| View previous topic :: View next topic |

| Author |

Saint's 60minflow |

kapilanand

White Belt

Joined: 31 Dec 2008

Posts: 4

|

Post: #46  Posted: Thu Apr 02, 2009 8:08 pm Post subject: Posted: Thu Apr 02, 2009 8:08 pm Post subject: |

|

|

| Stockhunter wrote: | Hi Kapil,

Welcome to this thread and thanks for sharing your views. If I can take this liberty, may I request you to help the traders here like MJ is currently doing through this thread by probably starting a new thread on 30 mins miniflow and 10 mins ambush system?

Apologies in advance if if you do not have time however it will be a great service to icharts trader community if someone can start these threads separately as different traders having different trading horizons. I think the intraday tarders here would love to see these new threads.

MJ - any thoughts from you on these two intraday systems?

Cheers

SH |

Thanks SH for the kind words. It would be difficult for me to start a thread on this at present, as I am slightly tied up with the TS site where we follow these methods.

Kapil

|

|

| Back to top |

|

|

|

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #47  Posted: Fri Apr 03, 2009 3:41 pm Post subject: Posted: Fri Apr 03, 2009 3:41 pm Post subject: |

|

|

No problems Kapil, I think 60 mins method is enough to learn and make money ... thanks anyways and good luck !

Cheers

SH

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #48  Posted: Fri Apr 03, 2009 3:42 pm Post subject: Posted: Fri Apr 03, 2009 3:42 pm Post subject: |

|

|

| musicjunkie wrote: | Nothing much today. Added above the 5min bar.

So we are at Initial position +1Add

MJ |

MJ - new SL?

|

|

| Back to top |

|

|

musicjunkie1

White Belt

Joined: 24 Mar 2009

Posts: 8

|

Post: #49  Posted: Fri Apr 03, 2009 3:49 pm Post subject: Posted: Fri Apr 03, 2009 3:49 pm Post subject: |

|

|

Keeping it at days low, as of now. Waiting for a biggish bar to trigger 2 bar. If we have a gap situation then will use the gap rules as usual.

The intraday strategies are good as well. As Kapil mentioned you can read the rules on the TS website and we can continue to discuss the methodology in practice here.

MJ

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #50  Posted: Mon Apr 06, 2009 11:27 am Post subject: Posted: Mon Apr 06, 2009 11:27 am Post subject: |

|

|

Reversed to shorts at the 5min - Filter.

Now short....and holding..

Roughly 300pts gain in that upmove, do remember that the actual position was bigger since the risk on this long trade was small....so money-wise bigger gain then those 2-3 losses posted before..

MJ

|

|

| Back to top |

|

|

ConMan

White Belt

Joined: 06 Aug 2008

Posts: 344

|

Post: #51  Posted: Mon Apr 06, 2009 11:56 am Post subject: Posted: Mon Apr 06, 2009 11:56 am Post subject: |

|

|

Dear MJ

Short at what level. What would be the SL. I am not able to open icharts at office today.

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #52  Posted: Mon Apr 06, 2009 12:47 pm Post subject: Posted: Mon Apr 06, 2009 12:47 pm Post subject: |

|

|

Stops at days high as usual + filter

MJ

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #53  Posted: Mon Apr 06, 2009 10:49 pm Post subject: hi Posted: Mon Apr 06, 2009 10:49 pm Post subject: hi |

|

|

Hi MJ,

Good that atleast now I can crosscheck my understanding of this strategy from your thread  My PC had long become anti-TJ site My PC had long become anti-TJ site  never opens. never opens.

Have you shifted your SL to 2 pm candle high + filter, now?

Though 3 pm candle is higher - but it might be (2 pm one) considered as new PH...

Though personally I would like the SL to be kept still at day's high - but where is it as per system now?

Regards,

Saikat

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #54  Posted: Tue Apr 07, 2009 9:23 am Post subject: Posted: Tue Apr 07, 2009 9:23 am Post subject: |

|

|

| ..or have you reversed your position due to EOD reversal?

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #55  Posted: Tue Apr 07, 2009 11:23 am Post subject: Posted: Tue Apr 07, 2009 11:23 am Post subject: |

|

|

Hi! mj,

Just went through the shoutbox archives of yesterday (06-Apr-09) where sh checked with you whether you reversed your position from longs to shorts at 3285 - filter.

The low of the 1st bar in the 5minute chart is 3246.95. Could you please clarify why 3285?

Thanks and regards,

Amit

P.S. -> SH, if you could also please help, I would be grateful

|

|

| Back to top |

|

|

saikat

White Belt

Joined: 31 Mar 2008

Posts: 317

|

Post: #56  Posted: Tue Apr 07, 2009 12:17 pm Post subject: Posted: Tue Apr 07, 2009 12:17 pm Post subject: |

|

|

hi Amit/SH,

Let me try to answer this...

NF 1st min candle low was 3285.55. Where do you see 3246?

SH --> the short was based on day's first candle low. EOD reversal (even if u call it reversal) was still below that shorting point and even the LTP was below last PH ie 2 pm high 3277. So as per me 'eod reversal' rule not to be applied.

MJ --> Pl confirm

Regards,

Saikat

| amitrajangulati wrote: | Hi! mj,

Just went through the shoutbox archives of yesterday (06-Apr-09) where sh checked with you whether you reversed your position from longs to shorts at 3285 - filter.

The low of the 1st bar in the 5minute chart is 3246.95. Could you please clarify why 3285?

Thanks and regards,

Amit

P.S. -> SH, if you could also please help, I would be grateful |

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #57  Posted: Tue Apr 07, 2009 12:27 pm Post subject: Posted: Tue Apr 07, 2009 12:27 pm Post subject: |

|

|

Okay, lets go over the trade yesterday.

We were long the previous day with 1 Add, we get a gap up. First wee look whether the gap is away from the past 2-3 days range. Criteria met yesterday.

Second we want a bearsih 5 min bar, Criteria met.

We move our stops to the low of the 5min bar, i.e 3285-Filter. For gap days our filter is slightly bigger, just to make sure its a strong move down after a huge Gap up.

Price reaches our order and we exit longs and reverse to shorts at the same time.

Now our stops are at the high of the day. We wait and do nothing. Later in the day we have a new pivot high, but we need to wait for new lows which comes 3pm bar. We would have also added in this bar however filter saves us from the add.

Now as soon as we get new lows we move stops to the new pivot high which is the 3pm bar. No waiting for another bar to complete,straight away move stops.

Hope the above is clear.

Now, For the EOD reversal query. We use EOD reversals ONLY on pivots. Did we reverse on a pivot today? NO! therefore we remain short. The only way we reverse to longs is either a PH crack or we get a gap up the next day and we reverse at the high of the 5min bar.

Please feel free to ask any other questions/doubts....Right now limiting the discussion to only Nifty, as time progresses and everyone here becomes comfortable we can discuss better flowing stocks.

MJ

Last edited by musicjunkie on Tue Apr 07, 2009 12:32 pm; edited 1 time in total |

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #58  Posted: Tue Apr 07, 2009 12:29 pm Post subject: Posted: Tue Apr 07, 2009 12:29 pm Post subject: |

|

|

Great answer Saikat....Keep up the good work.

MJ

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #59  Posted: Tue Apr 07, 2009 12:47 pm Post subject: Posted: Tue Apr 07, 2009 12:47 pm Post subject: |

|

|

| musicjunkie wrote: | Absolutely correct SH,

However there is one rule called the EOD reversal. Suppose we take a long as a PH breaks, near market closing price trades BELOW Pivot high, we revert to orinignal positions, which is shorts in this case.

Happy that these situations are coming up, So we reversed to longs yesterday but as price traded below PH we are back to shorts.

Gap up today I think, Lets see what happens to our shorts now.

Most welcome Eagle-eyes, Great to see you here

SJ, hope you got my pm....

Regards,

MJ |

MJ - thanks, understood all till now but the EOD reversal it seems.

As per above post where you reversed to shorts from longs.. you reversed because at EOD the traded price was below the new pivot high..

applying the same logic to your shorts yesterday.. when we made a 3 PM new pivot low... we started trading above it so why shouldn't it qualify as a reversal .. like it did in the earlier case?

Thanks MJ - this might be a stupid question but better ask than assume!

Cheers

SH

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #60  Posted: Tue Apr 07, 2009 1:25 pm Post subject: Posted: Tue Apr 07, 2009 1:25 pm Post subject: |

|

|

Hi!

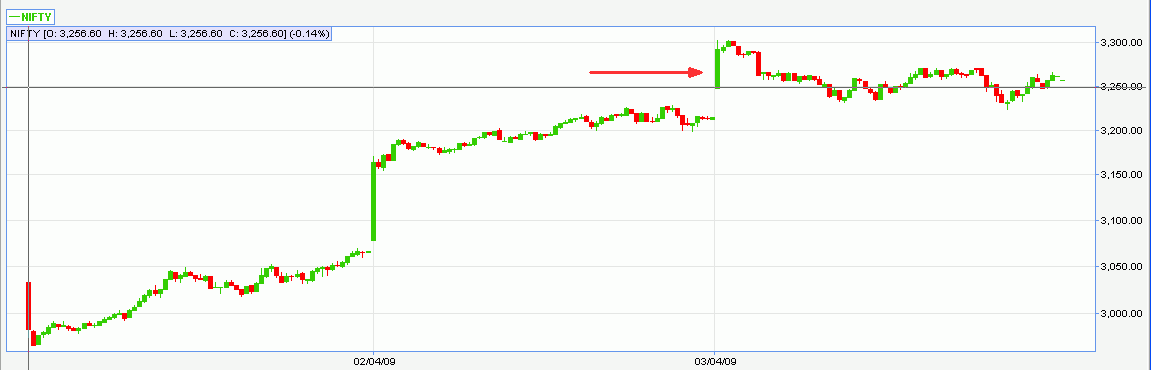

Attached is a 5 minute chart for your reference. Was referring to the 1st candle of the day marked with a red arrow.

- Amit

| Description: |

|

| Filesize: |

6.57 KB |

| Viewed: |

1556 Time(s) |

|

|

|

| Back to top |

|

|

|