| View previous topic :: View next topic |

| Author |

PULLBACK ENTRY LEVEL |

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #1  Posted: Fri Jul 29, 2011 2:42 pm Post subject: PULLBACK ENTRY LEVEL Posted: Fri Jul 29, 2011 2:42 pm Post subject: PULLBACK ENTRY LEVEL |

|

|

I am posting the trading strategy which can be named as” “pullback trading syrategy”.

I found it in some website long back, modified according to my convenience.

The main aim of this strategy is to encash the trend when it is in corrective mode. It is always better to wait for a price to correct a bit and then take position rather than buying at a high price and then getting trapped (bull trap) or selling at a low price and then the price moving up(bear trap).you may argue that buying high and selling higher and vise versa is all about breakout, but my experience says that the breakouts, in more than 50%cases proved to be false, so this strategy is about buy low and sell high(not buy high and sell higher).

First draw 30 sma and 10 ema on the eod chart of a stock which is in strong uptrend. Expected that at that time 10 ema is higher than 30 sma. Now, our work is to wait the stock to correct and come between 10 ema and 30 sma. It is not a rocket science, no logic, just it is being watched that 90% of the time the price starts to continue its primary trend from there itself . you can open any chart and appreciate that yourself.

entry 1: When the price is in between 10 ema and 30 sma arena, wait for a day when the eod bar refuse to make a new low. That should be your entry point keeping the stoploss at the previous day low.

entry 2: if during intraday trade, the price broke down below 30 sma, but then the bulls take control and cause the price to close well above the 30 sma( in eod bar it may look like a long legged dozi or in candlestick term , long lower shadow).that should be a time when you may take a long position with the low of the day as stoploss.

entry3: after correcting from the previous top, say, the price continues to fall in between the 10-30 ma arena and then suddenly it lost momentum and volume. There are really small volume and small range days for 3-4 trading session. In such scenario, we will consider that the players in the market are no more interested to sell the stock any further and it should resume its uptrend at any time. So as soon as the stock trades above those 3-4 days low rang day’s high one should take a long position keeping the stoploss below the lowest point of those days.

Target: though in 70%of the cases I have noticed that the recent high is the target but it even crosses that to \create a new high, so trail your stoploss carefully to rip the maximum benefit.

The strategy can give excellent result as I traded with this last year and did so many successful trade, I remember biocon, escorts, hul among the stocks that given more than 10% profit in 5-6 trading session.

I always follow the I charts “pullback in an uptrend” column to screen the stocks of my choice.

Use money management properly to get the maximum benefit eg. I started with a max balance of rs 1 lac, so I made it a point that including the brokerage and tax I would not loss more than 3% (rs 3000) of my total capital in a single trade, so I adjust my volume with respect to the stoploss accordingly.

I am not posting any chart as I know if you open any chart you will find this pullback to take place, well in most of the cases , only thing is the stock should be in strong uptrend .

In case of the falling stock, the stategy is exactly opposite than the one explained here.

Any feedback, charts are welcome.

Kindly modify this strategy for all of our benefit.feel free to ask any doubt.

ANS.

|

|

| Back to top |

|

|

|

|

|

tangiercap

White Belt

Joined: 31 Mar 2011

Posts: 7

|

Post: #2  Posted: Fri Jul 29, 2011 3:47 pm Post subject: Posted: Fri Jul 29, 2011 3:47 pm Post subject: |

|

|

hi ANS

can u pls post in brief with eod charts , so that i would be more clear and easy to undestand .

thnks

|

|

| Back to top |

|

|

shrimde

White Belt

Joined: 19 Feb 2009

Posts: 22

|

Post: #3  Posted: Fri Jul 29, 2011 6:55 pm Post subject: Posted: Fri Jul 29, 2011 6:55 pm Post subject: |

|

|

| Thanks for best strategy.I didnot understand:pullback in uptrends" in Icharts.Where it appears. pl. explain

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #4  Posted: Fri Jul 29, 2011 10:11 pm Post subject: Posted: Fri Jul 29, 2011 10:11 pm Post subject: |

|

|

| shrimde wrote: | | Thanks for best strategy.I didnot understand:pullback in uptrends" in Icharts.Where it appears. pl. explain |

dear shrimde,

go to stocklist- predefined technical scans- pullbacks in uptrend.

thanks and regards

ANS

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #5  Posted: Fri Jul 29, 2011 10:51 pm Post subject: Posted: Fri Jul 29, 2011 10:51 pm Post subject: |

|

|

Dear ANS,

Good strategy. There will be very few stocks which will be in a sustained uptrend. For most of the stocks the uptrend will wither away after 4 to 5 pull backs and trend may reverse also during one pullback.A classic example is Satyam computers.

There fore, Is there any way that we can stadardise and restrict our entry in to certain number of pull backs. may be with the help of some leading indicators or with the help of history.

By the way I can track from icharts " pullbacks in uptrend ". Whre can I track "pushups in downtrend"

Regards

RK

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #6  Posted: Fri Jul 29, 2011 11:17 pm Post subject: Posted: Fri Jul 29, 2011 11:17 pm Post subject: |

|

|

| rk_a2003 wrote: | Dear ANS,

Good strategy. There will be very few stocks which will be in a sustained uptrend. For most of the stocks the uptrend will wither away after 4 to 5 pull backs and trend may reverse also during one pullback.A classic example is Satyam computers.

There fore, Is there any way that we can stadardise and restrict our entry in to certain number of pull backs. may be with the help of some leading indicators or with the help of history.

By the way I can track from icharts " pullbacks in uptrend ". Whre can I track "pushups in downtrend"

Regards

RK |

DEAR RK,

i was expecting this doubt from someone. in fact, when i started trading i also was confused due to this. i suggest everyone to filter stock which has given a price volume breakout and after that showing correction. (or) those stocks in which the 10 ema crosses the 30 sma, and for first time after that the stock showing correction.

hope this will help.

sorry, left gym 8 years back. no idea of push ups.

tanks and regards.

ANS.

|

|

| Back to top |

|

|

drsureshbs

White Belt

Joined: 22 Oct 2008

Posts: 58

|

Post: #7  Posted: Sat Jul 30, 2011 12:54 am Post subject: Posted: Sat Jul 30, 2011 12:54 am Post subject: |

|

|

| ANS can u pl define the filter used to define stock instrong up treand or down trend. thank u

|

|

| Back to top |

|

|

rrk2006hyd

Yellow Belt

Joined: 13 Oct 2010

Posts: 874

|

Post: #8  Posted: Sat Jul 30, 2011 10:36 am Post subject: Posted: Sat Jul 30, 2011 10:36 am Post subject: |

|

|

| drsureshbs wrote: | | ANS can u pl define the filter used to define stock instrong up treand or down trend. thank u |

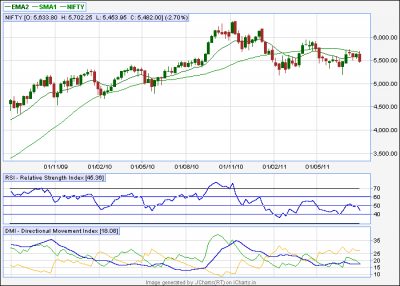

to find Stock Up/Down Trend us 2 Indicators

1.RSI(used to find out TRADING range)

2.ADX(used to find TREND)

RSI(13,30,70):

1.plot RSI in your daily,intraday charts.

2.plot lines RSI at 40-50-60

3.look for stocks which are going above 40,then BUY.

4.look for stocks which are coming below 60, then SELL

ADX(13,13): ADX used for TREND idetification

in ADX there are two things +DMI,-DMI.

1.IF +DMI>-DMI then BUY.

2.if -DMI>+DMI SELL

we can use icharts screener(EOD) for screening stocks.

| Description: |

|

| Filesize: |

14.72 KB |

| Viewed: |

585 Time(s) |

|

|

|

| Back to top |

|

|

drsureshbs

White Belt

Joined: 22 Oct 2008

Posts: 58

|

Post: #9  Posted: Sat Jul 30, 2011 2:28 pm Post subject: Posted: Sat Jul 30, 2011 2:28 pm Post subject: |

|

|

| ANS thank u

|

|

| Back to top |

|

|

shrimde

White Belt

Joined: 19 Feb 2009

Posts: 22

|

Post: #10  Posted: Sat Jul 30, 2011 5:34 pm Post subject: Posted: Sat Jul 30, 2011 5:34 pm Post subject: |

|

|

Dear ANS,

Thanks for providing informations on stocks in pullbacks

regards

shrimde

|

|

| Back to top |

|

|

|