| View previous topic :: View next topic |

| Author |

Short term recommendation |

rajpalmanish

White Belt

Joined: 14 Aug 2006

Posts: 6

|

Post: #1  Posted: Mon Aug 14, 2006 12:13 am Post subject: Short term recommendation Posted: Mon Aug 14, 2006 12:13 am Post subject: Short term recommendation |

|

|

Hi,

Can anyone who has a good knowledge of techincal analysis share some short terms calls for 15-30 days for 20-30% returrn.

Please don't share any fake calls as it can be a loss for someone.

|

|

| Back to top |

|

|

|

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #2  Posted: Mon Aug 14, 2006 7:05 pm Post subject: Posted: Mon Aug 14, 2006 7:05 pm Post subject: |

|

|

| mis1183 wrote: | enter into gnfc cmp-101

sl-93 time period-6 days exit at around 115 |

I too like GNFC. The thing that interests me most is the exploding OBV. Another thing I observe when stocks look like they are changing trends is the volume on UP days vs volume on DOWN days. In case of GNFC during the recent rally volume has been very less on down days and it has been strong on up days. This is a very good sign. A strong breakout above today's high would be a clear indication of coming rally for this stock.

mis1183, thanks for highlighting GNFC. Which one is the other stock? can you please give us its NSE/BSE symbol?

--SwingTrader

| Description: |

|

| Filesize: |

46.27 KB |

| Viewed: |

3650 Time(s) |

|

|

|

| Back to top |

|

|

game4trade

White Belt

Joined: 16 Aug 2006

Posts: 3

|

Post: #3  Posted: Wed Aug 16, 2006 9:40 am Post subject: Posted: Wed Aug 16, 2006 9:40 am Post subject: |

|

|

Hi,

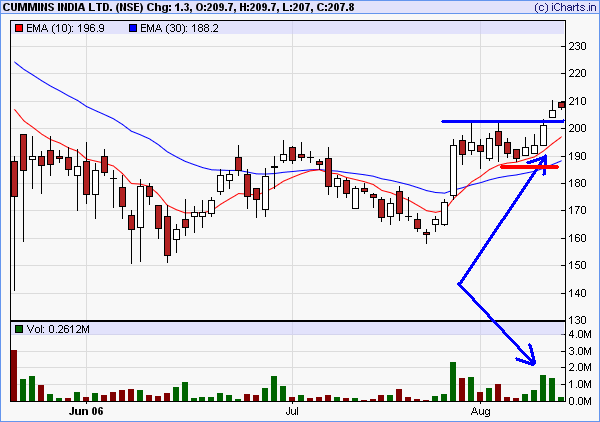

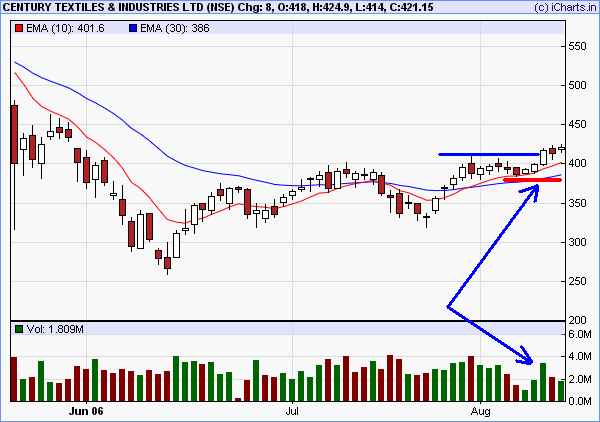

Any suggestions on CENTURYTEX and CUMMINSIND. Facing some resistance to break free.

Cheers,

Ashish.

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #4  Posted: Wed Aug 16, 2006 2:08 pm Post subject: Posted: Wed Aug 16, 2006 2:08 pm Post subject: |

|

|

| game4trade wrote: | Hi,

Any suggestions on CENTURYTEX and CUMMINSIND. Facing some resistance to break free.

Cheers,

Ashish. |

CENTURYTEX & CUMMINSIND are in very similar stages. Both have turned bullish and one can initiate positions in these stocks and place stops relatively close to the entry point (stops could be placed just below the recent swing low as shown in the charts below by drawing a red line). Both have had decent breakouts on above average volume.

| Description: |

|

| Filesize: |

13.5 KB |

| Viewed: |

3623 Time(s) |

|

| Description: |

|

| Filesize: |

13.22 KB |

| Viewed: |

3623 Time(s) |

|

|

|

| Back to top |

|

|

ranbhan

White Belt

Joined: 19 Aug 2006

Posts: 9

|

Post: #5  Posted: Sat Aug 19, 2006 11:39 am Post subject: wait before you buy GNFC Posted: Sat Aug 19, 2006 11:39 am Post subject: wait before you buy GNFC |

|

|

Looking at daily chart GNFC is still in down trend by its 14 day RSI. MACD is also not giving encouraging pic. Volumes are also shrinking.

Pl think before you buy GNFC at least short term targets are not well placed.

|

|

| Back to top |

|

|

ranbhan

White Belt

Joined: 19 Aug 2006

Posts: 9

|

Post: #6  Posted: Sat Aug 19, 2006 11:45 am Post subject: Century and Cummins Posted: Sat Aug 19, 2006 11:45 am Post subject: Century and Cummins |

|

|

Sorry as of today I beg to differ on cummins predictions. Its movement is more or less similar to GNFC. Infact for both these cos I predict down fall has just began or it will start after some sideways movement.

Regarding Century textile pic is not that clear. RSI is showing signs of revival but MACD and depleting volume indicates sideways movement.

Pic will become clear by next week.

Hold your breath till that time.

|

|

| Back to top |

|

|

ranbhan

White Belt

Joined: 19 Aug 2006

Posts: 9

|

Post: #7  Posted: Sat Aug 19, 2006 11:55 am Post subject: GNFC weekly charts Posted: Sat Aug 19, 2006 11:55 am Post subject: GNFC weekly charts |

|

|

Just to add here,

GNFC weekly charts is showing completion of wave 3 (It can max. upto 119.6 as 68% retrenchment) as per elliot wave theory.

As a result of this chances of making money out of this looks limited. If you are able to grab at current price pl try to exit below 119. Do not expect it to go above this level in any case.

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #8  Posted: Sun Aug 20, 2006 10:10 am Post subject: Posted: Sun Aug 20, 2006 10:10 am Post subject: |

|

|

Yes, GNFC has pulled back a bit. As I said above GNFC would give an indication of a possible rally only on a strong breakout above Aug 14th high of 102.6. Below that it is still in a long consolidation pattern.

As for CENTURYTEX & CUMMINSIND, they look fine to me and if the market is stable they can continue to rally from here.

The market usually has the final say in all this.

--SwingTrader

|

|

| Back to top |

|

|

tejas277

White Belt

Joined: 20 Sep 2006

Posts: 1

|

Post: #9  Posted: Wed Sep 20, 2006 6:39 pm Post subject: Petrochemical co turnaround Posted: Wed Sep 20, 2006 6:39 pm Post subject: Petrochemical co turnaround |

|

|

Can any one guide on short term potential in panama petro.

Cheers,

Tejas

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #10  Posted: Wed Sep 20, 2006 6:52 pm Post subject: Re: Petrochemical co turnaround Posted: Wed Sep 20, 2006 6:52 pm Post subject: Re: Petrochemical co turnaround |

|

|

| tejas277 wrote: | Can any one guide on short term potential in panama petro.

Cheers,

Tejas |

PANAMA PETRO (BSE CODE: 524820) recently had a breakout on strong volume and has pulled back a bit. It is at a good point where you can initiate position with a tight stop.

The way I usually buy is when a stock in a pullback breaks above the previous day's high and then I place a mental stop little below the previous day's low. If you don't follow this tactic then the most recent significant support is around 95 (but given the current market closing price of 108.45 this is a bit far so size your positions accordingly).

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

ssnkumar

White Belt

Joined: 29 Sep 2006

Posts: 2

|

Post: #11  Posted: Fri Sep 29, 2006 11:09 am Post subject: Any suggestion on Valecha and Orchid Chemicals Posted: Fri Sep 29, 2006 11:09 am Post subject: Any suggestion on Valecha and Orchid Chemicals |

|

|

Hi,

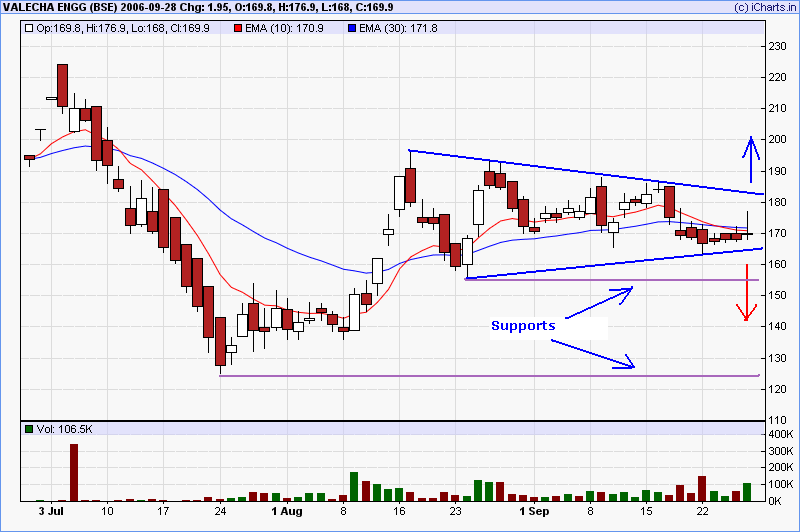

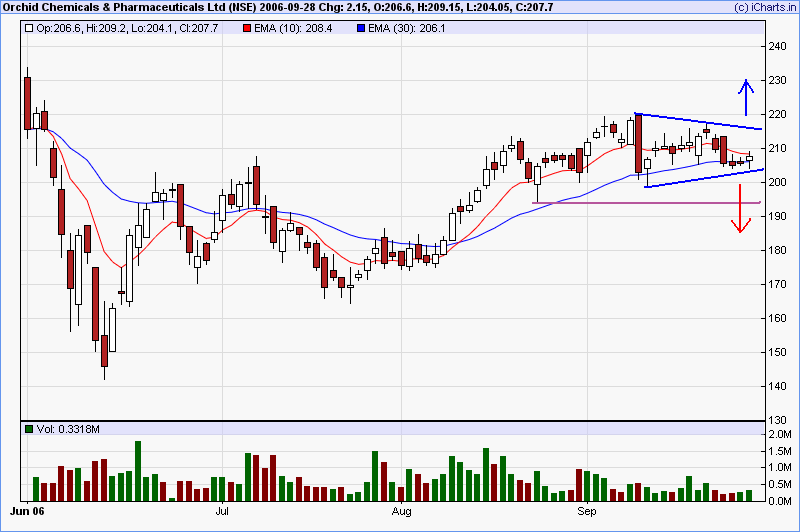

Can you please tell me the short term prospects of Valecha and Orchid Chemicals?

What does the charts indicate?

Thanks,

Narendra

|

|

| Back to top |

|

|

ssnkumar

White Belt

Joined: 29 Sep 2006

Posts: 2

|

Post: #12  Posted: Fri Sep 29, 2006 11:11 am Post subject: Prospects of Hotel Leela and Zeetele? Posted: Fri Sep 29, 2006 11:11 am Post subject: Prospects of Hotel Leela and Zeetele? |

|

|

Hi,

I have few shares of Hotel Leela and Zee Telefilms.

So, I want to know, how the stocks of these companies perform in short term and also over a period of 1 year?

Regards,

Narendra

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #13  Posted: Fri Sep 29, 2006 12:14 pm Post subject: Re: Any suggestion on Valecha and Orchid Chemicals Posted: Fri Sep 29, 2006 12:14 pm Post subject: Re: Any suggestion on Valecha and Orchid Chemicals |

|

|

| ssnkumar wrote: | Hi,

Can you please tell me the short term prospects of Valecha and Orchid Chemicals?

What does the charts indicate?

Thanks,

Narendra |

Both Valecha & Orchid Chem are in similar situations. Both are in triangle pattern formation which means consolidation. Wait until the triangle patterns gets resolved and you will know the probable direction of the stocks. If the stock breaks out above the triangle then there could be more upside and if it breaks downward then there could be downside. Look at the charts below for clues.

| Description: |

|

| Filesize: |

18.75 KB |

| Viewed: |

3314 Time(s) |

|

| Description: |

|

| Filesize: |

17.94 KB |

| Viewed: |

3314 Time(s) |

|

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #14  Posted: Fri Sep 29, 2006 12:24 pm Post subject: Re: Prospects of Hotel Leela and Zeetele? Posted: Fri Sep 29, 2006 12:24 pm Post subject: Re: Prospects of Hotel Leela and Zeetele? |

|

|

| ssnkumar wrote: | Hi,

I have few shares of Hotel Leela and Zee Telefilms.

So, I want to know, how the stocks of these companies perform in short term and also over a period of 1 year?

Regards,

Narendra |

Hotel Leela is in a long pullback after its strong breakout. It looks good but it has to consolidate around 65 itself and continue its uptrend. If it breaks down from here below 60-65 range then I would suggest closing the position. But if the market remains supportive then uptrend should continue.

Zee Tele is in a normal pullback and if market continues to be in good shape then it should continue its uptrend. If Zee breaks down below 285 I would suggest closing the position, otherwise just hold on and ride the uptrend.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

|