| View previous topic :: View next topic |

| Author |

Trading Divergences... |

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #16  Posted: Thu Mar 04, 2010 9:51 pm Post subject: Posted: Thu Mar 04, 2010 9:51 pm Post subject: |

|

|

rrsekhar,

Try trading divergences in higher timeframe like 30 mins, 60 mins etc., try spotting NVK setups in 5 mins TF (Class B divergences) and u might get good results.

Regards

Ravi

|

|

| Back to top |

|

|

|

|

|

rrsekhar

White Belt

Joined: 21 Feb 2010

Posts: 196

|

Post: #17  Posted: Thu Mar 04, 2010 10:20 pm Post subject: trading divergences Posted: Thu Mar 04, 2010 10:20 pm Post subject: trading divergences |

|

|

| thanx, ravi. i am actually very new to this. will act as per your advice

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

Post: #18  Posted: Fri Mar 05, 2010 3:11 pm Post subject: """THE MAGIC OF BETAS""" Posted: Fri Mar 05, 2010 3:11 pm Post subject: """THE MAGIC OF BETAS""" |

|

|

DEAR SIR,

PLEASE ADD A COLUMN IN THE SCREENER (EOD), A COLUMN SHOWING ""THE BETA VALUE"" OF EACH SCRIP.. THOSE SCRIPS WHOSE ONE YEAR DATA IS AVAILABLE, BETA VALUE WILL BE CALCULATED FOR THEM ONLY TO MAINTAIN THE STANDARDS AND ACCURACY..

ALSO BEFORE CALCULATING THE BETA VALUE ALL THE ADJUSTMENTS TO THE PRICE LIKE SPLIT, BONUS, BUYBACK DIVIDEND ETC ETC SHOULD BE MADE..

A ""BETA VALUE"" DESCRIBES THE RELATIONSHIP BETWEEN THE SCRIP AND THE BENCHMARK INDEX LIKE NIFTY/SENSEX..

INVESTORS SHOULD INVEST IN SCRIPS WITH BETA VALUE RANGING FROM 0.75 TO 1.35

WHILE THE DAY TRADERS SHOULD BUY/SELL SCRIPS WITH HIGHER BETA VALUE ABOVE 1.0 (ONE) IN ORDER TO HAVE MORE VOLATILITY/MOVEMENT IN BOTH UP AND DOWN SIDE..

THANKS A LOT,

SIDDHARTH

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #19  Posted: Mon Mar 08, 2010 11:24 pm Post subject: Posted: Mon Mar 08, 2010 11:24 pm Post subject: |

|

|

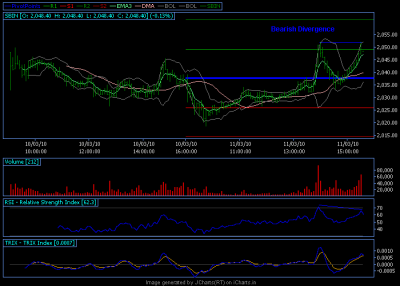

Class C Bearish Divergence in ACC... Lets see if the price comes down..

| Description: |

|

| Filesize: |

16.23 KB |

| Viewed: |

587 Time(s) |

|

|

|

| Back to top |

|

|

dgvikram

White Belt

Joined: 14 May 2009

Posts: 5

|

Post: #20  Posted: Thu Mar 11, 2010 11:59 pm Post subject: Please See if it is spotted correctly Posted: Thu Mar 11, 2010 11:59 pm Post subject: Please See if it is spotted correctly |

|

|

Hi Ravi,

I spotted this divergence in daily 5 min chart. Have I spotted it correctly so I can straightway take a short position next morning or there has to be some sort of conformation. Pls help

Regards

Bikram

| Description: |

|

| Filesize: |

24.77 KB |

| Viewed: |

646 Time(s) |

|

|

|

| Back to top |

|

|

SID2060

White Belt

Joined: 04 Nov 2009

Posts: 319

|

|

| Back to top |

|

|

SnoopTrade

White Belt

Joined: 01 Jun 2009

Posts: 56

|

Post: #22  Posted: Sat Mar 13, 2010 8:21 pm Post subject: Re: """THE MAGIC OF BETAS""" Posted: Sat Mar 13, 2010 8:21 pm Post subject: Re: """THE MAGIC OF BETAS""" |

|

|

Hi ST/PT,

I was hoping if these could be moved to a new post or any topic which may be relevant to "Beta"otherwise I am seeing lot of threads in the future getting hijacked/diverted from the original topic. I think it would be great service to these wonderful forum and the people who might be searching/reading for information and knowledge, if all the post relevant to a particular thread are in order.

I hope you will look into this....

Sorry if I sound very rude. I am very sad and disappointed...

Thanks n Regards,

mave_rick

| SID2060 wrote: | | SID2060 wrote: | DEAR SIR,

PLEASE ADD A COLUMN IN THE SCREENER (EOD), A COLUMN SHOWING ""THE BETA VALUE"" OF EACH SCRIP.. THOSE SCRIPS WHOSE ONE YEAR DATA IS AVAILABLE, BETA VALUE WILL BE CALCULATED FOR THEM ONLY TO MAINTAIN THE STANDARDS AND ACCURACY..

ALSO BEFORE CALCULATING THE BETA VALUE ALL THE ADJUSTMENTS TO THE PRICE LIKE SPLIT, BONUS, BUYBACK DIVIDEND ETC ETC SHOULD BE MADE..

A ""BETA VALUE"" DESCRIBES THE RELATIONSHIP BETWEEN THE SCRIP AND THE BENCHMARK INDEX LIKE NIFTY/SENSEX..

INVESTORS SHOULD INVEST IN SCRIPS WITH BETA VALUE RANGING FROM 0.75 TO 1.35

WHILE THE DAY TRADERS SHOULD BUY/SELL SCRIPS WITH HIGHER BETA VALUE ABOVE 1.0 (ONE) IN ORDER TO HAVE MORE VOLATILITY/MOVEMENT IN BOTH UP AND DOWN SIDE..

THANKS A LOT,

SIDDHARTH

|

PLZ DOWNLOAD THE ATTACHED PDF FILE. MUST DOWNLOAD. VERY USEFUL SHOWING THE CORRELATION BETWEEN ALL THE INTERNATIONAL STOCK MARKET...... |

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #23  Posted: Wed Mar 17, 2010 7:13 pm Post subject: Posted: Wed Mar 17, 2010 7:13 pm Post subject: |

|

|

SEE THE POWER OF DIVERGENCE.

regds

| Description: |

|

| Filesize: |

13.77 KB |

| Viewed: |

713 Time(s) |

|

|

|

| Back to top |

|

|

sandew

White Belt

Joined: 02 Feb 2009

Posts: 174

|

Post: #24  Posted: Wed Mar 17, 2010 9:43 pm Post subject: Request Posted: Wed Mar 17, 2010 9:43 pm Post subject: Request |

|

|

SherBaaz, hi

Is this a weekly chart and what is RSI parameter, please

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

Post: #25  Posted: Thu Mar 18, 2010 3:46 pm Post subject: Posted: Thu Mar 18, 2010 3:46 pm Post subject: |

|

|

Divergence trading in 60 min Tf in Canara Bank future.

| Description: |

|

| Filesize: |

12.4 KB |

| Viewed: |

647 Time(s) |

|

|

|

| Back to top |

|

|

sunrays

White Belt

Joined: 19 Dec 2009

Posts: 71

|

Post: #26  Posted: Thu Mar 18, 2010 4:30 pm Post subject: Posted: Thu Mar 18, 2010 4:30 pm Post subject: |

|

|

| Gud work sherbaaz n ravi

|

|

| Back to top |

|

|

rvg

White Belt

Joined: 31 Oct 2006

Posts: 279

|

Post: #27  Posted: Thu Mar 18, 2010 5:02 pm Post subject: Thanks Posted: Thu Mar 18, 2010 5:02 pm Post subject: Thanks |

|

|

Good work Sherbaaz / Ravi...

Sher.. we don't see you on the SB these days...

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #28  Posted: Thu Mar 18, 2010 9:51 pm Post subject: Trading Divergences Posted: Thu Mar 18, 2010 9:51 pm Post subject: Trading Divergences |

|

|

Hi Baaz

Long time no see, Howz your Aussie trip? Need a small clarification on this...

While trading divergence, if it's a NVK setup (Class B) we can easily take entry as we have a double bottom formed. However in Class A, how do you decide on the entry, there is every possibility that the price may come down (as in the case of Canara Bank) further. Do you use candlesticks as well to decide on the entry, in this case we have a Hammer and a doji together. What is the kind of SL you trade with, since it's futures, we cannot have a huge SL.

Regards

Ravi

|

|

| Back to top |

|

|

sherbaaz

Yellow Belt

Joined: 27 May 2009

Posts: 543

|

|

| Back to top |

|

|

Ravi_S

Yellow Belt

Joined: 15 Jun 2009

Posts: 569

|

Post: #30  Posted: Fri Mar 19, 2010 9:09 am Post subject: Posted: Fri Mar 19, 2010 9:09 am Post subject: |

|

|

Hi baaz

Doing good these days... Need to scan through Mr. Stevie Nison again to learn candlesticks... Would do so when time permits...

Ravi...

|

|

| Back to top |

|

|

|