| View previous topic :: View next topic |

| Author |

Seshareddy's PARSAR & Fibonacci (SPF) Trading System |

srmurralitharan

White Belt

Joined: 25 May 2009

Posts: 1

|

Post: #31  Posted: Thu Jul 30, 2009 7:46 pm Post subject: Gaps Posted: Thu Jul 30, 2009 7:46 pm Post subject: Gaps |

|

|

| How one should trade using this method when price gaps up/down above/below respective entry points?

|

|

| Back to top |

|

|

|

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #32  Posted: Thu Jul 30, 2009 7:50 pm Post subject: Posted: Thu Jul 30, 2009 7:50 pm Post subject: |

|

|

sherbaaz Hi

Excellent!!! Yes you have understood the system very well. And the 5min time frame you have used is also proving that this system works on any time frame.

Only thing I would like to say to here is about trade number two. Since PARSAR was in place and price movement was strong enough you would have taken position of going long at 3rd candle opening and keeping rest as usual. What I am saying is atleast wait for 10 -15min if the price is having strong momentum you can think of taking a trade because in 5min time frame you will definitely get enough points.

You can aslo blend this with SwingTrader's pivot levels so that you will find easier to take decision in such conditions. By doing this you could have got atleast addtional 50 points. Your Performance would have been improved significantly.

Well 108 points in a day is a good score, keep it up. Improve your performance with blending with various tools.

Cheers!!

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #33  Posted: Thu Jul 30, 2009 8:00 pm Post subject: Posted: Thu Jul 30, 2009 8:00 pm Post subject: |

|

|

san77s Hi,

Yes you use same levels or wait for new PARSAR Swing to be created. I have just edited the origianl post. Please read the foot note in the post. And also regularly keep checking for foot notes in original posts, these will be for improvisation of the system.

Cheers

Mayuresh Jahagirdar

Last edited by mayurnsk on Thu Jul 30, 2009 8:15 pm; edited 1 time in total |

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #34  Posted: Thu Jul 30, 2009 8:02 pm Post subject: Posted: Thu Jul 30, 2009 8:02 pm Post subject: |

|

|

amitrajangulati hi

Good work buddy keep it up.!!!!!!

Cheers & regards

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #35  Posted: Thu Jul 30, 2009 8:04 pm Post subject: Re: Gaps Posted: Thu Jul 30, 2009 8:04 pm Post subject: Re: Gaps |

|

|

| srmurralitharan wrote: | | How one should trade using this method when price gaps up/down above/below respective entry points? |

I would like to suggest you to back test it , you will get answers for your querry. Do some work buddy, it will be benificial to develop this system even further with your findings. So i expect you to post your findings and suggestions.

Thank you

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #36  Posted: Thu Jul 30, 2009 8:12 pm Post subject: Posted: Thu Jul 30, 2009 8:12 pm Post subject: |

|

|

Mayur,

Thanks a lot for your feed back yes you are right about 2nd trade. In fact it was also a tweezer bottom along with hammer(s) formation (not exact pattern) and I should have entered into long trade there as suggest by you even i wanted but i was just following you strategy to test it in live market, without any candlestick analysis(its one of the tool i use) . I had not used any other tool. BUT yes belnding it with other tools gives g8 results & ON STAND ALONE BASIS ITS A VERY EFFECTIVE STRATEGY.

Thanks once again for your feedback.

Regards,

Sherbaaz

|

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #37  Posted: Thu Jul 30, 2009 8:25 pm Post subject: Posted: Thu Jul 30, 2009 8:25 pm Post subject: |

|

|

sherbaaz

Yes you are absolutely right this is very effective strategy on standalone basis too. The blending with simpler tools will make this system even more effective. The blending tools used shall also be simpler one so that even a lay man can understand it very easily. Now like you use candle patterns, its fine for you but not every body can use it, because not all can interprete them. But yes you can blend it for your use. But I would like to improvise this system from my side with simpler tools as I dont want to kill its simplycity. So go ahead and blend it for your self. Who knows even your some candle patterns (repeatative)will be even simpler and may come out with new rules of trades using this system? So buddy keep posting your findings from experience.

Thanks for your response and interest in it.

Thank you.

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #38  Posted: Thu Jul 30, 2009 9:28 pm Post subject: Posted: Thu Jul 30, 2009 9:28 pm Post subject: |

|

|

deleted post

Last edited by amitrajangulati on Fri Jul 31, 2009 6:27 pm; edited 1 time in total |

|

| Back to top |

|

|

meetatex

White Belt

Joined: 08 May 2008

Posts: 71

|

Post: #39  Posted: Thu Jul 30, 2009 9:42 pm Post subject: GOLD CHART PLS THROW SOME LIGHT Posted: Thu Jul 30, 2009 9:42 pm Post subject: GOLD CHART PLS THROW SOME LIGHT |

|

|

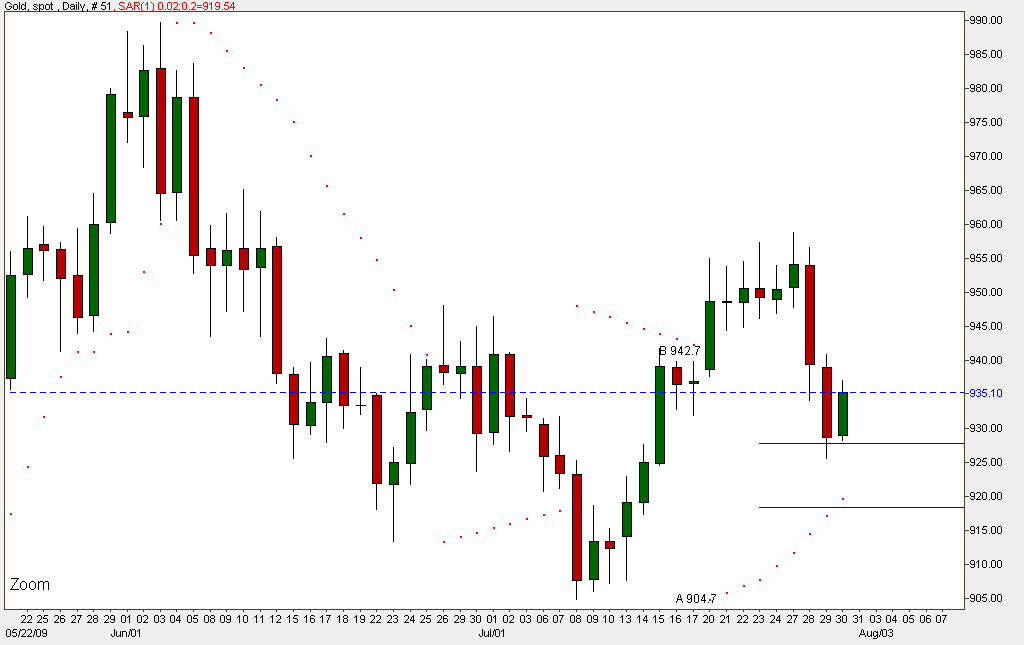

HI GUYS,

U R DOING NICE JOB OF SHARING THINGS

I HAVE A CHART OF GOLD IN DOLLOR TERM CAN U PLS FLASH SOME VIEW ON IT SO I CAN CONFIREM MY UNDERSTANDING

DIVYESH

WELL AS PER MY SYSTEM I M SHORT IN GOLD AT 14700 WITH SL OF 15000 TGT 14400-14000-13400

| Description: |

|

| Filesize: |

10.73 KB |

| Viewed: |

2182 Time(s) |

|

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #40  Posted: Thu Jul 30, 2009 10:07 pm Post subject: Posted: Thu Jul 30, 2009 10:07 pm Post subject: |

|

|

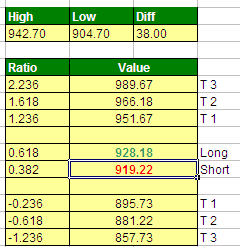

Hi! Meetatex,

Please have a look at the attached snapshot. As per this system, we should short below 919.22

Mayur, please do correct me if I am wrong.

Thanks & regards,

Amit Gulati

| Description: |

|

| Filesize: |

7.27 KB |

| Viewed: |

2192 Time(s) |

|

|

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #41  Posted: Thu Jul 30, 2009 11:43 pm Post subject: Posted: Thu Jul 30, 2009 11:43 pm Post subject: |

|

|

meetatex ( Divyesh) hi

what Amit Gulati is saying is true as per this system.

Regards

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #42  Posted: Fri Jul 31, 2009 12:19 pm Post subject: Posted: Fri Jul 31, 2009 12:19 pm Post subject: |

|

|

Hi!

Attached excel sheet has both the options ... 1. Original SPF Calculations and 2. All Fibo ratios.

Cheers,

Amit

| Description: |

|

Download |

| Filename: |

SPF Fibo Calculator.xls |

| Filesize: |

17.5 KB |

| Downloaded: |

1006 Time(s) |

Last edited by amitrajangulati on Fri Jul 31, 2009 6:28 pm; edited 1 time in total |

|

| Back to top |

|

|

mayurnsk

Moderator

Joined: 18 Jan 2007

Posts: 216

Location: Nasik, Maharashtra

|

Post: #43  Posted: Fri Jul 31, 2009 5:11 pm Post subject: Posted: Fri Jul 31, 2009 5:11 pm Post subject: |

|

|

amitrajangulati Hi

First of all let me request you to ask these un-related questions under new topic. Just start New thread.

Now as per Seshareddy's 1.618% theory is concerned , as per what he ment was take a daily candle , take high and low as point A & B and calculate 1.618% expannsion value when it reaches that level market turns. It is self explainatory. Nothing else.

Regards

Mayuresh Jahagirdar

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

|

| Back to top |

|

|

amitrajangulati

White Belt

Joined: 27 Jan 2009

Posts: 56

|

Post: #45  Posted: Fri Jul 31, 2009 9:48 pm Post subject: Posted: Fri Jul 31, 2009 9:48 pm Post subject: |

|

|

Hi! Sherbaaz,

Great trades! can you please share the basis of your exiting a trade. The timing looks good.

Thanks & regards,

Amit Gulati

|

|

| Back to top |

|

|

|