| View previous topic :: View next topic |

| Author |

READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY |

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #1  Posted: Fri Aug 09, 2013 6:38 pm Post subject: READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY Posted: Fri Aug 09, 2013 6:38 pm Post subject: READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY |

|

|

This tread shall give my reading [of over a DECADE] based on (overall broad based technical anlalysis) and "line" reading of stock price movement (aross time dimensions) the past many years. My trades shall be for suitably LEVERAGED TRADERS [willing to average and assigning high proability success rate to their probable technical trades]

While the ideas based on my past experience shall be "high rewarding for intra-day / short term play" with "very high sucess rate", the objective of this thread is to

- share my valuable experiences of being a DAY TRADER over a DECADE

- seek insights into "possible whipsaws / to GAIN KNOWLEDGE on how to AVOID huge trading DIPS ON A SINGLE TRADE" [stop losses, etc. money management etc.]

I shall be VERY SELECTIVE IN THIS THREAD [FOR BENEFIT OF USERS] though i would be trading in many other stocks as well

To start off, WIPRO Aug futures, following trades done on 8/8/13 -

- sold at 450 covered [average at 444] morning [PROFIT - 6 PER LOT]

- sold 446 [on reaction] covered at 443.5 in afternoon [PROFIT 2.5 PER LOT]

- sold at average 449 [from 447-452] in late trade [PENDING - higher quantity than morning trades]

shall cover at 446.5 to 442.5 on Monday 12/8/13 [bids placed],

shall sell some at 455-457

stop loss 470

rationale: doggi's at multiple time frames 448 resistance levels , vertical rise, TRADERS MIND - CLOSED AT HIGH on thurs [ I HAVE SEEN FROM LINE READING THAT THIS IS BEARISH WHEN IMPENDING REVERSAL HAS STARTED][color=blue][/color]

|

|

| Back to top |

|

|

|

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #2  Posted: Fri Aug 09, 2013 8:28 pm Post subject: READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY Posted: Fri Aug 09, 2013 8:28 pm Post subject: READING THE LINE [DAY TRADERS MIND] - FUTURES ONLY |

|

|

following trail comments, other reasons for "immediate short term" bearishness [wipro]

1) last 5 days daily chart - swing high at 463 [6/8], failure to cross [7/8]

2) ABC correction [started on 6/8] where B fails to cross A [7/8]

3) Head and shoulders break [daily] on 450 [support] - so sold on 8/8 morning also

4) attempted retest of neckline on 8/8 late trade

5) Oscillators about to cross over

closing stop 464, intra day stop 460 for conservative trader, 469-470 for positional trader

first half fall on 12/8 anticipated

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #3  Posted: Sat Aug 10, 2013 2:08 pm Post subject: Posted: Sat Aug 10, 2013 2:08 pm Post subject: |

|

|

Comments on Wipro [its about to turn to sell / distribution?] from Icharts Seniors [posted part in separate thread also] – would like someone to put in yearly [5 years at least] and minute [past 5 days] chart

Reasons for “atleast short term 1-3 weeks" bearishness [Wipro – current NF 450]

Long term time frame:

1) Multiple [at least 5 times] in past 5 years : tested 470 -500 levels

2) Channel top at 450 levels

3) Corrective started in March 2011 [ 495 levels] – to 310 [august 2011] – A leg

4) B leg [flat complex corrective in abcde within channel 320-450] – with ‘e’ leg completed at 450 on 7/8/2013 on closing basis

5) C leg on downtrend to start “immediately” – as long as trades below 470 levels

Recent activity

1) last 5 days daily chart - swing high at 463 [6/8], failure to cross [7/8]

2) ABC correction [started on 6/8] where B fails to cross A [7/8]

3) Head and shoulders break [daily] on 450 [support] - so sold on 8/8 morning also

4) attempted retest of neckline on 8/8 late trade

5) Oscillators about to cross over

6) volumes less on recent ris

Trade plan :

I) sell immediate

II) intra day stop 460 for conservative trader

III) 470-475 for positional trader [closing basis]

IV) Targets – 435, 426, 405, 397

V) Sell on rise strategy can also be adopted on intra-day basis

|

|

| Back to top |

|

|

shivan.sn

White Belt

Joined: 24 Oct 2011

Posts: 11

|

Post: #4  Posted: Sat Aug 10, 2013 5:49 pm Post subject: Posted: Sat Aug 10, 2013 5:49 pm Post subject: |

|

|

| very nice detailed explanation on wipro............thanks for ur valuable analysis.........

|

|

| Back to top |

|

|

ravib99

White Belt

Joined: 05 May 2013

Posts: 8

|

Post: #5  Posted: Sun Aug 11, 2013 8:58 am Post subject: Wipro trend Posted: Sun Aug 11, 2013 8:58 am Post subject: Wipro trend |

|

|

| though i am new, the rationale behind this is very interesting and confirms in other parameters as well, however the time frame & target levels are not clear to me, thanks.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #6  Posted: Sun Aug 11, 2013 6:30 pm Post subject: Posted: Sun Aug 11, 2013 6:30 pm Post subject: |

|

|

Hi understand your query

If you see my preface

- I am targetting small profit points only (within range of thurs last) on higher levergae which I can hold for next week or so (or if see it closing consistently above 470 or "line" would tell me actually)

- again if u see preface, "my trades" will have "very high success probability for TARGETs I am TRADING in ie till 435-442 levels - last few days first support)

- but I need GUIDANCE from seniors on how to capture much higher profits till (targets 427 - 405 there are fibonacci retracements of rise 397 is support at time of breakout after recent results7

- NOTE that on thurs some prominent technical anchors on TV were bearish at 438 levels on wipro but any trade at that point would have resulted in loss

- point is when "retracements starts" often short sellers or technicians like us who can read charts and see impending decline are stopped out by operators.

- hence I suggest one way trade (or as mentioned earlier sell on INTRA day rise) and hence working with NOT to great risk rewards (initially)

- point is I get out of winning trade (as I expect to get out at 440 levels) and then AGAIN see chart ("line") pattern and then may be AGAIN REENTER the trade

Pls let me know your comments

Thanks

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #7  Posted: Mon Aug 12, 2013 3:01 pm Post subject: Posted: Mon Aug 12, 2013 3:01 pm Post subject: |

|

|

Wipro is topping out. However, conservative day traders who sold in morning in small quantities can exit if it remains above 454 [current 455 approx].

Line : Morning hour high not broken suggesting weakness. It can register a closing high though today.

I am holding my shorts which were added at 455 levels today. There can be one last bout of "suggestive bulishness" but not ACTUAL. As mentioned before, 470-475 levels very got area to short.

AmitAgg

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #8  Posted: Tue Aug 13, 2013 1:04 pm Post subject: Posted: Tue Aug 13, 2013 1:04 pm Post subject: |

|

|

2 points on wipro : i) hope conservative traders could get 'out' on 'earlier buy' - call given at 3.00 pm yesterday..quick trading decision..ii) i guess today's rise is the last bout of bullishness. iii) traders can short 470 levels with stop at 487. 483 is 1.618 of previous A wave on current leg from 320 levels.

Since there has been a vertical rise not supported by high volumes, it is given to me that whenever there is a turn, now (467) or at 475 or 483, there shall be 25-30 points till 454 - 448 levels minimum on Wipro.

Big money is made on impending turns ..if are willing to ride the risk. Trendlines have FINAL target of 510 if it streches to maximum - this level is not for traders being very wide.

pls see make or break thread also for Rajmohan's & Vinay's comments on Wipro/ Infy - which are precise.

Rgs

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #9  Posted: Tue Aug 13, 2013 1:14 pm Post subject: Posted: Tue Aug 13, 2013 1:14 pm Post subject: |

|

|

| One last point - the stock is behaving as per the philosophy of my thread. We shall see the "5-7 LEARNINGS" [for me and others] [i shall explain later] when the complete trade pattern fans out. I am short in it and adding shorts till 483.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #10  Posted: Wed Aug 14, 2013 2:22 pm Post subject: Posted: Wed Aug 14, 2013 2:22 pm Post subject: |

|

|

Just see what was writtern yesterday.. the turn has come today.

wipro falls from 472 to 454 - first support. can cover major portion

Learnings:

Big money is made on forecasting impending turns

One way trade [on avergaing one way] is required for trading at "tehnical tops"

Counter trend [weekly] trades are difficult to manage

Trades used for averaging shall give profit on a a dip [may be retracement], wherein the original quanity can be sold at near no profit or loss

Conservative traders should know when to get out when daily price is not closing as per expectation [based on candle pattern etc.] - BUT BUT be prepared to "re-enter" same side position next day again to capture points differential

Conviction is "NECESSARY" and important part of trade

Stocks will retrace at least ONCE at previous highs and use this opportunity to book profits

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #11  Posted: Wed Aug 14, 2013 5:33 pm Post subject: Posted: Wed Aug 14, 2013 5:33 pm Post subject: |

|

|

Congrats! Amit,

On your success and for your undettered conviction with your method.But, I would like to see some more trades.

To be frank it could be dangerous to predict turns at tops and bottoms with out any concrete signal for a turn just based on previous highs and lows and it could be fatal to keep on averaging.Though, personally my majority trades depends on turns at tops and bottoms in the form of Fusion method.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #12  Posted: Wed Aug 14, 2013 8:21 pm Post subject: Posted: Wed Aug 14, 2013 8:21 pm Post subject: |

|

|

Many thanks for your comments. I would say this and its important for this new thread and all shall find interesting

- I said "very high sucess rates" this is without being overconfident and my challenge would be to throw over 80-90 percent sucess in this thread (this is based on.experience and READING of LINE)

- if u look closely at my all comment for the trade on wipro (it gives technical reasoning when first sign of weekness was shown when it closed before 450 few days back)

- reading the line is title of thread : I could read at "same moment" for conversative traders to get out at 455 levels , wipro did exactly that rose next day and again fell day after next is today

- now I am unsure of its trajectory

- for this thread, I REQUEST seniors to guide me HOW to make more profits and when in there view shall technical indicators CONFIRM daily / weekly sell. (Eg : it rises from todays low of 454and fails to cross high of 472 and breaks 450 again)

- I would learn your method more closely and my objective of starting this thread would then achieve some purpose

- pls understand that I DO SEE impending turns (whatever you like to call it ...belief technical etc) but I NEED FURTHER technical precision fron senior or some technical method to reduce risk

- once people see my thread notes and make modification / suggestions to my trading style, I can actually give you "very high sucess rates" (its trading plan / money management that needs improvement)

Regards and thanks RK.

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #13  Posted: Sat Aug 17, 2013 10:01 am Post subject: Posted: Sat Aug 17, 2013 10:01 am Post subject: |

|

|

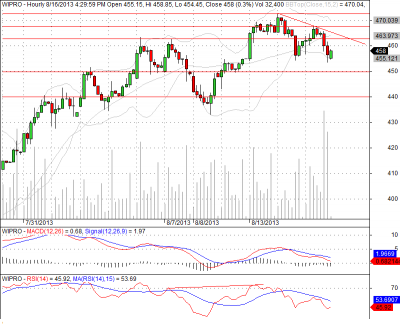

Here is my take on Wipro. It made a lower high on hourly chart and yet to make a lower low. The latest two bearish candles registered higher volumes which can be interpreted as unloading in this context(It can as well be interpreted as emergence of buyers at lower price near support).

From a short term perspective we may expect that RBI measures may work and hope for Rupee strengthening at least on short term basis, in that case Wipro may go down further. Targets.. 450 and 440. The 3 horizontal lines on upper part are resistances and two lines lower are supports.

IT pack is moving up on the weakness of the rupee whereas fundamentals are changing fast against them. I feel the honeymoon ends for IT sector once rupee strengthens and the daunting negative fundamentals comes to forefront which can lead the southward journey for them. In that case Wipro is the weakest link in IT chain (This last Para is of no use for short term trading).

| Description: |

|

| Filesize: |

47.21 KB |

| Viewed: |

659 Time(s) |

|

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #14  Posted: Sat Aug 17, 2013 11:10 am Post subject: Posted: Sat Aug 17, 2013 11:10 am Post subject: |

|

|

Thanks RK.agreed

- just as I anticipated in my last post (whether it becomes sell if it does not break 472 as it did not on friday).

- but anticipation is NO GOOD is you (that is me) are NOT 90 percent sure of trajectory which I was not (considering others in thread did not totally support my "advance analysis") - hence did not take any short trade on Friday (hence overall it is as good as not knowing anything and my anticipation despite turning right does not count)

- MSCI index percentage increase is supporting it and hence one can stay away unless 450 is broken (but then I like to trade at higher ranges rather than supports)

- that's what its all about - can anyone tell me whether it woulf still be a sell below 450

- it behaved like Reliance Capital on friday (RCAP shot from 455 to 469 and back to 455 is less than 2 mins few days back) - wipro fell to 457 then immediately rose above 465 NF and then fell (it smells of operator getting out BUT BUT I am unsure of wipro though this movement would have made me short RCAP is seen In RCAP)

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #15  Posted: Sun Aug 18, 2013 11:01 am Post subject: Posted: Sun Aug 18, 2013 11:01 am Post subject: |

|

|

Idea Cellular - shall top out at 180-182

[point is IF i see price of 179-180 for FIRST TIME then immediate sell in LARGE quantities]

i) C [3rd wave] pattern target [starting 100] being met at 180 =being 50*1.618+100

ii) multiple trendlines support at 156-162-169 - currently above 169 [CMP 171]

iii) expanding triangle? - some days back 176 high after a week fall to 158 and then back to 177 on friday [16th]. closed at 171

again ...can rise to 182 but break of 170 shall result in fall [mim] to 165-166 and then to 158

so can SELL AT STAGES [sep futures may be]

- one lot at 170 [if it trades below 169.5 on 19th...then add and cover up at 165-163 [intra-day call]

- one lot 173 [first resistance at 174 then 177]

- one lot at 180 odd levels [if it comes]

can add shorts depending on movement - to decide over the next week

shall fine tune strategy based on stock movement in early part of next week

|

|

| Back to top |

|

|

|