| View previous topic :: View next topic |

| Author |

Swing Trading : The Speculator way |

ronypan

White Belt

Joined: 07 Aug 2010

Posts: 197

|

Post: #736  Posted: Wed Jun 08, 2011 8:42 am Post subject: Posted: Wed Jun 08, 2011 8:42 am Post subject: |

|

|

Thanks alot.. I wanted to use this method but I didn't find any proper stuff regarding d same.. Waiting for ur post in weekend..

| Speculator wrote: | I have got too many questions and PMs which i have not answered. Before i forget, i will post here as a reminder to myself.

1) Is 8 ema above 34 ema required for a valid rejection ?

2) Can 5-min be used with swing system for intra?

3) Can 10-min be used for swing trading ?

4) We had a 15-min rejection, but 10-min failed to give a rejection. Should we take the 15-min rejection in that case or not ?

5) Can we use pivot breaks for entry ? If so what should be the stop loss ? What are the advantages and disadvantages of trading pivot breaks ?

6) Role of RSI(5) in determining pivots.

I will answer all these questions over the weekend. I will also be adding a small refinement to the price above 8 ema rule.

This thread has grown too big and it's very difficult for a newbie to find the relevant sections of the method. So i will be moving some of the stuff related to the technique into another thread.

- Speculator |

|

|

| Back to top |

|

|

|

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

|

| Back to top |

|

|

rainbow

White Belt

Joined: 25 Feb 2010

Posts: 202

|

Post: #738  Posted: Thu Jun 09, 2011 7:58 am Post subject: Re: Crude Posted: Thu Jun 09, 2011 7:58 am Post subject: Re: Crude |

|

|

Jai:

you, spec, sumit and others make me thirsty to start commo

great trade on crude, buddy. booked profits or holding? and why is there no 'woooooooo' like the standard procedure of ichartians?

Have a nice day

Cheers

DJ

| Jai2000 wrote: | The magic of Pivot Breakkkk- 100 points within few mnts

Spec sir

Jai |

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #739  Posted: Thu Jun 09, 2011 10:29 am Post subject: Posted: Thu Jun 09, 2011 10:29 am Post subject: |

|

|

| NF 30min still in downtrend with downswing pivot at 5608

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

Post: #740  Posted: Fri Jun 10, 2011 2:11 pm Post subject: Nifty Pivot Posted: Fri Jun 10, 2011 2:11 pm Post subject: Nifty Pivot |

|

|

Nifty new Down Swing Pivot 15 & 30 TF- 5576.30

Jai

( i've marked 5476.30 it's typing error & the Pivot is 5576.35

| Description: |

|

| Filesize: |

29.74 KB |

| Viewed: |

391 Time(s) |

|

Last edited by Jai2000 on Fri Jun 10, 2011 4:16 pm; edited 1 time in total |

|

| Back to top |

|

|

avinash02

White Belt

Joined: 22 Feb 2009

Posts: 343

|

Post: #741  Posted: Fri Jun 10, 2011 2:27 pm Post subject: Re: Nifty Pivot Posted: Fri Jun 10, 2011 2:27 pm Post subject: Re: Nifty Pivot |

|

|

| Jai2000 wrote: | Nifty new Down Swing Pivot 15 & 30 TF- 5476.30

Jai |

jai

down swing pivot is now 5576.3

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

Post: #742  Posted: Fri Jun 10, 2011 4:13 pm Post subject: Nifty Pivot Posted: Fri Jun 10, 2011 4:13 pm Post subject: Nifty Pivot |

|

|

Avinash,

sorry it's typing error....... sorry it's typing error.......

Jai

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #743  Posted: Fri Jun 10, 2011 4:58 pm Post subject: Posted: Fri Jun 10, 2011 4:58 pm Post subject: |

|

|

At end-of-day 10-June-2011

NF 30min Downswing pivot 5577

BNF 30min Upswing pivot 10330

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #745  Posted: Wed Jun 15, 2011 3:42 pm Post subject: Posted: Wed Jun 15, 2011 3:42 pm Post subject: |

|

|

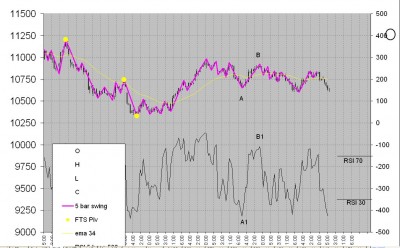

I am posting BNF 60min chart (picture title wrongly mentions 30min).

Currently running in upswing with upswing pivot at 10330 and has made a high of 10984.

Point A is retracement below ema and also rsi<30>70 but not a new high in price for this swing. So as of now 'A' can not be an upswing pivot.

Subsequently, 'A' is broken.

Now can we take 'B' as the point to be overtaken (instead of 10984), upon which , we may designate a higher bottom compared to 10330 as upswing pivot?

please try to clear me on this.

regards

| Description: |

|

| Filesize: |

137.03 KB |

| Viewed: |

371 Time(s) |

|

|

|

| Back to top |

|

|

jjm

White Belt

Joined: 17 Mar 2010

Posts: 411

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #747  Posted: Wed Jun 15, 2011 7:51 pm Post subject: Posted: Wed Jun 15, 2011 7:51 pm Post subject: |

|

|

| jjm wrote: | Dear Vinst,

Refer the chart

To consider pt A as pivot we need a new recovery high.. yes you are right

Once earlier pivot is taken out we wait for rejection and if we get the new recovery high or low the pivot shifts..

It is clear to you..after pt A we did not get new recovery high so pivot will not shift.. and unless we break 10330 the trend will not reverse it will be in uptrend only..there is no meaning in between tops and bottoms

Yeh ekdam aasan hai ..iski pehchan ke liye simples sa rule hai

Me do pahadoki chotiya dekhta hoo..bichki khai yane pivot .. ye khai 34 ko touch karni chahiye... if it doesnot then at lest rsi 5 shld be OS ..

Regards,

JJM |

JJM,

Thanks for explaining.

regards

|

|

| Back to top |

|

|

Jai2000

White Belt

Joined: 09 Aug 2010

Posts: 346

|

|

| Back to top |

|

|

enroute

White Belt

Joined: 01 May 2010

Posts: 64

|

Post: #749  Posted: Thu Jun 16, 2011 8:47 am Post subject: Posted: Thu Jun 16, 2011 8:47 am Post subject: |

|

|

Hi Jai,thats a grt trade which u hd done with crude. i m also following spec sir's method..but even nw i m nt able to overcm fear of taking each n every move..plz suggest hw u hv maintained ur mind as rock solid(without emotions) to follow a strategy wholeheartedly inspite of hitting some stoplosses....

reply awaited

regards

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #750  Posted: Thu Jun 16, 2011 9:16 am Post subject: Posted: Thu Jun 16, 2011 9:16 am Post subject: |

|

|

| jjm wrote: | Dear Vinst,

Refer the chart

To consider pt A as pivot we need a new recovery high.. yes you are right

Once earlier pivot is taken out we wait for rejection and if we get the new recovery high or low the pivot shifts..

It is clear to you..after pt A we did not get new recovery high so pivot will not shift.. and unless we break 10330 the trend will not reverse it will be in uptrend only..there is no meaning in between tops and bottoms

Yeh ekdam aasan hai ..iski pehchan ke liye simples sa rule hai

Me do pahadoki chotiya dekhta hoo..bichki khai yane pivot .. ye khai 34 ko touch karni chahiye... if it doesnot then at lest rsi 5 shld be OS ..

Regards,

JJM |

JJM / Jai / Spec sir,

is there no way to 'shorten' this type of large SL which remains large for many days?

regards

|

|

| Back to top |

|

|

|