|

|

| View previous topic :: View next topic |

| Author |

The Power of Number 44 |

vinay28

Black Belt

Joined: 24 Dec 2010

Posts: 11748

|

Post: #61  Posted: Wed Feb 29, 2012 8:49 pm Post subject: Posted: Wed Feb 29, 2012 8:49 pm Post subject: |

|

|

| If I understood Rameshraja's theory, you can take next lower multiplier(s) of 11 as SL if you want to keep it tight. Am I right, rameshraja?

|

|

| Back to top |

|

|

|

|  |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #62  Posted: Wed Feb 29, 2012 9:13 pm Post subject: Posted: Wed Feb 29, 2012 9:13 pm Post subject: |

|

|

| stejasmehta wrote: | Dear Vinst ,

Then below green next level will be 209 which is black coloured can we use that as sl or we need to take 176 level which is green coloured ?

Actually i m very confused i dont know whether to use green coloured as sl if nifty options closes below green colour ?

Kindly help me |

RR sir suggested to use multiples of 11. But the issue is that for an instrument priced in the range of 150 and above, using SL of 11 is very dicey.

So for 5500PE, I am using multiples of 44 only.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #63  Posted: Thu Mar 01, 2012 9:40 pm Post subject: Posted: Thu Mar 01, 2012 9:40 pm Post subject: |

|

|

| vinst wrote: | Nifty 5500PE closed at 252 on 24-Feb thereby making SL as 176 on closing basis. It has stayed abv its SL as of today end-of -day.

watching it for '44' compliance !! |

1-Mar-2012 :Nifty 5500PE closed at 218, continuing to be above its SL of 176

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #64  Posted: Fri Mar 02, 2012 7:22 pm Post subject: Posted: Fri Mar 02, 2012 7:22 pm Post subject: |

|

|

| vinst wrote: | | vinst wrote: | Nifty 5500PE closed at 252 on 24-Feb thereby making SL as 176 on closing basis. It has stayed abv its SL as of today end-of -day.

watching it for '44' compliance !! |

1-Mar-2012 :Nifty 5500PE closed at 218, continuing to be above its SL of 176 |

2-Mar-2012 :Nifty 5500PE closed at 211, continuing to be above its SL of 176

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #65  Posted: Sat Mar 03, 2012 6:43 pm Post subject: Posted: Sat Mar 03, 2012 6:43 pm Post subject: |

|

|

| vinst wrote: | | vinst wrote: | | vinst wrote: | Nifty 5500PE closed at 252 on 24-Feb thereby making SL as 176 on closing basis. It has stayed abv its SL as of today end-of -day.

watching it for '44' compliance !! |

1-Mar-2012 :Nifty 5500PE closed at 218, continuing to be above its SL of 176 |

2-Mar-2012 :Nifty 5500PE closed at 211, continuing to be above its SL of 176 |

3-Mar-2012 :Nifty 5500PE closed at 205, continuing to be above its SL of 176

|

|

| Back to top |

|

|

kishjk7551

White Belt

Joined: 26 Jan 2008

Posts: 293

|

Post: #66  Posted: Sat Mar 03, 2012 11:26 pm Post subject: Posted: Sat Mar 03, 2012 11:26 pm Post subject: |

|

|

Hi Vinst even 5300CE is moving according to "44 compliance " please check if my understanding is correct

3-Mar-2012 :Nifty 5300CE closed at 210, continuing to be above its SL of 176

Dear Rameshraja please update your latest views , lets keep the thread interactive.

Regards

Jayant

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #67  Posted: Tue Mar 06, 2012 5:29 pm Post subject: Posted: Tue Mar 06, 2012 5:29 pm Post subject: |

|

|

| vinst wrote: | | vinst wrote: | | vinst wrote: | | vinst wrote: | Nifty 5500PE closed at 252 on 24-Feb thereby making SL as 176 on closing basis. It has stayed abv its SL as of today end-of -day.

watching it for '44' compliance !! |

1-Mar-2012 :Nifty 5500PE closed at 218, continuing to be above its SL of 176 |

2-Mar-2012 :Nifty 5500PE closed at 211, continuing to be above its SL of 176 |

3-Mar-2012 :Nifty 5500PE closed at 205, continuing to be above its SL of 176 |

6-Mar-2012 :Nifty 5500PE closed at ~305, revised SL 220 on closing basis.

|

|

| Back to top |

|

|

pvramesh

White Belt

Joined: 01 Jan 2011

Posts: 35

|

Post: #68  Posted: Wed Mar 07, 2012 5:54 am Post subject: Posted: Wed Mar 07, 2012 5:54 am Post subject: |

|

|

| I read all the discussions from the time this topic has started, but still I am confused how with this strategy you can earn a decent or meagre profit. As i understand with all these discussions, more emphasis is laid on where to keep Stop Loss level(which is one less of 44 magic number from chart). Taking example of PE5500, it fluctuated from some 218 level which is above 176 and then it went up around 305 on 6th March, so revised Stop Level 220 on closing basis. This does not give any indication how you can trade PE 5500 from February 24 to 6th March when it reversed down trend to uptrend. except for revised SL from 220 on closing basis. I am very new to the trading and wants to trade with atleast some marginal profit both in uptrens and down trend market. Kindly help how this strategy does this.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #69  Posted: Wed Mar 07, 2012 11:19 am Post subject: Posted: Wed Mar 07, 2012 11:19 am Post subject: |

|

|

| pvramesh wrote: | | I read all the discussions from the time this topic has started, but still I am confused how with this strategy you can earn a decent or meagre profit. As i understand with all these discussions, more emphasis is laid on where to keep Stop Loss level(which is one less of 44 magic number from chart). Taking example of PE5500, it fluctuated from some 218 level which is above 176 and then it went up around 305 on 6th March, so revised Stop Level 220 on closing basis. This does not give any indication how you can trade PE 5500 from February 24 to 6th March when it reversed down trend to uptrend. except for revised SL from 220 on closing basis. I am very new to the trading and wants to trade with atleast some marginal profit both in uptrens and down trend market. Kindly help how this strategy does this. |

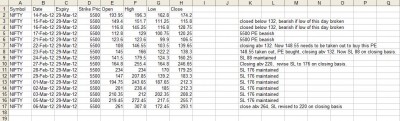

posting one example when a trader is looking to buy the nifty 5500PE.

click the picture for a full size.

| Description: |

|

| Filesize: |

112.21 KB |

| Viewed: |

632 Time(s) |

|

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #70  Posted: Wed Mar 07, 2012 11:57 am Post subject: Posted: Wed Mar 07, 2012 11:57 am Post subject: |

|

|

| pvramesh wrote: | | I read all the discussions from the time this topic has started, but still I am confused how with this strategy you can earn a decent or meagre profit. As i understand with all these discussions, more emphasis is laid on where to keep Stop Loss level(which is one less of 44 magic number from chart). Taking example of PE5500, it fluctuated from some 218 level which is above 176 and then it went up around 305 on 6th March, so revised Stop Level 220 on closing basis. This does not give any indication how you can trade PE 5500 from February 24 to 6th March when it reversed down trend to uptrend. except for revised SL from 220 on closing basis. I am very new to the trading and wants to trade with atleast some marginal profit both in uptrens and down trend market. Kindly help how this strategy does this. |

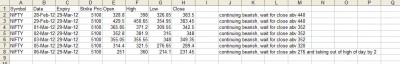

another example of trader wanting to buy 5100CE

| Description: |

|

| Filesize: |

59.79 KB |

| Viewed: |

555 Time(s) |

|

|

|

| Back to top |

|

|

phoneix

White Belt

Joined: 16 Feb 2012

Posts: 21

|

Post: #71  Posted: Wed Mar 07, 2012 12:53 pm Post subject: Posted: Wed Mar 07, 2012 12:53 pm Post subject: |

|

|

| vinst wrote: | | pvramesh wrote: | | I read all the discussions from the time this topic has started, but still I am confused how with this strategy you can earn a decent or meagre profit. As i understand with all these discussions, more emphasis is laid on where to keep Stop Loss level(which is one less of 44 magic number from chart). Taking example of PE5500, it fluctuated from some 218 level which is above 176 and then it went up around 305 on 6th March, so revised Stop Level 220 on closing basis. This does not give any indication how you can trade PE 5500 from February 24 to 6th March when it reversed down trend to uptrend. except for revised SL from 220 on closing basis. I am very new to the trading and wants to trade with atleast some marginal profit both in uptrens and down trend market. Kindly help how this strategy does this. |

posting one example when a trader is looking to buy the nifty 5500PE.

click the picture for a full size. |

I think Vinst, you are so confused that you are not able to understand that POWER OF 44 is completely misguiding & One of the Biggest fact you are not looking into , its OPTION Market not CASH MARKET, can i ask you what would some one do if it closes above 132 on a particular day & if there is a Gap Down opening next day, his entire CAPITAL will be ripped off.

You have bought PUT on 23rd Feb , where the closing price was @138.3 & you are maintaining a STOP LOSS OF 88.

IS THAT A JOKE? FROM 138.3 to 88, are u Billionaire?

Nothing is free in this world & if it is than IT IS NOT WORTH HAVING IT,ITS WORTHLESS. Someone says he has done this & that with so many years & understood 44 as the HOLY GRAIL than my dear , Buy a ticket & flew down to Manhattan, Tons of Analyst are on the Road. Fell Free

|

|

| Back to top |

|

|

jyothi2011

White Belt

Joined: 10 Oct 2011

Posts: 81

|

Post: #72  Posted: Wed Mar 07, 2012 1:06 pm Post subject: why not nearest multiple of 44 Posted: Wed Mar 07, 2012 1:06 pm Post subject: why not nearest multiple of 44 |

|

|

| Mr.Vinst on ur excel chart for 5100 ce u have written on 28.02.12 "continuing bearish wait for close above 440." my question is why 440 instead of nearest multiple of 44 ie 396? pls explain. tks

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #73  Posted: Wed Mar 07, 2012 1:12 pm Post subject: Posted: Wed Mar 07, 2012 1:12 pm Post subject: |

|

|

| phoneix wrote: | | vinst wrote: | | pvramesh wrote: | | I read all the discussions from the time this topic has started, but still I am confused how with this strategy you can earn a decent or meagre profit. As i understand with all these discussions, more emphasis is laid on where to keep Stop Loss level(which is one less of 44 magic number from chart). Taking example of PE5500, it fluctuated from some 218 level which is above 176 and then it went up around 305 on 6th March, so revised Stop Level 220 on closing basis. This does not give any indication how you can trade PE 5500 from February 24 to 6th March when it reversed down trend to uptrend. except for revised SL from 220 on closing basis. I am very new to the trading and wants to trade with atleast some marginal profit both in uptrens and down trend market. Kindly help how this strategy does this. |

posting one example when a trader is looking to buy the nifty 5500PE.

click the picture for a full size. |

I think Vinst, you are so confused that you are not able to understand that POWER OF 44 is completely misguiding & One of the Biggest fact you are not looking into , its OPTION Market not CASH MARKET, can i ask you what would some one do if it closes above 132 on a particular day & if there is a Gap Down opening next day, his entire CAPITAL will be ripped off.

You have bought PUT on 23rd Feb , where the closing price was @138.3 & you are maintaining a STOP LOSS OF 88.

IS THAT A JOKE? FROM 138.3 to 88, are u Billionaire?

Nothing is free in this world & if it is than IT IS NOT WORTH HAVING IT,ITS WORTHLESS. Someone says he has done this & that with so many years & understood 44 as the HOLY GRAIL than my dear , Buy a ticket & flew down to Manhattan, Tons of Analyst are on the Road. Fell Free |

Phoenix,

If i did mistake, then you have pointed out and I thank you for it.

But there is no need for attaching most of the other adjectives.

Besides, I don't expect anyone to put entire capital in one option trade. Such trading shouldn't be done, anyway and by any method.

Now, please tell me , what would you do with '44' and trading in options? please take an example so that i can improve my understanding.

regards,

Last edited by vinst on Wed Mar 07, 2012 1:17 pm; edited 1 time in total |

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #74  Posted: Wed Mar 07, 2012 1:15 pm Post subject: Re: why not nearest multiple of 44 Posted: Wed Mar 07, 2012 1:15 pm Post subject: Re: why not nearest multiple of 44 |

|

|

| jyothi2011 wrote: | | Mr.Vinst on ur excel chart for 5100 ce u have written on 28.02.12 "continuing bearish wait for close above 440." my question is why 440 instead of nearest multiple of 44 ie 396? pls explain. tks |

you are right. 396 should have been taken.

thanks.

|

|

| Back to top |

|

|

pvramesh

White Belt

Joined: 01 Jan 2011

Posts: 35

|

Post: #75  Posted: Wed Mar 07, 2012 7:47 pm Post subject: Posted: Wed Mar 07, 2012 7:47 pm Post subject: |

|

|

dear vinst

It has become more confusing. Pl.clarify the examples you have given: to buy 5100ce, eod on 28th Feb. is 383 which is above 352, Then why not buy? why to wait for 440 close? Had it been brought a decent profit of 450 could have been made. since that time it never went up till today. Lost a golden chance. In another example given by you for buying 5500pe on 22nd Feb. you said 148.55 needs to be taken out and did not buy on that day. What is the meaning of this action?next day 148.55 has been taken out and you boought PE, since it closed above 132. Is it not contradicting your action of not buying 5100CE at 383 which is clearly above 352 and buying 5500PE at 138 because it is above 132? I think if we follow this system probably we may trade 1 or 2 times in a month and if that trades goes against with so much volatality in the market we land up with huge loss. Pl. correct me if i am wrong.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|