| View previous topic :: View next topic |

| Author |

Technical dissection - NIFTY |

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #46  Posted: Mon Dec 13, 2010 4:03 pm Post subject: Posted: Mon Dec 13, 2010 4:03 pm Post subject: |

|

|

Good one sharebaaz,

Today on intraday charts, if you analyse you will get selling climax, accumulation and finally the mark up..

In other words there was nvk set up

Someone may call it double bottom...

This is the beauty of TA ..

Happy analysing...

Regards,

RT

|

|

| Back to top |

|

|

|

|

|

WILL2WIN

White Belt

Joined: 05 Mar 2010

Posts: 51

|

Post: #47  Posted: Mon Dec 13, 2010 4:14 pm Post subject: Posted: Mon Dec 13, 2010 4:14 pm Post subject: |

|

|

| Sherbaaz, RT nice VSA based predictions. Thats the only tool to detect the SmartMoney movement. Keep up the efforts.

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #48  Posted: Mon Dec 13, 2010 11:12 pm Post subject: Posted: Mon Dec 13, 2010 11:12 pm Post subject: |

|

|

Today nifty respected the stop loss 5790..

Today market tested the level of 5800 and bounced back sharply...

It has conquered two imp levels 5870 and 5900

5870: Monthly opening

5900: 50% of 6070-5720

Maket closed above 5900 so clear strength..

Now we should revise our stoploss to 5840

Upcoming hurdles for the Nifty 5924,5952,5976

5976 is difficult one..

Lets see what happens..

(All levels are spot)

Regards,

RT

|

|

| Back to top |

|

|

yawalkar

White Belt

Joined: 02 Oct 2010

Posts: 58

|

Post: #49  Posted: Tue Dec 14, 2010 7:35 am Post subject: Posted: Tue Dec 14, 2010 7:35 am Post subject: |

|

|

| RoyalTrader wrote: | Dear acharyams,

If you are ready to take risk then yes you can short below 5790 with a s/l of 5820 and a target 5730 all spots.

My trailing stoploss levels should not be taken as SAR levels.. Agressive traders can do so but not advisable to all..

I always mention when to open fresh long or shorts and when to book profits..

Make an habit of booking profit, dont let greed to take control of your emotions, trade and finally money...

Regards,

RT |

Dear RT,

can you explain how you calculate stop loss. In this case how you calculate nifty 5790 for short and 5820 for long

Last edited by yawalkar on Tue Dec 14, 2010 7:46 am; edited 1 time in total |

|

| Back to top |

|

|

yawalkar

White Belt

Joined: 02 Oct 2010

Posts: 58

|

Post: #50  Posted: Tue Dec 14, 2010 7:45 am Post subject: Posted: Tue Dec 14, 2010 7:45 am Post subject: |

|

|

| RoyalTrader wrote: | Stoploss mentioned yesterday 5790 spot...

Today market gave another (mostly last) opportunity to go long.. Who made money..?

Today was a trap for bears..

Understand the power of SMART MONEY

Just follow it and enjoy...

Regards,

RT |

Dear RT,

Can you explain where u found smart money on chart? can you explain please?

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #51  Posted: Tue Dec 14, 2010 9:35 pm Post subject: Posted: Tue Dec 14, 2010 9:35 pm Post subject: |

|

|

Dear Yawalkar,

SMART MONEY can not be easily seen on the chart like indicators or overlays.. For that you need to understand the relationship between volume and price,, If you analyse volume and price carefully you can spot what operators are doing.. It is said that in market 95% people loose money and only 5% people gain.. But those 5 % peoples profit = other 95% peoples loss.. as market is a zero sum game...

Knowledge of candlesticks is an added advantage to those who are following VSA (Violume Spread Analysis)..

As per VSA there are 4 phases in the market

1. Accumulation

2. Mark up

3. Distribution

4. Mark down

Some times there may be reaccumulation phase after a mark up..

Seeling climax, Buying climax are also two important concepts in VSA..

I will go step by step to explain this to all...

Watch out this space I will post an example soon...

Regards,

RT

|

|

| Back to top |

|

|

ashis

White Belt

Joined: 28 Mar 2010

Posts: 75

|

Post: #52  Posted: Tue Dec 14, 2010 10:21 pm Post subject: Posted: Tue Dec 14, 2010 10:21 pm Post subject: |

|

|

Dear RT

It is our pleasure if you will guide us properly about your bellow mentioned 4-points.

Regards

Ashis

| RoyalTrader wrote: | Dear Yawalkar,

SMART MONEY can not be easily seen on the chart like indicators or overlays.. For that you need to understand the relationship between volume and price,, If you analyse volume and price carefully you can spot what operators are doing.. It is said that in market 95% people loose money and only 5% people gain.. But those 5 % peoples profit = other 95% peoples loss.. as market is a zero sum game...

Knowledge of candlesticks is an added advantage to those who are following VSA (Violume Spread Analysis)..

As per VSA there are 4 phases in the market

1. Accumulation

2. Mark up

3. Distribution

4. Mark down

Some times there may be reaccumulation phase after a mark up..

Seeling climax, Buying climax are also two important concepts in VSA..

I will go step by step to explain this to all...

Watch out this space I will post an example soon...

Regards,

RT |

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #53  Posted: Tue Dec 14, 2010 10:23 pm Post subject: Posted: Tue Dec 14, 2010 10:23 pm Post subject: |

|

|

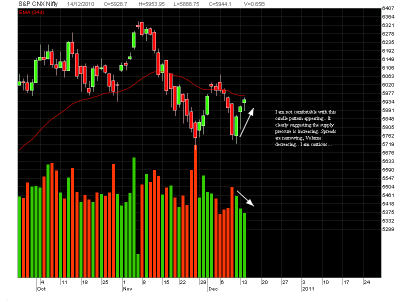

Before going deep in to VSA, some daily updates.

first let me answer to the question How I derived the level of 5790 as S/L

Dear Yawalkar, its simple 50% of last candle spread 5857-5721=136

136/2=68+5721= 5789

50% of big green candle is a good support...

For tomorrow I am little cautious... If tomorrow happens to be a big green candle then I am ok.. But if Market starts fallling.. Then I would Like to keep 5910 (spot) as my stop loss for long.. aggresive traders can short but not recommended.. market may take support around 5860 spot tomorrow or day after.. One can think of re-entering there

Please find attached chart...

Regards,

RT

| Description: |

|

| Filesize: |

36.92 KB |

| Viewed: |

549 Time(s) |

|

|

|

| Back to top |

|

|

yawalkar

White Belt

Joined: 02 Oct 2010

Posts: 58

|

Post: #54  Posted: Wed Dec 15, 2010 5:44 am Post subject: Posted: Wed Dec 15, 2010 5:44 am Post subject: |

|

|

| RoyalTrader wrote: | Dear Yawalkar,

SMART MONEY can not be easily seen on the chart like indicators or overlays.. For that you need to understand the relationship between volume and price,, If you analyse volume and price carefully you can spot what operators are doing.. It is said that in market 95% people loose money and only 5% people gain.. But those 5 % peoples profit = other 95% peoples loss.. as market is a zero sum game...

Knowledge of candlesticks is an added advantage to those who are following VSA (Violume Spread Analysis)..

As per VSA there are 4 phases in the market

1. Accumulation

2. Mark up

3. Distribution

4. Mark down

Some times there may be reaccumulation phase after a mark up..

Seeling climax, Buying climax are also two important concepts in VSA..

I will go step by step to explain this to all...

Watch out this space I will post an example soon...

Regards,

RT |

Thanks RT,

For such a wonderful explanation.

I am very hungry to know the details.

can you suggest me any book or web site for VSA?

And do share your knowlede ASAP.

|

|

| Back to top |

|

|

sharemuthu

White Belt

Joined: 21 Aug 2009

Posts: 154

|

Post: #55  Posted: Wed Dec 15, 2010 8:59 am Post subject: Posted: Wed Dec 15, 2010 8:59 am Post subject: |

|

|

Nice one RT thanks

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #56  Posted: Wed Dec 15, 2010 2:02 pm Post subject: Posted: Wed Dec 15, 2010 2:02 pm Post subject: |

|

|

| yawalkar wrote: | | RoyalTrader wrote: | Dear Yawalkar,

SMART MONEY can not be easily seen on the chart like indicators or overlays.. For that you need to understand the relationship between volume and price,, If you analyse volume and price carefully you can spot what operators are doing.. It is said that in market 95% people loose money and only 5% people gain.. But those 5 % peoples profit = other 95% peoples loss.. as market is a zero sum game...

Knowledge of candlesticks is an added advantage to those who are following VSA (Violume Spread Analysis)..

As per VSA there are 4 phases in the market

1. Accumulation

2. Mark up

3. Distribution

4. Mark down

Some times there may be reaccumulation phase after a mark up..

Seeling climax, Buying climax are also two important concepts in VSA..

I will go step by step to explain this to all...

Watch out this space I will post an example soon...

Regards,

RT |

Thanks RT,

For such a wonderful explanation.

I am very hungry to know the details.

can you suggest me any book or web site for VSA?

And do share your knowlede ASAP. |

Hi,

Read Tom Williams- Master the markets. He has coined the term VSA. Now you can understand it in theory but without a charting software it would be very difficult (but not impossible) to apply.

I differ with RT with regard to knowledge of candlesticks as an added advantage (even though I am BIG learner of it) for VSA. Actually its a disadvantage as VSA does not take into consideration the OPEN PRICE, which is very imp for candlesticks patterns and analysis.

Now why VSA does not take into account the OPEN PRICE? My guess is that Tom Williams wrote the book around 1992 and till that time candlesticks were not as popular as they are today.

Regards,

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #57  Posted: Wed Dec 15, 2010 9:43 pm Post subject: VSA Posted: Wed Dec 15, 2010 9:43 pm Post subject: VSA |

|

|

As commited.. Here comes my first example..

After going through the chart you will become familier with seiiling climax accumulation.. and a break out leading to a mark up...

Any comments, Suggestions doubts are welcome...

Rgards,

RT

| Description: |

|

| Filesize: |

55.87 KB |

| Viewed: |

600 Time(s) |

|

|

|

| Back to top |

|

|

nageswararao_v

White Belt

Joined: 22 Jul 2010

Posts: 54

|

Post: #58  Posted: Thu Dec 16, 2010 12:06 am Post subject: Re: VSA Posted: Thu Dec 16, 2010 12:06 am Post subject: Re: VSA |

|

|

| RoyalTrader wrote: | As commited.. Here comes my first example..

After going through the chart you will become familier with seiiling climax accumulation.. and a break out leading to a mark up...

Any comments, Suggestions doubts are welcome...

Rgards,

RT |

Hi RT,

Can we apply the same theory for intra day? is it suitable?

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #59  Posted: Thu Dec 16, 2010 12:21 am Post subject: Posted: Thu Dec 16, 2010 12:21 am Post subject: |

|

|

yes nageswararao,

It is suitable to all timeframes in all markets.. It is based on law of demand and supply, which is universally applicable..

Regards,

RT

|

|

| Back to top |

|

|

RoyalTrader

White Belt

Joined: 31 Oct 2010

Posts: 75

|

Post: #60  Posted: Thu Dec 16, 2010 8:12 am Post subject: nifty update Posted: Thu Dec 16, 2010 8:12 am Post subject: nifty update |

|

|

Nifty update:

As expected market broke yesteday 5910 and took support at 5865 and closed below 5900..

Now the weakness is clearly visible on charts.. Strength will come back only if there are two hourly closings above 5900..

Otherwise below 5860 targets are 5840,5800,5750,5730,5690..

This time 5690 may not hold out.. Take care...

Regards,

RT

|

|

| Back to top |

|

|

|