| View previous topic :: View next topic |

| Author |

Swing Trading : The Speculator way |

ashis

White Belt

Joined: 28 Mar 2010

Posts: 75

|

Post: #316  Posted: Sat Feb 26, 2011 11:29 pm Post subject: Re: NIFTY 15TF Posted: Sat Feb 26, 2011 11:29 pm Post subject: Re: NIFTY 15TF |

|

|

Dear Chrome sir,

It is our pleasure if you will guide us about your point with example so we can improve our knowledge.

Regards

Ashis

| chrome wrote: | | Jai2000 wrote: | Ashis hi,

@5460.10 NF was clearly Over sold.Hope you use RSI 5!

Regards,

Jai. |

i wonder why rest of 11 chances of long as per rsi5 inbetween are not validated for long trades....pls take this query in a gud cause... |

|

|

| Back to top |

|

|

|

|

|

avinash02

White Belt

Joined: 22 Feb 2009

Posts: 343

|

Post: #317  Posted: Sun Feb 27, 2011 10:20 am Post subject: help sir Posted: Sun Feb 27, 2011 10:20 am Post subject: help sir |

|

|

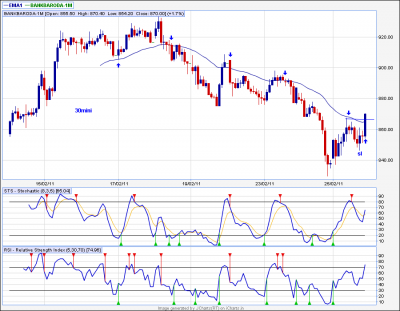

i follow swing method and i attached bob fut chart plz tell me it is correct or not plz reply ...i m new for this method help me sir

| Description: |

|

| Filesize: |

43.94 KB |

| Viewed: |

483 Time(s) |

|

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #318  Posted: Mon Feb 28, 2011 9:08 am Post subject: Swing pivots - Feb 28, 2011 Posted: Mon Feb 28, 2011 9:08 am Post subject: Swing pivots - Feb 28, 2011 |

|

|

In uptrending markets trade bullish rejections. In downtrending markets trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5346

30-min: Downtrending, Downswing Pivot 5346

Copper (April series)

15-min: Uptrending, Upswing Pivot 438

30-min: Uptrending, Upswing Pivot 438

- Speculator

|

|

| Back to top |

|

|

priti_pimple

White Belt

Joined: 17 Feb 2011

Posts: 3

|

Post: #319  Posted: Mon Feb 28, 2011 10:37 am Post subject: help sir Posted: Mon Feb 28, 2011 10:37 am Post subject: help sir |

|

|

Dear sir,

what is the settings for swing trading stocks futurs ? is it same as for nifty

Thanks in advance

priti

|

|

| Back to top |

|

|

kanna

White Belt

Joined: 03 Jan 2010

Posts: 91

|

Post: #320  Posted: Mon Feb 28, 2011 9:22 pm Post subject: Posted: Mon Feb 28, 2011 9:22 pm Post subject: |

|

|

druzva for you

| Description: |

|

| Filesize: |

31.95 KB |

| Viewed: |

496 Time(s) |

|

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #321  Posted: Tue Mar 01, 2011 7:33 am Post subject: Re: Swing pivots - Feb 28, 2011 Posted: Tue Mar 01, 2011 7:33 am Post subject: Re: Swing pivots - Feb 28, 2011 |

|

|

| Speculator wrote: | In uptrending markets trade bullish rejections. In downtrending markets trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5346

30-min: Downtrending, Downswing Pivot 5346

Copper (April series)

15-min: Uptrending, Upswing Pivot 438

30-min: Uptrending, Upswing Pivot 438

- Speculator |

specda,

charts please sir.

regards,

girish

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #322  Posted: Tue Mar 01, 2011 8:17 am Post subject: Swing pivots - March 1, 2011 Posted: Tue Mar 01, 2011 8:17 am Post subject: Swing pivots - March 1, 2011 |

|

|

In uptrending markets trade bullish rejections. In downtrending markets trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5499

30-min: Downtrending, Downswing Pivot 5499

Copper:

30-min: Uptrending, Upswing Pivot 447.30

- Speculator

Girish,

You can mark these pivots on the charts yourself. It should not be very difficult

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #323  Posted: Tue Mar 01, 2011 8:50 am Post subject: Re: Swing pivots - Feb 28, 2011 Posted: Tue Mar 01, 2011 8:50 am Post subject: Re: Swing pivots - Feb 28, 2011 |

|

|

| Speculator wrote: | In uptrending markets trade bullish rejections. In downtrending markets trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5346

30-min: Downtrending, Downswing Pivot 5346

Copper (April series)

15-min: Uptrending, Upswing Pivot 438

30-min: Uptrending, Upswing Pivot 438

- Speculator |

Hi Spec,

On 28-Feb, we would have gone long on NF above 5346 and later in the day, shorted below 5314 which became upswing pivot after going long.

Is the above correct?

regards

vin

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #324  Posted: Thu Mar 03, 2011 8:57 am Post subject: Swing pivots - March 3 Posted: Thu Mar 03, 2011 8:57 am Post subject: Swing pivots - March 3 |

|

|

In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Uptrending, Upswing Pivot 5310

30-min: Uptrending, Upswing Pivot 5310

Copper:

30-min: Downtrending, Downswing Pivot 451.8

- Speculator

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

Post: #325  Posted: Thu Mar 03, 2011 12:16 pm Post subject: Some Gud points from SB Posted: Thu Mar 03, 2011 12:16 pm Post subject: Some Gud points from SB |

|

|

Dear friends,

If any spec sir's follower missd today's SB,here the modified rules for you.•

Speculator : The only reason people use 5-min charts for rejects is for small SL.

• Speculator : But 5-min rejects have lot of whipsaws.

• Speculator : So here's a small hint.

• Speculator : Wait for price to hit 34 ema on 15-min.

• Speculator : At that point switch to 5-min chart and trade the 5-min reject.

Speculator : The rule is we need to close above the highs of prior candle. The prior candle can be green or red.

Speculator : : Keep it simple. Wait for price to come close to 34 on 15-min, which has happened now(He mentiond 10.30 candle-15TF)

Speculator : At this point take any valid rejections from 5-min.

• Speculator : Any 5-min rejections from this point should work.

• jjm : specji no need of candle to be above 34 ema, we need just a close above 8 ema 5 tf right?

• Speculator : jjm: No no. All 3 rejections rules should be satisified even on 5-min.

Spec sir thanks a lot.You are the one who guide us in right way in all times!

Sekharinvest Sir we miss you.Pls come to SB as soon as possible.

Regards,

Jai.

| Description: |

|

| Filesize: |

18.75 KB |

| Viewed: |

431 Time(s) |

|

| Description: |

|

| Filesize: |

18.51 KB |

| Viewed: |

421 Time(s) |

|

|

|

| Back to top |

|

|

nonchalant zooid

White Belt

Joined: 09 Sep 2010

Posts: 19

|

Post: #326  Posted: Thu Mar 03, 2011 12:45 pm Post subject: Re: Some Gud points from SB Posted: Thu Mar 03, 2011 12:45 pm Post subject: Re: Some Gud points from SB |

|

|

Excellent work jai.Thanks for compiling

| Jai2000 wrote: | Dear friends,

If any spec sir's follower missd today's SB,here the modified rules for you.•

Speculator : The only reason people use 5-min charts for rejects is for small SL.

• Speculator : But 5-min rejects have lot of whipsaws.

• Speculator : So here's a small hint.

• Speculator : Wait for price to hit 34 ema on 15-min.

• Speculator : At that point switch to 5-min chart and trade the 5-min reject.

Speculator : The rule is we need to close above the highs of prior candle. The prior candle can be green or red.

Speculator : : Keep it simple. Wait for price to come close to 34 on 15-min, which has happened now(He mentiond 10.30 candle-15TF)

Speculator : At this point take any valid rejections from 5-min.

• Speculator : Any 5-min rejections from this point should work.

• jjm : specji no need of candle to be above 34 ema, we need just a close above 8 ema 5 tf right?

• Speculator : jjm: No no. All 3 rejections rules should be satisified even on 5-min.

Spec sir thanks a lot.You are the one who guide us in right way in all times!

Sekharinvest Sir we miss you.Pls come to SB as soon as possible.

Regards,

Jai. |

|

|

| Back to top |

|

|

sanju251416

White Belt

Joined: 15 Feb 2010

Posts: 10

|

Post: #327  Posted: Thu Mar 03, 2011 1:31 pm Post subject: Posted: Thu Mar 03, 2011 1:31 pm Post subject: |

|

|

| jai/spec - cud u pls explain about three rejections rules mentioned ? Thks.

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

Post: #328  Posted: Thu Mar 03, 2011 1:50 pm Post subject: Reply Posted: Thu Mar 03, 2011 1:50 pm Post subject: Reply |

|

|

| sanju251416 wrote: | | jai/spec - cud u pls explain about three rejections rules mentioned ? Thks. |

Sanju hi,

You can find it @page no 9.

Jai

|

|

| Back to top |

|

|

sanju251416

White Belt

Joined: 15 Feb 2010

Posts: 10

|

Post: #329  Posted: Thu Mar 03, 2011 2:15 pm Post subject: Posted: Thu Mar 03, 2011 2:15 pm Post subject: |

|

|

| thks a ton, jai...

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #330  Posted: Thu Mar 03, 2011 4:01 pm Post subject: Re: Some Gud points from SB Posted: Thu Mar 03, 2011 4:01 pm Post subject: Re: Some Gud points from SB |

|

|

Very handy compilation, Jai. Thank you

|

|

| Back to top |

|

|

|