| View previous topic :: View next topic |

| Author |

SP Day Trading Strategy(+1,000 points pm) |

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #1  Posted: Mon Oct 10, 2011 4:51 pm Post subject: SP Day Trading Strategy(+1,000 points pm) Posted: Mon Oct 10, 2011 4:51 pm Post subject: SP Day Trading Strategy(+1,000 points pm) |

|

|

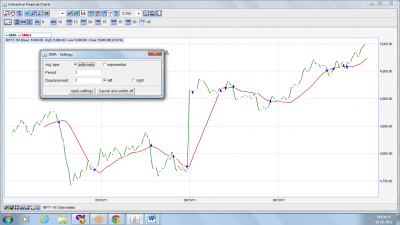

Subject strategy is quite simple user no need to be an expert in Technical Analysis. In this strategy you need to focus only on DMA and SMA 45 lines in 3 or 4 minute tf without any candles.

Process:

Set up

1) Select J-Charts (Premium)

2) Select Nifty 1 Month

3) Select 3 or 4 mnt TF

4) Select colour panel

5) Select white colour for first three candles (price, Bullish and Bearish) with this set up u will not see any candles in charts and this helps you to stick to single indicator and you will not react to fast changing candles.

Entry and Exit:

6) When DMA crosses SMA45 line from down side to upside then go LONG (Buy) or line moves from upside to down then go SHORT (sell) and use the same principle to to exit long or short (Check the attached chart to understand the process better and DMA set up lines)

3 minutes tf gives an average 3 to 5 calls in 4 minuests 2 to 3 calls depending on risk appetite you can chose the time frame.

Wish you all good luck.

Shanker Parray

|

|

| Back to top |

|

|

|

|

|

tanhadil1984

White Belt

Joined: 08 Jun 2011

Posts: 36

|

Post: #2  Posted: Mon Oct 10, 2011 4:56 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) Posted: Mon Oct 10, 2011 4:56 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) |

|

|

| parray wrote: | Subject strategy is quite simple user no need to be an expert in Technical Analysis. In this strategy you need to focus only on DMA and SMA 45 lines in 3 or 4 minute tf without any candles.

Process:

Set up

1) Select J-Charts (Premium)

2) Select Nifty 1 Month

3) Select 3 or 4 mnt TF

4) Select colour panel

5) Select white colour for first three candles (price, Bullish and Bearish) with this set up u will not see any candles in charts and this helps you to stick to single indicator and you will not react to fast changing candles.

Entry and Exit:

6) When DMA crosses SMA45 line from down side to upside then go LONG (Buy) or line moves from upside to down then go SHORT (sell) and use the same principle to to exit long or short (Check the attached chart to understand the process better and DMA set up lines)

3 minutes tf gives an average 3 to 5 calls in 4 minuests 2 to 3 calls depending on risk appetite you can chose the time frame.

Wish you all good luck.

Shanker sParray |

sir,

there is no chart attached,plz attach the chart, nd plz explain how to put dma setting

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #3  Posted: Mon Oct 10, 2011 5:02 pm Post subject: SP Day Trading Strategy(+1,000 points pm) Posted: Mon Oct 10, 2011 5:02 pm Post subject: SP Day Trading Strategy(+1,000 points pm) |

|

|

OOps, pls find the same..

| Description: |

|

| Filesize: |

151.98 KB |

| Viewed: |

2389 Time(s) |

|

|

|

| Back to top |

|

|

zritesh

White Belt

Joined: 03 Apr 2010

Posts: 53

|

Post: #4  Posted: Mon Oct 10, 2011 5:58 pm Post subject: Posted: Mon Oct 10, 2011 5:58 pm Post subject: |

|

|

Parray ji, i have never seen such a simple strategy.... can it be used for commodity also.. have you back tested this strategy...

i have seen your earlier one of 750+ point which Mr. Bullion is following consistently.. and i guess he is successful also.. if this one works to then believe me no need to do any other analysis day and night,

thank you very much for providing this simple strategy.

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #5  Posted: Tue Oct 11, 2011 4:09 pm Post subject: Posted: Tue Oct 11, 2011 4:09 pm Post subject: |

|

|

hi ritesh,

earlier posted strategy for swing and this strategy is only for day trading. this strategy works in all segments. hope you had successful day . day like today also generated profit of 45 points with 4 trades.

wish u good luck..

shanker parray

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #6  Posted: Tue Oct 11, 2011 9:11 pm Post subject: Posted: Tue Oct 11, 2011 9:11 pm Post subject: |

|

|

dear parray,

nice work! now kindly explain if you are using 3 or 4 min time frame ? and then what is meant by DMA, is it the current market price that you wanted to say?

regards.

ANS.

|

|

| Back to top |

|

|

opportunist

White Belt

Joined: 27 Apr 2010

Posts: 356

|

Post: #7  Posted: Tue Oct 11, 2011 9:34 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) Posted: Tue Oct 11, 2011 9:34 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) |

|

|

| parray wrote: | Subject strategy is quite simple user no need to be an expert in Technical Analysis. In this strategy you need to focus only on DMA and SMA 45 lines in 3 or 4 minute tf without any candles.

Process:

Set up

1) Select J-Charts (Premium)

2) Select Nifty 1 Month

3) Select 3 or 4 mnt TF

4) Select colour panel

5) Select white colour for first three candles (price, Bullish and Bearish) with this set up u will not see any candles in charts and this helps you to stick to single indicator and you will not react to fast changing candles.

Entry and Exit:

6) When DMA crosses SMA45 line from down side to upside then go LONG (Buy) or line moves from upside to down then go SHORT (sell) and use the same principle to to exit long or short (Check the attached chart to understand the process better and DMA set up lines)

3 minutes tf gives an average 3 to 5 calls in 4 minuests 2 to 3 calls depending on risk appetite you can chose the time frame.

Wish you all good luck.

Shanker Parray |

Parray DMA is flat at the last few tics since it is shifted left. Now how to remove this problem as i would come to know of a cross over after several ticks have passed. I think instead of DMA we should use some lower ema/sma with 45 SMA

Regards,

Oppo

|

|

| Back to top |

|

|

tanhadil1984

White Belt

Joined: 08 Jun 2011

Posts: 36

|

Post: #8  Posted: Tue Oct 11, 2011 11:34 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) Posted: Tue Oct 11, 2011 11:34 pm Post subject: Re: SP Day Trading Strategy(+1,000 points pm) |

|

|

| opportunist wrote: | | parray wrote: | Subject strategy is quite simple user no need to be an expert in Technical Analysis. In this strategy you need to focus only on DMA and SMA 45 lines in 3 or 4 minute tf without any candles.

Process:

Set up

1) Select J-Charts (Premium)

2) Select Nifty 1 Month

3) Select 3 or 4 mnt TF

4) Select colour panel

5) Select white colour for first three candles (price, Bullish and Bearish) with this set up u will not see any candles in charts and this helps you to stick to single indicator and you will not react to fast changing candles.

Entry and Exit:

6) When DMA crosses SMA45 line from down side to upside then go LONG (Buy) or line moves from upside to down then go SHORT (sell) and use the same principle to to exit long or short (Check the attached chart to understand the process better and DMA set up lines)

3 minutes tf gives an average 3 to 5 calls in 4 minuests 2 to 3 calls depending on risk appetite you can chose the time frame.

Wish you all good luck.

Shanker Parray |

Parray DMA is flat at the last few tics since it is shifted left. Now how to remove this problem as i would come to know of a cross over after several ticks have passed. I think instead of DMA we should use some lower ema/sma with 45 SMA

Regards,

Oppo |

yes mr parry i have faced the same prob,wen we r having 3 or 4 mins tf, wen crossover takes place,price usully had already made a gud amout of moment.

same way wen i tried to use yout other strategy in 2 mins tf,wen sma crosses XX50 or 100, it usually trades wid a gap of atleast 20-30 points,strategy luks gud widout looking at the real time prices, or may be i m not able to implement it properly or not able to understand how to execute this strategy, plz help

|

|

| Back to top |

|

|

rishu

White Belt

Joined: 08 Dec 2009

Posts: 38

|

Post: #9  Posted: Wed Oct 12, 2011 9:12 am Post subject: Posted: Wed Oct 12, 2011 9:12 am Post subject: |

|

|

| Nice Strategy....works well..........Regards

|

|

| Back to top |

|

|

rishu

White Belt

Joined: 08 Dec 2009

Posts: 38

|

Post: #10  Posted: Wed Oct 12, 2011 10:54 am Post subject: Posted: Wed Oct 12, 2011 10:54 am Post subject: |

|

|

For positional gains, the following will also work well:

1. use either 20 min or 60 min chart

2. The settings of DMA would be 20 and 3.

3. use 20 sma

Trade according to crossover of 20 sma and 20 dma.

Pl. consider trying.

Regards

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #11  Posted: Thu Oct 13, 2011 4:06 pm Post subject: Posted: Thu Oct 13, 2011 4:06 pm Post subject: |

|

|

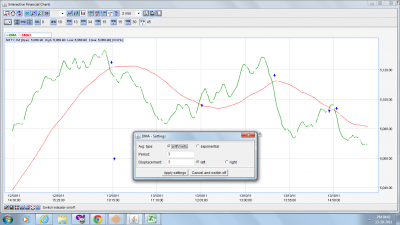

Hope everybody had brilliant two days, today +70 points with 2tf/total 5 trades. except one trade all in profit.

opp: stick to the same settings do not watch candles . this works better with lower tf .

who ever spots the buy and sell signal pls post the same so everybody can view it and benefit from the same.

cheers,

shanker parray.

| Description: |

|

| Filesize: |

157.68 KB |

| Viewed: |

1115 Time(s) |

|

|

|

| Back to top |

|

|

yesogna

White Belt

Joined: 01 Jul 2010

Posts: 8

|

Post: #12  Posted: Thu Oct 13, 2011 5:25 pm Post subject: Posted: Thu Oct 13, 2011 5:25 pm Post subject: |

|

|

Nice Strategy !!!!!

Selfless & Great Job!!!!!!

Thank You Mr.Shanker Parray

|

|

| Back to top |

|

|

lakshit

White Belt

Joined: 12 Jan 2010

Posts: 58

|

Post: #13  Posted: Thu Oct 13, 2011 6:11 pm Post subject: Posted: Thu Oct 13, 2011 6:11 pm Post subject: |

|

|

| Thanks for a great and simpler strategy, have gained in individual stock keeping same in practice. Thanks once again Mr.Parray, Br/Lakshit

|

|

| Back to top |

|

|

ANS_KOL

White Belt

Joined: 16 Jul 2011

Posts: 84

|

Post: #14  Posted: Thu Oct 13, 2011 7:33 pm Post subject: Posted: Thu Oct 13, 2011 7:33 pm Post subject: |

|

|

| ANS_KOL wrote: | dear parray,

nice work! now kindly explain if you are using 3 or 4 min time frame ? and then what is meant by DMA, is it the current market price that you wanted to say?

regards.

ANS. |

can anybody please explain what is meant by -WHEN DMA CROSSES SMA 45 LINE FROM BELOW, GO LONG...

while I understand simple moving average in 3 min time frame I fail to understand what DMA is taken into consideration while trading?

will somebody come up and explain?

ANS.

|

|

| Back to top |

|

|

rishu

White Belt

Joined: 08 Dec 2009

Posts: 38

|

Post: #15  Posted: Thu Oct 13, 2011 8:28 pm Post subject: Posted: Thu Oct 13, 2011 8:28 pm Post subject: |

|

|

Dear Mr. Parray,

I have also closely watched the chart which you have posted below. As per my calculation, there are total five trades which are as follows:

Buy Sell Gain/ Loss

5103 5110 +7

5103 5103 0

5103 5096 -7

5096 5096 0

5070 5096 +26 Net Gain: +26 points

If we go from crossover to crossover, the scenario is as above stated OR there is some other method of exiting the trade because after the crossovers, the movements were strong. It will be highly appreciated if you could clarify how you calculated +70 points in this trade. One more thing I wish to say that if we just go through the charts after the trade, it doesn't clarify the actual picture because when the crossover happens it doesn't happen as it looks in the chart. It happens much after price rise or fall as has been noticed by other forum members also.

Regards

|

|

| Back to top |

|

|

|