| View previous topic :: View next topic |

| Author |

SH 30 minutes swinging yorker method - Nifty (Alchemist) |

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #76  Posted: Tue Feb 24, 2015 8:09 pm Post subject: Posted: Tue Feb 24, 2015 8:09 pm Post subject: |

|

|

No bearish cross done today.. you need to upload data for minimum 250 days to get the right picture and EMAs

Cheers

SH

|

|

| Back to top |

|

|

|

|

|

simply.index

White Belt

Joined: 28 Jun 2014

Posts: 158

|

Post: #77  Posted: Wed Feb 25, 2015 9:23 am Post subject: Posted: Wed Feb 25, 2015 9:23 am Post subject: |

|

|

Well said SH,

Infact nifty spot was around the 200ema value (8750) for most part of the day and has bounced from there. If the closing is above 8750, would go long.[/quote]

50 points gain, booked half. SH ...

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #78  Posted: Wed Feb 25, 2015 4:13 pm Post subject: Posted: Wed Feb 25, 2015 4:13 pm Post subject: |

|

|

| deleted.

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #79  Posted: Thu Feb 26, 2015 12:40 pm Post subject: Posted: Thu Feb 26, 2015 12:40 pm Post subject: |

|

|

5/200 bearish Yorker done now ...sold march series at 8790

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #80  Posted: Thu Feb 26, 2015 1:56 pm Post subject: Posted: Thu Feb 26, 2015 1:56 pm Post subject: |

|

|

| Alchemist wrote: | 5/200 bearish Yorker done now ...sold march series at 8790

Cheers

SH |

50% booking should be done at 8720-8725 now as per the rules.

Cheers

SH

|

|

| Back to top |

|

|

snehil2010

White Belt

Joined: 04 Feb 2015

Posts: 19

|

Post: #81  Posted: Thu Feb 26, 2015 4:52 pm Post subject: Posted: Thu Feb 26, 2015 4:52 pm Post subject: |

|

|

Hello Alchemist,

I went through the entire thread and the strategy looks profitable. I do have few question for you:

1) What is the justification of using 5 and 200 period EMA? Is it based on some backtesting or just a wild guess?

2) Why do you use EMA instead of SMA? As per my analysis, SMA gives more accurate results on longes periods like 200.

Thanks,

Snehil

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #82  Posted: Thu Feb 26, 2015 9:20 pm Post subject: Posted: Thu Feb 26, 2015 9:20 pm Post subject: |

|

|

| snehil2010 wrote: | Hello Alchemist,

I went through the entire thread and the strategy looks profitable. I do have few question for you:

1) What is the justification of using 5 and 200 period EMA? Is it based on some backtesting or just a wild guess?

2) Why do you use EMA instead of SMA? As per my analysis, SMA gives more accurate results on longes periods like 200.

Thanks,

Snehil |

1) Wild guess

2) Please use SMA if you think its better.

Cheers

SH

|

|

| Back to top |

|

|

snehil2010

White Belt

Joined: 04 Feb 2015

Posts: 19

|

Post: #83  Posted: Fri Feb 27, 2015 12:48 am Post subject: Posted: Fri Feb 27, 2015 12:48 am Post subject: |

|

|

Hello Alchemist,

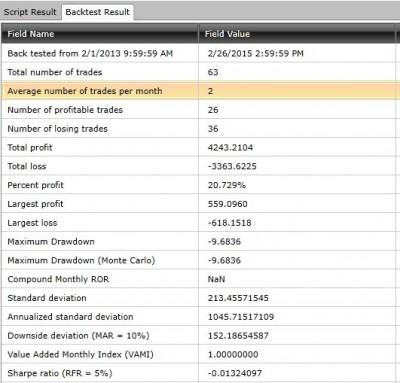

I backtested this strategy on 30 min NIFTY Spot chart of 2 years. Below are the buy/sell expressions:

Buy: CROSSOVER(EMA(CLOSE,5),EMA(CLOSE,200))=TRUE

Sell: CROSSOVER(EMA(CLOSE,200),EMA(CLOSE,5))=TRUE OR CROSSOVER(EMA(CLOSE,34),EMA(CLOSE,5))=TRUE

Please find attached the backtesting results. The calculations are based on 1 Lot of NIFTY.

The strategy doesn't seem very profitable. Please share your thoughts.

Thanks,

Snehil

| Description: |

|

| Filesize: |

62.27 KB |

| Viewed: |

416 Time(s) |

|

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #84  Posted: Fri Feb 27, 2015 11:34 am Post subject: Posted: Fri Feb 27, 2015 11:34 am Post subject: |

|

|

Did you test it with 5/34 EMA exit rule ?

Cheers

SH

|

|

| Back to top |

|

|

snehil2010

White Belt

Joined: 04 Feb 2015

Posts: 19

|

Post: #85  Posted: Fri Feb 27, 2015 12:06 pm Post subject: Posted: Fri Feb 27, 2015 12:06 pm Post subject: |

|

|

Alchemist,

Yes, both the exit rules are mentioned in SELL strategy

|

|

| Back to top |

|

|

simply.index

White Belt

Joined: 28 Jun 2014

Posts: 158

|

Post: #86  Posted: Fri Feb 27, 2015 1:52 pm Post subject: Posted: Fri Feb 27, 2015 1:52 pm Post subject: |

|

|

| Bullish crossover happened at 8762 and nifty just took off from there.

|

|

| Back to top |

|

|

shaheerzaman

White Belt

Joined: 05 Aug 2014

Posts: 93

|

Post: #87  Posted: Fri Feb 27, 2015 1:58 pm Post subject: Posted: Fri Feb 27, 2015 1:58 pm Post subject: |

|

|

Snehil,

You tested with 1 lot. Its critical to trade with atleast 2 lots. So that the first lot gives us 60-70 points. And the second lot continues to trade. I would also suggest to book the second lot at 17 EMA crossover rather than 34 EMA.

Alchemist can guide us more.

Thanks

shaheer

| snehil2010 wrote: | Alchemist,

Yes, both the exit rules are mentioned in SELL strategy |

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #88  Posted: Fri Feb 27, 2015 2:03 pm Post subject: Posted: Fri Feb 27, 2015 2:03 pm Post subject: |

|

|

| simply.index wrote: | | Bullish crossover happened at 8762 and nifty just took off from there. |

Yep - previous sell signal negated at 8830 NF so lost 40 points ... had booked 65 points yesterday on 50% so still a profitable trade.

now longs from 8830 running ... 50% to be booked at around 8900

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #89  Posted: Fri Feb 27, 2015 2:04 pm Post subject: Posted: Fri Feb 27, 2015 2:04 pm Post subject: |

|

|

| snehil2010 wrote: | Alchemist,

Yes, both the exit rules are mentioned in SELL strategy |

snehil - run it for last one month and show us the result ....I have made 600+ points in last one month and all trades are tracked here in this thread.... lets see if that matches your backtesting tool.

Cheers

SH

|

|

| Back to top |

|

|

Alchemist

Yellow Belt

Joined: 09 Aug 2010

Posts: 853

|

Post: #90  Posted: Fri Feb 27, 2015 3:09 pm Post subject: Posted: Fri Feb 27, 2015 3:09 pm Post subject: |

|

|

| Alchemist wrote: | | simply.index wrote: | | Bullish crossover happened at 8762 and nifty just took off from there. |

Yep - previous sell signal negated at 8830 NF so lost 40 points ... had booked 65 points yesterday on 50% so still a profitable trade.

now longs from 8830 running ... 50% to be booked at around 8900

Cheers

SH |

Booked 50% at 8894, 64 points.

Tomorrow budget day so hedged rest 50% by buying 8800 PE at 150

Cheers

SH

|

|

| Back to top |

|

|

|