|

|

| View previous topic :: View next topic |

| Author |

The Power of Number 44 |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #76  Posted: Wed Mar 07, 2012 8:02 pm Post subject: Posted: Wed Mar 07, 2012 8:02 pm Post subject: |

|

|

| pvramesh wrote: | dear vinst

It has become more confusing. Pl.clarify the examples you have given: to buy 5100ce, eod on 28th Feb. is 383 which is above 352, Then why not buy? why to wait for 440 close? Had it been brought a decent profit of 450 could have been made. since that time it never went up till today. Lost a golden chance. In another example given by you for buying 5500pe on 22nd Feb. you said 148.55 needs to be taken out and did not buy on that day. What is the meaning of this action?next day 148.55 has been taken out and you boought PE, since it closed above 132. Is it not contradicting your action of not buying 5100CE at 383 which is clearly above 352 and buying 5500PE at 138 because it is above 132? I think if we follow this system probably we may trade 1 or 2 times in a month and if that trades goes against with so much volatality in the market we land up with huge loss. Pl. correct me if i am wrong. |

Hello PVramesh,

I looked at 5100CE data from 28Feb so I won't take the trade on that day itself. With '44' levels, I am looking for a change in trend to happen to initiate a trade. I avoided using '44' to jump in some position coming from past. That's why for 5100CE , no trade initiation till 6-mar.

For 5500PE, when from seemingly bearish position, the PE closed abv 132 on 22-Feb (change in position occuring). To take position, the high of trigger day, needs to be taken out by Rs 2. that's why 146.55+2=148.55 is

the buy point (if crossed).

Now coming to the number of trades per month. If we want to have large number of trades, look at large number of strikes. I have looked at 2 strikes only, so naturally, we may have maximum 3-4 trades a month. If an EOD data is leading to 10 trades a month on a single scrip, the method is whipsawing and will likely lead to losses .

Coming to volatility, it always there. we use it as an excuse to desist from trading. If there is no volatility, no stock market.

thanks for raising questions !

regards,

|

|

| Back to top |

|

|

|

|  |

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #77  Posted: Wed Mar 07, 2012 8:27 pm Post subject: Posted: Wed Mar 07, 2012 8:27 pm Post subject: |

|

|

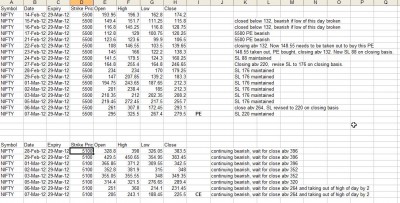

update on trial monitoring of nifty options by using '44' levels:

| Description: |

|

| Filesize: |

180.91 KB |

| Viewed: |

667 Time(s) |

|

|

|

| Back to top |

|

|

forexmoney

Yellow Belt

Joined: 19 Oct 2011

Posts: 851

|

Post: #78  Posted: Fri Mar 09, 2012 8:46 am Post subject: Posted: Fri Mar 09, 2012 8:46 am Post subject: |

|

|

| gm traders,i m new to this forum,kindly help me ...

|

|

| Back to top |

|

|

vikasdangri83

White Belt

Joined: 03 Nov 2010

Posts: 27

|

Post: #79  Posted: Fri Mar 09, 2012 8:23 pm Post subject: Posted: Fri Mar 09, 2012 8:23 pm Post subject: |

|

|

| very good artical on no.44 is a magic no. may be it is possible but if a stock have price 44 then what will stoploss or if i buy a stock almost 88 then my sl will 44 some confusion is behind so pls give some % basis target.thanks your friend vikas dangri.

|

|

| Back to top |

|

|

manass

White Belt

Joined: 21 Sep 2009

Posts: 172

|

Post: #80  Posted: Sat Mar 10, 2012 10:35 am Post subject: Re: The Power of Number 44 Posted: Sat Mar 10, 2012 10:35 am Post subject: Re: The Power of Number 44 |

|

|

| rameshraja wrote: | The Power of Number 44

When I was trading in Nifty Options, I always stumbled upon certain figures which have resisted on several occasions and I missed to book profits at higher levels and finally got out of trades with nominal profits. I was continuously facing this problem for more than couple of years, and mind kept telling me there is something a miss in my trading.

I started to put my head into all my past trades and in hindsight I should have made big gains in most of my trades but ledger showed dismal performance. I was breaking my head, why I was not able to pull the trigger at right time and at right price. Albeit, its impossible to catch the tops and bottoms of market.

While I was looking back at my trades along with Real time chart, I found on many occasions market came to a particular figure and got reversed from thereon. That’s where, I started my research on the behaviour of market.

I started working on Gann teachings of Dividing the Circle by 16 which gives the angle of 22 ½ degrees. Then dividing the Circle by 32 and get the angles and time periods of 11 ¼ degrees and their multiples. Again dividing the Circle by 64 which gives 5 5/8 degrees and their multiples.

I took the lead from the above, and developed my own system of trading based on the above, along with charting analysis.

Look at the worksheet I have attached herewith and see the multiples of Number 44 which are given in Green Colour. When Nifty or any stock closes above any of the multiples of 44 number, then previous multiple of number of 44 becomes Stop on closing basis for going long in market. Reverse is true for short. I have walked through the methodology which I have developed, and its upto you to finetune and see if its workable proposition for you. This is on price front and look at the Time using above numbers and see what happens to market when 44th bar (or any of the numbers given in worksheet) comes into force from swing low or high.

If you are able to find anything unique from this methodology, then you can share with other Forum members.

The only regret I have today, I am able to find many good methodologies after my Donkey’s years of being in market, and of late not able to concentrate more on working methodologies due to poor health and age factor. Had all these are known to me when I was 25 years old, then I would have benefited more from market.

Good Luck !! |

Thanks RR, WONDERFUL THEORY, at least for people like me, who are novice in the market; and also need to earn money with low profile / low profit/ low Risk to balance the ledger without much disturbance.

I'm a fan to VEERA's numbers, at the same time I am happy with his numbers in NF.

Now this 44 theory will help me too.

Both numbers are great.

Thanks once again

Regards

|

|

| Back to top |

|

|

forexmoney

Yellow Belt

Joined: 19 Oct 2011

Posts: 851

|

Post: #81  Posted: Sat Mar 10, 2012 2:31 pm Post subject: Posted: Sat Mar 10, 2012 2:31 pm Post subject: |

|

|

| hi guys,is anybody there tu explain nd discuss this strategy with me now?

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #82  Posted: Sat Mar 10, 2012 8:22 pm Post subject: Posted: Sat Mar 10, 2012 8:22 pm Post subject: |

|

|

| vikasdangri83 wrote: | | very good artical on no.44 is a magic no. may be it is possible but if a stock have price 44 then what will stoploss or if i buy a stock almost 88 then my sl will 44 some confusion is behind so pls give some % basis target.thanks your friend vikas dangri. |

you may use levels at multiples of 11.

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #83  Posted: Sat Mar 10, 2012 8:36 pm Post subject: Posted: Sat Mar 10, 2012 8:36 pm Post subject: |

|

|

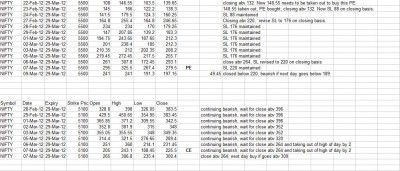

update on trial monitoring of nifty options by using '44' levels:

5500pe closed below SL. position closed as shown in picture.

5100ce closed abv 264 so next day buy above 309.

| Description: |

|

| Filesize: |

161.54 KB |

| Viewed: |

538 Time(s) |

|

|

|

| Back to top |

|

|

acharyams

Yellow Belt

Joined: 04 Jul 2010

Posts: 552

|

Post: #84  Posted: Sat Mar 10, 2012 10:14 pm Post subject: Posted: Sat Mar 10, 2012 10:14 pm Post subject: |

|

|

| vinst wrote: | update on trial monitoring of nifty options by using '44' levels:

5500pe closed below SL. position closed as shown in picture.

5100ce closed abv 264 so next day buy above 309. |

I beg your pardon,

one could have bought 5100 ce on 09.03.2012 when it crossed 245.1 ( 243.1 + 2) because the scrip closed @ 225.5 (i.e above 220) on 07.03.2012 with day high @ 243.1.

WHY DID YOU MENTION THE SAME AS BEARISH CLOSE ON 07.03.2012 though it closed above 220?

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #85  Posted: Sat Mar 10, 2012 10:36 pm Post subject: Posted: Sat Mar 10, 2012 10:36 pm Post subject: |

|

|

| acharyams wrote: | | vinst wrote: | update on trial monitoring of nifty options by using '44' levels:

5500pe closed below SL. position closed as shown in picture.

5100ce closed abv 264 so next day buy above 309. |

I beg your pardon,

one could have bought 5100 ce on 09.03.2012 when it crossed 245.1 ( 243.1 + 2) because the scrip closed @ 225.5 (i.e above 220) on 07.03.2012 with day high @ 243.1.

WHY DID YOU MENTION THE SAME AS BEARISH CLOSE ON 07.03.2012 though it closed above 220? |

since 28th feb, 5100ce has not been able to close above next '44' level as was indicated in picture. The next level for 7th-march was 264 which wasn't overcome on closing basis. 220 is only just as important as other '44' numbers.

|

|

| Back to top |

|

|

acharyams

Yellow Belt

Joined: 04 Jul 2010

Posts: 552

|

Post: #86  Posted: Sat Mar 10, 2012 11:14 pm Post subject: Posted: Sat Mar 10, 2012 11:14 pm Post subject: |

|

|

| vinst wrote: | | acharyams wrote: | | vinst wrote: | update on trial monitoring of nifty options by using '44' levels:

5500pe closed below SL. position closed as shown in picture.

5100ce closed abv 264 so next day buy above 309. |

I beg your pardon,

one could have bought 5100 ce on 09.03.2012 when it crossed 245.1 ( 243.1 + 2) because the scrip closed @ 225.5 (i.e above 220) on 07.03.2012 with day high @ 243.1.

WHY DID YOU MENTION THE SAME AS BEARISH CLOSE ON 07.03.2012 though it closed above 220? |

since 28th feb, 5100ce has not been able to close above next '44' level as was indicated in picture. The next level for 7th-march was 264 which wasn't overcome on closing basis. 220 is only just as important as other '44' numbers. |

One more question ,Sir

Closing price of 5300 ce for 07.03 was 110.3 and for 09.03 it was 159.05 with high of 165.

Is it a BUY on 12.03.2012 above 167 as the same conquered next multiple of 44 i.e 132 on closing basis on 9th March?

|

|

| Back to top |

|

|

Kedarjd

White Belt

Joined: 14 Sep 2010

Posts: 35

|

Post: #87  Posted: Sun Mar 11, 2012 12:14 am Post subject: Posted: Sun Mar 11, 2012 12:14 am Post subject: |

|

|

| Thanks Rameshraja!!!!

|

|

| Back to top |

|

|

forexmoney

Yellow Belt

Joined: 19 Oct 2011

Posts: 851

|

Post: #88  Posted: Sun Mar 11, 2012 11:08 am Post subject: Posted: Sun Mar 11, 2012 11:08 am Post subject: |

|

|

hi rameshraja,i m new to this forum,so i have sum queries is tat,if i buy or sell at any 44 price i.e.in green color,after buy\sell made i have to book profits in partial i.e.11 points or wait for full 44 points profits ,also tell me what about keeping stoploss i.e.11 points or 44 points.while using this sheet of 44 nos,du i have tu use any graphs or candles if yes pls du tell me...waiting fr reply

Last edited by forexmoney on Sun Mar 11, 2012 12:13 pm; edited 1 time in total |

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #89  Posted: Sun Mar 11, 2012 12:02 pm Post subject: Posted: Sun Mar 11, 2012 12:02 pm Post subject: |

|

|

| acharyams wrote: | | vinst wrote: | | acharyams wrote: | | vinst wrote: | update on trial monitoring of nifty options by using '44' levels:

5500pe closed below SL. position closed as shown in picture.

5100ce closed abv 264 so next day buy above 309. |

I beg your pardon,

one could have bought 5100 ce on 09.03.2012 when it crossed 245.1 ( 243.1 + 2) because the scrip closed @ 225.5 (i.e above 220) on 07.03.2012 with day high @ 243.1.

WHY DID YOU MENTION THE SAME AS BEARISH CLOSE ON 07.03.2012 though it closed above 220? |

since 28th feb, 5100ce has not been able to close above next '44' level as was indicated in picture. The next level for 7th-march was 264 which wasn't overcome on closing basis. 220 is only just as important as other '44' numbers. |

One more question ,Sir

Closing price of 5300 ce for 07.03 was 110.3 and for 09.03 it was 159.05 with high of 165.

Is it a BUY on 12.03.2012 above 167 as the same conquered next multiple of 44 i.e 132 on closing basis on 9th March? |

yes, 5300ce is a buy abv 167 on 12-March with SL of 88 on closing basis.

alternatively, one may wait it to retrace to 120-109 band and buy there. However, whether retracement will come or not is a matter to be overcome. All buys should be subject to same SL, i.e. 88, on closing basis.

|

|

| Back to top |

|

|

forexmoney

Yellow Belt

Joined: 19 Oct 2011

Posts: 851

|

Post: #90  Posted: Sun Mar 11, 2012 12:14 pm Post subject: Posted: Sun Mar 11, 2012 12:14 pm Post subject: |

|

|

| hi rameshraja,i m new to this forum,so i have sum queries is tat,if i buy or sell at any 44 price i.e.in green color,after buy\sell made i have to book profits in partial i.e.11 points or wait for full 44 points profits ,also tell me what about keeping stoploss i.e.11 points or 44 points.while using this sheet of 44 nos,du i have tu use any graphs or candles if yes pls du tell me...waiting fr reply

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|