| View previous topic :: View next topic |

| Author |

SH 30 minutes swinging yorker method - Nifty (Alchemist) |

neerav1234

White Belt

Joined: 30 May 2013

Posts: 8

|

Post: #511  Posted: Sat Jan 02, 2016 9:39 pm Post subject: Posted: Sat Jan 02, 2016 9:39 pm Post subject: |

|

|

| Sir went through that thread..although you have said ADD strategy wont b shared there..so can you pleasee tell where to find strategy details.

|

|

| Back to top |

|

|

|

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #512  Posted: Mon Jan 04, 2016 1:26 pm Post subject: Posted: Mon Jan 04, 2016 1:26 pm Post subject: |

|

|

| Alchemist wrote: | | Alchemist wrote: | Bullish crossover happened yesterday however high of the candle was not breached hence no longs triggered yesterday.

Today, at 2 PM, another bullish crossover happened and next candle broke the high of 2 PM candle triggering yorker longs today at NF 7816

Cheers

SH |

Today NF closed at around 7939 so trade is in around 120+ points profit. 50% lots should have been booked by now at 100 points profit.

Cheers

SH |

5/34 exit in longs given at 7880 NF hence all longs exited at 7880 giving a profit of around 60 points on rest 50%.

Nifty Yorker shorts also initiated later in the day at 7824 NF and Bank Nifty at 16735

Cheers

SH

|

|

| Back to top |

|

|

JAYSHREEHARI

White Belt

Joined: 30 Jan 2010

Posts: 22

|

Post: #513  Posted: Mon Jan 04, 2016 6:50 pm Post subject: Posted: Mon Jan 04, 2016 6:50 pm Post subject: |

|

|

Dear SH,

How many points should be considered for GAP UP / GAP DOWN rule.

Today should we have to exit long after breaking low till 9.30 AM.i.e

7902.

Thanks .

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #514  Posted: Mon Jan 04, 2016 7:35 pm Post subject: Posted: Mon Jan 04, 2016 7:35 pm Post subject: |

|

|

Hi,

Valid observation hence let me explain what I mean by gap. The gap rules kick in when opening candle is still away from 34 EMA ... however if the gap candle is somewhere around 34 EMA or 200 EMA, its better to wait for 5/34 exit or 5/200 exit.

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #515  Posted: Tue Jan 05, 2016 4:22 pm Post subject: Posted: Tue Jan 05, 2016 4:22 pm Post subject: |

|

|

| Alchemist wrote: | | Alchemist wrote: | | Alchemist wrote: | Bullish crossover happened yesterday however high of the candle was not breached hence no longs triggered yesterday.

Today, at 2 PM, another bullish crossover happened and next candle broke the high of 2 PM candle triggering yorker longs today at NF 7816

Cheers

SH |

Today NF closed at around 7939 so trade is in around 120+ points profit. 50% lots should have been booked by now at 100 points profit.

Cheers

SH |

5/34 exit in longs given at 7880 NF hence all longs exited at 7880 giving a profit of around 60 points on rest 50%.

Nifty Yorker shorts also initiated later in the day at 7824 NF and Bank Nifty at 16735

Cheers

SH |

BNF closed at 16515 today, more than 200 points profit hence I chose to book 50% at 16535 giving me 200 points profit. Rest 50% holding.

Similarly, I will book 50% profits in Nifty at around 100 points profit when and if it comes.

Cheers

SH

|

|

| Back to top |

|

|

JAYSHREEHARI

White Belt

Joined: 30 Jan 2010

Posts: 22

|

Post: #516  Posted: Tue Jan 05, 2016 5:42 pm Post subject: Posted: Tue Jan 05, 2016 5:42 pm Post subject: |

|

|

| Alchemist wrote: | Hi,

Valid observation hence let me explain what I mean by gap. The gap rules kick in when opening candle is still away from 34 EMA ... however if the gap candle is somewhere around 34 EMA or 200 EMA, its better to wait for 5/34 exit or 5/200 exit.

Cheers

SH |

Got it !

many many thanks for clarification.

|

|

| Back to top |

|

|

pmg123

White Belt

Joined: 14 Nov 2009

Posts: 25

|

Post: #517  Posted: Tue Jan 05, 2016 11:32 pm Post subject: Posted: Tue Jan 05, 2016 11:32 pm Post subject: |

|

|

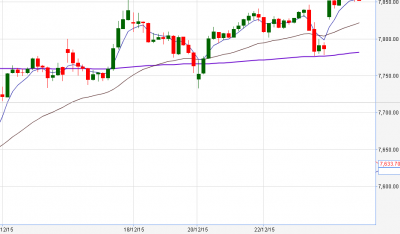

hello SH,

please help clarify the following:

1/ how do we address the opening candle on 17th since it is GAP UP (as of 3.30PM on 16th Dec, the cross over had NOT happened) the 34EMA has made bullish cross over on 200EMA ?

2/ @ 11.30, how do we address the bearish cross over of 200EMA by 34 EMA ?

Thanks in anticipation!

| Description: |

|

| Filesize: |

30.22 KB |

| Viewed: |

373 Time(s) |

|

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #518  Posted: Wed Jan 06, 2016 2:55 pm Post subject: Posted: Wed Jan 06, 2016 2:55 pm Post subject: |

|

|

PMG - opening candle have a bullish cross over of 5/200 EMA and hence buy order placed above opening candle high (which did not trigger).

At 11.30 candle, we got a bearish cross of 5/200 EMA hence previous bullish crossover negated. Sell order placed below 11.30 candle (which didn't trigger either).

Both were fake crossovers and we did not initiate any trade on both of them.

Cheers

SH

|

|

| Back to top |

|

|

pmg123

White Belt

Joined: 14 Nov 2009

Posts: 25

|

Post: #519  Posted: Wed Jan 06, 2016 3:48 pm Post subject: Posted: Wed Jan 06, 2016 3:48 pm Post subject: |

|

|

hello SH,

Thanks much for the quick revert!

so the understanding is as follows:

1/ In case the 5/200 EMA cross over happens during GAP-UP or GAP-DOWN opening then the BUY/SELL order to be placed above/below the opening candle high/low as applicable respectively, please confirm.

2/ Is the above rule applicable only for opening candle or any candle ?

Thanks in anticipation!

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #520  Posted: Wed Jan 06, 2016 6:28 pm Post subject: Posted: Wed Jan 06, 2016 6:28 pm Post subject: |

|

|

| any candle.

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #521  Posted: Thu Jan 07, 2016 9:28 am Post subject: Posted: Thu Jan 07, 2016 9:28 am Post subject: |

|

|

| Alchemist wrote: | | Alchemist wrote: | | Alchemist wrote: | | Alchemist wrote: | Bullish crossover happened yesterday however high of the candle was not breached hence no longs triggered yesterday.

Today, at 2 PM, another bullish crossover happened and next candle broke the high of 2 PM candle triggering yorker longs today at NF 7816

Cheers

SH |

Today NF closed at around 7939 so trade is in around 120+ points profit. 50% lots should have been booked by now at 100 points profit.

Cheers

SH |

5/34 exit in longs given at 7880 NF hence all longs exited at 7880 giving a profit of around 60 points on rest 50%.

Nifty Yorker shorts also initiated later in the day at 7824 NF and Bank Nifty at 16735

Cheers

SH |

BNF closed at 16515 today, more than 200 points profit hence I chose to book 50% at 16535 giving me 200 points profit. Rest 50% holding.

Similarly, I will book 50% profits in Nifty at around 100 points profit when and if it comes.

Cheers

SH |

Booked 50% NF at 7650 today (170 points profit) .... rest 50% holding now hedged with sold 7600 PE at 103

BNF also held....

Cheers

SH

|

|

| Back to top |

|

|

TSANNIDI

White Belt

Joined: 25 Jan 2012

Posts: 3

|

Post: #522  Posted: Fri Jan 08, 2016 9:14 pm Post subject: I do not see BULLISH yorker in NIFTY yet..... Posted: Fri Jan 08, 2016 9:14 pm Post subject: I do not see BULLISH yorker in NIFTY yet..... |

|

|

Hi Alche,

I dot not see bullish yorker in NIFTY SPOT....

Can you please explain bit more and point me to Bullish Cross over at 7816 levels..on 7th Jan or 8th JAN.

Thanks

TSANNIDI

|

|

| Back to top |

|

|

sanjayojha

White Belt

Joined: 13 Nov 2013

Posts: 151

|

Post: #523  Posted: Fri Jan 08, 2016 11:45 pm Post subject: Re: I do not see BULLISH yorker in NIFTY yet..... Posted: Fri Jan 08, 2016 11:45 pm Post subject: Re: I do not see BULLISH yorker in NIFTY yet..... |

|

|

| TSANNIDI wrote: | Hi Alche,

I dot not see bullish yorker in NIFTY SPOT....

Can you please explain bit more and point me to Bullish Cross over at 7816 levels..on 7th Jan or 8th JAN.

Thanks

TSANNIDI |

Dear Tsannidi

That particular post was written on 17 Dec not 7 /8 Jan. Pls chk chart on that date.

regards

Sanjay

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #524  Posted: Mon Jan 11, 2016 6:15 pm Post subject: Posted: Mon Jan 11, 2016 6:15 pm Post subject: |

|

|

Today was a gap down in favour of shorts (and away from 34 EMA), first candle high was 7529, hence as per gap rules booked 100% shorts at 7530 giving 290 points profit on this short trade in NF.

Fresh shorts to be taken at break of todays lows or near 34 EMA with 5/34 EMA crossover as the SL. Eventually entered fresh shorts at 34 EMA kiss today around 7600

Cheers

SH

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #525  Posted: Mon Jan 11, 2016 9:56 pm Post subject: Posted: Mon Jan 11, 2016 9:56 pm Post subject: |

|

|

| Alchemist wrote: | Today was a gap down in favour of shorts (and away from 34 EMA), first candle high was 7529, hence as per gap rules booked 100% shorts at 7530 giving 290 points profit on this short trade in NF.

Fresh shorts to be taken at break of todays lows or near 34 EMA with 5/34 EMA crossover as the SL. Eventually entered fresh shorts at 34 EMA kiss today around 7600

Cheers

SH |

wonder if as per rules, fresh short can only be taken on break of 30tf candle touching 34ema , rejecting the 34ema, hence at 7577.

|

|

| Back to top |

|

|

|