| View previous topic :: View next topic |

| Author |

SH 30 minutes swinging yorker method - Nifty (Alchemist) |

snehil2010

White Belt

Joined: 04 Feb 2015

Posts: 19

|

Post: #406  Posted: Sat Aug 01, 2015 3:10 pm Post subject: Posted: Sat Aug 01, 2015 3:10 pm Post subject: |

|

|

Hello Folks,

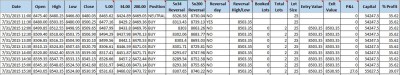

I have been preparing an Excel sheet for this strategy. Its near to completion, will share in this thread once done. Attached is the snapshot of that excel sheet.

Suggestions welcome.

Thanks,

Snehil

| Description: |

|

| Filesize: |

139.81 KB |

| Viewed: |

685 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

ajit602

White Belt

Joined: 11 Sep 2012

Posts: 370

|

Post: #407  Posted: Sat Aug 01, 2015 7:04 pm Post subject: Posted: Sat Aug 01, 2015 7:04 pm Post subject: |

|

|

| snehil2010 wrote: | Hello Folks,

I have been preparing an Excel sheet for this strategy. Its near to completion, will share in this thread once done. Attached is the snapshot of that excel sheet.

Suggestions welcome.

Thanks,

Snehil |

Thanks Snehil. As you are doing good work for us who do not know much about excel sheet. Thanks.

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #408  Posted: Sat Aug 01, 2015 8:18 pm Post subject: Posted: Sat Aug 01, 2015 8:18 pm Post subject: |

|

|

Hi,

Good attempt but truly I couldn't understand an iota of what this spreadsheet is showing ...

Cheers

SH

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #409  Posted: Tue Aug 04, 2015 6:27 pm Post subject: Posted: Tue Aug 04, 2015 6:27 pm Post subject: |

|

|

| Market above 8530 tomorrow shall give an additional buy signal. SL for 31st buy was protected today( although price moved below 200ema). Additonal buy can happen in morning. If not pierced a sell below 8480 May trigger subject to entry below crossover candle 5/200 ema 30tf

|

|

| Back to top |

|

|

AMBY

Yellow Belt

Joined: 05 Sep 2014

Posts: 503

|

Post: #410  Posted: Tue Aug 04, 2015 10:26 pm Post subject: Posted: Tue Aug 04, 2015 10:26 pm Post subject: |

|

|

| THANK YOU.

|

|

| Back to top |

|

|

snehil2010

White Belt

Joined: 04 Feb 2015

Posts: 19

|

Post: #411  Posted: Wed Aug 05, 2015 12:07 am Post subject: Posted: Wed Aug 05, 2015 12:07 am Post subject: |

|

|

| Alchemist wrote: | Hi,

Good attempt but truly I couldn't understand an iota of what this spreadsheet is showing ...

Cheers

SH |

Hi Alchemist,

I'll explain everything properly when I'll release the final version of excel sheet. If you are familiar with Excel based trading tools it wont be difficult for you.

Thanks,

Snehil

|

|

| Back to top |

|

|

SukhiAatma

White Belt

Joined: 21 May 2015

Posts: 3

|

Post: #412  Posted: Wed Aug 05, 2015 1:38 pm Post subject: 5/34 crossover and SL Posted: Wed Aug 05, 2015 1:38 pm Post subject: 5/34 crossover and SL |

|

|

| amitagg wrote: | | Market above 8530 tomorrow shall give an additional buy signal. SL for 31st buy was protected today( although price moved below 200ema). Additonal buy can happen in morning. If not pierced a sell below 8480 May trigger subject to entry below crossover candle 5/200 ema 30tf |

Hi Alchemist,

Yesterday there was clear 5/34 bearish crossover on NS @30 TF. NS did bounce back and again there was bullish crossover with both 5&34 ema above 200 ema. The 5/34 bearish crossover clearly indicated to exit the longs and we did re-enter when 5/34 bullish crossover. however, I read other members saying that SL was protected and you also said NF Bullish Yorker continue in SB. can you please explain.

Thanks

Sukhi Aatma

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #413  Posted: Wed Aug 05, 2015 2:16 pm Post subject: Re: 5/34 crossover and SL Posted: Wed Aug 05, 2015 2:16 pm Post subject: Re: 5/34 crossover and SL |

|

|

| SukhiAatma wrote: | | amitagg wrote: | | Market above 8530 tomorrow shall give an additional buy signal. SL for 31st buy was protected today( although price moved below 200ema). Additonal buy can happen in morning. If not pierced a sell below 8480 May trigger subject to entry below crossover candle 5/200 ema 30tf |

Hi Alchemist,

Yesterday there was clear 5/34 bearish crossover on NS @30 TF. NS did bounce back and again there was bullish crossover with both 5&34 ema above 200 ema. The 5/34 bearish crossover clearly indicated to exit the longs and we did re-enter when 5/34 bullish crossover. however, I read other members saying that SL was protected and you also said NF Bullish Yorker continue in SB. can you please explain.

Thanks

Sukhi Aatma |

Yes u are right. Alchemist will clarifty and clear the doubts.

Infact I only earlier once pointed to Sumesh Sol etc in some other post that entry should be below low or high of crossover candle.....this I experienced from my crude oil trades.........then Alchemist had amended or modified the system......this was not the trigger for SH / Alchemist strategies last year.....atleast for entries this is important.....for Sls also I would believe the same...... SO I considered SAR trade with 5/200 "confirmation crossover" as stop....... I would be wrong therefore simply as per rules (in not considering 5/34 exit).

(Another reason is 5/34 can be after an uptrending thrust has happended after 5/200 crossover to protect profits, in case of sideways move, we may allow the trade to move, and hence consider 5/200 crossover which I did this is not as per system but we can modify as "trade management" experience )

Since my other systems were in buy, I would protect the sold 8500 PUT (bullish trade) and booked the profits today , basis Umesh's random profit booking comment. Struggle at multiple points was suggesting a consolidation. Future likewise I made profits above 8503 spot yesterday and booked near closing.... Since I had 100 points premium safety in sold PUTs, I could ride the fall of 100 points yesterday....without triggering the stop since it was a BUY above JT 8440 level...and some other indicators....so did not want to exit on 5/34 crossover.

It has been pointed earlier that........Low of crossover candle/ 5/34 crossover..... etc are possible options for SL...

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #414  Posted: Wed Aug 05, 2015 3:56 pm Post subject: Re: 5/34 crossover and SL Posted: Wed Aug 05, 2015 3:56 pm Post subject: Re: 5/34 crossover and SL |

|

|

| SukhiAatma wrote: | | amitagg wrote: | | Market above 8530 tomorrow shall give an additional buy signal. SL for 31st buy was protected today( although price moved below 200ema). Additonal buy can happen in morning. If not pierced a sell below 8480 May trigger subject to entry below crossover candle 5/200 ema 30tf |

Hi Alchemist,

Yesterday there was clear 5/34 bearish crossover on NS @30 TF. NS did bounce back and again there was bullish crossover with both 5&34 ema above 200 ema. The 5/34 bearish crossover clearly indicated to exit the longs and we did re-enter when 5/34 bullish crossover. however, I read other members saying that SL was protected and you also said NF Bullish Yorker continue in SB. can you please explain.

Thanks

Sukhi Aatma |

Hi,

a mere crossover is not enough, we need to wait for highs/lows to be taken out of the crossover candle before entering/exiting trades.

Yesterday 5/34 bearish cross happened however the lows of the crossover candle was not breached hence longs continued.

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #415  Posted: Wed Aug 05, 2015 3:59 pm Post subject: Posted: Wed Aug 05, 2015 3:59 pm Post subject: |

|

|

| snehil2010 wrote: | | Alchemist wrote: | Hi,

Good attempt but truly I couldn't understand an iota of what this spreadsheet is showing ...

Cheers

SH |

Hi Alchemist,

I'll explain everything properly when I'll release the final version of excel sheet. If you are familiar with Excel based trading tools it wont be difficult for you.

Thanks,

Snehil |

Thanks, look forward to it.

Cheers

SH

|

|

| Back to top |

|

|

SukhiAatma

White Belt

Joined: 21 May 2015

Posts: 3

|

Post: #416  Posted: Wed Aug 05, 2015 10:53 pm Post subject: Re: 5/34 crossover and SL Posted: Wed Aug 05, 2015 10:53 pm Post subject: Re: 5/34 crossover and SL |

|

|

| Alchemist wrote: | | SukhiAatma wrote: | | amitagg wrote: | | Market above 8530 tomorrow shall give an additional buy signal. SL for 31st buy was protected today( although price moved below 200ema). Additonal buy can happen in morning. If not pierced a sell below 8480 May trigger subject to entry below crossover candle 5/200 ema 30tf |

Hi Alchemist,

Yesterday there was clear 5/34 bearish crossover on NS @30 TF. NS did bounce back and again there was bullish crossover with both 5&34 ema above 200 ema. The 5/34 bearish crossover clearly indicated to exit the longs and we did re-enter when 5/34 bullish crossover. however, I read other members saying that SL was protected and you also said NF Bullish Yorker continue in SB. can you please explain.

Thanks

Sukhi Aatma |

Hi,

a mere crossover is not enough, we need to wait for highs/lows to be taken out of the crossover candle before entering/exiting trades.

Yesterday 5/34 bearish cross happened however the lows of the crossover candle was not breached hence longs continued.

Cheers

SH |

Hi Alchemist,

Yeah.. that was one point I missed and forgot all together. Thanks for the input.

However, on the recent backtest ( just visual) I notice that both entry and exit are 20-40 away because of the breach confirmation of the crossover candle.

Thanks

Sukhi Aatma

|

|

| Back to top |

|

|

anusantosh

White Belt

Joined: 19 Jun 2011

Posts: 105

|

Post: #417  Posted: Mon Aug 10, 2015 3:37 pm Post subject: Confirmed? Posted: Mon Aug 10, 2015 3:37 pm Post subject: Confirmed? |

|

|

| Is 5-34 EMA crossover confirmed for present long to exit?

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #418  Posted: Mon Aug 10, 2015 7:10 pm Post subject: Re: Confirmed? Posted: Mon Aug 10, 2015 7:10 pm Post subject: Re: Confirmed? |

|

|

| anusantosh wrote: | | Is 5-34 EMA crossover confirmed for present long to exit? |

Only speaking for fresh short entry, it is yet to trigger

|

|

| Back to top |

|

|

vids

White Belt

Joined: 12 Mar 2010

Posts: 102

|

Post: #419  Posted: Mon Aug 10, 2015 9:56 pm Post subject: Re: Confirmed? Posted: Mon Aug 10, 2015 9:56 pm Post subject: Re: Confirmed? |

|

|

| anusantosh wrote: | | Is 5-34 EMA crossover confirmed for present long to exit? |

For longs to exit - today's 15:30 candle low needs to be taken-out.

|

|

| Back to top |

|

|

ajit602

White Belt

Joined: 11 Sep 2012

Posts: 370

|

Post: #420  Posted: Tue Aug 11, 2015 12:53 pm Post subject: Posted: Tue Aug 11, 2015 12:53 pm Post subject: |

|

|

| Position taken. Short

|

|

| Back to top |

|

|

|