| View previous topic :: View next topic |

| Author |

WW ON EOD CHARTS |

ian_botham47

White Belt

Joined: 09 May 2007

Posts: 12

|

Post: #601  Posted: Thu Jan 30, 2014 8:36 pm Post subject: Posted: Thu Jan 30, 2014 8:36 pm Post subject: |

|

|

| Would anybody pl. enlighten where i can find about ww pattern and trading on the basis of the same?

|

|

| Back to top |

|

|

|

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #602  Posted: Thu Jan 30, 2014 9:34 pm Post subject: Posted: Thu Jan 30, 2014 9:34 pm Post subject: |

|

|

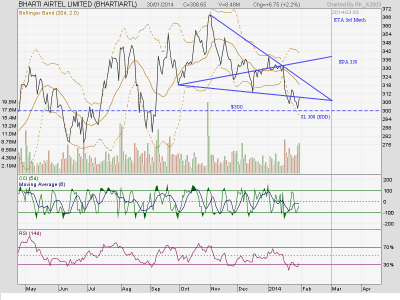

BHARTIARTL chart. Self explanatory.

| Description: |

|

| Filesize: |

108.9 KB |

| Viewed: |

547 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

|

| Back to top |

|

|

amitkbaid1008

Yellow Belt

Joined: 04 Mar 2009

Posts: 540

|

Post: #604  Posted: Fri Jan 31, 2014 12:00 am Post subject: Posted: Fri Jan 31, 2014 12:00 am Post subject: |

|

|

| rk_a2003 wrote: | | BHARTIARTL chart. Self explanatory. |

rk_a2003

Not an expert like you

But for WW charts should be bar/candle and not line chart

What is looking perfect in this line chart is blurred on candlestick chart due to non existence of swings which are shown in line chart

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #605  Posted: Fri Jan 31, 2014 12:07 am Post subject: Posted: Fri Jan 31, 2014 12:07 am Post subject: |

|

|

RK / Amit : let me guess how to trade Bharti:

1) down sloping channel from 318 with 309 as top [about current price]

2) buy "only" above 310.85 for target 315, 319

3) -ww on 15tf targeting 304-303 pending...

4) all stops at 302.5

5) it can be a quick entry and exit candidate if market +ve since it would be above 311 then......

6) i believe all profit booking should be done at 314.5/315 and may be 318 since it would not rise but fall back...

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #606  Posted: Fri Jan 31, 2014 7:34 am Post subject: Posted: Fri Jan 31, 2014 7:34 am Post subject: |

|

|

Amitkbaid, It's ok to find ww's in line charts.In any case you should be able to find the wave structure formed based on supply-demand variations.Some times it's quite revealing in line charts as in case of Bhartiartl.In that case nothing wrong in using line charts.Just for your information.... my first drawings on any chart beginned with I charts forum.I am no expert.It demands much more to be called an expert.

Amitagg, there are so many ways to trade ww's.What ever you feel comfortable you can proceed with that.I haven't checked 15 minute -ww .Will revert if I find any thing significant in 15 minute.

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #607  Posted: Fri Jan 31, 2014 9:24 am Post subject: Posted: Fri Jan 31, 2014 9:24 am Post subject: |

|

|

| bought barti at 313 futures [311 spot]...having small exit SL and target

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #608  Posted: Fri Jan 31, 2014 9:34 am Post subject: Posted: Fri Jan 31, 2014 9:34 am Post subject: |

|

|

| amitagg wrote: | | bought barti at 313 futures [311 spot]...having small exit SL and target |

now 312 futures can be close stop....good risk reward 1:3...to exit before 316 futures....

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #609  Posted: Fri Jan 31, 2014 9:44 am Post subject: Posted: Fri Jan 31, 2014 9:44 am Post subject: |

|

|

| amitagg wrote: | | amitagg wrote: | | bought barti at 313 futures [311 spot]...having small exit SL and target |

now 312 futures can be close stop....good risk reward 1:3...to exit before 316 futures.... |

crux time ...about to break up or down...stop to 312.5....exit on spike

|

|

| Back to top |

|

|

amitagg

Black Belt

Joined: 01 Oct 2013

Posts: 4559

|

Post: #610  Posted: Fri Jan 31, 2014 9:54 am Post subject: Posted: Fri Jan 31, 2014 9:54 am Post subject: |

|

|

| amitagg wrote: | | amitagg wrote: | | amitagg wrote: | | bought barti at 313 futures [311 spot]...having small exit SL and target |

now 312 futures can be close stop....good risk reward 1:3...to exit before 316 futures.... |

crux time ...about to break up or down...stop to 312.5....exit on spike |

otherwise weak since rises sold....can exit at 1: 1 profit...or trail to cost

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #611  Posted: Thu Feb 06, 2014 2:13 pm Post subject: Posted: Thu Feb 06, 2014 2:13 pm Post subject: |

|

|

AUROPHARMA -ww .Today is the result day.ETA Feb 12th .EPA 400.If a bearish candle forms today go short with day's high as SL. Alternatively one can buy puts also.

| Description: |

|

| Filesize: |

65.69 KB |

| Viewed: |

520 Time(s) |

|

|

|

| Back to top |

|

|

deepakms

White Belt

Joined: 13 Aug 2009

Posts: 194

|

Post: #612  Posted: Mon Feb 10, 2014 10:42 am Post subject: Posted: Mon Feb 10, 2014 10:42 am Post subject: |

|

|

BATAINDIA -WW on EOD.

Bata is also trading at a resistance zone of 986.

| Description: |

|

| Filesize: |

80.51 KB |

| Viewed: |

513 Time(s) |

|

|

|

| Back to top |

|

|

chandrujimrc

Brown Belt

Joined: 21 Apr 2009

Posts: 1683

|

Post: #613  Posted: Mon Feb 10, 2014 8:56 pm Post subject: Posted: Mon Feb 10, 2014 8:56 pm Post subject: |

|

|

India vix Eod +ww..Longs be cautious.

| Description: |

|

| Filesize: |

29.75 KB |

| Viewed: |

481 Time(s) |

|

|

|

| Back to top |

|

|

deepakms

White Belt

Joined: 13 Aug 2009

Posts: 194

|

Post: #614  Posted: Thu Feb 13, 2014 10:41 am Post subject: Posted: Thu Feb 13, 2014 10:41 am Post subject: |

|

|

McDowell -WW

| Description: |

|

| Filesize: |

39.93 KB |

| Viewed: |

473 Time(s) |

|

|

|

| Back to top |

|

|

rk_a2003

Black Belt

Joined: 21 Jan 2010

Posts: 2734

|

Post: #615  Posted: Thu Feb 20, 2014 3:15 pm Post subject: Posted: Thu Feb 20, 2014 3:15 pm Post subject: |

|

|

| A -ww in Apollo Tyres EOD chart.One can buy puts for a possible target of around 115 by expiry.

|

|

| Back to top |

|

|

|