|

|

| View previous topic :: View next topic |

| Author |

Trend Determination Methodolgy for Nifty and Stocks |

vishyvaranasi

Green Belt

Joined: 11 Jul 2011

Posts: 1159

|

Post: #16  Posted: Sun Feb 05, 2012 1:21 pm Post subject: Posted: Sun Feb 05, 2012 1:21 pm Post subject: |

|

|

| vinst wrote: | RR sir,

I want to take an example of DLF with data of week 23-Jan to 27-Jan-2012 to generate levels.

levels were to be traded in week 30-Jan to 3-Feb-2012.

Open High L ow Close

DLF 214.00 225.40 212.00 212.9

Trend Direction ----> 224.08 207.52

As trading began, DLF broke below 207.5.

We wait it to come up to 0.382 level on bearish side : 210.7 and short with SL at 0.236 level of bearish side which was 212.7.

Shorting level came and SL was triggered as DLF crossed abv 213.

Now to take the reversal trade on long side, should we wait for DLF to fall to 0.5 level of bearish side (which was 209.1) ? |

Hi Vinst,

Yeah u were perfect actually i was also of the same view of asking rameshraja with an example. I too had gonne thru some stocks but all that i had tested didnt brk the levels at all. So it will b fine if o csn explain with an example

|

|

| Back to top |

|

|

|

|  |

sairanga19

White Belt

Joined: 28 Nov 2009

Posts: 51

|

Post: #17  Posted: Sun Feb 05, 2012 1:48 pm Post subject: Posted: Sun Feb 05, 2012 1:48 pm Post subject: |

|

|

dear sir, your methodolgy itself shows your hard working, i want to through some more insight regarding price spreads ,price spread should be interpruted with volume,if price spread wide with expanding volume shows some professional activity i mean if the candle is green then any conscutive red candle with low volume shows little selling happening and u can expect higher prices. this interpretion can be applied to ur method if price breaks 61.8percent with good volume and spread, any retracing candle testing 38.2percent with low volume and low spread can be considered for bullish momentem, a green candle close above that low spread may be considered as buy, keeping sl below that previous candle,

thanks

|

|

| Back to top |

|

|

vishyvaranasi

Green Belt

Joined: 11 Jul 2011

Posts: 1159

|

Post: #18  Posted: Sun Feb 05, 2012 2:22 pm Post subject: Posted: Sun Feb 05, 2012 2:22 pm Post subject: |

|

|

| vishyvaranasi wrote: | | vinst wrote: | RR sir,

I want to take an example of DLF with data of week 23-Jan to 27-Jan-2012 to generate levels.

levels were to be traded in week 30-Jan to 3-Feb-2012.

Open High L ow Close

DLF 214.00 225.40 212.00 212.9

Trend Direction ----> 224.08 207.52

As trading began, DLF broke below 207.5.

We wait it to come up to 0.382 level on bearish side : 210.7 and short with SL at 0.236 level of bearish side which was 212.7.

Shorting level came and SL was triggered as DLF crossed abv 213.

Now to take the reversal trade on long side, should we wait for DLF to fall to 0.5 level of bearish side (which was 209.1) ? |

Hi Vinst,

by the way where did u get those lvls from . my lvls for DLF 23-27 jan are 214.05-224.5-20.80-211.60. so the trsading lvls r 220.07-203.13

Yeah u were perfect actually i was also of the same view of asking rameshraja with an example. I too had gonne thru some stocks but all that i had tested didnt brk the levels at all. So it will b fine if o csn explain with an example |

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #19  Posted: Sun Feb 05, 2012 2:32 pm Post subject: Posted: Sun Feb 05, 2012 2:32 pm Post subject: |

|

|

| vishyvaranasi wrote: | | vishyvaranasi wrote: | | vinst wrote: | RR sir,

I want to take an example of DLF with data of week 23-Jan to 27-Jan-2012 to generate levels.

levels were to be traded in week 30-Jan to 3-Feb-2012.

Open High L ow Close

DLF 214.00 225.40 212.00 212.9

Trend Direction ----> 224.08 207.52

As trading began, DLF broke below 207.5.

We wait it to come up to 0.382 level on bearish side : 210.7 and short with SL at 0.236 level of bearish side which was 212.7.

Shorting level came and SL was triggered as DLF crossed abv 213.

Now to take the reversal trade on long side, should we wait for DLF to fall to 0.5 level of bearish side (which was 209.1) ? |

Hi Vinst,

by the way where did u get those lvls from . my lvls for DLF 23-27 jan are 214.05-224.5-20.80-211.60. so the trsading lvls r 220.07-203.13

Yeah u were perfect actually i was also of the same view of asking rameshraja with an example. I too had gonne thru some stocks but all that i had tested didnt brk the levels at all. So it will b fine if o csn explain with an example |

|

I take data from NSE website. I have re-checked my data and found it to be correct.

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #20  Posted: Sun Feb 05, 2012 2:43 pm Post subject: Posted: Sun Feb 05, 2012 2:43 pm Post subject: |

|

|

Mr Vinst

Yes, you can enter reversal Long trade at 0.236 and add again at 0.50 and keep Stop few ticks below 0.618. For risk averse traders, its better to wait for pullback around 0.50 to have entry.

|

|

| Back to top |

|

|

vishyvaranasi

Green Belt

Joined: 11 Jul 2011

Posts: 1159

|

Post: #21  Posted: Sun Feb 05, 2012 2:45 pm Post subject: Re: Trend Determination Methodolgy for Nifty and Stocks Posted: Sun Feb 05, 2012 2:45 pm Post subject: Re: Trend Determination Methodolgy for Nifty and Stocks |

|

|

| rameshraja wrote: | Trend Determination Methodolgy

I use this simple method to find the trend of the market, be it Nifty or stocks. I use this simple statistical output as an additional tool to my Chart Analysis to find likely Support and Resistance Levels and its not Grail.

I use End of the day data for daily trading and use weekly and Monthly datas for Swing trading.

Let me explain below, an example for Day Trading and same method can be used for Weekly and Monthly, for Swing Trading:

I take Previous Day Open / High / Low / Close of officially announced figure from Exchange.

Weighted Average = (HIGH + LOW+ CLOSE +CLOSE ) DIVIDED by 4.

Spread : High Minus Low.

To calculate,likely Support and Resistance Levels, the following ratios of Fibonacci to be used.

13 / 23.60 / 38.20 / 50 /61.80 / 78.60 / 88.60 / 1.00 / 1.130 / 1.236 / 1.382 / 1.500 / 1.618 / 2 / 2.236 / 2.618 / 3.140 / 3.618 / 4.236

Calculation:

Spread multiplied by all the above ratios and added to Weighted Average. This will give different Levels of Resistance and when deducted from Weighted Average it will give Various Support levels of above ratios.

How to use the above Levels:

Nifty or Stock has the tendency to face stiff resistance around 23.60% and by stretching it can move to 38.2% and 50%. So also, will try taking Support at these levels on downside. The trend of the day will be determined when it breaks 61.80%.

If it breaks 61.80% of Resistance Level, then wait for the market to pullback to 38.20% and make Long entry with Stop placed a few ticks below 23.60%. and look for Targets of 1 to 1.382 and 1.618 of Expansion Levels. If the day, happens to be very bullish/ bearish, it can move to 2 and above ratios.

Same is exactly true for Shorting the Nifty or Stocks when it breaks 61.80% with the above mentioned method for long entry.

What if Stop of 23.60% stop is takenout:

I quit the trade once if Stop is takenout, and look for bounce to 50% ratio, to takeup reversal trade and go along with the flow of market, taking stop at few ticks above 61.8% or look at chart to keep Stop.

Once when stop of 23.60% is takenout, Market has the tendency to bounce once again closer to 50% and move to test Weighted Average Price and the levels on the otherside.

When you have these levels along with Chart, you will invariably find market facing resistance and Support at 38.2% and it will not be so easy to clear 61.80% so easily, as one of the breeds “BULL or BEAR” need to wrest control for the direction of trend.

During the day, if market doesn’t break 61.80% on anyside, then I assume market is in sideways and whenever it happened like this, I have only incurred loss on that in my trading as my trades get locked in stops.

I use 5 minutes chart with 125 SMA and 30 minutes chart with 34 EMA. I invariably find the Support or Resistance coming closer to 38.2% and wait for breakout.

Spread is a vast subject and fairly very accurate methodologies can be derived and no Professional trader across the Globe speak about this in any public domain and their Spread methodologies are kept close to their heart.

I have explained to you a simple methodology using the Spread, and there are very powerful methods using the Spread can be done.

I use the above method for Day Trading and I use weekly and Monthly data for Swing Trading.

Trade Well and follow the trend !!

|

Hi Ramesh,

Itll be vry much helpful if u can explain the reversa trade strategy once again. Also, explaining with an example of the ways to trade will be vry much helpfull for all followig this. Tat steel as per your strategy had tested a sell from the 23-27 figures. The next week SL is broken and then had got comnfused abt ur reversal trade. so the case with DLF. pl. explain with an example

|

|

| Back to top |

|

|

umesh1

Brown Belt

Joined: 24 Nov 2008

Posts: 1974

|

Post: #22  Posted: Sun Feb 05, 2012 2:58 pm Post subject: Posted: Sun Feb 05, 2012 2:58 pm Post subject: |

|

|

| rameshraja wrote: | Mr Vinay

Typing error in the the text only. Excel Sheet working is correct. I have given open figure in excel sheet to have reference of previous day open, but for purpose of calculation, open is not considered.

To your other querry, Close to be taken twice to arrive at weighted Average.

I am repeating again. Calculation for Weighted Average = (HIGH+LOW+CLOSE+CLOSE)/4

I am sorry .. to have troubled you all. |

RameshSir,

Thanks for clarification,For applying same on intraday as for fridays levels spread wasTrend Direction 5312.00 5228.45

But after nifty crossed 5312.00 it has not retraced back to 0.5 (5304) or 0.38(5296)

so in that case theres no entry as per strategy even though nifty range was good for the day,or any other strategy along with it to be folowed for intra day

Regards

Umesh

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #23  Posted: Sun Feb 05, 2012 2:59 pm Post subject: Posted: Sun Feb 05, 2012 2:59 pm Post subject: |

|

|

Mr Sairanga

Spread is a fantastic tool to trade if you develop your own methodology. Its a powerful one if you could find some method to takeup trades.

On a given day of the trade, if Nifty advances by entire spread of the previous day from current day's low, then it normally tend to close at highest level. and if it declines by entire spread of previous day from current day's High, then it may endup with lowest close.

Example: 23-01-2012 Nifty OHLC

5034.00 5062.30 5034.00 5051.05. The spread on that day was 28.30 points.

On 24.01.2012, the low of Nifty Future 5048.60.. and if you add this spread of previous day 28.30 to 5048.60, you will get 5076.90. When NF crossed this 5077 on that day, it blasted to 5149.50 and closed at 5120.45.

Another interesting fact about spread, the day when it breaks spread value like on 24.01.2012 and closed in green, next day it will not break the previous day low 90% of time. And reverse is true when previous day spread breaks from day's high.

Many methodologies are there using spread values. Higher the time frame, it works awesome .. You can check this weekly and Monthly datas.

|

|

| Back to top |

|

|

rameshraja

Expert

Joined: 24 Nov 2006

Posts: 1121

|

Post: #24  Posted: Sun Feb 05, 2012 3:12 pm Post subject: Posted: Sun Feb 05, 2012 3:12 pm Post subject: |

|

|

Mr Umesh

Yours and Mr Vinst querry are same. Thats why I said, if you can take risk, then enter at 0.236 and add on pullback around 0.500. Last Friday, was an exception as it broke the 0.618 value around 2 P.M. and didn't have the time for market to pullback to around 0.500 and it wanted to moveup on momentum.

9.15 to 9.30 AM and 1.30 to 2 PM are very important in a day's trading. Both Bars are very vital for day's trading. the bar 9.15 to 9.30 filters all overnight global and local news / events and 1.30 to 2 PM bar decides on close of the market.

Best Wishes

|

|

| Back to top |

|

|

umesh1

Brown Belt

Joined: 24 Nov 2008

Posts: 1974

|

Post: #25  Posted: Sun Feb 05, 2012 3:34 pm Post subject: Posted: Sun Feb 05, 2012 3:34 pm Post subject: |

|

|

| rameshraja wrote: | Mr Umesh

Yours and Mr Vinst querry are same. Thats why I said, if you can take risk, then enter at 0.236 and add on pullback around 0.500. Last Friday, was an exception as it broke the 0.618 value around 2 P.M. and didn't have the time for market to pullback to around 0.500 and it wanted to moveup on momentum.

9.15 to 9.30 AM and 1.30 to 2 PM are very important in a day's trading. Both Bars are very vital for day's trading. the bar 9.15 to 9.30 filters all overnight global and local news / events and 1.30 to 2 PM bar decides on close of the market.

Best Wishes |

Ramesh Sir

Thanks for it,I agree with you ,yes exceptions are always there and friday was one of it,your strategy will definitely give a boost to gann and ema50 which i have been following for intraday.I shall try the same with other liquid stocks.

Regards

Umesh

|

|

| Back to top |

|

|

umesh1

Brown Belt

Joined: 24 Nov 2008

Posts: 1974

|

Post: #26  Posted: Sun Feb 05, 2012 3:37 pm Post subject: Posted: Sun Feb 05, 2012 3:37 pm Post subject: |

|

|

| umesh1 wrote: | | rameshraja wrote: | Mr Umesh

Yours and Mr Vinst querry are same. Thats why I said, if you can take risk, then enter at 0.236 and add on pullback around 0.500. Last Friday, was an exception as it broke the 0.618 value around 2 P.M. and didn't have the time for market to pullback to around 0.500 and it wanted to moveup on momentum.

9.15 to 9.30 AM and 1.30 to 2 PM are very important in a day's trading. Both Bars are very vital for day's trading. the bar 9.15 to 9.30 filters all overnight global and local news / events and 1.30 to 2 PM bar decides on close of the market.

Best Wishes |

Ramesh Sir

Thanks for it,I agree with you ,yes exceptions are always there and friday was one of it,your strategy will definitely give a boost for intraday traders like me.I shall try the same with other liquid stocks.

Regards

Umesh |

|

|

| Back to top |

|

|

ajeya12

White Belt

Joined: 30 Oct 2011

Posts: 132

|

Post: #27  Posted: Sun Feb 05, 2012 4:14 pm Post subject: Re: Trend Determination Methodolgy for Nifty and Stocks Posted: Sun Feb 05, 2012 4:14 pm Post subject: Re: Trend Determination Methodolgy for Nifty and Stocks |

|

|

| rameshraja wrote: | Trend Determination Methodolgy

I use this simple method to find the trend of the market, be it Nifty or stocks. I use this simple statistical output as an additional tool to my Chart Analysis to find likely Support and Resistance Levels and its not Grail.

I use End of the day data for daily trading and use weekly and Monthly datas for Swing trading.

Let me explain below, an example for Day Trading and same method can be used for Weekly and Monthly, for Swing Trading:

I take Previous Day Open / High / Low / Close of officially announced figure from Exchange.

Weighted Average = (HIGH + LOW+ CLOSE +CLOSE ) DIVIDED by 4.

Spread : High Minus Low.

To calculate,likely Support and Resistance Levels, the following ratios of Fibonacci to be used.

13 / 23.60 / 38.20 / 50 /61.80 / 78.60 / 88.60 / 1.00 / 1.130 / 1.236 / 1.382 / 1.500 / 1.618 / 2 / 2.236 / 2.618 / 3.140 / 3.618 / 4.236

Calculation:

Spread multiplied by all the above ratios and added to Weighted Average. This will give different Levels of Resistance and when deducted from Weighted Average it will give Various Support levels of above ratios.

How to use the above Levels:

Nifty or Stock has the tendency to face stiff resistance around 23.60% and by stretching it can move to 38.2% and 50%. So also, will try taking Support at these levels on downside. The trend of the day will be determined when it breaks 61.80%.

If it breaks 61.80% of Resistance Level, then wait for the market to pullback to 38.20% and make Long entry with Stop placed a few ticks below 23.60%. and look for Targets of 1 to 1.382 and 1.618 of Expansion Levels. If the day, happens to be very bullish/ bearish, it can move to 2 and above ratios.

Same is exactly true for Shorting the Nifty or Stocks when it breaks 61.80% with the above mentioned method for long entry.

What if Stop of 23.60% stop is takenout:

I quit the trade once if Stop is takenout, and look for bounce to 50% ratio, to takeup reversal trade and go along with the flow of market, taking stop at few ticks above 61.8% or look at chart to keep Stop.

Once when stop of 23.60% is takenout, Market has the tendency to bounce once again closer to 50% and move to test Weighted Average Price and the levels on the otherside.

When you have these levels along with Chart, you will invariably find market facing resistance and Support at 38.2% and it will not be so easy to clear 61.80% so easily, as one of the breeds “BULL or BEAR” need to wrest control for the direction of trend.

During the day, if market doesn’t break 61.80% on anyside, then I assume market is in sideways and whenever it happened like this, I have only incurred loss on that in my trading as my trades get locked in stops.

I use 5 minutes chart with 125 SMA and 30 minutes chart with 34 EMA. I invariably find the Support or Resistance coming closer to 38.2% and wait for breakout.

Spread is a vast subject and fairly very accurate methodologies can be derived and no Professional trader across the Globe speak about this in any public domain and their Spread methodologies are kept close to their heart.

I have explained to you a simple methodology using the Spread, and there are very powerful methods using the Spread can be done.

I use the above method for Day Trading and I use weekly and Monthly data for Swing Trading.

Trade Well and follow the trend !!

|

Ramesh raja ji,

Very good ,successful technique u have shared with us, the fellow traders...but this comes with experience. hats off u shared

Last edited by ajeya12 on Sun Feb 05, 2012 4:16 pm; edited 1 time in total |

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #28  Posted: Sun Feb 05, 2012 4:16 pm Post subject: Posted: Sun Feb 05, 2012 4:16 pm Post subject: |

|

|

Mr. Ramesh,

Nice to see you here again in the forum after a long time. Welcome back!!!

Regards.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #29  Posted: Sun Feb 05, 2012 4:50 pm Post subject: Posted: Sun Feb 05, 2012 4:50 pm Post subject: |

|

|

| rameshraja wrote: | Mr Vinst

Yes, you can enter reversal Long trade at 0.236 and add again at 0.50 and keep Stop few ticks below 0.618. For risk averse traders, its better to wait for pullback around 0.50 to have entry. |

RR sir, thanks.

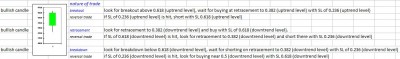

I am attaching a picture of 3 scenarios to enter a trade after a stock makes a bullish candle. Please check if these scenarios are correct.

please click on the picture to view full size.

| Description: |

|

| Filesize: |

61.29 KB |

| Viewed: |

706 Time(s) |

|

|

|

| Back to top |

|

|

vinst

Black Belt

Joined: 09 Jan 2007

Posts: 3303

|

Post: #30  Posted: Sun Feb 05, 2012 4:59 pm Post subject: Posted: Sun Feb 05, 2012 4:59 pm Post subject: |

|

|

| sairanga19 wrote: | dear sir, your methodolgy itself shows your hard working, i want to through some more insight regarding price spreads ,price spread should be interpruted with volume,if price spread wide with expanding volume shows some professional activity i mean if the candle is green then any conscutive red candle with low volume shows little selling happening and u can expect higher prices. this interpretion can be applied to ur method if price breaks 61.8percent with good volume and spread, any retracing candle testing 38.2percent with low volume and low spread can be considered for bullish momentem, a green candle close above that low spread may be considered as buy, keeping sl below that previous candle,

thanks    |

sairanga,

thanks for further insight.

complex to follow for 'volume' beginner like me.

Kept for future use.

|

|

| Back to top |

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You can attach files in this forum

You can download files in this forum

|

Powered by phpBB © 2001, 2005 phpBB Group

|

|

|