| View previous topic :: View next topic |

| Author |

Reverse Momentum Technique |

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #61  Posted: Sun Aug 16, 2009 11:16 pm Post subject: Learning your technique Posted: Sun Aug 16, 2009 11:16 pm Post subject: Learning your technique |

|

|

Ajit

Could you please clarify if the breakout needs to happen in the 3rd candle itself? Here if you see all the three breakouts have happened in the 5th Candle (4386) and 4th candle in the rest of the two cases.

Regards

Ravi

|

|

| Back to top |

|

|

|

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #62  Posted: Sun Aug 16, 2009 11:28 pm Post subject: Learning your technique Posted: Sun Aug 16, 2009 11:28 pm Post subject: Learning your technique |

|

|

Here is an example of Bearish signal... Let me know if this is fine. Also if you see a 4595 level the target has been achieved on the subsequent day. Can we take the indicators from the previous day and trade the next day if market opens favourably?

Regards

Ravi

| Description: |

|

| Filesize: |

8.77 KB |

| Viewed: |

2354 Time(s) |

|

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #63  Posted: Mon Oct 05, 2009 3:00 pm Post subject: explanation of technique. Posted: Mon Oct 05, 2009 3:00 pm Post subject: explanation of technique. |

|

|

AJIT sir,

Though you explained the technique on Ms-word doc. still iam not clear.I request you to kindly explain the technique thoroughly with the examples of i-charts as iam quite new to trading and admired at seeing the feedbacks posted by others .Hope you will take this extra pain for new beginners like us.Thanking you,sir,in anticipation,

regards,

srihari.

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #64  Posted: Tue Oct 06, 2009 8:08 pm Post subject: learning of technique Posted: Tue Oct 06, 2009 8:08 pm Post subject: learning of technique |

|

|

AJIT sir,

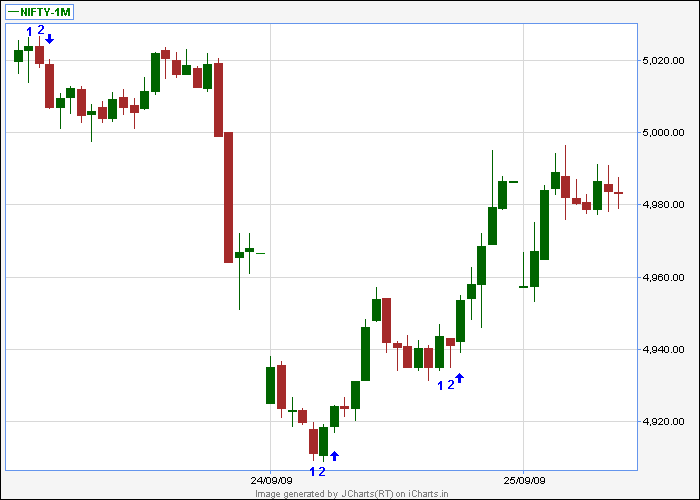

iam here with attaching the nifty-1m 5min tf chart.Based on reverse momentum technique, i have marked the short trades with down arrows and long trades with up arrows.they are as follows.Kindly post your suggestions.

1}SHORT at 10:35AM,11:30 AM,12:10 PM.

2}LONG at 12:30 PM,1:50 PM,2:15 PM.

I request Mr.GOUTAM, Mr. VINST AND Mr.QUICK MURUGAN also to send their feed-backs on the entry points marked.

| Description: |

|

| Filesize: |

34.04 KB |

| Viewed: |

705 Time(s) |

|

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #65  Posted: Thu Oct 08, 2009 3:12 pm Post subject: explanation of technique. Posted: Thu Oct 08, 2009 3:12 pm Post subject: explanation of technique. |

|

|

QuickGMurugun sir,

with my little understanding of technique,iam entering trades but end result is losses for me.Kindly explain the technique as your posts suggest that you have a good understanding of technique.

regards,

srihari.

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #66  Posted: Fri Oct 09, 2009 4:20 pm Post subject: Posted: Fri Oct 09, 2009 4:20 pm Post subject: |

|

|

Srihari....

I think you havent identified the candles properly.

Ill try to explain you in simple terms.

Assuming 5 mins TF

If you see candles having Higher Highs (HH) & Higher Lows (HL) ....

In the charts that you have pasted 10.25 candle has formed a high.... so you should go short below the low of 10.20 candle.

Similarly, for longs....you need to have an inside candle....in the sense the high & low of the current candle should be within high and lows of previous candles.

12.20 candle is an inside candle....so you should go long above 12.15 candle high....both ways you would have made profits

Do limited trades and paste charts regularly...Ill clarify....

Regards

QGM

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #68  Posted: Sat Oct 10, 2009 12:38 pm Post subject: Posted: Sat Oct 10, 2009 12:38 pm Post subject: |

|

|

Answers.....

1. You can max look at 5 candles....

2. The set up doesnt look at green/red candle. All it wants is HH/HL for shorts and inside candle for longs.

3. For shorts you need to have HH/HL candle & no inside candles.

4. Inside candle for long is a must.

5. Trade the next candle.

Dont forget to add some filters to the same.

The system is tried on 5 mins TF...so dont have too much idea on longer tf. This is not a fool proof system infact none is....This is a system with proper SLs & Exits. Keep 2-3 trades a day and get over with it for the day.

Please remember to enter SLs & Exit prices the moment you enter into a trade. Backtest it for few months/paper trade & then start doing it realtime.

All the best

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #69  Posted: Sun Oct 11, 2009 11:20 am Post subject: understanding of RMT Posted: Sun Oct 11, 2009 11:20 am Post subject: understanding of RMT |

|

|

QGM sir,

Thanks for your crystal-clear explanation.In the process of gaining grip, I have marked some trades in the below charts.kindly correct me if Iam wrong.

-NUMBER 1 shows previous candle.

-NUMBER 2 shows middle candle.

-down arrow for SHORTS and up arrow for LONGS execution candles.

-This is 15min tf of nifty-1m.

-10:45 "1" candle low is:4909 and 11:00 "2" candle low is:4908.70.Will "2" candle qualify as inside candle for LONGS.

Regards,

srihari

| Description: |

|

| Filesize: |

6.36 KB |

| Viewed: |

1796 Time(s) |

|

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #70  Posted: Mon Oct 12, 2009 10:16 am Post subject: Posted: Mon Oct 12, 2009 10:16 am Post subject: |

|

|

Srihari,

Kindly confirm highs & lows of all the candles marked 1,2

Regards

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #71  Posted: Mon Oct 12, 2009 10:55 am Post subject: understanding of RMT Posted: Mon Oct 12, 2009 10:55 am Post subject: understanding of RMT |

|

|

QGM sir,

SHORT TRADE:

- 1 st candle 10:00 HIGH:5026.40 LOW:5014.10

-2 nd candle 10:15 HIGH:5026.80 LOW:5018

LONG-TRADE:

-1 st candle 10:45 HIGH:4919.55 LOW:4909

-2 nd candle 11:00 HIGH:4919.10 LOW:4908.70

-1st candle 13:45 HIGH:4946.85 LOW:4934

-2nd candle 14:00 HIGH:4943 LOW:4935.05

15 min tf of nifty-1m.

Regards,

srihari

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #72  Posted: Mon Oct 12, 2009 2:50 pm Post subject: RMT learning. Posted: Mon Oct 12, 2009 2:50 pm Post subject: RMT learning. |

|

|

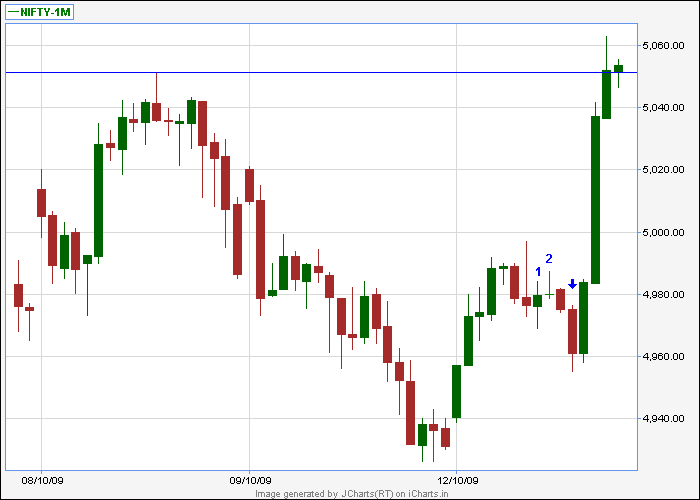

QGM sir,

Another shocking day for me.After observing 12:00 and 12:20 candles of today nifty-1m chart{20 min tf} I went short on 13:00 candle at 4960. With in no time nifty-1m zoomed upto 5041 forcing me to book heavy losses.

1]Sir,whether I identified short set-up rightly or not?

2] In case set-up is correct and it backfires us, how to protect one self from such heavy losses.Iam afraid of entering stop-loss due to nifty volatility.

treating me as disciple,kindly guide me.

regards,

srihari

| Description: |

|

| Filesize: |

6.65 KB |

| Viewed: |

1935 Time(s) |

|

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #73  Posted: Mon Oct 12, 2009 4:39 pm Post subject: Posted: Mon Oct 12, 2009 4:39 pm Post subject: |

|

|

Dear Srihari

Your earlier trades are right (one on 15mins tf)...

In the recent post I think you are working on 20 mins TF. Srihari, please stick to a TF & follow that day in and day out. I dont know why you are not looking at 5mins TF.

A trader with SL is bound to lose money & all the capital. Dont think of volatility & other things. If you do a trade without SL no one can help you from making heavy losses.

Remember the strategy framed by Ajit is for 5 mins TF & so are the SL & tgts. You might have a bad day now and then but the whole idea is to minimise your losses & expand your gains. So trade with discipline,for ex, not more than 3 trades a day. Strict SL, book profits or trail SL.

Without discipline even the best of your strategies will not work.

TRADE LIKE A SYSTEM. DONT PUT IN YOUR THOUGHTS IN TRADE.

Please share with me your trades on 5 mins TF tomorrow. I think you are identifying your trade setup rightly.

Regards

QGM

|

|

| Back to top |

|

|

ajit123

White Belt

Joined: 11 Oct 2006

Posts: 65

Location: bokaro,jharkhand

|

Post: #74  Posted: Tue Oct 13, 2009 12:31 pm Post subject: hello Posted: Tue Oct 13, 2009 12:31 pm Post subject: hello |

|

|

hi folks

its nice to see that my friends here are going great following the reverse momentum technique.but looking at the discussions i have come to the conclusion that stops and targets are not being followed in the right manner.targets are not that important as the stops are, as if you dont use stops it will just gallop your own capital.capital must not be eroded. do apply stops at the set points and then look for the other trades. for any query you can post questions here.

presently i am testing my other research and will disclose that after proper forward testing only.

thanks.

|

|

| Back to top |

|

|

srihari

White Belt

Joined: 02 Jul 2009

Posts: 21

|

Post: #75  Posted: Tue Oct 13, 2009 4:08 pm Post subject: LEARNING OF RMT Posted: Tue Oct 13, 2009 4:08 pm Post subject: LEARNING OF RMT |

|

|

AJIT sir,

Very nice to see you back in the forum.In your temporary absence, Iam getting valuable guidance and teachings from Mr.QUICKGMURUGAN sir. Being the author of this R.M.Technique I would request you to clarify me on the following points.

1]The set-up should consist of previous candle,immediately followed by middle candle and then followed by maximum two execution candles.

YES or NO?

2]Middle inside candle for long set-up is must. YES or NO?

3] Higher High & higher Low middle candle is must for short set-up. YES or NO?

4]How to enter trade? Just keep a filter of 3-4 points above the high of previous candle and enter the long-trade on execution candle or wait for the execution candle to close above the high of the previous candle.Because many times either the execution candle is crossing 3-4 points above the high of previous candle but closing much below it or the execution candle is closing 10-15 points above the high of previous candle thus reducing the profit points by 10-15.

Kindly clarify me on the above points and request you to keep in touch with the forum by posting charts.Please take this extra work for the benefit of no. of new-comers like me.

Regards,

srihari.

|

|

| Back to top |

|

|

|