| View previous topic :: View next topic |

| Author |

SVKum's BB10 strategy |

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #31  Posted: Mon Jan 30, 2012 4:13 pm Post subject: Posted: Mon Jan 30, 2012 4:13 pm Post subject: |

|

|

Sumesh!

Congratulations! and Thanks for sharing it with us. I too read it some where never took it seriously.

Even you don't trade aset up and find it at a later stage do post them too.

Why don't you open a separate thread for it with an appropriate name.

|

|

| Back to top |

|

|

|

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #32  Posted: Mon Jan 30, 2012 4:19 pm Post subject: Posted: Mon Jan 30, 2012 4:19 pm Post subject: |

|

|

| rk_a2003 wrote: | Sumesh!

Congratulations! and Thanks for sharing it with us. I too read it some where never took it seriously.

Even you don't trade aset up and find it at a later stage do post them too.

Why don't you open a separate thread for it with an appropriate name. |

RK brother, I'm still dealing with various scenario of bb10 setups, and with every passing day I must say it is improving(touch wood  ) . I shall definitely post such setups if I get. ) . I shall definitely post such setups if I get.

I'm highly obliged to svkum sir, rvg sir and mayur sir who have taught me how to use this... If any of you have any objection in posting such gapup setups (as it is not directly linked with this setups), I shall post somewhere else..Please let me know.

Regards,

Sumesh

|

|

| Back to top |

|

|

jsg

White Belt

Joined: 02 Oct 2011

Posts: 37

|

Post: #33  Posted: Mon Jan 30, 2012 5:15 pm Post subject: Posted: Mon Jan 30, 2012 5:15 pm Post subject: |

|

|

| Somesh, what time frame and what BB setting?

|

|

| Back to top |

|

|

svkum

White Belt

Joined: 14 Feb 2007

Posts: 321

|

Post: #34  Posted: Mon Jan 30, 2012 6:24 pm Post subject: Posted: Mon Jan 30, 2012 6:24 pm Post subject: |

|

|

SUMESH,

There is a intraday screener , in which yu have to selct tf as 5 mts, and in bollinger band --resistance at upper band or support at lower band .

Get the reqd result at 9.15 , and see if this can help.

Only prob is this bollinger band 20 and not 10 , PT if can get that option , better.

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #35  Posted: Mon Jan 30, 2012 8:37 pm Post subject: Posted: Mon Jan 30, 2012 8:37 pm Post subject: |

|

|

| svkum wrote: | SUMESH,

There is a intraday screener , in which yu have to selct tf as 5 mts, and in bollinger band --resistance at upper band or support at lower band .

Get the reqd result at 9.15 , and see if this can help.

Only prob is this bollinger band 20 and not 10 , PT if can get that option , better. |

Thanks a lot sir for the information.. I will try it tomorrow.

In fact, there is an option of "upper band breakout" and "Lower band breakout" also, which we can effectively screen and use for our purpose. Now my job of finding suitable breakout candidate is far easier than before with this screener..  thank you so much for giving hint.. thank you so much for giving hint..

Regards,

Sumesh

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #36  Posted: Mon Jan 30, 2012 8:39 pm Post subject: Posted: Mon Jan 30, 2012 8:39 pm Post subject: |

|

|

| jsg wrote: | | Somesh, what time frame and what BB setting? |

Timeframe we use for intraday trades is 15tf, and BB(10) ..

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #37  Posted: Mon Jan 30, 2012 9:03 pm Post subject: HINDCOPPER Posted: Mon Jan 30, 2012 9:03 pm Post subject: HINDCOPPER |

|

|

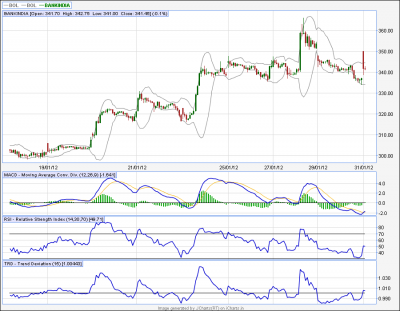

HINDCOPPER..eod

=============

Can this Flag BO along with bb(10) bo show its effect tomorrow ?

| Description: |

|

| Filesize: |

20 KB |

| Viewed: |

582 Time(s) |

|

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #38  Posted: Tue Jan 31, 2012 6:22 am Post subject: Re: A VERY GOOD USE OF BB10.. Posted: Tue Jan 31, 2012 6:22 am Post subject: Re: A VERY GOOD USE OF BB10.. |

|

|

| sumesh_sol wrote: | Dear Friends,

Few days back I read it in some site, that if a stock opens up much high than upper band of bb, and closes the first candle in red (may be inverted hammer type) out of band, then there is a very strong possibility of it to touch it mid of band and lower band.

So this can be used to initiate short trade . We can use logical SL in this case.. Please see 3 different trades I took during past couple of days... They all hit target of lower band( and in fact much below after that )

The problem is how to find such setup, so what I do is I try to find top 5 nifty/Jr. nifty stocks in the first 15 mnts. and if any of them fullfils this condition I take trade..

Suggetions are welcome..

Regards,

Sumesh |

hi sumesh,

these are contra trend trades.

i have posted earlier that if market is not trending then reverse trade can be taken on observing reversal candle like doji or long legged hammer.

for more conservative traders, signal can be taken if previous days hi/lo is broken.

this is just my cent

regards,

girish

|

|

| Back to top |

|

|

jsg

White Belt

Joined: 02 Oct 2011

Posts: 37

|

Post: #39  Posted: Tue Jan 31, 2012 9:20 am Post subject: Posted: Tue Jan 31, 2012 9:20 am Post subject: |

|

|

| thanks Sumesh

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #40  Posted: Tue Jan 31, 2012 9:37 am Post subject: ULTRACEMCO Posted: Tue Jan 31, 2012 9:37 am Post subject: ULTRACEMCO |

|

|

ULTRACEMCO..

gapup case..(but mkt is up.. so be careful)

| Description: |

|

| Filesize: |

39.39 KB |

| Viewed: |

544 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #41  Posted: Tue Jan 31, 2012 9:40 am Post subject: BANKINDIA Posted: Tue Jan 31, 2012 9:40 am Post subject: BANKINDIA |

|

|

BANKINDIA..

Another gapup case...

| Description: |

|

| Filesize: |

46.52 KB |

| Viewed: |

541 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #42  Posted: Wed Feb 01, 2012 11:34 am Post subject: Gap Down case..(CROMPGREAV) Posted: Wed Feb 01, 2012 11:34 am Post subject: Gap Down case..(CROMPGREAV) |

|

|

Gap Down case..(CROMPGREAV)..

======================

Today I traded one gap down (first cc closed in green hammer)..

Result is awesome...

| Description: |

|

| Filesize: |

49.65 KB |

| Viewed: |

570 Time(s) |

|

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #43  Posted: Wed Feb 01, 2012 9:33 pm Post subject: LOVABLE Posted: Wed Feb 01, 2012 9:33 pm Post subject: LOVABLE |

|

|

LOVABLE...eod

============

Multiple BOs in eod chart...

| Description: |

|

| Filesize: |

27.07 KB |

| Viewed: |

534 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #44  Posted: Wed Feb 01, 2012 9:39 pm Post subject: Re: Gap Down case..(CROMPGREAV) Posted: Wed Feb 01, 2012 9:39 pm Post subject: Re: Gap Down case..(CROMPGREAV) |

|

|

| sumesh_sol wrote: | Gap Down case..(CROMPGREAV)..

======================

Today I traded one gap down (first cc closed in green hammer)..

Result is awesome... |

|

|

| Back to top |

|

|

sumesh_sol

Brown Belt

Joined: 06 Jun 2010

Posts: 2344

|

Post: #45  Posted: Thu Feb 02, 2012 9:38 am Post subject: Posted: Thu Feb 02, 2012 9:38 am Post subject: |

|

|

hi friends,

Dishtv & Canbk looks to me gap up case.. I will short them when macd crossover happens downside..

Please see online charts...

|

|

| Back to top |

|

|

|