|

|

| View previous topic :: View next topic |

| Author |

RUNNING WITH THE WOLVES |

jjm

White Belt

Joined: 17 Mar 2010

Posts: 411

|

Post: #406  Posted: Sat Sep 10, 2011 3:07 pm Post subject: Posted: Sat Sep 10, 2011 3:07 pm Post subject: |

|

|

[quote="rk_a2003"]The classical WW pattern explains overshooting at point 5 and convergence of line 1 3 5 and line 2 4 . It also accepts without overshooting at point 5 and without convergence of lines.

I have not read any thing about undershooting .Still as per your charts it appears even undrshooting is possible. Logically also we can say when overshooting is possible why not undershooting. We need to back test it on several times then only we can conclude.

One more observation is if we take wicks as reference we get optimistic price targets, and if we take real body as reference we get conservative targets.

Yes will keep a tab on this

JJM

|

|

| Back to top |

|

|

|

|  |

ronypan

White Belt

Joined: 07 Aug 2010

Posts: 197

|

Post: #407  Posted: Sat Sep 10, 2011 5:11 pm Post subject: Posted: Sat Sep 10, 2011 5:11 pm Post subject: |

|

|

Thanks..

Its cleared with this..

| jjm wrote: | | ronypan wrote: | M&M--- Is is valid pattern and right time to short M&M in weekly chart?

Experts please comments.. |

Rony we need HH ..pt5>pt3>p1 for bullish and LL for bearish : Pt5< pt3<pt1

Most important : Pt 4 lies betn pt 1 and 2

Hope it is clear

Regards,

JJM |

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #408  Posted: Sun Sep 11, 2011 10:23 am Post subject: Re: TATAPOWER-1M EOD Posted: Sun Sep 11, 2011 10:23 am Post subject: Re: TATAPOWER-1M EOD |

|

|

| shrvij wrote: | TATAPOWER-1M

Sumesh,Jim sir,

pl check tatapower eod chart for bullish ww.

sorry can't load chart.I have marked 19/08/11 low pt 1,high of 02/09/11 pt 2, 05/09/11 pt 3, 08/09/11 pt 4, & check today's closing.

Am I right? Further, rsi shows +ve divergence.

Pl guide.

Thanks & regards,

shraddha |

Hi,

For a good WW (you can never get ideal), points 1,3,5 should have decent spacing between them, here there is hardly any space.. In fact, if you see the chart, it looks more like a descending triangle, and the fact that it is still holding 1000 mark is probably due to human nature of attracting towards round numbers (100, 250, 700, 1000 etc..)

So , in fact if it closes below 1000/990 then a good 100+ points fall is expected.

Regards,

Sumesh

| Description: |

|

| Filesize: |

20.11 KB |

| Viewed: |

330 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #409  Posted: Sun Sep 11, 2011 11:04 am Post subject: OBSERVATIONS.. Posted: Sun Sep 11, 2011 11:04 am Post subject: OBSERVATIONS.. |

|

|

| rk_a2003 wrote: | The classical WW pattern explains overshooting at point 5 and convergence of line 1 3 5 and line 2 4 . It also accepts without overshooting at point 5 and without convergence of lines.

I have not read any thing about undershooting .Still as per your charts it appears even undrshooting is possible. Logically also we can say when overshooting is possible why not undershooting. We need to back test it on several times then only we can conclude.

One more observation is if we take wicks as reference we get optimistic price targets, and if we take real body as reference we get conservative targets.

| jjm wrote: | Wanting to share a recent observation in WW patterns..

A bar that forms Pt 5 in pattern not necessarily touching TL drawn from pt 1 to 3

One has to see the value of bar...if we are getting HH/LL value at pt 5..still Waves are considered and respective tgts are met..

For illustration posting few charts..

Now request to all those who has been studying can share their views or write up if they have any..

Do we have a valid Pt 5 always touching to TL or overshooting TL ..Can it be considered valid pt 5 even if undershoots..

If we have three conditions ;

a) touching TL

b) overshooting TL

c) undershooting TL

Where the hell am I going to create my position..this is the dilemma I am still facing

Regards,

JJM |

|

Hi jjm bhai,

Talking abt the obervations, I would also like to share few..

1.) WW pattern have been occuring and will keep coming in future also because of very nature of price imbalance in the market.. So, my philosophy is if there is any confusion in determining proper points, then I will just leave it. I may loose opportunity, but at least I will not loose my peace for want of clarity... There is always next time

2.) Proper ENTRY as you said correctly is very important, for this I have observed that(in case of + WW setup), upon reversal, if price closes above 8 ema in the trading timeframe , then it can be considered as entry for "half" quantity. Price however MUST close INSIDE channel again. Anything outside is mere taking chance..

Other half qty can be entered upon breach of point 3's high.

These have helped me in previous WW trades, and by no means I'm suggesting as part of original rules. Everyone is free to find his own technique. Even If they work for me in 8 out of 10 trades, I will make it as mandatory screening method for WW trades...

3.) Trading hourly(60tf) is best if you can afford big SL. For a poor trader like me with little trading capital, it is good if only 5/15 tf setups are traded, as the results are faster and also trading expenses (SL) are low, so I can trade without much emotional stress. This of course assuming not a big chunk is at stake at one go

Regards,

Sumesh

|

|

| Back to top |

|

|

peace69

White Belt

Joined: 27 Aug 2009

Posts: 113

|

Post: #410  Posted: Sun Sep 11, 2011 12:11 pm Post subject: Posted: Sun Sep 11, 2011 12:11 pm Post subject: |

|

|

| hi jjm, sumesh. nice sharing. it always be helpful in coming trades. with all pros & cons, i prefer to stick to classic ww pattern-overshoot & reenter pt 5. that will lessen trade opportunity-qtywise as well as rrr wise-; but at the same time may lessen whipsaws too. & that's imp for my trading style at current. offcourse this is my understanding & may be wrong. needs to track for a while to come on any conclusion. i'll also prefer to check timewise symetricality betwen pt 1-2 & pt 3-4 as well as pt 1-3 & pt 2-4 as much as posible.more parrelel the lines, more trustworthy the pattern will be imo. jjm, i come to know 'bot this pattern from u. so i'm thankfull to u for introducing it. it's really awsome & producive. sumesh, yes. i agree to u about 60 tf pattern more producive & reliable. & also agree to prefering LTF for lesser risk & fast result. regards.

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #411  Posted: Sun Sep 11, 2011 1:59 pm Post subject: MAX Posted: Sun Sep 11, 2011 1:59 pm Post subject: MAX |

|

|

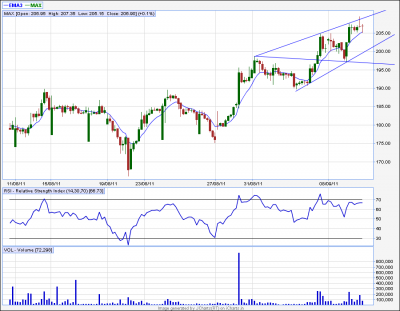

MAX..60tf

========

Although very strong on EOD , a CLOSE below 205 on 60tf can take it to 196..

| Description: |

|

| Filesize: |

50.48 KB |

| Viewed: |

378 Time(s) |

|

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

|

| Back to top |

|

|

chiragbvyas

White Belt

Joined: 18 Feb 2010

Posts: 469

|

Post: #413  Posted: Mon Sep 12, 2011 6:08 pm Post subject: hi Posted: Mon Sep 12, 2011 6:08 pm Post subject: hi |

|

|

jjm bhai,

trying to understand and drawn this ww chart pls have a look and correct me. i would like to learn from my mistakes.

Regards,

Thanks.

Chirag.

| Description: |

|

| Filesize: |

23.12 KB |

| Viewed: |

344 Time(s) |

|

|

|

| Back to top |

|

|

Shahii

White Belt

Joined: 15 Apr 2011

Posts: 46

|

Post: #414  Posted: Mon Sep 12, 2011 6:52 pm Post subject: Re: hi Posted: Mon Sep 12, 2011 6:52 pm Post subject: Re: hi |

|

|

| chiragbvyas wrote: | jjm bhai,

trying to understand and drawn this ww chart pls have a look and correct me. i would like to learn from my mistakes.

Regards,

Thanks.

Chirag. |

chirag bhai .. ww ka majak to mat udao aise draw kar ke  ... everything is there in the forum.. start reading from first page ... everything is there in the forum.. start reading from first page

|

|

| Back to top |

|

|

adsingh101

White Belt

Joined: 09 Nov 2010

Posts: 242

|

Post: #415  Posted: Mon Sep 12, 2011 10:42 pm Post subject: Mphasis_15min Posted: Mon Sep 12, 2011 10:42 pm Post subject: Mphasis_15min |

|

|

Mphasis Future on 15min target 353 once it enters the channel.

| Description: |

|

| Filesize: |

68.31 KB |

| Viewed: |

385 Time(s) |

|

|

|

| Back to top |

|

|

chandrujimrc

Brown Belt

Joined: 21 Apr 2009

Posts: 1683

|

Post: #416  Posted: Tue Sep 13, 2011 2:20 pm Post subject: Runnining with the woolves Posted: Tue Sep 13, 2011 2:20 pm Post subject: Runnining with the woolves |

|

|

Dear friends,

Is it bull ww set up nifty fut 1 hour tf.

chandru

| Description: |

|

| Filesize: |

21.02 KB |

| Viewed: |

381 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #418  Posted: Wed Sep 14, 2011 2:31 pm Post subject: BATAINDIA Posted: Wed Sep 14, 2011 2:31 pm Post subject: BATAINDIA |

|

|

BATAINDIA ..60tf

=========

| Description: |

|

| Filesize: |

36.93 KB |

| Viewed: |

344 Time(s) |

|

|

|

| Back to top |

|

|

adsingh101

White Belt

Joined: 09 Nov 2010

Posts: 242

|

Post: #419  Posted: Wed Sep 14, 2011 2:46 pm Post subject: Bhartiartl_15min Posted: Wed Sep 14, 2011 2:46 pm Post subject: Bhartiartl_15min |

|

|

Bhartiartl_15 min Sumesh pls correct me if i am wrong.

| Description: |

|

| Filesize: |

58.17 KB |

| Viewed: |

330 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #420  Posted: Wed Sep 14, 2011 3:10 pm Post subject: TATAPOWER Posted: Wed Sep 14, 2011 3:10 pm Post subject: TATAPOWER |

|

|

TATAPOWER ..60tf

=============

Looks to be a good candidate for ww. NOT YET CONFIRMED, as it has not reentered into channel.. However, as it is forming a base at current level, I bought small qty with SL as low (small SL !) .

If and only if it enters into channel again (and preferebly closes above pt3), I will buy full qty.

Regards,

Sumesh

| Description: |

|

| Filesize: |

26.31 KB |

| Viewed: |

356 Time(s) |

|

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|