| View previous topic :: View next topic |

| Author |

Swing Trading : The Speculator way |

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #91  Posted: Mon Mar 15, 2010 6:51 pm Post subject: Posted: Mon Mar 15, 2010 6:51 pm Post subject: |

|

|

| Speculator wrote: | Interestingly many stocks got oversold today, without breaking their swing pivots, like ABAN, Tatasteel, TataMotors etc. So tommorow if these stocks hold above their swing pivots and breakout, then it is bullish and i will be a buyer. On the other hand if they break below their hourly swing pivots, i will start shorting these stocks on bounces. Tommorow, hopefully will be an interesting day.

|

Good insight.. thanks !!

|

|

| Back to top |

|

|

|

|

|

ramesh_sil

White Belt

Joined: 23 Feb 2010

Posts: 3

|

Post: #92  Posted: Tue Mar 16, 2010 9:18 pm Post subject: Swing Trading : The Speculator way Posted: Tue Mar 16, 2010 9:18 pm Post subject: Swing Trading : The Speculator way |

|

|

Spec,

I appreciate your hardwork in educating us in the swing trading. I am using this for the last 1 month and it is giving great results. Excellent work.

Special Thanks to Sekharinvest for documenting the strategy.

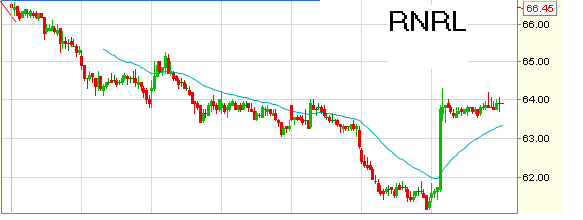

I trade in RNRL. Today the stock went up 4 % in few minutes. I would like to get your insight on trading such moves. Normally I use swing pivot to exit trade and use the price rejection strategy to enter the trade. Previously I bought RNRL @ 61 and sold around 65.

| Description: |

|

| Filesize: |

10.67 KB |

| Viewed: |

5744 Time(s) |

|

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #93  Posted: Wed Mar 17, 2010 8:34 am Post subject: Posted: Wed Mar 17, 2010 8:34 am Post subject: |

|

|

| Swing pivot on Nifty moves to 5105.50. The uptrend continues. As long as we continue to hold above the swing pivot, look for opportunities to go long on rejections, especially on those stocks which are oversold and holding above their swing pivots. Yesterday i mentioned a few - Tatamotors, TataSteel, ABAN etc. They all broke out above ther swing pivots yesterday. Today look for a pullback to 34 and rejection to go long on these stocks.

|

|

| Back to top |

|

|

smsmss

White Belt

Joined: 13 Oct 2009

Posts: 123

|

Post: #94  Posted: Wed Mar 17, 2010 8:44 am Post subject: Posted: Wed Mar 17, 2010 8:44 am Post subject: |

|

|

Thanxxx a ton Spec for the insights, we really appreciate it........

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #95  Posted: Wed Mar 17, 2010 8:51 am Post subject: Posted: Wed Mar 17, 2010 8:51 am Post subject: |

|

|

ramesh_sil,

Please have a look on the chart posted below TF 30 min EMA 34.

RNRL has failed to give a close above Swing pivot which is at 64 now. You can enter once it closes above. If you wish you can also enter even if it fails to close above 64 and take a pull back to EMA 34 but that that entry might be against the trend and you sincerely need to pray for trend to resume upward that is price moves past 64.

Untill now there is no valid entry for longs. Forget about that 4% move at most that might have taken out your SL - had you been in short position.

SHEKHAR

| Description: |

|

| Filesize: |

24.46 KB |

| Viewed: |

590 Time(s) |

|

|

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

Post: #96  Posted: Wed Mar 17, 2010 10:39 am Post subject: Posted: Wed Mar 17, 2010 10:39 am Post subject: |

|

|

Hi Specs,

I have a question. Could you please answer - please refer the attached chart of ABAN.

Rgds,

SW

| Speculator wrote: | Swing pivot on Nifty 60-min at 5092 held again today. So Nifty remains on a upswing. All action above 5092 should be considered as high level consolidation.

Interestingly many stocks got oversold today, without breaking their swing pivots, like ABAN, Tatasteel, TataMotors etc. So tommorow if these stocks hold above their swing pivots and breakout, then it is bullish and i will be a buyer. On the other hand if they break below their hourly swing pivots, i will start shorting these stocks on bounces. Tommorow, hopefully will be an interesting day.

Here's a chart of ABAN which shows that situation. We are oversold as indicated by the stochastics but we could not break the swing pivot. So the strategy for tommorow is simple. If we break below the swing pivot, short any bounces. If we breakout with a hourly close above 13 ema, go long. Tatasteel, Tatamotors are also in a similar situation.

- Speculator |

| Description: |

|

| Filesize: |

132.09 KB |

| Viewed: |

801 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #97  Posted: Wed Mar 17, 2010 12:14 pm Post subject: Posted: Wed Mar 17, 2010 12:14 pm Post subject: |

|

|

SW,

Nice to see you taking keen interest in Spec's swing. Hope we will be enlightened by your experience.

Probably you missed, Spec was explaining the strategy to enter longs when the price has not taken out the pivot, using STS & 13 EMA on Hrly chart. That chart is Hrly with 13 EMA.

I am posting below 30 min charts with 34 ema and pivot marked.

Hope this clarify.

Still there is a question for Spec. posted on chart.

Is it that there is no candle close above previous high ?

SHEKHAR

PS: Pl. ignore the indicators they are set to my default.

| Description: |

|

| Filesize: |

44.99 KB |

| Viewed: |

715 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #98  Posted: Wed Mar 17, 2010 4:11 pm Post subject: Posted: Wed Mar 17, 2010 4:11 pm Post subject: |

|

|

Hi,

Posted below couple of charts.

TF: 30min and EMA 34 for all.

SHEKHAR

| Description: |

|

| Filesize: |

26.44 KB |

| Viewed: |

649 Time(s) |

|

| Description: |

|

| Filesize: |

25.44 KB |

| Viewed: |

590 Time(s) |

|

| Description: |

|

| Filesize: |

25.39 KB |

| Viewed: |

584 Time(s) |

|

| Description: |

|

| Filesize: |

29.57 KB |

| Viewed: |

563 Time(s) |

|

|

|

| Back to top |

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #99  Posted: Wed Mar 17, 2010 9:41 pm Post subject: Request Posted: Wed Mar 17, 2010 9:41 pm Post subject: Request |

|

|

Shekharinvest, You hv written below " Probably you missed, Spec was explaining the strategy to enter longs when the price has not taken out the pivot, using STS & 13 EMA on Hrly chart."

I too missed the same; can you please post a chart or two on this , that i think should be fine.

Thank You for your hard work.

Last edited by sandew on Thu Mar 18, 2010 10:01 am; edited 1 time in total |

|

| Back to top |

|

|

swaroopbn

White Belt

Joined: 12 Feb 2008

Posts: 39

|

|

| Back to top |

|

|

smsmss

White Belt

Joined: 13 Oct 2009

Posts: 123

|

|

| Back to top |

|

|

ramesh_sil

White Belt

Joined: 23 Feb 2010

Posts: 3

|

Post: #102  Posted: Thu Mar 18, 2010 3:56 am Post subject: Posted: Thu Mar 18, 2010 3:56 am Post subject: |

|

|

| Sekhar,Thanks for your insights on RNRL.

|

|

| Back to top |

|

|

Speculator

Expert

Joined: 15 Apr 2008

Posts: 149

|

Post: #103  Posted: Thu Mar 18, 2010 10:37 am Post subject: Posted: Thu Mar 18, 2010 10:37 am Post subject: |

|

|

Guys,

Interesting discussion below on ABAN. I never recommned entering long when we are in a downtrend.

Just to be clear, 30-min can be on a downtrend, while 60-min can be on an uptrend, as in case of ABAN. I am using 34 ema in both cases. ABAN 30-min entered a downtrend after breaking the 1272 pivot. So one should be short if they are using 30-min charts. On the other hand, 60-min upswing pivot is at 1192 which is not yet broken. So those trading 60-min charts should be looking for long oportunity on any valid rejection from 34.

Do not mix timeframes. Remain consistent with the timeframe you trade in.

-Speculator

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #104  Posted: Thu Mar 18, 2010 3:54 pm Post subject: up and downswing pivots Posted: Thu Mar 18, 2010 3:54 pm Post subject: up and downswing pivots |

|

|

shekharinvestorji/speculatorji,

the 34 ema for hourly charts is available for only 4-5 days on i-charts.hence i am not able to decide the upswing and downswing pivots. kindly guide, pl.

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #105  Posted: Fri Mar 19, 2010 4:39 pm Post subject: Re: up and downswing pivots Posted: Fri Mar 19, 2010 4:39 pm Post subject: Re: up and downswing pivots |

|

|

| girishhu1 wrote: | shekharinvestorji/speculatorji,

the 34 ema for hourly charts is available for only 4-5 days on i-charts.hence i am not able to decide the upswing and downswing pivots. kindly guide, pl.  |

girish,

In Icharts - intraday time frame setting by default is 3 days. You can increase it to any number I use 40 days of data. It is 3rd button from right on top of the chart.

Hope this will solve your problem.

SHEKHAR

|

|

| Back to top |

|

|

|