| View previous topic :: View next topic |

| Author |

READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY |

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #436  Posted: Sun Dec 29, 2013 8:08 pm Post subject: Posted: Sun Dec 29, 2013 8:08 pm Post subject: |

|

|

from Reading of Sahil's thread and Vinay's comment on overall bullishness and EW counts [own analysis]

markets "shall reverse [read : high probability]" to "Down" around 8/1/014 - gann day...if it rises "slowly to 6360 [or may be unlikely though to 6415]

given mutliple resistances at

6357 - monthly resistance

6260- top of gap

6339-6343 : previous JT number and other confluences

shall look to add "puts" around 6325-6260.

......if 6325 does not break and 6283 breaks, then be very cautius indeed.....

pls note that calls are not moving higher over a weekly time frame or so.....vix is down and "wait" for vix to rise to have a more trending market.....

dont expect 6500 in Jan 2013 entirely.... since for me 5th extended shall be complete little above 6415 even if rises above 6360....

then fall to 6150 or 6030 or 5790 or 5920.......

then rise to 6700-7300-7800 over February - July 2014....

this is not estimate but EW time and price targets....though approx.

so while i maintain bullish view for next year.....one wave and last wave down is pending.......

pls watch carefully the above...happy trading in new year!!!

Last edited by amitagg on Mon Dec 30, 2013 2:29 pm; edited 1 time in total |

|

| Back to top |

|

|

|

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #437  Posted: Sun Dec 29, 2013 8:13 pm Post subject: Posted: Sun Dec 29, 2013 8:13 pm Post subject: |

|

|

| I feel 6500NF is possible and so is 6200 in Jan. 16/01 could be turnaround day.

|

|

| Back to top |

|

|

saumya12

Brown Belt

Joined: 21 Dec 2011

Posts: 1509

|

Post: #438  Posted: Sun Dec 29, 2013 10:12 pm Post subject: Posted: Sun Dec 29, 2013 10:12 pm Post subject: |

|

|

| vinay28 wrote: | | I feel 6500NF is possible and so is 6200 in Jan. 16/01 could be turnaround day. |

IMO NS 6500 is possible

| Description: |

|

| Filesize: |

22.67 KB |

| Viewed: |

185 Time(s) |

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #439  Posted: Mon Dec 30, 2013 12:16 am Post subject: Posted: Mon Dec 30, 2013 12:16 am Post subject: |

|

|

Thanks Vinay / Saumya,

I shall take full note.

Rgs

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #440  Posted: Mon Dec 30, 2013 9:23 am Post subject: Posted: Mon Dec 30, 2013 9:23 am Post subject: |

|

|

| with my view of sideways to down view or slow rise only, sold 6400 call at 94.....believe a good risk reward.....shall update later

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #441  Posted: Mon Dec 30, 2013 9:44 am Post subject: Posted: Mon Dec 30, 2013 9:44 am Post subject: |

|

|

| would expect markets to slide to 6268 now.....wherein shorts should cover if not partially at 6284

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #442  Posted: Mon Dec 30, 2013 10:21 am Post subject: Posted: Mon Dec 30, 2013 10:21 am Post subject: |

|

|

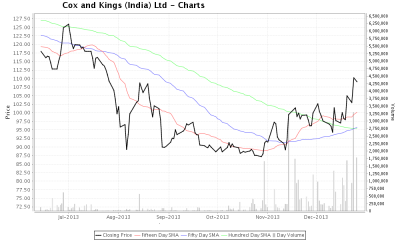

cox bought in cash at 111...see the rising volumes and moving average crossover....shall exit when better opportunities come by....target and stop loss choose as per any self method

| Description: |

|

| Filesize: |

99.22 KB |

| Viewed: |

208 Time(s) |

|

|

|

| Back to top |

|

|

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #443  Posted: Mon Dec 30, 2013 10:35 am Post subject: Posted: Mon Dec 30, 2013 10:35 am Post subject: |

|

|

| amitagg wrote: | | would expect markets to slide to 6268 now.....wherein shorts should cover if not partially at 6284 |

interestingly the positional SL for long is also about 6268NS.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #444  Posted: Mon Dec 30, 2013 2:31 pm Post subject: Posted: Mon Dec 30, 2013 2:31 pm Post subject: |

|

|

| amitagg wrote: | from Reading of Sahil's thread and Vinay's comment on overall bullishness and EW counts [own analysis]

markets "shall reverse [read : high probability]" to "Down" around 8/1/014 - gann day...if it rises "slowly to 6360 [or may be unlikely though to 6415]

given mutliple resistances at

6357 - monthly resistance

6260- top of gap

6339-6343 : previous JT number and other confluences

shall look to add "puts" around 6325-6260.

......if 6325 does not break and 6283 breaks, then be very cautius indeed.....

pls note that calls are not moving higher over a weekly time frame or so.....vix is down and "wait" for vix to rise to have a more trending market.....

dont expect 6500 in Jan 2013 entirely.... since for me 5th extended shall be complete little above 6415 even if rises above 6360....

then fall to 6150 or 6030 or 5790 or 5920.......

then rise to 6700-7300-7800 over February - July 2014....

this is not estimate but EW time and price targets....though approx.

so while i maintain bullish view for next year.....one wave and last wave down is pending.......

pls watch carefully the above...happy trading in new year!!! |

as written yesterday....6400 call now at 74 from 94 booked 50%

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #445  Posted: Mon Dec 30, 2013 2:41 pm Post subject: Posted: Mon Dec 30, 2013 2:41 pm Post subject: |

|

|

| amitagg wrote: | | cox bought in cash at 111...see the rising volumes and moving average crossover....shall exit when better opportunities come by....target and stop loss choose as per any self method |

cox up 5% since posted today....exiting...it can rise to 125...

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #446  Posted: Mon Dec 30, 2013 3:33 pm Post subject: Posted: Mon Dec 30, 2013 3:33 pm Post subject: |

|

|

| bought Bombay dyeing at 76.....in cash ..stop 70...target 85+

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #447  Posted: Tue Dec 31, 2013 9:45 am Post subject: Posted: Tue Dec 31, 2013 9:45 am Post subject: |

|

|

| bought Jain Irrigation futures @ 74

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #448  Posted: Tue Dec 31, 2013 11:45 am Post subject: Posted: Tue Dec 31, 2013 11:45 am Post subject: |

|

|

bought joti structures at 30.....watch the rising volumes and 5 year chart.....

have over the past days, traded for profit [hit and run -when up 4-5%],

- gati [ 10% profit in one day.....up "further" over 20% in two days since i exited]

- ruchi soya [10% profit in one day]

- cox and kings [5% profit in one day]

- bombay dyeing [2% profit in one day]

- tvs [on downside] - risky

-NOW jyoti structures..

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #449  Posted: Tue Dec 31, 2013 11:51 am Post subject: Posted: Tue Dec 31, 2013 11:51 am Post subject: |

|

|

have exited jain irrigation at nominal loss

as well as watching Lovable for upside trade above 298....bid placed for buying above 298....an early entrant for upsides if materialised and good spike pattern today....need to consolidate sideways for more confirmation.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #450  Posted: Wed Jan 01, 2014 10:32 am Post subject: Posted: Wed Jan 01, 2014 10:32 am Post subject: |

|

|

booked 3-4% profit in Jyoti structures in one day and

now entered Elder Pharma at 252....target 275....but shall book earlier....a good reversal happening

|

|

| Back to top |

|

|

|