|

|

| View previous topic :: View next topic |

| Author |

Swing Trading : The Speculator way |

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #376  Posted: Fri Mar 18, 2011 6:54 pm Post subject: Posted: Fri Mar 18, 2011 6:54 pm Post subject: |

|

|

Spec - Thanks for the document.. it's one thing to read books authored by unknown great authors and its another to read the experience of a trader whom we interact with..

Thanks again

|

|

| Back to top |

|

|

|

|  |

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #377  Posted: Mon Mar 21, 2011 8:38 am Post subject: Swing pivots - March 21, 2011 Posted: Mon Mar 21, 2011 8:38 am Post subject: Swing pivots - March 21, 2011 |

|

|

In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5562

30-min: Downtrending, Downswing Pivot 5562

Copper:

30-min: Uptrending, Upswing Pivot 420.4

-Speculator

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #378  Posted: Mon Mar 21, 2011 9:52 am Post subject: Re: Swing pivots - March 21, 2011 Posted: Mon Mar 21, 2011 9:52 am Post subject: Re: Swing pivots - March 21, 2011 |

|

|

Spec,

With the previous recovery low broken (@ 5375.60) the new swing pivot has moved to 5423. Correct me if I'm wrong.

Regards

Ravi

| Speculator wrote: | In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5562

30-min: Downtrending, Downswing Pivot 5562

Copper:

30-min: Uptrending, Upswing Pivot 420.4

-Speculator |

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #379  Posted: Mon Mar 21, 2011 10:01 am Post subject: Re: Swing pivots - March 21, 2011 Posted: Mon Mar 21, 2011 10:01 am Post subject: Re: Swing pivots - March 21, 2011 |

|

|

| Ravi_S wrote: | Spec,

With the previous recovery low broken (@ 5375.60) the new swing pivot has moved to 5423. Correct me if I'm wrong.

Regards

Ravi

| Speculator wrote: | In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5562

30-min: Downtrending, Downswing Pivot 5562

Copper:

30-min: Uptrending, Upswing Pivot 420.4

-Speculator |

|

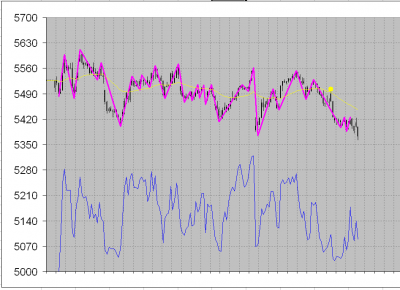

Ravi,

I am getting Dnswing pivot at 5502 now (from 17th-Mar). Shown in yellow dot

| Description: |

|

| Filesize: |

31.02 KB |

| Viewed: |

362 Time(s) |

|

|

|

| Back to top |

|

|

enroute

White Belt

Joined: 01 May 2010

Posts: 64

|

Post: #380  Posted: Mon Mar 21, 2011 11:53 pm Post subject: Posted: Mon Mar 21, 2011 11:53 pm Post subject: |

|

|

On 15mins chart,NF had made new swing pivot @ 5420.25 while making new low of 5360 on 21st march.but that pivot point had been taken in intraday and make new high of 5424..but the low of 5360 has not been taken..

it means nifty-1m is in uptrend in 15min tf.spec sir,plz put light on this..

regards

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #381  Posted: Tue Mar 22, 2011 7:41 am Post subject: Posted: Tue Mar 22, 2011 7:41 am Post subject: |

|

|

Profitrd, I presume the pivot was not taken out, which means no candle close above the pivot, so we are still in downtrend.

Also in 60 mins if you consider 13 EMA, the pivot remains the same as what we have got, 60 mins, 34 EMA is giving the pivot what vinst has mentioned.

REgards

Ravi

| profitrd wrote: | On 15mins chart,NF had made new swing pivot @ 5420.25 while making new low of 5360 on 21st march.but that pivot point had been taken in intraday and make new high of 5424..but the low of 5360 has not been taken..

it means nifty-1m is in uptrend in 15min tf.spec sir,plz put light on this..

regards |

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #382  Posted: Tue Mar 22, 2011 8:02 am Post subject: Swing pivots - March 22, 2011 Posted: Tue Mar 22, 2011 8:02 am Post subject: Swing pivots - March 22, 2011 |

|

|

vinst, profitrd, ravis,

There still seems to be confusion over identifying pivots.  Today we broke the 15/3 lows of 5376. So a new downswing pivot was formed. How to identify this pivot ? Simple ! Find out where the rejection happened for the first time in the current swing. 17/3 10:00 AM candle was the first rejection for this swing. Find the highest high preceding that rejection. That's your pivot. Highest high preceding the rejection candle was 16/3 13:30 candle high which is 5552. So 5552 is the current downswing pivot. Today we broke the 15/3 lows of 5376. So a new downswing pivot was formed. How to identify this pivot ? Simple ! Find out where the rejection happened for the first time in the current swing. 17/3 10:00 AM candle was the first rejection for this swing. Find the highest high preceding that rejection. That's your pivot. Highest high preceding the rejection candle was 16/3 13:30 candle high which is 5552. So 5552 is the current downswing pivot.

In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5552

30-min: Downtrending, Downswing Pivot 5552

Copper:

30-min: Uptrending, Upswing Pivot 420.4

-Speculator

|

|

| Back to top |

|

|

rajanadar

White Belt

Joined: 31 Mar 2009

Posts: 20

|

Post: #383  Posted: Tue Mar 22, 2011 9:11 am Post subject: Re: Swing pivots - March 22, 2011 Posted: Tue Mar 22, 2011 9:11 am Post subject: Re: Swing pivots - March 22, 2011 |

|

|

| Speculator wrote: | vinst, profitrd, ravis,

There still seems to be confusion over identifying pivots.  Today we broke the 15/3 lows of 5376. So a new downswing pivot was formed. How to identify this pivot ? Simple ! Find out where the rejection happened for the first time in the current swing. 17/3 10:00 AM candle was the first rejection for this swing. Find the highest high preceding that rejection. That's your pivot. Highest high preceding the rejection candle was 16/3 13:30 candle high which is 5552. So 5552 is the current downswing pivot. Today we broke the 15/3 lows of 5376. So a new downswing pivot was formed. How to identify this pivot ? Simple ! Find out where the rejection happened for the first time in the current swing. 17/3 10:00 AM candle was the first rejection for this swing. Find the highest high preceding that rejection. That's your pivot. Highest high preceding the rejection candle was 16/3 13:30 candle high which is 5552. So 5552 is the current downswing pivot.

In uptrending markets, trade bullish rejections. In downtrending markets, trade bearish rejections.

Nifty:

15-min: Downtrending, Downswing Pivot 5552

30-min: Downtrending, Downswing Pivot 5552

Copper:

30-min: Uptrending, Upswing Pivot 420.4

-Speculator |

Thanks Spec.

However, my understanding is that when price rejects from the 34 ema and forms a new low, the high of the rejection candle becomes the new pivot. With this understanding, 21st Mar 9.30 candle was a rejection and formed new low so 5420.25 should be the pivot or am I missing something here?

|

|

| Back to top |

|

|

enroute

White Belt

Joined: 01 May 2010

Posts: 64

|

Post: #384  Posted: Tue Mar 22, 2011 9:22 am Post subject: Posted: Tue Mar 22, 2011 9:22 am Post subject: |

|

|

thanx spec

|

|

| Back to top |

|

|

kanna

White Belt

Joined: 03 Jan 2010

Posts: 91

|

Post: #385  Posted: Tue Mar 22, 2011 10:03 am Post subject: Re: Swing pivots - March 22, 2011 Posted: Tue Mar 22, 2011 10:03 am Post subject: Re: Swing pivots - March 22, 2011 |

|

|

[quote="rajanadar"] | Speculator wrote: | vinst, profitrd, ravis,

Thanks Spec.

However, my understanding is that when price rejects from the 34 ema and forms a new low, the high of the rejection candle becomes the new pivot. With this understanding, 21st Mar 9.30 candle was a rejection and formed new low so 5420.25 should be the pivot or am I missing something here? |

hi raja

your understanding is not correct. i believe.

we see rejection candle for a trade entry. thats all. Pivot is the highest high (as spec told) which was formed before the new low

|

|

| Back to top |

|

|

rajanadar

White Belt

Joined: 31 Mar 2009

Posts: 20

|

Post: #386  Posted: Tue Mar 22, 2011 11:01 am Post subject: Re: Swing pivots - March 22, 2011 Posted: Tue Mar 22, 2011 11:01 am Post subject: Re: Swing pivots - March 22, 2011 |

|

|

[quote="kanna"] | rajanadar wrote: | | Speculator wrote: | vinst, profitrd, ravis,

Thanks Spec.

However, my understanding is that when price rejects from the 34 ema and forms a new low, the high of the rejection candle becomes the new pivot. With this understanding, 21st Mar 9.30 candle was a rejection and formed new low so 5420.25 should be the pivot or am I missing something here? |

hi raja

your understanding is not correct. i believe.

we see rejection candle for a trade entry. thats all. Pivot is the highest high (as spec told) which was formed before the new low |

Thanks Kanna.

I am attaching the chart of NF from 3rd Feb till 11th Feb, when we were in a downtrend. I have marked the pivot points as per my understanding with arrow marks -

1) 5565.5 (4th Feb 10.45 candle)

2) 5443.65 (7th feb 3.00 candle)

3) 5285 (10th Feb 2.15 candle)

Is it correct?

However, Considering the Highest High, then only 5565.5 (4th Feb 10.45 candle) will be the pivot. Kindly help.

| Description: |

|

| Filesize: |

69.4 KB |

| Viewed: |

429 Time(s) |

|

|

|

| Back to top |

|

|

GUDGUY

White Belt

Joined: 10 Nov 2010

Posts: 2

|

Post: #387  Posted: Tue Mar 22, 2011 7:57 pm Post subject: SWING PIVOTS Posted: Tue Mar 22, 2011 7:57 pm Post subject: SWING PIVOTS |

|

|

Hello Gentlemne,I hv just joined your elite group of Technical analysts.I m a newbee. I want 2 know hw SWING PIVOT is calculated  .and d importanceof 34 EMA for Intraday Charting.Gentlemen ,I usally do only BTST / STBT trading and some times Intraday.Can u please guide me hw 2 select reliable entry and exit points. Thanks a lot. Good luck and take care.Mr.Prem .and d importanceof 34 EMA for Intraday Charting.Gentlemen ,I usally do only BTST / STBT trading and some times Intraday.Can u please guide me hw 2 select reliable entry and exit points. Thanks a lot. Good luck and take care.Mr.Prem

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #388  Posted: Tue Mar 22, 2011 8:04 pm Post subject: Re: SWING PIVOTS Posted: Tue Mar 22, 2011 8:04 pm Post subject: Re: SWING PIVOTS |

|

|

Hello GUDGUY,

Please go through this thread from the start... It would be informative and useful... All documents have been put by SPEC and SHEKAR in this thread...

Regards

Ravi

| GUDGUY wrote: | Hello Gentlemne,I hv just joined your elite group of Technical analysts.I m a newbee. I want 2 know hw SWING PIVOT is calculated  .and d importanceof 34 EMA for Intraday Charting.Gentlemen ,I usally do only BTST / STBT trading and some times Intraday.Can u please guide me hw 2 select reliable entry and exit points. Thanks a lot. Good luck and take care.Mr.Prem .and d importanceof 34 EMA for Intraday Charting.Gentlemen ,I usally do only BTST / STBT trading and some times Intraday.Can u please guide me hw 2 select reliable entry and exit points. Thanks a lot. Good luck and take care.Mr.Prem |

|

|

| Back to top |

|

|

rajanadar

White Belt

Joined: 31 Mar 2009

Posts: 20

|

Post: #389  Posted: Tue Mar 22, 2011 8:21 pm Post subject: Re: Swing pivots - March 22, 2011 Posted: Tue Mar 22, 2011 8:21 pm Post subject: Re: Swing pivots - March 22, 2011 |

|

|

[quote="rajanadar"] | kanna wrote: | | rajanadar wrote: | | Speculator wrote: | vinst, profitrd, ravis,

Thanks Spec.

However, my understanding is that when price rejects from the 34 ema and forms a new low, the high of the rejection candle becomes the new pivot. With this understanding, 21st Mar 9.30 candle was a rejection and formed new low so 5420.25 should be the pivot or am I missing something here? |

hi raja

your understanding is not correct. i believe.

we see rejection candle for a trade entry. thats all. Pivot is the highest high (as spec told) which was formed before the new low |

Thanks Kanna.

I am attaching the chart of NF from 3rd Feb till 11th Feb, when we were in a downtrend. I have marked the pivot points as per my understanding with arrow marks -

1) 5565.5 (4th Feb 10.45 candle)

2) 5443.65 (7th feb 3.00 candle)

3) 5285 (10th Feb 2.15 candle)

Is it correct?

However, Considering the Highest High, then only 5565.5 (4th Feb 10.45 candle) will be the pivot. Kindly help. |

Hi Spec / Ravi / Jai,

Kindly let me know if my understanding above is correct.

Thanks.

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

Post: #390  Posted: Tue Mar 22, 2011 9:55 pm Post subject: Nifty pivot Posted: Tue Mar 22, 2011 9:55 pm Post subject: Nifty pivot |

|

|

Raja,

3 pivots u mentiond are correct. If you watch charts closely, that time price were trading below 34ema, so rejection candle's high was pivot.But now situation totally changed,price jumping above & below 34 ema! That's why you are little comfused. Just read spec sir's answer for -"vnst, profitrd, ravi" again your doubt will be clear. Raja just for you - if we got new low below 5376.15 & above 5360 on 18/3/"11, then 5420.25 would have been New pivot!

Hope it will help you to undersatnd something!

Regards,

Jai

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|