| View previous topic :: View next topic |

| Author |

STOCKS -HEDGE TRADING [ WELGRO ] |

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #31  Posted: Wed Dec 19, 2012 4:35 pm Post subject: UPDATE : 19.12.2012 Posted: Wed Dec 19, 2012 4:35 pm Post subject: UPDATE : 19.12.2012 |

|

|

UPDATE : 19.12.2012

HEROMOTOCO LONG AT : 1832 [ NOW CMP 1922 ] = + 90 [ NOW CMP 90.90 ] = + 6.60

HEROMOTOCO 1800 CALL LONG AT : 60.65 [ exit at 112.40 ] = + 51.75

HEROMOTOCO 1850 PUT LONG AT : 53.80 [ cmp = 4.00 ] = - 49.80

NET PROFIT : + 91.95 POINTS * LOT SIZE 125

PROFIT IN Rs. 11500.00

POSITIONS STILL OPEN ,HOLD  |

|

| Back to top |

|

|

|

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #32  Posted: Wed Dec 19, 2012 4:46 pm Post subject: UPDATE : 19.12.2012 Posted: Wed Dec 19, 2012 4:46 pm Post subject: UPDATE : 19.12.2012 |

|

|

UPDATE : 19.12.2012

TATAMOTORS LONG AT : 286.60 [ NOW CMP : 308 ] = + 21.40

TATAMOTORS 280 CALL LONG AT : 12.25 [ exit at 23.00 ] = + 10.75

TATAMOTORS 290 PUT LONG AT : 10.75 [ cmp = 0.90 ] = - 9.85

NET PROFIT : + 22.30 POINTS * LOT SIZE 1000

PROFIT IN Rs. 22300.00

POSITIONS STILL OPEN ,HOLD  |

|

| Back to top |

|

|

sanju777

White Belt

Joined: 13 Jun 2011

Posts: 87

|

Post: #33  Posted: Wed Dec 19, 2012 5:21 pm Post subject: Posted: Wed Dec 19, 2012 5:21 pm Post subject: |

|

|

Welgro ,

You just Rock...& Rock....

Keep it going buddy...

Kudos to your study

Sanjay |

|

| Back to top |

|

|

Vikas91

White Belt

Joined: 28 Nov 2012

Posts: 140

|

Post: #34  Posted: Wed Dec 19, 2012 5:59 pm Post subject: Posted: Wed Dec 19, 2012 5:59 pm Post subject: |

|

|

Welgro ,

U R Rocking STAR

I have one doubt if possible please clarify

why 3 position in one trade that you buy Future, options both call/put and selling at cost and loosing brokarage on it. If you buy future then hedging with put is ok i think and vice versa for shorts.

Wating for your reply egarly.Kindly reply when time permits to You.

Thanks in advance |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #35  Posted: Thu Dec 20, 2012 12:50 pm Post subject: Posted: Thu Dec 20, 2012 12:50 pm Post subject: |

|

|

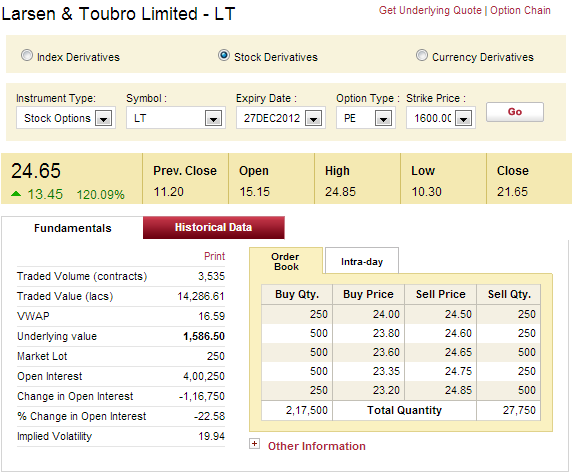

LT FUTURE TRAIL STOP LOSS HIT,EXITED LT FUTURE ...

STILL HOLDING 1600 PE  |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #36  Posted: Thu Dec 20, 2012 1:33 pm Post subject: Posted: Thu Dec 20, 2012 1:33 pm Post subject: |

|

|

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #37  Posted: Sat Dec 22, 2012 2:56 pm Post subject: Posted: Sat Dec 22, 2012 2:56 pm Post subject: |

|

|

| welgro wrote: | LT FUTURE TRAIL STOP LOSS HIT,EXITED LT FUTURE ...

STILL HOLDING 1600 PE  |

NOW LT 1600 PE CMP : 24.65

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #38  Posted: Sat Dec 22, 2012 3:41 pm Post subject: IDFC JAN2013 FUTURE Posted: Sat Dec 22, 2012 3:41 pm Post subject: IDFC JAN2013 FUTURE |

|

|

24/12/12 MONDAY, IF IDFC JAN 2013 FUTURE TRADES BELOW 170.50 THEN BUY THE FOLLOWING 3 POSITIONS ...

SELL IDFC JAN 2013 FUTURE IF TRADE BELOW 170.50 +

BUY IDFC JAN 2013 180 PUT OPTION +

BUY IDFC JAN 2013 170 CALL OPTION +

I WILL UPDATE THE ENTRY PRICES ON MONDAY ONCE THE TRADE IS EXECUTED.

|

|

| Back to top |

|

|

chetan83

Brown Belt

Joined: 19 Feb 2010

Posts: 2037

|

Post: #39  Posted: Sat Dec 22, 2012 3:47 pm Post subject: Re: HCLTECH DEC FUTURE Posted: Sat Dec 22, 2012 3:47 pm Post subject: Re: HCLTECH DEC FUTURE |

|

|

| welgro wrote: | BUY HCLTECH DEC FUTURE NOW CMP 634.50 +

BUY HCLTECH DEC 620 CALL OPTION :19.75 +

BUY HCLTECH DEC 640 PUT OPTION : 14.00

HOLD 3 OPEN POSITIONS,EXIT CALL LATER

MARGIN REQUIRED : 65.000

MAX LOSS : 15,000 |

BUY HCLTECH DEC FUTURE NOW CMP 634.50 +

21/12/12 = 632.50 = -2

BUY HCLTECH DEC 620 CALL OPTION :19.75 +

21/12/12 = 14 = -2

BUY HCLTECH DEC 640 PUT OPTION : 14.00

21/12/12 = 13.35 = -0.65

let loss of Rs.2325/-

Still holding. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #40  Posted: Sat Dec 22, 2012 7:41 pm Post subject: TCS JAN 2013 FUTURE Posted: Sat Dec 22, 2012 7:41 pm Post subject: TCS JAN 2013 FUTURE |

|

|

BUY TCS JAN 2013 FUTURE CMP : 1265

BUY TCS JAN 2013 1250 CALL OPTION CMP : 51.50

BUY TCS JAN 2013 1300 PUT OPTION CMP : 60.45

HOLD 3 OPEN POSITIONS,EXIT CALL LATER

TCS ~ BULLISH WOLF WAVE PATTERN

|

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #41  Posted: Sun Dec 23, 2012 6:53 pm Post subject: Re: IDFC JAN2013 FUTURE Posted: Sun Dec 23, 2012 6:53 pm Post subject: Re: IDFC JAN2013 FUTURE |

|

|

| welgro wrote: | 24/12/12 MONDAY, IF IDFC JAN 2013 FUTURE TRADES BELOW 170.50 THEN BUY THE FOLLOWING 3 POSITIONS ...

SELL IDFC JAN 2013 FUTURE IF TRADE BELOW 170.50 +

BUY IDFC JAN 2013 180 PUT OPTION +

BUY IDFC JAN 2013 170 CALL OPTION +

I WILL UPDATE THE ENTRY PRICES ON MONDAY ONCE THE TRADE IS EXECUTED.

|

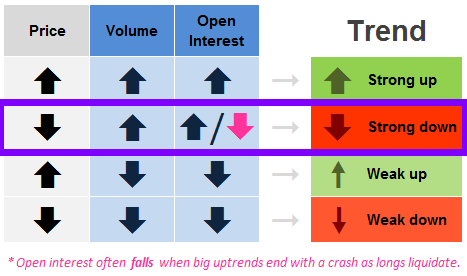

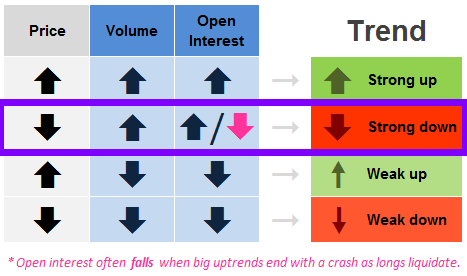

Open Interest Basics

Interpreting Open Interest

Open Interest (OI) is the number of contracts outstanding in the marketplace. Open Interest only applies to futures and option contracts. Changes in open interest either confirms price action or acts as a warning of a potentially weakening trend.

A hypothetical situation is given next to help grasp the concept of Open Interest:

A new futures contract expiration month is opened for trading. Currently, no one has bought or sold a futures contract.

A trader (Trader #1) buys a futures contract, but in order for this to happen, someone has to sell that trader the future. Therefore, for every buyer there is an equal and opposite seller (Trader #2). When this transaction occurs, the open interest is increased from zero to one. There is now one contract outstanding in the marketplace.

Trader #3 decides to sell a future and subsequently another trader (Trader #4) has to buy that futures contract; therefore, open interest is now at two.

Trader #1 goes to the marketplace and sells his/her futures contract. Trader #3 decides to buy back his/her short future. After the transaction takes place, Trader #1 no longer owns a futures contract. Similarly, Trader #3 no longer owns a futures contract. Effectively, the marketplace has one less futures contract outstanding. The open interest went down to one.

Generally open interest increases over the life of the futures contract (note: futures contracts expire, same with options). When futures contract months or quarters transition from one month or quarter to the next month or quarter, the future closest to expiration (called the "front month") decreases in open interest and the next futures contract (called the "back month") increases. This is shown with the chart of the E-mini S&P 500 Futures contract above.

The chart above of the E-mini S&P 500 Futures contract shows both the March S&P 500 future and the June S&P 500 future as the futures near March expiration. Note how the March and June futures contract open interest rises steadily over time; this is normal over the life of a futures contract.

Also note the dramatic decrease in the open interest of the March S&P future as the contract is nearing expiration. In contrast, note the dramatic increase of the June S&P futures contract as futures traders "roll over" their futures positions to the next futures expiration contract (June).

Learning about Open Interest is important, but using it to help futures or options trading is better. Interpreting Open Interest is up next. |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #42  Posted: Wed Dec 26, 2012 11:00 am Post subject: Re: UPDATE : 19.12.2012 Posted: Wed Dec 26, 2012 11:00 am Post subject: Re: UPDATE : 19.12.2012 |

|

|

| welgro wrote: | UPDATE : 19.12.2012

HEROMOTOCO LONG AT : 1832 [ NOW CMP 1922 ] = + 90 [ NOW CMP 90.90 ] = + 6.60

HEROMOTOCO 1800 CALL LONG AT : 60.65 [ exit at 112.40 ] = + 51.75

HEROMOTOCO 1850 PUT LONG AT : 53.80 [ cmp = 4.00 ] = - 49.80

NET PROFIT : + 91.95 POINTS * LOT SIZE 125

PROFIT IN Rs. 11500.00

POSITIONS STILL OPEN ,HOLD  |

HERO MOTOCO FUTURE CMP : 1872 ...

EXIT HEROMOTOCO FUTURE NOW.

HOLD HEROMOTOCO 1850 PUT |

|

| Back to top |

|

|

welgro

Brown Belt

Joined: 24 Sep 2012

Posts: 1784

|

Post: #43  Posted: Thu Dec 27, 2012 10:15 am Post subject: Posted: Thu Dec 27, 2012 10:15 am Post subject: |

|

|

| ALL MY POSITIONAL CALLS WHICH ONE IN OPEN .I WILL CLOSE THE POSITIONS AT TODAY 3.15 PM |

|

| Back to top |

|

|

|