| View previous topic :: View next topic |

| Author |

Swing Trading : The Speculator way |

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #106  Posted: Fri Mar 19, 2010 4:44 pm Post subject: Posted: Fri Mar 19, 2010 4:44 pm Post subject: |

|

|

Hi,

Posted below are some charts with latest Swing pivots marked.

All charts are 30 Min and EMA 34.

Hope ppl find them to be useful.

SHEKHAR

| Description: |

|

| Filesize: |

26.91 KB |

| Viewed: |

722 Time(s) |

|

| Description: |

|

| Filesize: |

23.27 KB |

| Viewed: |

640 Time(s) |

|

| Description: |

|

| Filesize: |

25.73 KB |

| Viewed: |

612 Time(s) |

|

| Description: |

|

| Filesize: |

27.66 KB |

| Viewed: |

620 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #107  Posted: Sun Mar 21, 2010 8:40 am Post subject: Posted: Sun Mar 21, 2010 8:40 am Post subject: |

|

|

As Shekar posed below, the swing pivot on NF has moved to 5221.40. A break of that will kickstart a downswing. With the RBI increasing the repo rate by 25 bps on friday afterhours, combined with the selloff in U.S, we should likely see a gap-down below the pivot on Monday.

My plan is to start building shorts around 5180-5200 area and add more if we move higher to get a better average price (with a 5282 SL). Many stocks were struggling to mount a breakout for the last 2-3 days, which was an indication that some correction was coming. It's too early to speculate on how deep the selloff is going to be.

- Speculator

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #108  Posted: Sun Mar 21, 2010 9:58 am Post subject: Posted: Sun Mar 21, 2010 9:58 am Post subject: |

|

|

The BO during friday closing looked inconclusive.

It may not be considered as a new high - or it was a double top.

Hence, it's safe to assume swing pivot as previous pivot - i.e. 5100.

Mkt will crash only below 5100. Until then play longs with dips

Rgds,

Sw

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #109  Posted: Mon Mar 22, 2010 12:15 am Post subject: Posted: Mon Mar 22, 2010 12:15 am Post subject: |

|

|

| swaroopbn wrote: |

Mkt will crash only below 5100. Until then play longs with dips  |

I agree.. will this bearish news fuel a bullish rally

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #110  Posted: Mon Mar 22, 2010 9:35 am Post subject: Posted: Mon Mar 22, 2010 9:35 am Post subject: |

|

|

Swaroop,

The swing pivot is 5221 unambigously. Price made a new high and that is a fact and the swing pivot system is based on facts. Whether the breakout was conclusive or not is a personal judgement. You could be right in your judgement. But a break of 5221 puts us in a downswing. So the system says short below 5282.

Buying dip when the system says short is a bad idea. Bcoz if the correction runs deeper, then not will one be wrong on their long positions but will also miss the downmove. On the other hand, if the correction is very shallow, then shorts will end up making little or no money. But when the system turns back into an upswing, we can always position long again.

|

|

| Back to top |

|

|

maha

White Belt

Joined: 05 Oct 2008

Posts: 24

|

Post: #111  Posted: Mon Mar 22, 2010 3:07 pm Post subject: Posted: Mon Mar 22, 2010 3:07 pm Post subject: |

|

|

| Speculator wrote: | Swaroop,

The swing pivot is 5221 unambigously. Price made a new high and that is a fact and the swing pivot system is based on facts. Whether the breakout was conclusive or not is a personal judgement. You could be right in your judgement. But a break of 5221 puts us in a downswing. So the system says short below 5282.

Buying dip when the system says short is a bad idea. Bcoz if the correction runs deeper, then not will one be wrong on their long positions but will also miss the downmove. On the other hand, if the correction is very shallow, then shorts will end up making little or no money. But when the system turns back into an upswing, we can always position long again. |

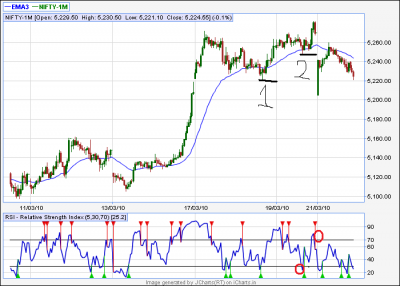

| Description: |

| speculator sir attached 15min TF nifty future chart, please explain why swing pivot is at 5221.40( point 1 in chart) and not at 5248.25 (point 2 ). I am new and trying to learn TA so if there is any mistake please forgive me .THANX |

|

| Filesize: |

36.82 KB |

| Viewed: |

762 Time(s) |

|

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #112  Posted: Mon Mar 22, 2010 6:12 pm Post subject: Posted: Mon Mar 22, 2010 6:12 pm Post subject: |

|

|

Maha,

That's a good question and has been answered many times in the shoutbox.

From 5221 to 5281 is one swing. When you have multiple rejections from the ema in a swing, choose the lowest point in the swing as the pivot.

In this particular chart of 15-min ema, there were two rejections from 34 ema, one at 5221 and the other at 5248. The lowest point of the swing was 5221. So that becomes the pivot.

If it's ambigous, looking at the higher timeframe chart helps too. In this case, if you look at 30-min, clearly the pivot is 5221.

|

|

| Back to top |

|

|

smsmss

White Belt

Joined: 13 Oct 2009

Posts: 123

|

Post: #113  Posted: Tue Mar 23, 2010 12:15 am Post subject: Posted: Tue Mar 23, 2010 12:15 am Post subject: |

|

|

thanx for the views Spec...

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #114  Posted: Thu Mar 25, 2010 4:23 pm Post subject: Posted: Thu Mar 25, 2010 4:23 pm Post subject: |

|

|

Hi

Nifty shorts covered today when RSI came out of OS and price failed to make new low.

Tatamotors still in downswing after breaking the S pivot at 766, it has not approached even once - EMA 34, starting from 780.

SHEKHKAR

| Description: |

|

| Filesize: |

22.87 KB |

| Viewed: |

736 Time(s) |

|

| Description: |

|

| Filesize: |

23.75 KB |

| Viewed: |

636 Time(s) |

|

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #115  Posted: Mon Mar 29, 2010 9:07 am Post subject: Posted: Mon Mar 29, 2010 9:07 am Post subject: |

|

|

| The downswing ended up as a sideways consolidation. With new highs we are back in a upswing with the swing pivot at 5194.

|

|

| Back to top |

|

|

maha

White Belt

Joined: 05 Oct 2008

Posts: 24

|

Post: #116  Posted: Tue Mar 30, 2010 4:36 pm Post subject: Posted: Tue Mar 30, 2010 4:36 pm Post subject: |

|

|

| spec sir can u please explain how 5194 became swing pivot on 15min chart

|

|

| Back to top |

|

|

smsmss

White Belt

Joined: 13 Oct 2009

Posts: 123

|

Post: #117  Posted: Fri Apr 02, 2010 1:49 pm Post subject: Posted: Fri Apr 02, 2010 1:49 pm Post subject: |

|

|

After gap filling and consolidation NF still rising... now let us see that 5245 can become a new swing pivot or not. On the first day of financial year NF giving indications of strength, but can it sustain thats the question!!!

| Description: |

|

| Filesize: |

28.79 KB |

| Viewed: |

615 Time(s) |

|

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #118  Posted: Fri Apr 02, 2010 4:55 pm Post subject: Posted: Fri Apr 02, 2010 4:55 pm Post subject: |

|

|

| smsmss wrote: | | After gap filling and consolidation NF still rising... now let us see that 5245 can become a new swing pivot or not. On the first day of financial year NF giving indications of strength, but can it sustain thats the question!!! |

Sure it will

Good amount of accumulation has happened around the zone 5245-5280 // now this band should provide the support and we should make new high in a day or two max.

Rgds,

SW

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #119  Posted: Fri Apr 02, 2010 6:26 pm Post subject: Posted: Fri Apr 02, 2010 6:26 pm Post subject: |

|

|

Maha,

5194 is the swing pivot based on the 30/60-min chart. In this low volatile environment, the 15-min will generate a lot of false signals. So it's better to use the hourly for swing pivots.

|

|

| Back to top |

|

|

maha

White Belt

Joined: 05 Oct 2008

Posts: 24

|

Post: #120  Posted: Fri Apr 02, 2010 8:54 pm Post subject: Posted: Fri Apr 02, 2010 8:54 pm Post subject: |

|

|

| Speculator wrote: | Maha,

5194 is the swing pivot based on the 30/60-min chart. In this low volatile environment, the 15-min will generate a lot of false signals. So it's better to use the hourly for swing pivots. |

| Description: |

|

| Filesize: |

30 KB |

| Viewed: |

604 Time(s) |

|

| Description: |

| spec sir thanx for reply, actually the swing pivot 5194 is below 34 ema in both 30 and 60 min. timeframe, it is not formed by rejection from 34 ema thats why query please clarify my mistakes |

|

| Filesize: |

34.56 KB |

| Viewed: |

579 Time(s) |

|

|

|

| Back to top |

|

|

|