| View previous topic :: View next topic |

| Author |

Positional / Swing Views. |

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #46  Posted: Wed May 03, 2017 10:01 pm Post subject: Posted: Wed May 03, 2017 10:01 pm Post subject: |

|

|

Positional View on ALICON

Weekly chart may multi year breakout, Weekly close above 501 can give long term breakout for 600 - 810. With failure of pattern below 420.

Current Price: ₹ 518

Stock P/E: 24.25

Earnings yield: 7.66%

YOY Quarterly sales growth: 5.33%

QoQ Sales: 18.44%

Sales growth 3Years: 12.6%

Sales growth 5Years: 19%

Debt/Equity : 1.34

Interest Coverage Ratio : 3.24

Return on Net worth(equity): 18.38%

Return on capital employed: 18.30%

Operating Margin: 11.12%

Promoter holding: 71.00%

For more information on fundamentals visit:

http://fundata.in/companysearch/ratio/console/Alicon%20Castalloy%20Ltd%20%7C%20531147%20%7C%20ALICON/Alicon%20Cast.

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

38.55 KB |

| Viewed: |

591 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #47  Posted: Tue May 09, 2017 1:22 pm Post subject: Posted: Tue May 09, 2017 1:22 pm Post subject: |

|

|

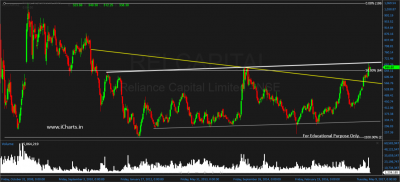

Positional View on RELCAPITAL

Weekly chart may multi year breakout, Weekly close above 690 can give long term breakout for 900 - 1200. With failure of pattern below 545.

Current Price: ₹ 670

Stock P/E: 13.39

Price to Book Value : 0.81

Dividend Yield : 1.51%

Earnings yield: 7.47%

YOY Quarterly sales growth: 79.30%

QoQ Sales: 27.58%

Sales growth 3Years: 10%

Sales growth 5Years: 13%

Return on Net worth(equity): 6%

Modified Operating Margin: 9%

Promoter holding: 52%

For more information on fundamentals visit:

http://fundata.in/companysearch/ratio/console/Reliance%20Capital%20Ltd%20%7C%20500111%20%7C%20RELCAPITAL/Reliance%20Capital

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

122.89 KB |

| Viewed: |

507 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #48  Posted: Thu May 11, 2017 9:56 am Post subject: Posted: Thu May 11, 2017 9:56 am Post subject: |

|

|

Amara Raja Batteries Ltd(Positional): Will breakout of Inverse Head and Shoulders above Daily close of 930 with Failure/stop loss below 850 can move up to 1131 - 1362 - 1743.

CMP : 915

P/E Ratio : 31.51

Price to Book Value : 7.31

Sales 3 Years CAGR : 16.6%

Sales 5 Years CAGR : 22%

Operating Margin : 16.50%

Debt/Equity : 0.04

Promoter Holding : 52.06%

Return On Net Worth(Equity) : 23.22 %

For more information on fundamentals visit:

http://fundata.in/companysearch/ratio/stand/Amara%20Raja%20Batteries%20Ltd%20%7C%20500008%20%7C%20AMARAJABAT/Amara%20Raja%20Batt.

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

84.54 KB |

| Viewed: |

535 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #49  Posted: Wed May 17, 2017 1:01 pm Post subject: Posted: Wed May 17, 2017 1:01 pm Post subject: |

|

|

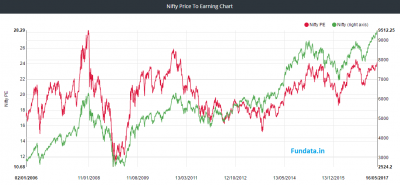

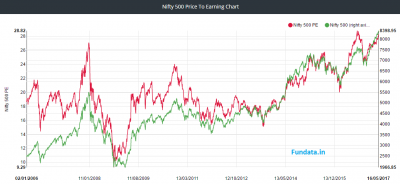

Are Earnings Improving ?

Nifty 50 & 500 has run up more than 6% & 10% from Sep'16, P/E is yet to break High of Sep'16.

http://fundata.in/marketbreadth/PEChart

| Description: |

|

| Filesize: |

63.35 KB |

| Viewed: |

527 Time(s) |

|

| Description: |

|

| Filesize: |

62.48 KB |

| Viewed: |

516 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #50  Posted: Wed May 17, 2017 1:58 pm Post subject: Posted: Wed May 17, 2017 1:58 pm Post subject: |

|

|

Bhansali Engineering Polymers Ltd Weekly chart may give multi year breakout, Weekly close above 45 can give long term breakout for 66 - 102. With failure of pattern below 33.

Promoter's holding has nearly increase by 10%.

Company has reduced their debt in last one year.

Market Cap.: ₹ 717.54Cr.

Stock P/E: 20368

Earnings yield(EBIT/EV): 10.36%

YOY Quarterly sales growth: 26.63%

Debt/Equity : 0.31

Return on Net worth(equity): 27.24%

Return on capital employed: 40.32%

Operating Margin: 10%

Promoter holding: 55%

For more information on fundamentals visit:

http://fundata.in/companysearch/ratio/stand/Bhansali%20Engineering%20Polymers%20Ltd%20%7C%20500052%20%7C%20BEPL/Bhansali%20Engg.

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

94.18 KB |

| Viewed: |

571 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #51  Posted: Fri May 19, 2017 10:52 am Post subject: Posted: Fri May 19, 2017 10:52 am Post subject: |

|

|

Positional View on Wipro Ltd

Weekly chart may give Inverse head and shoulders breakout, Weekly close above 540 can give long term breakout for 650- 774 - 1000. With failure of pattern below 480.

Current Price: ₹ 518

Stock P/E: 15.01

YOY Quarterly sales growth: 5.3%

QoQ Sales: 5.10%

Sales growth 3Years: 11%

Sales growth 5Years: 11%

Debt/Equity : 0.25

Return on Net worth(equity): 19%

Return on capital employed: 20%

Operating Margin: 21%

Promoter holding: 73.25%

For more information on fundamentals visit:

http://fundata.in/companysearch/ratio/console/Wipro%20Ltd%20%7C%20507685%20%7C%20WIPRO/Wipro

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

136.83 KB |

| Viewed: |

556 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #52  Posted: Mon Sep 11, 2017 3:32 pm Post subject: Posted: Mon Sep 11, 2017 3:32 pm Post subject: |

|

|

Positional View on H T Media Ltd

Weekly chart has given breakout, daily close above 108 can give long term breakout for 137-180-210-270. With failure of pattern below 81.

Current Price: ₹ 102.5

Market Cap (Rs Cr.) : 2381.02

Stock P/E: 9.18

Sales growth 3Years: 3.67%

Sales growth 5Years: 4%

Debt/Equity : 0.51

Price to Book Value : 1.07

Return on Net worth(equity): 12.28%

Return on capital employed: 11.62%

Promoter holding: 69.51%

For more information on fundamentals visit:

http://fundata.in/companysearch/report/H%20T%20Media%20Ltd%20%7C%20532662%20%7C%20HTMEDIA/H%20T%20Media

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

96.59 KB |

| Viewed: |

516 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #53  Posted: Tue Sep 12, 2017 2:23 pm Post subject: Posted: Tue Sep 12, 2017 2:23 pm Post subject: |

|

|

Positional View on Divis Lab Ltd

Daily chart may give Inverse head and shoulders breakout, Daily close above 810 can give long term breakout for 855-963- 1233. With failure of pattern below 666.

Current Price: ₹ 782

Stock P/E: 21

YOY Quarterly sales growth: -19.27%

Sales growth 3Years: 17%

Sales growth 5Years: 17%

Debt/Equity : 0.01

Return on Net worth(equity): 17%

Return on capital employed: 21%

Operating Margin: 30%

Promoter holding: 52.07%

For more information on fundamentals visit:

http://fundata.in/companysearch/analysis/Divis%20Laboratories%20Ltd%20%7C%20532488%20%7C%20DIVISLAB/Divi's%20Lab.

*** We DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

96.29 KB |

| Viewed: |

540 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #54  Posted: Thu Sep 14, 2017 2:15 pm Post subject: Posted: Thu Sep 14, 2017 2:15 pm Post subject: |

|

|

Positional View on Solar Industries India Ltd Ltd

Chart may give breakout, Daily close above 927 can give long term breakout for 1026-1167- 1305. With failure of pattern below 846.

Current Price: ₹ 782

Stock P/E: 40.02

YOY Quarterly sales growth: 15.79%

Sales growth 3Years: 11.72%

Sales growth 5Years: 10%

Debt/Equity : 0.52

Return on Net worth(equity): 22.02%

Return on capital employed: 20.7%

Operating Margin: 19.51%

Promoter holding: 52.07%

For more information on fundamentals visit:

http://fundata.in/companysearch/analysis/Solar%20Industries%20India%20Ltd%20%7C%20532725%20%7C%20SOLARINDS/Solar%20Inds.

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

85.39 KB |

| Viewed: |

529 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #55  Posted: Wed Oct 04, 2017 4:55 pm Post subject: Posted: Wed Oct 04, 2017 4:55 pm Post subject: |

|

|

Positional View on FDC Ltd

Chart may give breakout, Weekly close above 208.80 can give long term breakout for 243-297-333-369-441 . With failure of pattern below 162

It is nearly debt free company.

Current Price: ₹ 190

Stock P/E: 20

YOY Quarterly sales growth: -10%

Sales growth 3Years: 7%

Sales growth 5Years: 7%

Return on Net worth(equity): 16.03%

Return on capital employed: 21.50%

Operating Margin: 27.39%

Promoter holding: 68.89%

For more information on fundamentals visit:

http://fundata.in/companysearch/analysis/FDC

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

89 KB |

| Viewed: |

576 Time(s) |

|

Last edited by hemant.icharts on Thu Nov 02, 2017 10:17 am; edited 1 time in total |

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #56  Posted: Thu Oct 12, 2017 5:21 pm Post subject: Posted: Thu Oct 12, 2017 5:21 pm Post subject: |

|

|

Positional View on Harita Seating Systems Ltd

Chart may give breakout, Weekly close above 873 can give long term breakout for 1008-1200-1500-1800-2400. With failure of pattern below 693

It is nearly debt free company.

Current Price: ₹ 830

Stock P/E: 23.05

YOY Quarterly sales growth: 12.74%

Sales growth 3Years: 11.45%

Sales growth 5Years: 5%

Return on Net worth(equity): 34.53%

Return on capital employed: 43.93%

Debt to Equity : 0.08

Operating Margin: 8.5%

Promoter holding: 66.35%

For more information on fundamentals visit:

http://fundata.in/companysearch/report/Harita%20Seating%20Systems%20Ltd%20%7C%20590043%20%7C%20HARITASEAT/Harita%20Seating

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

68.76 KB |

| Viewed: |

489 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #57  Posted: Mon Oct 16, 2017 12:46 pm Post subject: Posted: Mon Oct 16, 2017 12:46 pm Post subject: |

|

|

Positional View on Ramco Industries Ltd

Chart may give breakout, Daily close above 297 can give long term breakout for 378 - 500 - 600. With failure of pattern below 230

Current Price: ₹ 290

Stock P/E: 37.48

YOY Quarterly sales growth: 9.77%

Sales growth 3Years: 2.62%

Sales growth 5Years: 2%

Return on Net worth(equity): 1.85%

Return on capital employed: 3.43%

Debt to Equity : 0.13

Operating Margin: 13.45%

Promoter holding: 53.92%

For more information on fundamentals visit:

http://fundata.in/companysearch/report/Ramco%20Industries%20Ltd%20%7C%20532369%20%7C%20RAMCOIND/Ramco%20Inds.

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

23.19 KB |

| Viewed: |

508 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #58  Posted: Tue Oct 17, 2017 9:56 am Post subject: Posted: Tue Oct 17, 2017 9:56 am Post subject: |

|

|

Positional View on Swelect Energy Systems Ltd

Chart may give breakout, Daily close above 560 can give long term breakout for 658 - 702- 927. With failure of pattern below 486

Current Price: 530

Stock P/E: 16

YOY Quarterly sales growth: 21.87%

Sales growth 3Years: 11%

Return on Net worth(equity): 1%

Return on capital employed: 2.32%

Debt to Equity : 0.18

Operating Margin: 15.5%

Promoter holding: 63.46%

For more information on fundamentals visit:

http://fundata.in/companysearch/report/Swelect%20Energy%20Systems%20Ltd%20%7C%20532051%20%7C%20SWELECTES/Swelect%20Energy

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

86.97 KB |

| Viewed: |

505 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #59  Posted: Tue Oct 31, 2017 3:13 pm Post subject: Posted: Tue Oct 31, 2017 3:13 pm Post subject: |

|

|

Update:

Looks like Inverse Head and Shoulder breakout can happen above 200

| hemant.icharts wrote: | Positional View on FDC Ltd

Chart may give breakout, Weekly close above 208.80 can give long term breakout for 243-297-333-369-441 . With failure of pattern below 162

It is nearly debt free company.

Current Price: ₹ 190

Stock P/E: 20

YOY Quarterly sales growth: -10%

Sales growth 3Years: 7%

Sales growth 5Years: 7%

Return on Net worth(equity): 16.03%

Return on capital employed: 21.50%

Operating Margin: 27.39%

Promoter holding: 68.89%

For more information on fundamentals visit:

http://fundata.in/companysearch/analysis/FDC

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments. |

| Description: |

|

| Filesize: |

30.82 KB |

| Viewed: |

519 Time(s) |

|

|

|

| Back to top |

|

|

hemant.icharts

Site Admin

Joined: 10 May 2011

Posts: 334

|

Post: #60  Posted: Thu Nov 23, 2017 5:37 pm Post subject: Posted: Thu Nov 23, 2017 5:37 pm Post subject: |

|

|

Positional View on Technocraft Industries (India) Ltd

Chart may give breakout, Daily close above 511 can give long term breakout for 585- 700- 810-1050. With failure of pattern below 378

Current Price: 530

Stock P/E: 13.63

YOY Quarterly sales growth: 21.87%

Sales growth 5 Years: 9%

Sales growth (YoY): 13.82%

Net Profit Growth (YoY): 27.50%

Return on Net worth(equity): 14.82%

Return on capital employed: 15.63%

Debt to Equity : 0.46

Operating Margin: 13.32%

Promoter holding: 75%

For more information on fundamentals visit:

http://fundata.in/companysearch/report/TIIL

*** WE DO NOT recommend anything here. The above is for educational purposes only. Please take your own decision about your investments.

| Description: |

|

| Filesize: |

90.69 KB |

| Viewed: |

453 Time(s) |

|

|

|

| Back to top |

|

|

|