| View previous topic :: View next topic |

| Author |

SP Strategy(+650 points PM) |

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #16  Posted: Mon Aug 01, 2011 4:06 pm Post subject: Posted: Mon Aug 01, 2011 4:06 pm Post subject: |

|

|

| wait Parry-- not so easy to new comers--

|

|

| Back to top |

|

|

|

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #17  Posted: Mon Aug 01, 2011 4:10 pm Post subject: Posted: Mon Aug 01, 2011 4:10 pm Post subject: |

|

|

Parry-- it would be just a chance that gap up n came down-- -- it may not happen---

so if short on Friday below 5500-- what will he do at 5544-= wait -- now here he will be in panic n take long above 5550-[that would be good for him] so line didnt cross 5550 so no exit n long-- it went below 5500-- now once it again went above 5550-- he will exit and long---

I think that the right way--

why would we assume that he has no position of short in hand-- and more over why will one make a fast short without line crossing 5550-- n coming down--

Please explain ???

|

|

| Back to top |

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #18  Posted: Mon Aug 01, 2011 4:15 pm Post subject: Posted: Mon Aug 01, 2011 4:15 pm Post subject: |

|

|

Now long-- or short--- or Booking long n short-- will he decide with 30 Sec-- or 2 min only---

No problem even 5--10 point cheaper or expensive--as target is big--

Friday---

Long -- then Sl hit---

Short --then Sl hit

Long and then Sl hit

Short Sl hit--

Long Sl hit

n short carry

is that right ??

If so 5 Sl hit -- making a loss of almost 50--60 points--

|

|

| Back to top |

|

|

viraj5

White Belt

Joined: 23 Jul 2010

Posts: 32

|

Post: #19  Posted: Mon Aug 01, 2011 5:28 pm Post subject: Settings ???? Posted: Mon Aug 01, 2011 5:28 pm Post subject: Settings ???? |

|

|

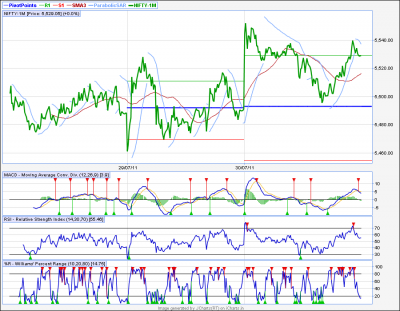

Are you keeping SMA3 =45 for 2min TF ????

Regards

Viraj

|

|

| Back to top |

|

|

viraj5

White Belt

Joined: 23 Jul 2010

Posts: 32

|

Post: #20  Posted: Mon Aug 01, 2011 5:43 pm Post subject: Settings ???? Posted: Mon Aug 01, 2011 5:43 pm Post subject: Settings ???? |

|

|

Do you want to keep settings SMA3=45 with 2 min/ 3 min TF ????

Regards

Viraj

| Description: |

|

| Filesize: |

76.29 KB |

| Viewed: |

702 Time(s) |

|

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #21  Posted: Tue Aug 02, 2011 8:57 am Post subject: Posted: Tue Aug 02, 2011 8:57 am Post subject: |

|

|

Parray,

I have now added .xlsx and .docs to the list of allowed attachments. You should be able to attach those files here.

*** This is about the problem you reported in shoutbox yesterday about not being able to attach .xlsx and .docs files.

Regards.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

prabit

White Belt

Joined: 02 Jul 2009

Posts: 133

|

Post: #22  Posted: Tue Aug 02, 2011 9:04 am Post subject: Posted: Tue Aug 02, 2011 9:04 am Post subject: |

|

|

| SwingTrader wrote: | Parray,

I have now added .xlsx and .docs to the list of allowed attachments. You should be able to attach those files here.

*** This is about the problem you reported in shoutbox yesterday about not being able to attach .xlsx and .docs files.

Regards. |

Thanks ST sir for such prompt action.

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #23  Posted: Tue Aug 02, 2011 9:41 am Post subject: Posted: Tue Aug 02, 2011 9:41 am Post subject: |

|

|

Thanks Prabit and ST.

i will answer all other queries after trading hours. sorry folks keep u waiting.

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #24  Posted: Tue Aug 02, 2011 4:01 pm Post subject: Posted: Tue Aug 02, 2011 4:01 pm Post subject: |

|

|

viraj, for best results use 2 mnt tf.

with ref to stop loss, ideal will be 25 to 35 pnts and roll the tsl once u r in profit as per risk reward ratio.

if u r highly in to intraday and quick to react then go with 30 seconds tf in case of swift move of 50 to 80 points or just act whenever that happens. as per my observation in a month we will be presented with 3 to 4 times such moves otherwise just stick to 2 mnt tf.

just to quote past seven months ( jan to Jul) 2 mnt tf gave total 112 trades

64 trades in profit and 48 trades in loss. Total profit points 5587 and loss is 841= that means average profit is 678 points per month.

average total 16 calls per month ( 10 positive and 6 negative). without worrying too much of which to tf to use just stick to 2 mnt tf overall for sure it is highly profitable only thing do not allow mind to take over the strategy.

As i mentioned July was the worst month and you might have noticed in the chart that July alone we had 9 loss calls 6 positive calls still strategy delivered profit of +250 points.

hoping that every one will make good profits.

Cheers.

Shanker Parray

|

|

| Back to top |

|

|

GAJ

White Belt

Joined: 09 Dec 2010

Posts: 24

|

Post: #25  Posted: Tue Aug 02, 2011 4:43 pm Post subject: Posted: Tue Aug 02, 2011 4:43 pm Post subject: |

|

|

"When SMA3 line crosses xx50 or x100 "

What do you mean by xx50 and x100 ?

|

|

| Back to top |

|

|

DEWGH

White Belt

Joined: 20 Feb 2011

Posts: 119

|

Post: #26  Posted: Tue Aug 02, 2011 6:44 pm Post subject: Posted: Tue Aug 02, 2011 6:44 pm Post subject: |

|

|

Are you keeping SMA3 =45 for 2min TF ????

Regards

Viraj

Hi Parray Sir,

Seems gr8 strat as per ur results.

The thing confusing to us is sma3.

What i have understood is it is not sma3 but sma45 (inbuilt in ichart)

My understanding correct?

Tx

|

|

| Back to top |

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #27  Posted: Tue Aug 02, 2011 11:18 pm Post subject: Posted: Tue Aug 02, 2011 11:18 pm Post subject: |

|

|

xx50----x100---

that is in multiple of 50--or 100--- like 5450--5500--5550--5600

|

|

| Back to top |

|

|

Rahulsharmaat

Black Belt

Joined: 04 Nov 2009

Posts: 2766

|

Post: #28  Posted: Tue Aug 02, 2011 11:24 pm Post subject: Posted: Tue Aug 02, 2011 11:24 pm Post subject: |

|

|

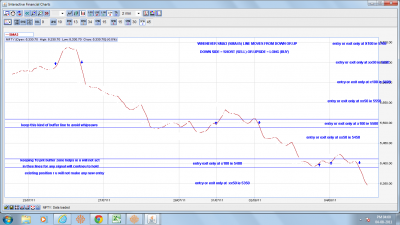

Seeing whipsaws on Friday-- i have done some modification

i buy or exit or short when the 3 ema line value is 5 point plus xx50--x100

Say-- today it cross 5450-- and again dipped below 5450-- so Trade was buy --exit-- short--

again above 5450-- short --exit-- buy

I have added 5 points to EMA value---

when it cross 5450-- i see EMA line value--if it cross 5455-- i buy-- this helped me today in above--- Buy--exit--Short--Exit-- whipsaw---

I did only one trade --thats long -- when it cros 5450

|

|

| Back to top |

|

|

prabit

White Belt

Joined: 02 Jul 2009

Posts: 133

|

Post: #29  Posted: Wed Aug 03, 2011 9:50 am Post subject: Posted: Wed Aug 03, 2011 9:50 am Post subject: |

|

|

| Rahulsharmaat wrote: | | what is When SMA3 line crosses xx50 or x100 ????? |

rahul,

I suppose,

xx50 & x100 , means multiple of 50 e.g. 4500,4550,4600,4650 .......

|

|

| Back to top |

|

|

parray

White Belt

Joined: 04 Oct 2010

Posts: 102

|

Post: #30  Posted: Thu Aug 04, 2011 4:07 pm Post subject: Posted: Thu Aug 04, 2011 4:07 pm Post subject: |

|

|

sorry guys out of station cud not reply ur quiries.

prabit u r understanding is correct.

dewagh- sma3 or sma45 is same.

gaj pls refer attached charts in the thread u will understand better.

please refer attached chart for more clarity.

Rahul instead of EMA try the same with SMA with 10 points buffer zone that will be more stable and u can cut down negative calls.

| Description: |

|

| Filesize: |

125.52 KB |

| Viewed: |

862 Time(s) |

|

|

|

| Back to top |

|

|

|