|

|

| View previous topic :: View next topic |

| Author |

Saint's 60minflow |

musicjunkie1

White Belt

Joined: 24 Mar 2009

Posts: 8

|

Post: #1  Posted: Tue Mar 24, 2009 5:38 pm Post subject: Saint's 60minflow Posted: Tue Mar 24, 2009 5:38 pm Post subject: Saint's 60minflow |

|

|

Restarting the thread....Here are the rules

| Quote: | ENTRY AND EXIT

This is an "always in the trade" type of a method and each Reversal point is an Entry point for the new trade in the opposite direction. We will talk about when and where to enter and reverse in the subsequent paras.

ENTRY and REVERSAL POINTS

A.PIVOTS:-Let us talk shorts,as the case is always to talk in terms of longs……..Lower Pivot Highs and Lows,visible ones,visually obvious ones,………every breakdown to new lows is an opportunity to bring stops down to the latest pivot high.Keep doing this till a previous pivot high is broken.A break of that pivot high and we exit all Short positions—-initial as well as Adds and enter initial positions Long. It's as simple as it can be, just focus on 2 things:a.visual b.new lows,then move stops.REVERSAL is Rs 15 below the previous pivot low in case of Nifty. This Rs 15 is what we call a "Filter" and it varies with each security depending on its price and volatility.

B.2 BAR METHOD:—In a vertical move,where there are no pivots,move stops to the high of 2 bars back in a down move……move stops to the low of 2 bars back in an up move.REVERSAL is Rs20 below/above 2 bars back(taking Nifty as an example).

Why are we suddenly using 2 bars? Well, a euphoric rise or a Panic drop doesn't give an opportunity to move stops, in such cases we take the help of the 2 bar method to place stops. Be careful, we dont want you using the 2 bar after say 3 up bars, We want huge WRB in a vertical rise.

C.VISUAL GAPS:A visual gap is simply a gap that can be seen visually…….and we utilise them in our strategy whether we get them against or in our position.

Gaps Against:

Say you are holding a Short position and the market next day opens against you and beyond your existing stops. You would reverse at the opening 5 min bar high plus a filter of 20points (taking Nifty as an example) to get out of Shorts into Long position.

In case you are holding Longs and the market next day opens below your existing stops, you would reverse at the opening 5 min bar low minus a filter of 20points (taking Nifty as an example) to get out of Longs into Short position.

Gaps In Our Favour:

Scenario 1:You are holding Short positions in NF,and market gaps down visually and below the existing pivots. You would add at the opening bar low less filter (say 7 in case of nifty). The stops then are moved as per the 2 bar method or pivots…whichever gives a closer stop. Wait ideally for a lower pivot to form to get a better Reversal point.

Scenario 2:You are holding Long positions and market gaps up visually on your 60min charts. Wait for the first bar to close. If this bar is Red….meaning thereby it has a closing lesser than the opening……reverse to Shorts at this opening bar low-filter (20points say for Nifty). If the subsequent bars keep going higher, nothing to be done except Adding at the opening bar high plus filter and then moving the stops to the opening bar low.

Scenario 3:You are holding Long positions and market gaps up visually on your 60min charts. Wait for the first bar to close. If this bar is Green….meaning thereby it has a closing higher than the opening……move stops as per the 2 bar method unless a pivot is closer than that. If the subsequent bars keep going higher, nothing to be done except Adding at the opening bar high plus filter. Wait ideally for a higher pivot to form to get a better Reversal point.

D.FAILED BREAKOUT BAR REVERSAL: Supposing a bar takes out a Pivot high and puts us out of Short position into a fresh Long position. Now supposing we are NOT able to take out the highs of this BREAK OUT BAR, we get an indication that the break out was false…and so we reverse to SHORTS again below the low of the break out bar minus the filter. IF we have a breakout in the Direction of the trend, and then it fails, we have ample reasons to reverse our positions. Whether we are sitting with initial positions or with adds, a failure of a breakout/breakdown is a great place to reverse and capitalize on.

E.END OF DAY REVERSAL: Imagine holding a Long position, initial along with adds. A counter move happens, takes out the pivot lows and puts you out of that trade into a fresh Short position. Now, by the end of that trading day, we should have a closing below the pivots which had put us into that trade. Inability to have a stronger close in our favour would mean that the breakout lacked strength and hence we need to reverse our position back to Longs. And when we use the End of day reversal…we reverse with full position…Original as well as Adds which we held before entering this Short Trade. Vice versa for Shorts.

As an example….say we are long 4 lots of Nifty and add 6 more lots on our way. A reversal happens and we enter into Shorts with 3 or 4 lots. Now in case we have an End of Day reversal that day…we will get Long with our original position of 10 lots…..behaving as if the Shorts we took that day did not happen at all.

ADDS

This is the real meat of the system. We keep adding to our winning position while not correspondingly increasing our overall risk. Depending on the nature and trend-worthiness of the security, we can Add 2 to 5 times in a security. Since each Add point comes on the breach of a pivot or WRB, we would be moving our stops up or down. Therefore the overall risk even after the Adds is either the same or is reduced, but certainly not increased beyond a point.

A few points to note in this regard:

(a) While adding, we take into consideration the pivots we make during our current trade. A pivot which occured 2 or 3 days before we entered our current position is of no interest to us and so we dont use it for adds.

(b) In case of an opening in the direction of our trade which is beyond any pivot or previous high of the current trade, we Add above/below the high/low of the opening bar with a small filter. For example, say the previous day high/pivot was at 3000 and next day we have the opening 5min bar high at 3040..we would add to our position at 3040+7(supposing Nifty).

(c) Preferably, we should Add the same quantity as we had in our initial trade. However, care should be taken so as to ensure our Money management system should be comfortable with the size of Adds we take.

(d) As written, we decide on how many times we Add in a security depending on its trendiness. As an example, we would suggest the following number of Adds in a few popular nifty stocks. However, each is supposed to do his own backtests to ascertain the correct number of Adds he is comfortable using:

Nifty: Initial Position+3 ADDS

Aban: Initial Positions + 5 ADDS

RelCap: Initial Position + 3 ADDS

L&T: Initial Position + 3 ADDS

JP Associates: Initial Position + 3 ADDS

CANDLESTICK PATTERN,TECHNICAL PATTERNS,SUPPORTS/RESISTANCE

:-None required or going to be utilised.

ADVICE

More active intervention is required especially on gap days……..but other than the right amount of action,no more than that is required.Don't go around over scrutinisng,over analysing……..once the processes are looked into,your job is to stay out of the way between yourself and the trade.Your job is to get the direction right and allow the Market to do all the hard work and put money in your pockets while you sip your coffee and laze around. |

|

|

| Back to top |

|

|

|

|  |

musicjunkie1

White Belt

Joined: 24 Mar 2009

Posts: 8

|

Post: #2  Posted: Tue Mar 24, 2009 5:41 pm Post subject: Posted: Tue Mar 24, 2009 5:41 pm Post subject: |

|

|

Reposting this recent trade of nifty. We are currently short now, with stops at HOD. Holding shorts......

| Description: |

|

| Filesize: |

46.7 KB |

| Viewed: |

1707 Time(s) |

|

Last edited by musicjunkie1 on Tue Mar 24, 2009 8:47 pm; edited 1 time in total |

|

| Back to top |

|

|

musicjunkie1

White Belt

Joined: 24 Mar 2009

Posts: 8

|

Post: #3  Posted: Tue Mar 24, 2009 5:47 pm Post subject: Posted: Tue Mar 24, 2009 5:47 pm Post subject: |

|

|

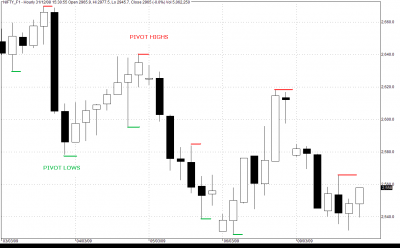

What is a pivot? or rather what does it look like?

| Description: |

|

| Filesize: |

20.28 KB |

| Viewed: |

1040 Time(s) |

|

Last edited by musicjunkie1 on Tue Mar 24, 2009 8:46 pm; edited 1 time in total |

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #4  Posted: Tue Mar 24, 2009 6:49 pm Post subject: Posted: Tue Mar 24, 2009 6:49 pm Post subject: |

|

|

MJ - thanks for the thread. For some reasons the pictures are not opening up for me? Is it possible for you to report the charts with a changed format?

Cheers

SH

|

|

| Back to top |

|

|

musicjunkie1

White Belt

Joined: 24 Mar 2009

Posts: 8

|

Post: #5  Posted: Tue Mar 24, 2009 8:44 pm Post subject: Posted: Tue Mar 24, 2009 8:44 pm Post subject: |

|

|

Ouch SH...no idea why its not loading...sent you a pm with a website address all details are there...

Regards,

MJ-

|

|

| Back to top |

|

|

emsenthil123

White Belt

Joined: 17 Oct 2008

Posts: 9

|

Post: #6  Posted: Tue Mar 24, 2009 10:29 pm Post subject: Posted: Tue Mar 24, 2009 10:29 pm Post subject: |

|

|

| Good work MJ.

|

|

| Back to top |

|

|

sunsoft.Tech

White Belt

Joined: 02 Apr 2007

Posts: 4

|

Post: #7  Posted: Wed Mar 25, 2009 8:44 am Post subject: Posted: Wed Mar 25, 2009 8:44 am Post subject: |

|

|

Hi MJ

I have been using Saint's sytem for NF with RSEX and its working really fine.

Best Regards

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #8  Posted: Wed Mar 25, 2009 9:40 am Post subject: Posted: Wed Mar 25, 2009 9:40 am Post subject: |

|

|

Hi sunsoft,

Lets leave the website address for now, im reproducing everything here...so no worries.

ITs a wikidot website, so you can goto wikidot.com and search, im sure you will find it.

Currently We are short NF 60min with stops at yesterdays high. Will keep updating. Like I have learnt live, it will be easier to understand the concepts live, with actual trading. But please go through the rules again and again.

Regards,

MJ-

|

|

| Back to top |

|

|

tomy

White Belt

Joined: 04 Dec 2007

Posts: 3

|

Post: #9  Posted: Wed Mar 25, 2009 11:51 am Post subject: Posted: Wed Mar 25, 2009 11:51 am Post subject: |

|

|

music sir i coundnt get wat rate is pivot is it the value only or its H+L+c value of tat bar

can i got ur e mail id too

want to ask some questions

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #10  Posted: Wed Mar 25, 2009 1:10 pm Post subject: Posted: Wed Mar 25, 2009 1:10 pm Post subject: |

|

|

Should have mentioned this in the beginning.

Pivots are NOT Pivot points. They are two very different things. Forget all you know about PP inthis thread.

Lets go over what a pivot is.

Saint used a hand analogy, look at you hand.

1st green bar is your pinky finger

2nd HH LL bar is the ring finger

New highs! middle finger

Till now what we have is a rally, not an uptrend. the decline starts at fore finger and thumb.

What formation we have is a PH now. Check the charts posted below. The Pivot high (PH) is formed because of the middle and ring finger.

Vice versa for a Pivot PL.....

Do ask questions here, this is what this thread is for, no need to mail me, but thanks for taking the time to post your intent.

MJ

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #11  Posted: Wed Mar 25, 2009 4:07 pm Post subject: Posted: Wed Mar 25, 2009 4:07 pm Post subject: |

|

|

Hey MJ - can you please put a chart of your recent trade where you shorted and explaininig why? I will be greatful...

Cheers

SH

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #12  Posted: Wed Mar 25, 2009 5:04 pm Post subject: Posted: Wed Mar 25, 2009 5:04 pm Post subject: |

|

|

Here it is.....Have accepted you in the site

do get back to me here, if any doubt.

Will be posting here as well.....

MJ

| Description: |

|

| Filesize: |

43.63 KB |

| Viewed: |

873 Time(s) |

|

|

|

| Back to top |

|

|

Stockhunter

White Belt

Joined: 10 Jun 2008

Posts: 193

|

Post: #13  Posted: Wed Mar 25, 2009 5:33 pm Post subject: Posted: Wed Mar 25, 2009 5:33 pm Post subject: |

|

|

| musicjunkie wrote: | Here it is.....Have accepted you in the site

do get back to me here, if any doubt.

Will be posting here as well.....

MJ |

Excellent thanks MJ , now I understand it was a 2 bar break that initiated the short. Lets follow through this trade onwards now by probably posting charts at every day after tradinghours showing adds/exits etc.

It will be one of the most valued thread then on icharts.. and I will be a daily reader

Cheers

SH

|

|

| Back to top |

|

|

musicjunkie

White Belt

Joined: 23 Mar 2007

Posts: 70

|

Post: #14  Posted: Wed Mar 25, 2009 5:43 pm Post subject: Posted: Wed Mar 25, 2009 5:43 pm Post subject: |

|

|

Thanks SH ....great will follow up everyday then...a little help from members will be appreciated

MJ

|

|

| Back to top |

|

|

sunsoft.Tech

White Belt

Joined: 02 Apr 2007

Posts: 4

|

Post: #15  Posted: Thu Mar 26, 2009 9:40 am Post subject: Posted: Thu Mar 26, 2009 9:40 am Post subject: |

|

|

| Thanks MJ.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|