| View previous topic :: View next topic |

| Author |

READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY |

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #451  Posted: Wed Jan 01, 2014 10:49 am Post subject: Posted: Wed Jan 01, 2014 10:49 am Post subject: |

|

|

squared elder pharma at 3% profit from 252 to 261.....in one hour...

now looking for next entry...it can rise to 275

|

|

| Back to top |

|

|

|

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #452  Posted: Wed Jan 01, 2014 12:05 pm Post subject: Posted: Wed Jan 01, 2014 12:05 pm Post subject: |

|

|

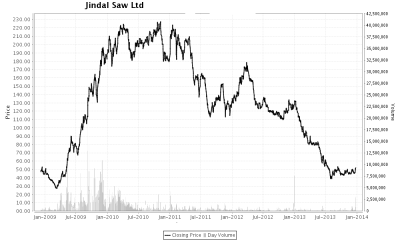

now bought Jindal Saw at 53.5.....see 5-year chart attached and recent triple MA crossover and somehwat volume spikes...

| Description: |

|

| Filesize: |

93.7 KB |

| Viewed: |

221 Time(s) |

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #453  Posted: Wed Jan 01, 2014 12:40 pm Post subject: Posted: Wed Jan 01, 2014 12:40 pm Post subject: |

|

|

boom see chart done 4% in half hour....exited most....56 from 53.5

strategy of cash mid and small cap trading working extremely well in sideways market.....

| Description: |

|

| Filesize: |

15.38 KB |

| Viewed: |

220 Time(s) |

|

|

|

| Back to top |

|

|

manojkr78

Green Belt

Joined: 07 Mar 2011

Posts: 1014

|

Post: #454  Posted: Wed Jan 01, 2014 12:52 pm Post subject: Posted: Wed Jan 01, 2014 12:52 pm Post subject: |

|

|

amit,

Happy New Year.....

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #455  Posted: Wed Jan 01, 2014 1:47 pm Post subject: Posted: Wed Jan 01, 2014 1:47 pm Post subject: |

|

|

HAPPY NEW & PROFITABLE YEAR TO YOU AND ALL ICHARTIANS.

REGARDS

AMIT AGGARWAL

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #456  Posted: Wed Jan 01, 2014 3:24 pm Post subject: Posted: Wed Jan 01, 2014 3:24 pm Post subject: |

|

|

| bought core education @ 22....

|

|

| Back to top |

|

|

musicaldelhi

White Belt

Joined: 17 Nov 2011

Posts: 186

|

Post: #457  Posted: Wed Jan 01, 2014 7:01 pm Post subject: Posted: Wed Jan 01, 2014 7:01 pm Post subject: |

|

|

Happy New Year Amit ji..

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #458  Posted: Thu Jan 02, 2014 10:32 am Post subject: Posted: Thu Jan 02, 2014 10:32 am Post subject: |

|

|

exited core at small profit and entered Rolta [cash] 73.5...target 78...stop 68.5

today reversal of sideways consol for many days....speculative stock and IT....would gain on upside...look at 5 year chart also for confirmation.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #459  Posted: Thu Jan 02, 2014 2:38 pm Post subject: Posted: Thu Jan 02, 2014 2:38 pm Post subject: |

|

|

cash buying for past few days....and non-levaraged trades....saved the week gone by........holding rolta....markets would confuse and possibly fall further before rising.....

no to estimate now the extent of fall...buying only above 6310.....

as i had posted few days back....6415 was stiff.....not to mention it cannot be reached...

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #460  Posted: Thu Jan 02, 2014 5:01 pm Post subject: Posted: Thu Jan 02, 2014 5:01 pm Post subject: |

|

|

| amitagg wrote: | | amitagg wrote: | from Reading of Sahil's thread and Vinay's comment on overall bullishness and EW counts [own analysis]

markets "shall reverse [read : high probability]" to "Down" around 8/1/014 - gann day...if it rises "slowly to 6360 [or may be unlikely though to 6415]

given mutliple resistances at

6357 - monthly resistance

6260- top of gap

6339-6343 : previous JT number and other confluences

shall look to add "puts" around 6325-6260.

......if 6325 does not break and 6283 breaks, then be very cautius indeed.....

pls note that calls are not moving higher over a weekly time frame or so.....vix is down and "wait" for vix to rise to have a more trending market.....

dont expect 6500 in Jan 2013 entirely.... since for me 5th extended shall be complete little above 6415 even if rises above 6360....

then fall to 6150 or 6030 or 5790 or 5920.......

then rise to 6700-7300-7800 over February - July 2014....

this is not estimate but EW time and price targets....though approx.

so while i maintain bullish view for next year.....one wave and last wave down is pending.......

pls watch carefully the above...happy trading in new year!!! |

as written yesterday....6400 call now at 74 from 94 booked 50%  |

markings in bold few days back....met in terms of price earlier to time......would expect shorts to force retail bull liquidation [through more downside] before kickstarting the "bull run" of 2014

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #461  Posted: Fri Jan 03, 2014 1:14 am Post subject: Posted: Fri Jan 03, 2014 1:14 am Post subject: |

|

|

ending diagonal downside can be 6030-5970 or even 5920......6142 is first key support.....timewise one should wait for February mid for 'sustainable' rebound...given mutiple supports in 6000-6150 range, markets likely to be sideways down to 6030-6140 and then rise to 6700+

break of trendline from 5115 lows or 5700 lows immaterial since markets searching for a 'c' wave down from 6415.....which shall be last bear value ..before the sustained uptrend in mid of the year..

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #462  Posted: Fri Jan 03, 2014 12:42 pm Post subject: Posted: Fri Jan 03, 2014 12:42 pm Post subject: |

|

|

posting ROLTA charts bought in cash.....for investors [promotors gaining shareholding] .....10-year support at 50-60 region.....rising daily weekly monthly......break of trendline above 68 and lower.....speculative stock once gains traction..... IT basket....."cash bottom" levels for the stock....mid cap...financials improving

hundreds of possibilities and mid-cap charts fascinating....to buy on all dips...

may be entry is at first breakout of significant low of 2014. shall see.

| Description: |

|

| Filesize: |

45.23 KB |

| Viewed: |

179 Time(s) |

|

| Description: |

|

| Filesize: |

36.09 KB |

| Viewed: |

210 Time(s) |

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #463  Posted: Fri Jan 03, 2014 2:19 pm Post subject: Posted: Fri Jan 03, 2014 2:19 pm Post subject: |

|

|

| one full strength stock is Ranbaxy....above 472 it shall touch 500+ in short time....

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #464  Posted: Fri Jan 03, 2014 2:47 pm Post subject: Posted: Fri Jan 03, 2014 2:47 pm Post subject: |

|

|

| sometimes when a full blown gap down does not materialise in morning though SGX is down, it means buying strength and can take market to high that day.....but strength only above 6265...otherwiswe down targets are open till 6129/ 6030...

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #465  Posted: Fri Jan 03, 2014 3:19 pm Post subject: Posted: Fri Jan 03, 2014 3:19 pm Post subject: |

|

|

| amitagg wrote: | | one full strength stock is Ranbaxy....above 472 it shall touch 500+ in short time.... |

risen Rs 10 since posted

|

|

| Back to top |

|

|

|