| View previous topic :: View next topic |

| Author |

Swing Trading Natural Gas with 8EMA, 8SMA and 13SMA |

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #1  Posted: Mon Mar 28, 2016 4:49 am Post subject: Swing Trading Natural Gas with 8EMA, 8SMA and 13SMA Posted: Mon Mar 28, 2016 4:49 am Post subject: Swing Trading Natural Gas with 8EMA, 8SMA and 13SMA |

|

|

Hi All

ICharts as well as it group members have given me Immense knowledge on various trading systems.

I would like to share one of my trading rules which I have taken from iCharts group itself and then may have modified in bits and pieces.

I am sharing this strategy because I feel that I have taken a lot from here and wanted to give something back so that others can benefiet.

Now the Strategy

Indicators: 8EMA, 8SMA & 13SMA

Time Frame: 30 Minutes

Buy 2 lots of NG when 8EMA Crosses 13SMA.

Book 1st Lot (profit/Loss) when 8EMA crosses back 8SMA and continue the second lot till 8EMA crosses back 13SMA

When 8EMA crosses down 13SMA book the second lot.

This will be a Short signal too

Short two lots of NG when 8EMA crosses down to 13SMA.

Book 1st lot (profit/loss) when 8EMA crosses up 8SMA and conitnue the second lot tile 8EMA crosses back 13 SMA.

Money Management

If NG is trading at 100 and lot size is 2500 then total Price of one contract is 100 * 2500 = 2,50,000

Since you are trading two lots the amount of trade will be 5,00,000

Money required to trade this setup for two lot when NG is at Rs 100/- should be Rs 75,000/-

So for every Rs 75000 you can trade 2 lots of NG with this method.

Now if it happens that you have entered first time and you got a loss and you capital is down to less than 75000/- then you need to stop this strategy

and come up only when you have 75000/- to trade this. I would suggest you should be having 1,00,000/- before using this straetgy.

Now to enter first do paper trading on this and when you find that there are two consecutive loss with this strategy then the third time you should be entering

with real money chances are this one will be a proftable trade.

Now regarding MA cross which I have a learnt this a harder way.

For Buy Signal's

If 8EMA = 100.15

8SMA = 100.14

13SMA = 99.99

Is this a signal to buy ? No because I will consider 8EMA (100.1) & 8SMA (100.1) as equal and will not enter the trade I will wait for next candle to see if the 8EMA > 8SMA

In next candle if situation is like this.

8EMA = 100.20

8SMA = 100.19

The definitely this will be a Buy signal for me and I will enter this trade.

Disadvantage of this Trading System.

You need to be on the screen more often even though it is for 30 minutes only

The tick size is 0.10 which means each tick cost Rs. 250 which is huge amount.

Sometime it happens that you will not get the NG on exactly on closing price means you may get 250 less from the theoretical value.

On Thursday evening around 7 or 8 p.m. news result comes due to which the NG position may turns against you. But don't worry 80% of the time you will be on the right side.

With this strategy I have made 40% per month also and 20%-30% is a normal thing with two lot's of NG.

I have left this strategy and adopted a slower one as I have doubled money which I was struggling to do for the past many years and wanted to spent less screen time.

Wanted to share this, also it can be documented here and anyone can benefit from this.

This strategy will generate around 40 signals a month.

Kindly note I will not be giving calls or updating anything much on this. If any one who is trading this and want to update this can do so.

I will appreciate if anyone can guide me on how we can execute an order at the price we want.

सर्वे भवन्तु सुखिनः

सर्वे सन्तु निरामयाः ।

सर्वे भद्राणि पश्यन्तु

मा कश्चिद्दुःखभाग्भवेत् ।

|

|

| Back to top |

|

|

|

|

|

AMBY

Yellow Belt

Joined: 05 Sep 2014

Posts: 503

|

Post: #2  Posted: Mon Mar 28, 2016 10:48 am Post subject: Posted: Mon Mar 28, 2016 10:48 am Post subject: |

|

|

| Thank You for new strategy.

|

|

| Back to top |

|

|

pavan29

Green Belt

Joined: 26 Jun 2012

Posts: 1047

|

Post: #3  Posted: Mon Mar 28, 2016 11:18 am Post subject: Posted: Mon Mar 28, 2016 11:18 am Post subject: |

|

|

Hydrogen

I would like to compare my method's performance with you...

For the next 30 days, I will post my results in a separate forum. Kindly post yours too....

Will check our performances at the end...My calls will be combination of positional + intraday

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #4  Posted: Mon Mar 28, 2016 7:43 pm Post subject: Posted: Mon Mar 28, 2016 7:43 pm Post subject: |

|

|

Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss.

|

|

| Back to top |

|

|

pavan29

Green Belt

Joined: 26 Jun 2012

Posts: 1047

|

Post: #5  Posted: Mon Mar 28, 2016 7:46 pm Post subject: Posted: Mon Mar 28, 2016 7:46 pm Post subject: |

|

|

| Hydrogen wrote: | Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss. |

Hydro

It is ok...anyways....when switching from Indian to US markets, be cautious as our methods may not give the same output...

All the best!!

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #6  Posted: Mon Mar 28, 2016 8:35 pm Post subject: Posted: Mon Mar 28, 2016 8:35 pm Post subject: |

|

|

| Hydrogen wrote: | Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss. |

Just one question

Why chosen NG over crude and if other scrips chosen are lead and nickel. Why NG over crude! Generally a comment welcome and also a comment in context of your specific strategy.

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #7  Posted: Tue Mar 29, 2016 2:46 am Post subject: Posted: Tue Mar 29, 2016 2:46 am Post subject: |

|

|

| amitagg wrote: | | Hydrogen wrote: | Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss. |

Just one question

Why chosen NG over crude and if other scrips chosen are lead and nickel. Why NG over crude! Generally a comment welcome and also a comment in context of your specific strategy. |

I don't know why I choosed NG over crude oil. I think at that time crude oil was costly and as per my money management I was not having money to trade crude full lot.

Later on I had applied this strategy on CRUEOIL but this never worked on crude.

However some two years back I had tested on LEADMINI 4SMA 4EMA & 6SMA on 60 Min charts and found out profitable. but never traded it was in excel only. It one and only same. At that time no money management. When to increase the lot and so on...

Regarding Lead and Nickel question. I started trading Rohan Ji Strategy (Supertrend 8,2 & 65 EMA) and about to put CrudeOil in my trading I was waiting for fund to grow up but till then I have to fly to US.

After returning definitely I will be trading Lead-Nickel-CrudeOil but till then will be doing Excel based paper trading.

After my trading fund has reached a particular level, I will leave this strategy also and will be trading only delivery based trading

on Daily charts on NSE, but till the time my fund doesn't reach that level I will be trading on MCX.

Now no jumping hear and there

1 Mantra, 1 Trading strategy, 1 exercise regime, A Simple Food & Clothing. This I want to follow till the end of my life.

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #8  Posted: Tue Mar 29, 2016 2:57 am Post subject: Posted: Tue Mar 29, 2016 2:57 am Post subject: |

|

|

| pavan29 wrote: | | Hydrogen wrote: | Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss. |

Hydro

It is ok...anyways....when switching from Indian to US markets, be cautious as our methods may not give the same output...

All the best!! |

Thanks for your wishes, I have to dig here for strategy and what suites my profile. Still in process...

|

|

| Back to top |

|

|

Hydrogen

White Belt

Joined: 18 Feb 2014

Posts: 87

|

Post: #9  Posted: Tue Mar 29, 2016 3:01 am Post subject: Posted: Tue Mar 29, 2016 3:01 am Post subject: |

|

|

| Hydrogen wrote: | Hi Pavan29

I will not be able to post live calls. However I have some back tested excel sheet that I can upload here, which is one year old.

Currently I am staying in US and planning to invest in US markets.

It is the method which helped me to make my 1 lac to 2 lac after around 5 years of trading journey and then I left this and followed Rohan ji Strategy to Invest in Lead and Nickel ((SuperTrend 8,2) and 65EMA.). Because it is slow strategy and need to share less screen time.

After returning from here I will be following Supertrend strategy only. Mine is good for trading 4-10 lots but not more than that.

NG is very volatile and I had drawdown with this strategy of around 25% in a single day. But recovered very fast then.

Need guts to follow the system even if it is giving continuous loss. |

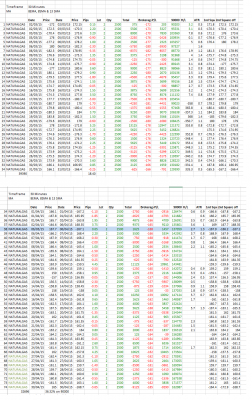

Backtesting result attached in the screenshot

| Description: |

|

| Filesize: |

187.82 KB |

| Viewed: |

551 Time(s) |

|

|

|

| Back to top |

|

|

|