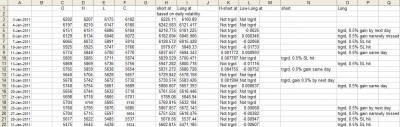

backtest for Jan 2011 by taking SL = tgt = 0.5%

click the picture for full size.

| Description: |

|

| Filesize: |

140.45 KB |

| Viewed: |

522 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #101  Posted: Sun Nov 06, 2011 5:47 pm Post subject: Posted: Sun Nov 06, 2011 5:47 pm Post subject: |

|

|

Thanks! Vinst

Trade triggered 14 times out of 20 days.

6 times SL hit.

Winning % 57.

This is for 1 month data.May not be suffice for a conclusion.

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #102  Posted: Sun Nov 06, 2011 6:56 pm Post subject: Posted: Sun Nov 06, 2011 6:56 pm Post subject: |

|

|

Dear Vinst,

good job. But whenever I used it , kept a stoploss of 50 points and not 0.5 %. I know you have made it keeping a more rational stoploss , but that is not the strategy exactly.

Let s see how november span out , because there were opportunities of fast profit booking during intraday which may be missed during backtesting.

thanks and regards

ANS.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #103  Posted: Sun Nov 06, 2011 7:04 pm Post subject: Posted: Sun Nov 06, 2011 7:04 pm Post subject: |

|

|

Hi ANS_KOL and rk_2003

1) fixed number based SL is problem since backtest in 2009 would be for NF values of 3000. So % based SL would be better choice.

2) I took SL of 0.5% based on minor observation that 1% or 50 point SL would eat away more than the profits.

3) one month test is not expected to form any conclusion. it is just to provide part of the data.

I have allowed the trades to run to next day which i feel is improper since by next day new value of DV has come into market and should form its effect.

Pls advise if trades to be completed intraday only.

I'll continue backtest based on fresh inputs.

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #104  Posted: Sun Nov 06, 2011 7:11 pm Post subject: Posted: Sun Nov 06, 2011 7:11 pm Post subject: |

|

|

| maooliservice wrote: | Dear ANS,

will u pls explain with chart how to trade with 7ema+34ema and

overbought/oversold strategy u hv explain to Mr Vinay

Regards

Mohan |

Dear Mohan,

you don t need a chart to explain how to trade with 7-34 ema. I normally use it while trading in cash market ie for going long in a scrip for a positional or BTST type of perspective.

1.Find out a stock with an ascending 7 days ema line and wait for the stock to give 2 overnight close above it with a volume more than 25% of the last 7 days simple average volume..

Simple trend following system with great return for a buy today, sell tomorrow type of trade.But people good at trailing stoploss can gain more profit from it.

2.Find out a stock with ascending 34 days ema line and wait for 3 overnight close above it.I found reading the volume is not of much importance in it , but it should be considerable.Hold it positional keeping stoploss of previous day low and continue with it.

Both of them can be used in case of positional short with exactly opposite criteria of going long.

Kindly note that these are not strategies. Just my small experience and observation during my trading days.You showed interest in it so I explained.

Thanks and regards.

ANS.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #105  Posted: Sun Nov 06, 2011 8:17 pm Post subject: Posted: Sun Nov 06, 2011 8:17 pm Post subject: |

|

|

"I have allowed the trades to run to next day which i feel is improper since by next day new value of DV has come into market and should form its effect. Pls advise if trades to be completed intraday only.I'll continue backtest based on fresh inputs."

You are right vinst . Let us stick to Intraday for intial backtest; carrying forward may not be right as per original strategy.

If possible you may test it for two situations.

1.With a stop loss of 50 points and a target of 30-35 points.

2.As per your proposal....... with a dyanmic SL(based on volatality) which comes around 30-35 points.

However, I expect ANS response in this regard.

RK

|

|

| Back to top |

|

|

|