| View previous topic :: View next topic |

| Author |

TRADING THE BREAKOUTS: Positional Longs only |

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #1  Posted: Sun Jan 03, 2016 2:55 pm Post subject: TRADING THE BREAKOUTS: Positional Longs only Posted: Sun Jan 03, 2016 2:55 pm Post subject: TRADING THE BREAKOUTS: Positional Longs only |

|

|

Starting this thread to trade breakouts in the stocks, all trades will be long only with medium term perspective. Post will be as and when opportunity presents itself and funds are available for investment

The setup is taken from freely available material from the internet and the credit goes to respective Authors and initial few charts are their creation this fact is acknowledged. I shall post charts from Indian stocks to make my point.

Happy Trading !

SHEKHAR

|

|

| Back to top |

|

|

|

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #2  Posted: Sun Jan 03, 2016 3:15 pm Post subject: Posted: Sun Jan 03, 2016 3:15 pm Post subject: |

|

|

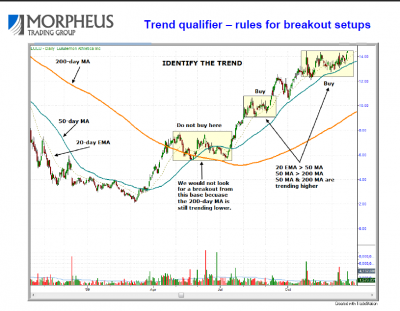

SETUP

Before a stock makes our breakout “watch-list,†it must satisfy

two key criteria:

Stock must be in a clear and distinct uptrend

Stock must have a valid basing pattern

Stocks must be in a clear and distinct uptrend, as follows:

ô€º 20â€day EMA must be trading at or near the 50â€day MA when the stock

is forming a base and clearly above the 50â€day MA when in trend

mode. For pullback trades, the 20â€day EMA must be above the 50â€day

MA.

ô€º 20â€day EMA must be above the 200â€day MA

ô€º 50â€day MA must be above the 200â€day MA

ô€º Both the 50 and 200â€day MAs must be in a clear uptrend for at least a

few months.

ô€º The price action should be in an uptrend with a series of higher highs

and higher lows in place over the past 3 †6 months (at the very least).

ô€º Current price should at least be 30 †40% above the 52â€week low.

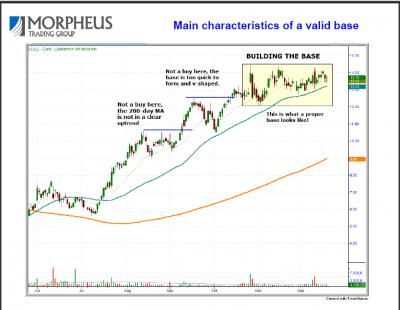

Stocks must have a valid basing pattern

ô€º A base (or zone of congestion) is anywhere from 1 month to 1

year in length. For our style of trading, we prefer bases that form

in a 1 - 3 month period that find and hold support of the 50-day

MA.

ô€º We want to see “tight†price action in the base, especially during

the last two weeks before the breakout.

ô€º A valid base should pullback anywhere from 10 - 30% off the

swing high. Once a stock retraces 40 - 50% or more, we begin to

question the strength of the uptrend.

ô€º We must see a “higher low†form within the base. This is crucial

to the pattern. Without a higher low forming, we have no way to

set a stop and therefore can not define the risk.

ô€º Volume should be declining during a base, or at the very least, not

heavier than average. If there are too many days of heavy

volume selling in a base, the base could be faulty.

NB: ST/ PT I have purposefully not deleted name of the trading group from the charts to acknowledge their work. I am not connected to them in any manner what so ever.

| Description: |

|

| Filesize: |

63.03 KB |

| Viewed: |

693 Time(s) |

|

| Description: |

|

| Filesize: |

46.04 KB |

| Viewed: |

661 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #3  Posted: Sun Jan 03, 2016 3:22 pm Post subject: Posted: Sun Jan 03, 2016 3:22 pm Post subject: |

|

|

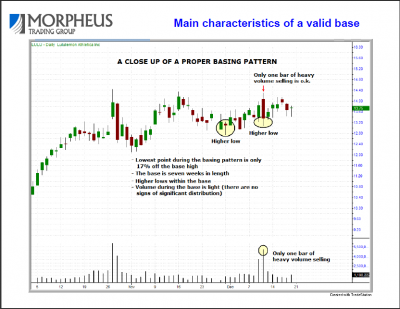

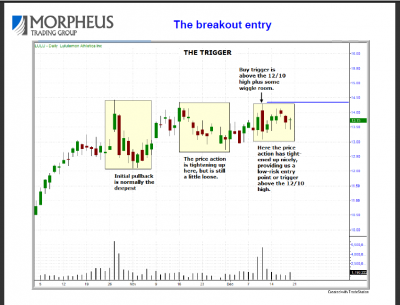

A close look into the Basing Pattern and Breakout Entry

| Description: |

|

| Filesize: |

50.56 KB |

| Viewed: |

659 Time(s) |

|

| Description: |

|

| Filesize: |

43.65 KB |

| Viewed: |

605 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

|

| Back to top |

|

|

shaheerzaman

White Belt

Joined: 05 Aug 2014

Posts: 93

|

Post: #5  Posted: Sun Jan 03, 2016 8:22 pm Post subject: Posted: Sun Jan 03, 2016 8:22 pm Post subject: |

|

|

Shekhar,

Thanks for starting such a nice thread. All the best.

I read the setup. For the below chart of igrasahi motors, i think you should wait for the 50 day MA to turn up. Right now its flat.

Thanks

Shaheer

|

|

| Back to top |

|

|

S.S.

White Belt

Joined: 09 Feb 2011

Posts: 241

|

Post: #6  Posted: Wed Jan 06, 2016 7:12 pm Post subject: Posted: Wed Jan 06, 2016 7:12 pm Post subject: |

|

|

long trigeer in igarashi shekhar ????

| shekharinvest wrote: | Here is the chart of Igarashi Motors I shall be keeping an eye on, in the coming days.

That's enough work for a day

Happy Trading

SHEKHAR  |

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #7  Posted: Thu Jan 07, 2016 10:35 am Post subject: Posted: Thu Jan 07, 2016 10:35 am Post subject: |

|

|

| S.S. wrote: | long trigeer in igarashi shekhar ????

| shekharinvest wrote: | Here is the chart of Igarashi Motors I shall be keeping an eye on, in the coming days.

That's enough work for a day

Happy Trading

SHEKHAR  |

|

Yes Long triggered above 665 close SL is quite low at 551. I did entered above 665 but came out in the closing hours because it lost the significant gains it made in the day and SL was far away, shall look for fresh entry and possibly smaller SL.

Keep an Eye.

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

|

| Back to top |

|

|

|