|

|

| View previous topic :: View next topic |

| Author |

Saint's 60minflow |

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #166  Posted: Mon May 25, 2009 5:49 pm Post subject: Posted: Mon May 25, 2009 5:49 pm Post subject: |

|

|

Hi! mj,

THANKS A LOT! for all your help.

Regards,

Amit

|

|

| Back to top |

|

|

|

|  |

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #167  Posted: Fri May 29, 2009 10:42 am Post subject: Posted: Fri May 29, 2009 10:42 am Post subject: |

|

|

Hi! mj,

A query please ...

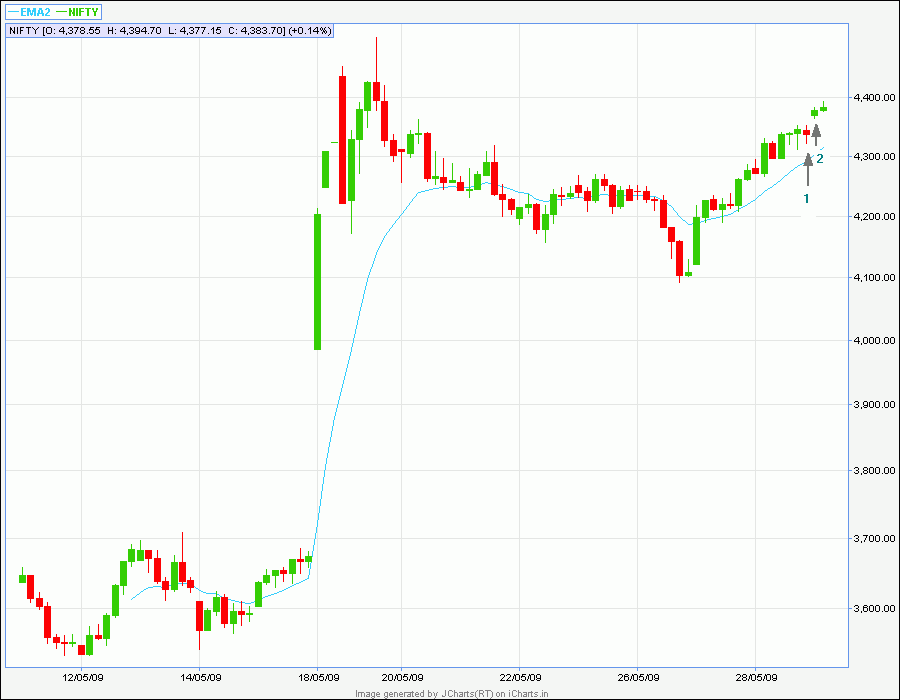

Attached is today's chart.

As per Saint's rules, we add on the high of 5 min bar + 7 (filter) keeping the 5 min bar low as stop loss.

There is another rule where he says that if there is a gap up and the 5 min bar is green, move the TSL to the low of the previous 2 bars or pivot low whichever is closer.

So, today, what rule should we follow for the TSL ... the 5 min bar low or 2 bar low.

Thanks & regards,

Amit

| Description: |

|

| Filesize: |

9.96 KB |

| Viewed: |

1468 Time(s) |

|

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #168  Posted: Fri May 29, 2009 6:37 pm Post subject: Posted: Fri May 29, 2009 6:37 pm Post subject: |

|

|

HI MJ - I am out of the flow longs today at closing around 4450 since I wanted a close above 4455 today to hold longs (not as per flow but something else i follow)... I am ready to long again on Monday based on first 5 min candle breakout.

However from a flow perspective, the last hour bar seems like an EOD reversal hence in any case longs should have been booked and shorts opened.

Any comments?

Cheers

SH

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #169  Posted: Fri May 29, 2009 9:33 pm Post subject: Posted: Fri May 29, 2009 9:33 pm Post subject: |

|

|

HI Sh,

Actually stops still at yesterdays Pivot. Not using that "wrb" low....very far , but if we make new highs on Monday then we have a new pivot.

Its great you exited the flow with a profit, good job  , but flow perspective is that we are still long. As you know we are trying to catch a huge trend and are not interested in making a profit on every trade. Making money everyday comes from day-trading , but flow perspective is that we are still long. As you know we are trying to catch a huge trend and are not interested in making a profit on every trade. Making money everyday comes from day-trading

Entering on 5min break sounds fine, keep stops at pivots then.

Have a great Weekend !

Regards

MJ-

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #170  Posted: Fri May 29, 2009 10:52 pm Post subject: Posted: Fri May 29, 2009 10:52 pm Post subject: |

|

|

Hi! mj,

I had posted a query below. I think you might have overlooked it.

Regarding the stops as per your reply to SH's post, should we not follow the 2 bar low as the pivot is very far?

Would be grateful if you could please clarify the above 2 queries.

Thanks & regards,

Amit

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #171  Posted: Sat May 30, 2009 6:06 pm Post subject: Posted: Sat May 30, 2009 6:06 pm Post subject: |

|

|

Dear MJ

I had a query on the rule mentioned for PIVOTs...the stops for Shorts are at PH (if PL is formed)......and the reversal is at (PL - Filter)....wont the reversal point be much closer to the trade than PH???....

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #172  Posted: Sat May 30, 2009 7:18 pm Post subject: Posted: Sat May 30, 2009 7:18 pm Post subject: |

|

|

Sorry Amit ! I don't know how I missed your post despite you even posting a chart.

Yes we add above the 5min high on gap days that open in our favour.

Stops are ALWAYS at previous pivot or 2 bar. In the chart you posted its at pivot.

Now, that is the flow rule. What I do is that I add above 5min highs then take that add out if the low is violated since my stops are miles away at a pivot. So if we have a 100pts gap up i dont have to worry if there is a fall after my adds are triggered.

Also, please cheack Nifty futures as nifty spot cannot be traded. We make our decisions from nifty future charts only, spot charts are never seen.

Bullishanad, I did not understand your query, could you kindly rephrase the question?

Thanks & regards,

MJ-

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #173  Posted: Sat May 30, 2009 7:57 pm Post subject: Posted: Sat May 30, 2009 7:57 pm Post subject: |

|

|

HI MJ

The query is the same as Amit asked on 22nd May

What i need clarification on is: If Saint is talking about Shorts, then why is he talking about reversals below the previous pivot low. Should the reversal not be above the previous pivot high?...

If you see the initial post,just when you started this thread...you have mentioned in the PIVOT para that one should reverse the shorts at PL - filter....

"ENTRY and REVERSAL POINTS

A.PIVOTS:-Let us talk shorts,as the case is always to talk in terms of longs……..Lower Pivot Highs and Lows,visible ones,visually obvious ones,………every breakdown to new lows is an opportunity to bring stops down to the latest pivot high.Keep doing this till a previous pivot high is broken.A break of that pivot high and we exit all Short positions—-initial as well as Adds and enter initial positions Long. It's as simple as it can be, just focus on 2 things:a.visual b.new lows,then move stops.REVERSAL is Rs 15 below the previous pivot low in case of Nifty. This Rs 15 is what we call a "Filter" and it varies with each security depending on its price and volatility. "

Hope I have made my questions clear...

Anand Rathi

|

|

| Back to top |

|

|

RKM

White Belt

Joined: 06 Apr 2009

Posts: 137

|

Post: #174  Posted: Sun May 31, 2009 11:13 am Post subject: Posted: Sun May 31, 2009 11:13 am Post subject: |

|

|

Hi MJ,

Perhaps I am asking a similar question to the one that Amit has asked, but would welcome your clarification. As you say, the present stop is at the 3pm low of 28.05.09. Considering the vertical move on the 29th, why should it not be shifted to the 12 noon WRB low?

Also, am learning something new from you every time. I liked your strategy of getting out of your latest add in case the market turns against you. Since I joined the flow about two weeks ago, I have seen us losing a large number of points every time we had to reverse, and I was looking for a way to protect at least some of that, without being unfaithful to the basic principle of the flow system. Now I can think of this route as well. Just one question - here also do you use a large filter (as for a reversal on gap days), or something else?

Good to hear from you as always, MJ.

Cheers,

Makhijani

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #176  Posted: Mon Jun 01, 2009 9:26 pm Post subject: Posted: Mon Jun 01, 2009 9:26 pm Post subject: |

|

|

Hi Amit,

Yes by low I meant low of the 5min bar. Again this is my preference and not mentioned anywhere in the flow rules.

About your chart. Or stops are not using 2 bar. they are still at pivot which is 11pm high (4249+15). Im a little aggressive and would have taken 1300 bar high, minor difference.

Another thing I wanted to mention but was a little hesitant is that when prices retrace a a move against us by a large margin very quickly, we take any pivot that comes then. So if we are long and next day we have a fast fall retracing alot of the upmove , we reverse to shorts as soon as a PL is formed.

A good example is your chart. We are short. Stop at pivots. Next day gap up and stops arent moving. howver we have retraced most of the downmove so we take any new PH formations to reverse, the 12pm bar makes a pivot and we reverse there to longs.

Regards,

MJ-

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #177  Posted: Mon Jun 01, 2009 10:51 pm Post subject: Posted: Mon Jun 01, 2009 10:51 pm Post subject: |

|

|

HI MJ

The query is the same as Amit asked on 22nd May

What i need clarification on is: If Saint is talking about Shorts, then why is he talking about reversals below the previous pivot low. Should the reversal not be above the previous pivot high?...

If you see the initial post,just when you started this thread...you have mentioned in the PIVOT para that one should reverse the shorts at PL - filter....

"ENTRY and REVERSAL POINTS

A.PIVOTS:-Let us talk shorts,as the case is always to talk in terms of longs……..Lower Pivot Highs and Lows,visible ones,visually obvious ones,………every breakdown to new lows is an opportunity to bring stops down to the latest pivot high.Keep doing this till a previous pivot high is broken.A break of that pivot high and we exit all Short positions—-initial as well as Adds and enter initial positions Long. It's as simple as it can be, just focus on 2 things:a.visual b.new lows,then move stops.REVERSAL is Rs 15 below the previous pivot low in case of Nifty. This Rs 15 is what we call a "Filter" and it varies with each security depending on its price and volatility. "

Hope I have made my questions clear...

Anand Rathi

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #178  Posted: Tue Jun 02, 2009 10:14 am Post subject: Posted: Tue Jun 02, 2009 10:14 am Post subject: |

|

|

Dear mj,

THANKS A LOT for your support and time.

Warm regards,

Amit

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #179  Posted: Tue Jun 02, 2009 6:49 pm Post subject: Posted: Tue Jun 02, 2009 6:49 pm Post subject: |

|

|

Sorry Anand, something wrong there.

forget about that line, i will edit it out. If we are short our reversal is at PH +F

Thanks Amit, Always such a pleasure, all I have done is cleared up the rules, the most important and difficult part of execution is yet to come. good luck!

Regards,

MJ-

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #180  Posted: Wed Jun 03, 2009 2:19 pm Post subject: Posted: Wed Jun 03, 2009 2:19 pm Post subject: |

|

|

Hi Musicjunkie,

I am new to this site and has been hearing lots about saint 60 min flow. Well i try to find it here and there but i want to start it from beginning. I would request you to help me out from where to start what to read and how to implement.

I hope you and other members will help me out.

Regards,

Sherbaaz

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|