| View previous topic :: View next topic |

| Author |

SH 30 minutes swinging yorker method - Nifty (Alchemist) |

anilnegi

White Belt

Joined: 02 Oct 2012

Posts: 38

|

Post: #106  Posted: Sat Mar 07, 2015 5:03 pm Post subject: Posted: Sat Mar 07, 2015 5:03 pm Post subject: |

|

|

Alchemist bhai

i am not able to draw 200 EMA in 30 minute chart as it has limitation of upto 5 days only, i am using sharekhan trade tiger software, however, 5 and 34 is possible is it sufficient to trade this method,

with you signature i somehow recognize but just not disclose the name

thanks

anil negi

|

|

| Back to top |

|

|

|

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #107  Posted: Sat Mar 07, 2015 6:13 pm Post subject: Posted: Sat Mar 07, 2015 6:13 pm Post subject: |

|

|

| anilnegi wrote: | Alchemist bhai

i am not able to draw 200 EMA in 30 minute chart as it has limitation of upto 5 days only, i am using sharekhan trade tiger software, however, 5 and 34 is possible is it sufficient to trade this method,

with you signature i somehow recognize but just not disclose the name

thanks

anil negi |

Use other version of TT uou can get in that.

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #108  Posted: Sat Mar 07, 2015 10:33 pm Post subject: Posted: Sat Mar 07, 2015 10:33 pm Post subject: |

|

|

| anilnegi wrote: | Alchemist bhai

i am not able to draw 200 EMA in 30 minute chart as it has limitation of upto 5 days only, i am using sharekhan trade tiger software, however, 5 and 34 is possible is it sufficient to trade this method,

with you signature i somehow recognize but just not disclose the name

thanks

anil negi |

I don't use SK TT to trade now a days however now I think you can load upto 30 days.... a much easier option is to buy icharts subscription

you recognised me right, I am stockhunter (SH).

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #109  Posted: Sat Mar 07, 2015 10:35 pm Post subject: Posted: Sat Mar 07, 2015 10:35 pm Post subject: |

|

|

| katariajs wrote: | Dear Alchemist,

Can this strategy be applied on Bank Nifty too? |

yes .. should work on bnf too.

cheers

sh

|

|

| Back to top |

|

|

anilnegi

White Belt

Joined: 02 Oct 2012

Posts: 38

|

Post: #110  Posted: Sat Mar 07, 2015 11:14 pm Post subject: Posted: Sat Mar 07, 2015 11:14 pm Post subject: |

|

|

| anilnegi wrote: | Alchemist bhai

i am not able to draw 200 EMA in 30 minute chart as it has limitation of upto 5 days only, i am using sharekhan trade tiger software, however, 5 and 34 is possible is it sufficient to trade this method,

with you signature i somehow recognize but just not disclose the name

thanks

anil negi |

ok, will use advance version, by the way what are charges for ichart subscription

anil negi

|

|

| Back to top |

|

|

anilnegi

White Belt

Joined: 02 Oct 2012

Posts: 38

|

Post: #111  Posted: Sat Mar 07, 2015 11:20 pm Post subject: Posted: Sat Mar 07, 2015 11:20 pm Post subject: |

|

|

| Alchemist wrote: | | anilnegi wrote: | Alchemist bhai

i am not able to draw 200 EMA in 30 minute chart as it has limitation of upto 5 days only, i am using sharekhan trade tiger software, however, 5 and 34 is possible is it sufficient to trade this method,

with you signature i somehow recognize but just not disclose the name

thanks

anil negi |

I don't use SK TT to trade now a days however now I think you can load upto 30 days.... a much easier option is to buy icharts subscription

you recognised me right, I am stockhunter (SH).

Cheers

SH |

i was right just got confuse with white belt doesnt belong to you though. i was right just got confuse with white belt doesnt belong to you though.

|

|

| Back to top |

|

|

anusantosh

White Belt

Joined: 19 Jun 2011

Posts: 105

|

Post: #112  Posted: Mon Mar 09, 2015 8:05 am Post subject: 200 ema Posted: Mon Mar 09, 2015 8:05 am Post subject: 200 ema |

|

|

| I have subscription of icharts but don't know how to draw 200 ema line. How I can draw that to trade in your method?

|

|

| Back to top |

|

|

taruj

White Belt

Joined: 20 Apr 2011

Posts: 260

|

Post: #113  Posted: Mon Mar 09, 2015 8:55 am Post subject: Re: 200 ema Posted: Mon Mar 09, 2015 8:55 am Post subject: Re: 200 ema |

|

|

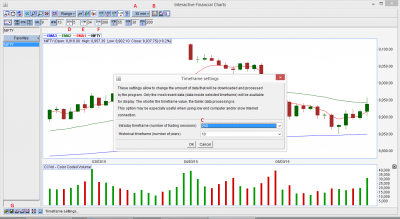

| anusantosh wrote: | | I have subscription of icharts but don't know how to draw 200 ema line. How I can draw that to trade in your method? |

Follow the alphabets

A: Select Time Frame = 30 Mins

B: Select the Time Frame Settings

C: Make intraday time frame (no. of trading sessions) = 250 (Click OK)

D, E, F: Set EMAs 5, 34, 200 (Make sure that the EMA button is ON)

G: Press this button to save changes.

| Description: |

|

| Filesize: |

54.67 KB |

| Viewed: |

528 Time(s) |

|

|

|

| Back to top |

|

|

kamal.icharts

Site Admin

Joined: 10 Apr 2013

Posts: 576

|

Post: #114  Posted: Mon Mar 09, 2015 10:17 am Post subject: Re: 200 ema Posted: Mon Mar 09, 2015 10:17 am Post subject: Re: 200 ema |

|

|

Thanks Taruj Bhai

|

|

| Back to top |

|

|

ajit602

White Belt

Joined: 11 Sep 2012

Posts: 370

|

Post: #115  Posted: Mon Mar 09, 2015 11:26 am Post subject: Posted: Mon Mar 09, 2015 11:26 am Post subject: |

|

|

| Short taken or not. Pls confirm

|

|

| Back to top |

|

|

power star99

White Belt

Joined: 14 Feb 2013

Posts: 27

|

Post: #116  Posted: Mon Mar 09, 2015 1:18 pm Post subject: Posted: Mon Mar 09, 2015 1:18 pm Post subject: |

|

|

| Short not taken .low of the candle not broken , below 8798 spot short can be created is it correct Alchem sir.

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #117  Posted: Mon Mar 09, 2015 4:24 pm Post subject: Posted: Mon Mar 09, 2015 4:24 pm Post subject: |

|

|

Nifty spot cross happened at 11 AM candle and the low of that candle was 8814 .. so trade to be taken when NS hits 8813 (equated to NF hitting 8845).

Short was triggered by 11.30 AM candle when it breached 8814 on NS and hit 8845 on NF ....

50% should have booked today at 8770-8780 (65 to 75 points profit) and rest should be held as per the rules.

As 30 mins RSI is oversold, alternative strategy can also be to sell 8750 puts at 98

Cheers

SH

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #118  Posted: Mon Mar 09, 2015 4:39 pm Post subject: Posted: Mon Mar 09, 2015 4:39 pm Post subject: |

|

|

| Alchemist wrote: | Nifty spot cross happened at 11 AM candle and the low of that candle was 8814 .. so trade to be taken when NS hits 8813 (equated to NF hitting 8845).

Short was triggered by 11.30 AM candle when it breached 8814 on NS and hit 8845 on NF ....

50% should have booked today at 8770-8780 (65 to 75 points profit) and rest should be held as per the rules.

As 30 mins RSI is oversold, alternative strategy can also be to sell 8750 puts at 98

Cheers

SH |

Once again system worked and nifty moved as expected .. Congratulation to you Alc...

Booking 50% is perfectly fine, but because RSI oversold should we take hedging ? Do u feel rsi divergence is a better signal for starting hedging ?

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #119  Posted: Mon Mar 09, 2015 10:06 pm Post subject: Posted: Mon Mar 09, 2015 10:06 pm Post subject: |

|

|

| sumesh_sol wrote: | | Alchemist wrote: | Nifty spot cross happened at 11 AM candle and the low of that candle was 8814 .. so trade to be taken when NS hits 8813 (equated to NF hitting 8845).

Short was triggered by 11.30 AM candle when it breached 8814 on NS and hit 8845 on NF ....

50% should have booked today at 8770-8780 (65 to 75 points profit) and rest should be held as per the rules.

As 30 mins RSI is oversold, alternative strategy can also be to sell 8750 puts at 98

Cheers

SH |

Once again system worked and nifty moved as expected .. Congratulation to you Alc...

Booking 50% is perfectly fine, but because RSI oversold should we take hedging ? Do u feel rsi divergence is a better signal for starting hedging ? |

Sumesh - this is where Trading becomes an art and doesnt stay anymore a science where 1+1 is always 2.

RSI divergence - definitely start hedging with options.

RSI oversold/overbought but no divergence yet - this is where subjectivity and gut 'feeling' kicks in. If larger TF is UP but 30 mins is down ... I would feel more secure to hedge when RSI oversold. If the larger TF is down and RSI is also oversold..I can be more courageous and continue naked shorts. It's all subjective here...

Cheers

SH

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #120  Posted: Tue Mar 10, 2015 8:23 am Post subject: Posted: Tue Mar 10, 2015 8:23 am Post subject: |

|

|

| Alchemist wrote: |

If the larger TF is down and RSI is also oversold..I can be more courageous and continue naked shorts. It's all subjective here...

Cheers

SH |

Thanks for the input. Surely this holds merit. Trade management is more important then entering trade to earn consistently.

|

|

| Back to top |

|

|

|