|

|

| View previous topic :: View next topic |

| Author |

Saint's 60minflow |

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #151  Posted: Mon May 18, 2009 9:40 am Post subject: Posted: Mon May 18, 2009 9:40 am Post subject: |

|

|

No position for me until we make a PL. ITs also a good idea to wait for reversal now

MJ-

Last edited by musicjunkie on Mon May 18, 2009 10:56 am; edited 1 time in total |

|

| Back to top |

|

|

|

|  |

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #152  Posted: Mon May 18, 2009 10:55 am Post subject: Posted: Mon May 18, 2009 10:55 am Post subject: |

|

|

Hi! mj,

Attached is the format for the 60 min Intraday rules.

Would be grateful if you could you please add your comments and upload the same.

Thanks for all your help.

Regards,

Amit

| Description: |

|

Download |

| Filename: |

60 min Intraday rules.doc |

| Filesize: |

23.5 KB |

| Downloaded: |

568 Time(s) |

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #153  Posted: Mon May 18, 2009 11:11 am Post subject: Posted: Mon May 18, 2009 11:11 am Post subject: |

|

|

Hi amrit, thanks for uplaoding the file.

Iv sent you a PM on where you can study the miniflow, it has too many variations to be compartmentalized in a plan, go through it , im sure you will get it.

Discussion can be done here as always

Cheers

MJ-

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #154  Posted: Tue May 19, 2009 12:30 am Post subject: Posted: Tue May 19, 2009 12:30 am Post subject: |

|

|

Hi! mj,

Thanks a lot for your reply.

I prefer the 60 min flow to the 60 min mini flow as of now.

More later ...

Once again, thanks a ton for everything.

Cheers,

Amit

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #155  Posted: Wed May 20, 2009 1:52 pm Post subject: Rules Posted: Wed May 20, 2009 1:52 pm Post subject: Rules |

|

|

Hi! stoxx,

As per PT sir's acknowledgement in the SB, following is the link for the rules. This was sent to me by mj.

http://tradersaint.com/swingflowtrade

Cheers,

Amit

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #156  Posted: Thu May 21, 2009 11:16 am Post subject: Posted: Thu May 21, 2009 11:16 am Post subject: |

|

|

Stops for short entry at todays 5min bar low.

Personally, will take longs above yesterdays pivot high as well....

MJ-

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #157  Posted: Thu May 21, 2009 2:30 pm Post subject: Posted: Thu May 21, 2009 2:30 pm Post subject: |

|

|

Hi! mj,

Did not understand "Stop for entry ..."

Could you please elaborate.

Thanks,

Amit

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #158  Posted: Thu May 21, 2009 2:42 pm Post subject: Posted: Thu May 21, 2009 2:42 pm Post subject: |

|

|

Hi Amit,

Let start with the 20th, the flow is long and we are waiting for a pivot to form. We get that at the 5min bar of the day which is 4286-F. Now we wait for new highs to move the stops, we don't get them, however we get a long sideways move.

After say 4 bars of sideways we are no longer waiting for new highs, move stops.

No trigger on that day, instead we get new lows but not past our filter, STILL LONG. Market shuts....

Next day, which is today, we have the 5min making new lows, past our previous pivot levels. So we move stops to today's 5min low....

Hit, we are short, EOD reversal above 4245. Many people waiting out, I will carry this short, and reverse EOD if we get a EOD reversal

Regards,

MJ-

Last edited by musicjunkie on Fri May 22, 2009 9:15 am; edited 1 time in total |

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

|

| Back to top |

|

|

RKM

White Belt

Joined: 06 Apr 2009

Posts: 137

|

Post: #160  Posted: Thu May 21, 2009 10:12 pm Post subject: Posted: Thu May 21, 2009 10:12 pm Post subject: |

|

|

Hi MJ,

I think many of us missed the 'long' bus and entered through a short below the 1300 bar of yesterday, the 20th May with an add below today's 1200 nn bar. SAR above the high of today's 1400 bar.

Any advice?

Makhijani

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #161  Posted: Fri May 22, 2009 9:28 am Post subject: Posted: Fri May 22, 2009 9:28 am Post subject: |

|

|

The flow was long on the 20th because we were carrying previous days longs with stops at 11am bar low of the 19th. Now frankly speaking if i were carrying longs with stops 3oopts away, thats something I just cannot take.

I would have booked and exited at opening on the 19th.

We reversed to shorts yesterday with no adds yet , stops at yesterdays high of day (HOD). We are short now, we look to see the move made NOW, meaning we dont add on previous pivot breaks, we are trading in the NOW, if a pivot is formed and breaks to the downside today we add, we are not bothered by break of pivots which were formed 3 days ago.

About the 2 bar question, im finding it difficult to explain but we get wrbs vertical moves up and we trail stops 2 bars BACK every new high is made, the moment a new high fails to come about our stops stay where they are and we wait for a PL to form, if that doesnt happen we need a few more bars going up to start trailing with 2 bar. This situation stops at lows of the 18th, very far away, thats why would have booked.

Hope i didnt confuse you

Regards,

MJ-

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #162  Posted: Fri May 22, 2009 9:34 am Post subject: Posted: Fri May 22, 2009 9:34 am Post subject: |

|

|

The best way of learning is by seeing it in action, theory is more of a waste of time, the past month we have seen almost all situations come. You all must have a fair idea of what the system's limitations and strengths.

Take what you think is useful and reject the unnecessary, backtest and make your own version of the flow.....

Good luck

MJ-

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #163  Posted: Fri May 22, 2009 6:56 pm Post subject: Posted: Fri May 22, 2009 6:56 pm Post subject: |

|

|

Hi! mj,

Firstly, thanks a lot for taking the time and effort to clarify things. Really do appreciate this.

As you rightly said, one would need to fine tune the system according to his / her temperament.

2 queries please ...

Attached are 2 charts:

Chart 1 - Snapshot of one of the rules

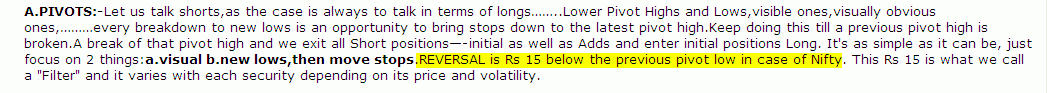

1) I know this is kind of late to ask you this, but better to get the cobwebs cleared ... What does Saint mean by the statement (highlighted in snapshot)

What i need clarification on is: If Saint is talking about Shorts, then why is he talking about reversals below the previous pivot low. Should the reversal not be above the previous pivot high?

Also, what filter of Rs.15 is he referring to?

2) Do you keep a filter above / below the previous pivot high / low, or do you just reverse when the pivot gets taken out

---------------------

Chart 2 - 60 min chart

1) Can you please let me know if I have marked the pivots correctly (marked with blue lines)

2) Would we be long today above the pivot (marked with blue arrow)

Once again, thanks a million for everything and sorry for the bother.

Regards,

Amit

| Description: |

|

| Filesize: |

8.21 KB |

| Viewed: |

1571 Time(s) |

|

| Description: |

|

| Filesize: |

8.3 KB |

| Viewed: |

1571 Time(s) |

|

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #165  Posted: Mon May 25, 2009 9:16 am Post subject: Posted: Mon May 25, 2009 9:16 am Post subject: |

|

|

Hi Amrit,

Very nice to see such good posts of yours. Always a pleasure discussing out our views on things.

The highlighted text All saint is saying that we use a filter of 15 above pivot highs and pivot lows. So we are short, long above pivot high + filter, which is 15 in this case, keeps changing, And short below PL.

You have understood it correctly.

Yes they are correctly marked and we are indeed long today.

Without fitlers we will have too many bad trades, filter is a must! Simply add your filter to the Pivot highs/lows to enter the trade, them put your stop loss, and relax, wait, add,add,add, reverse.....

Regards,

MJ-

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|