|

|

| View previous topic :: View next topic |

| Author |

SPREAD TRADING ~ Welgro |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #1  Posted: Fri Sep 12, 2014 11:55 am Post subject: SPREAD TRADING ~ Welgro Posted: Fri Sep 12, 2014 11:55 am Post subject: SPREAD TRADING ~ Welgro |

|

|

Intermarket Spreads

An Intermarket spread can be accomplished by going long futures in one market,and short futures of the same month in another market. For example: Short MayWheat and Long May Soybeans.

Intermarket spreads can become calendar spreads by using long and short futures indifferent markets and in different months.

Note : I am very New in Spread Trading.Calls Updates only for Learning purpose. Dont try to took trade as per this basis. Once Get good knowlage about this system then we will try real trade...

All updates only " PAPER TRADE"

| Description: |

|

Download |

| Filename: |

Bonus Future Spread Trading.pdf |

| Filesize: |

224.02 KB |

| Downloaded: |

648 Time(s) |

|

|

| Back to top |

|

|

|

|  |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #2  Posted: Fri Sep 12, 2014 11:56 am Post subject: Posted: Fri Sep 12, 2014 11:56 am Post subject: |

|

|

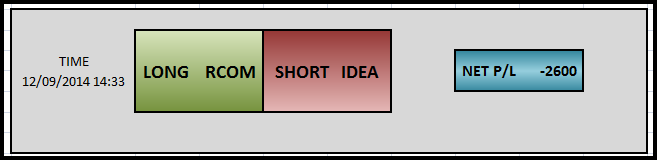

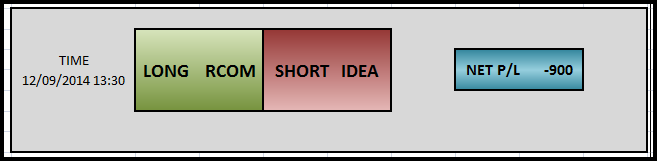

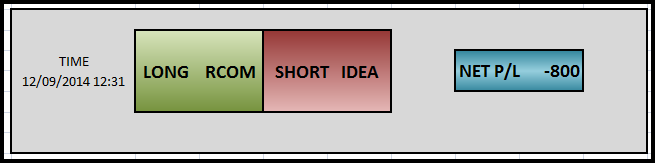

Position will square off at 3:15PM.

| Description: |

|

| Filesize: |

7.91 KB |

| Viewed: |

4062 Time(s) |

|

| Description: |

|

| Filesize: |

7.96 KB |

| Viewed: |

4077 Time(s) |

|

| Description: |

|

| Filesize: |

8.01 KB |

| Viewed: |

4086 Time(s) |

|

| Description: |

|

| Filesize: |

52.92 KB |

| Viewed: |

659 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #3  Posted: Fri Sep 12, 2014 3:21 pm Post subject: Posted: Fri Sep 12, 2014 3:21 pm Post subject: |

|

|

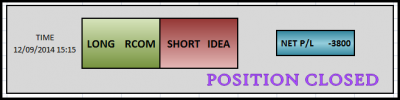

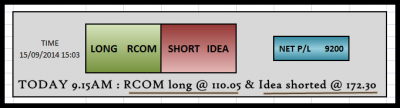

POSITION CLOSED

| Description: |

|

| Filesize: |

12.24 KB |

| Viewed: |

534 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #4  Posted: Fri Sep 12, 2014 5:33 pm Post subject: Posted: Fri Sep 12, 2014 5:33 pm Post subject: |

|

|

You seem to have chosen idea/rcom randomly. What is the price co-relation between them ? Moreover, Spread trades are not meant for Intraday trading.

For Intermarket spreads a good price co-relation is the first and the foremost requirement between the two stocks/commodities, once we establish the co-relation, any deviation from the average is exploited to make profit.

I would suggest you to go thru the thread " Spread Trading - A Simple Trading Strategy for Maximizing Your Profits " by iGURU in another popular forum.

As per my understanding this strategy is more suitable for commodities, since I don't trade commodities I have never pursued it.

Happy Trading !

SHEKHAR

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #5  Posted: Fri Sep 12, 2014 7:13 pm Post subject: Posted: Fri Sep 12, 2014 7:13 pm Post subject: |

|

|

| shekharinvest wrote: | You seem to have chosen idea/rcom randomly. What is the price co-relation between them ? Moreover, Spread trades are not meant for Intraday trading.

For Intermarket spreads a good price co-relation is the first and the foremost requirement between the two stocks/commodities, once we establish the co-relation, any deviation from the average is exploited to make profit.

I would suggest you to go thru the thread " Spread Trading - A Simple Trading Strategy for Maximizing Your Profits " by iGURU in another popular forum.

As per my understanding this strategy is more suitable for commodities, since I don't trade commodities I have never pursued it.

Happy Trading !

SHEKHAR  |

It was suggested yesterday to buy IOC and short BPCL....pls do own calc....to see if results are in consonance with Iguru's method ...then we may find it working it stocks as well

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #6  Posted: Fri Sep 12, 2014 9:32 pm Post subject: Posted: Fri Sep 12, 2014 9:32 pm Post subject: |

|

|

shekharinvest , Thanks for your valuable suggestion.Just now i try to this method in PAPER TRADE.

After some months trading i will get drawdown % and conciliation experience about this system,if its really give good return,i will try to take real trades.Other wise i will get good experience.

| Quote: |

I have not failed. I've just found 10,000 ways that won't work.”

― Thomas A. Edison

|

1. Pairs Trading is a process of buying the cheaper stock and selling the costly stock simultaneously in the futures segment to benefit from all kinds of market condition.

2. When two correlated stocks are chosen for the trade with market neutral approach then the trading method known as Pairs Trading. Example : ICICI Bank and HDFC Bank both in the private banking sector and have close similarity in the business model.

3. In Pairs Trading, the 2 stocks can be traded in 2 following ways :

a) Mean Reverting Stocks : If the 2 stocks are highly correlated & cointegrated, however far the Spread (between the 2 stocks) moves away (increases) from the Mean Spread, at some point in time it will start moving back towards its Mean. In such pairs, a trade can be entered into whenever the Spread moves (2% or more) away from the Mean and then squared off, when the Spread moves back towards its Mean.

b) Directional Strategies : Pairs that are not Mean Reverting can be traded similar to trading any individual scrip, with the only difference being that the Spread between the two stocks is to be used for trading. We can use Moving Average, MACD, RSI, Pivot Points, Fibonacci, etc., on the Spread.

4. A Spread is the Difference between 2 Stocks (OR 1 Index & 1 Stock OR 2 Indices). This difference should not be an Absolute number, i.e., the differential can be Positive as well as Negative. The advantage of trading Spreads is that it is not as Volatile as the individual scrips. (But this does not mean that there won’t be any losses……if not traded & managed properly, this strategy can lead to huge losses.)

5. Current Spread is the Difference between Last Traded Price (LTP) or Current Market Price (CMP) of the 2 stocks.

6. Mean Spread is the Average Spread [Sum of Spread divided by No. of Observations]

7. Upper Spread is Average Spread multiplied by 102% [Average Spread + (Average Spread x 2%)]

8. Lower Spread is Average Spread multiplied by 98% [Average Spread - (Average Spread x 2%)]

9. Maximum Spread is the Maximum Difference between the 2 stocks over a period of time, say 1 month, 3 months, 1 year, etc.

10. Minimum Spread is the Minimum Difference between the 2 stocks over a period of time, say 1 month, 3 months, 1 year, etc.

Trade Initiation Criteria :- (we will take the price of SBI - Rs. 1920/-, & ICICI Bank - Rs. 975/-, into consideration as an example)

1. Current Spread > Upper Spread : When the Current Spread trades above the Upper Spread, the following signal should be generated,

Buy Inexpensive Stock and Sell Expensive Stock (Example – Buy ICICI Bank and Sell SBI)

2. Current Spread < Lower Spread : When the Current Spread trades below the Lower Spread, the following signal should be generated,

Buy Expensive Stock and Sell Inexpensive Stock (Example – Buy SBI and Sell ICICI Bank)

Monday plan to build : UNIONBANK & SBIN ~ SPREAD TRADE

| Description: |

|

| Filesize: |

52.45 KB |

| Viewed: |

610 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #7  Posted: Sat Sep 13, 2014 1:22 pm Post subject: Posted: Sat Sep 13, 2014 1:22 pm Post subject: |

|

|

Edward Dobson - Understanding Spreads

| Description: |

|

| Filesize: |

275.69 KB |

| Viewed: |

580 Time(s) |

|

| Description: |

| Edward Dobson - Understanding Spreads |

|

Download |

| Filename: |

Edward Dobson - Understanding Spreads.pdf |

| Filesize: |

558.73 KB |

| Downloaded: |

1301 Time(s) |

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #8  Posted: Sat Sep 13, 2014 2:16 pm Post subject: Posted: Sat Sep 13, 2014 2:16 pm Post subject: |

|

|

MCX ZINC LEAD ~ SPREAD

| Description: |

|

| Filesize: |

53.42 KB |

| Viewed: |

608 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #9  Posted: Sat Sep 13, 2014 4:10 pm Post subject: Posted: Sat Sep 13, 2014 4:10 pm Post subject: |

|

|

Statistical Arbitrage/Pair Trading System

The Statistical Arbitrage/Pair Trading System is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy. The pair trading was pioneered by Gerry Bamberger and later led by Nunzio Tartaglias quantitative group at Morgan Stanley in the 1980s.

The strategy monitors performance of two historically correlated securities eg Bajaj auto-Hero Honda, Lead- Zinc. When the correlation between the two securities temporarily weakens, i.e. one stock moves up while the other moves down, the pairs trade would be to short the outperforming stock and to long the underperforming one, betting that the "spread" between the two would eventually converge. The divergence within a pair can be caused by temporary supply/demand changes, large buy/sell orders for one security, reaction for important news about one of the companies, and so on. A profit situation arising from pricing inefficiencies between securities. Investors identify the arbitrage situation through mathematical modelling techniques The strategy of matching a long position with a short position in two stocks of the same sector. This creates a hedge against the sector and the overall market that the two stocks are in. The hedge created is essentially a bet that you are placing on the two stocks; the stock you are long in versus the stock you are short in.

What makes Spread Trading such a profitable and easy way to trade?

• There is no stop when trading spreads. It is not possible to use stops in a spread trade. Because you are long in one market and short in another, you have become invisible to and immune to "stop fishing."

• Spreads can considerably reduces the risk in trading compared with straight futures trading. Every spread is a hedge. Trading the difference between two contracts in an intramarket spread results in much lower risk to the trader.

• Spreads on futures normally requires much lower margins than any other form of trading, even lower than the margin requirements for option trading. The result is much greater efficiency in the use of your capital. It is not unusual to be able to trade 10 spreads putting up the same amount of margin as required for 1 outright futures position.

• Spread trades are much less volatile than other forms of trading. They are considerably less volatile than share trading, option trading, or straight futures trading. In fact, it is because of such low volatility that margins for spreads are so low.

• Spreads typically trend more often, more steeply, and for a longer time than do other forms of trading. Since "the trend is your friend,"spread trading is friendlier. Spreads trend because of something real taking place in the underlying fundamentals. They are not moved by market makers and market movers, who push markets to run the stops.

• Spreads create a more level playing field. Because there are no stops possible, spread trading is a better form of trading.

To pair trade we have formulated the following indicators

- StdDev - the measurement standard deviation correlated pairs

- Spread - measurement difference is correlated pairs

- Stochastic - value for differences Stochastic Oscillator correlated pairs

Standard deviation:

We measure the standard deviation of price (close) of correlated pairs and the difference then is displayed as a curve. The price usually varies within certain limits, and these limits movement just counting. Once the price gets out, so it easily and close the sale of usable after returning to the mean . Ideal trade then means to enter somewhere at 2s. Indi implements the first entry before 2s and then according to the statistics less frequent values by percentiles (adjustable), mostly based on the value of 2.5s and 3.5s where already such a motion, at least.

THANKS TO : [CONTENT REMOVED BY ADMIN]

|

|

| Back to top |

|

|

anand512

White Belt

Joined: 26 Jun 2009

Posts: 109

|

Post: #10  Posted: Sat Sep 13, 2014 7:48 pm Post subject: Posted: Sat Sep 13, 2014 7:48 pm Post subject: |

|

|

sir

is there any strategy for BTST and STBT trades

pl. explain it.

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #11  Posted: Mon Sep 15, 2014 10:00 am Post subject: Posted: Mon Sep 15, 2014 10:00 am Post subject: |

|

|

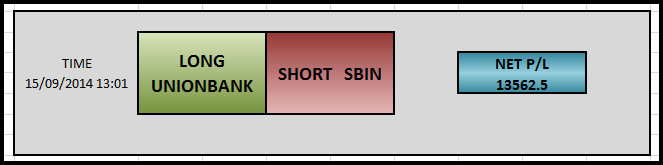

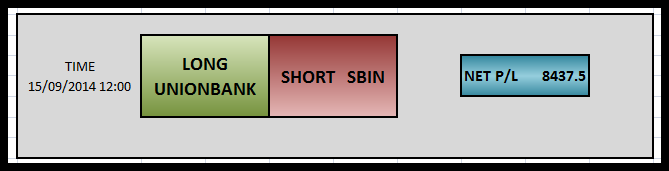

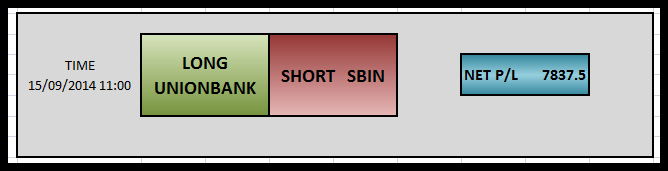

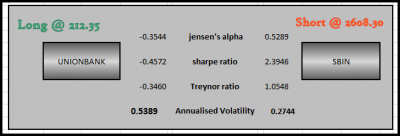

SPREAD ~ UNIONBANK-SBIN

POSITION CREATED AT 9.15am... PLAN TO CLOSE POSITION AT 3.15 pm

| Description: |

|

| Filesize: |

9.48 KB |

| Viewed: |

3728 Time(s) |

|

| Description: |

|

| Filesize: |

8.94 KB |

| Viewed: |

3742 Time(s) |

|

| Description: |

|

| Filesize: |

8.9 KB |

| Viewed: |

3754 Time(s) |

|

| Description: |

|

| Filesize: |

14.66 KB |

| Viewed: |

516 Time(s) |

|

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #12  Posted: Mon Sep 15, 2014 1:11 pm Post subject: Posted: Mon Sep 15, 2014 1:11 pm Post subject: |

|

|

Welgro,

Be careful NOT to post any external references here in the forum. We have removed a reference in your today's earlier post. I urge you to thoroughly check what you are posting here before you submit it in the forum.

Thanks.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #13  Posted: Mon Sep 15, 2014 1:27 pm Post subject: Posted: Mon Sep 15, 2014 1:27 pm Post subject: |

|

|

Dear SwingTrader,

I cannot get you, How to update strategy article with out author info.

may be its not big issue,I am not provide any url's

any way its wrong ?(updates author info with out url),

Then how to discuss about the strategy with some other article ?...

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #14  Posted: Mon Sep 15, 2014 2:32 pm Post subject: Posted: Mon Sep 15, 2014 2:32 pm Post subject: |

|

|

UNIONBANK ~ SBIN

update 2.30 PM

| Description: |

|

| Filesize: |

9.18 KB |

| Viewed: |

3779 Time(s) |

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #15  Posted: Mon Sep 15, 2014 3:11 pm Post subject: Posted: Mon Sep 15, 2014 3:11 pm Post subject: |

|

|

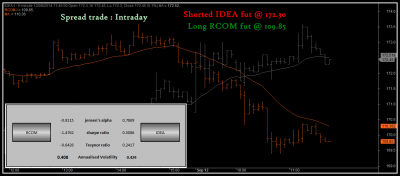

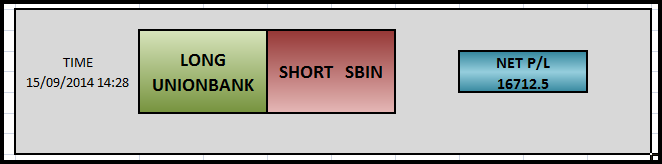

12/09/2014 (RCOM -IDEA ) SPREAD TRADE END WITH = 3800 LOSS

But Today (9.15 AM) if i took the same position ? Made profit : 9200 !!!

| Description: |

|

| Filesize: |

16.29 KB |

| Viewed: |

515 Time(s) |

|

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|