| View previous topic :: View next topic |

| From which Method early trend change should get found |

| Moving Averages |

|

16% |

[ 31 ] |

| Indicators |

|

11% |

[ 22 ] |

| Candelstics |

|

33% |

[ 63 ] |

| Mov Avg with Indicators |

|

21% |

[ 40 ] |

| Breakout Trading |

|

17% |

[ 34 ] |

|

| Total Votes : 190 |

|

| Author |

How to catch early TREND REVERSAL |

systrader

White Belt

Joined: 25 Apr 2013

Posts: 129

|

Post: #1  Posted: Sat Feb 01, 2014 12:28 pm Post subject: How to catch early TREND REVERSAL Posted: Sat Feb 01, 2014 12:28 pm Post subject: How to catch early TREND REVERSAL |

|

|

There are various indicators and Moving averages Like MACD, STS, ATR SMA, EMA, DMA, WMA It seems often that they are lagging in nature and the main trend is judged/ catched only after the trend end's or about to end leads to significant loss or minor profit. So what is the solution for that Is there any possibility to catch the trend as it starts/Ends ?????

The answer:-

YES

But How?????

and which among them to given more importance.........

Views are welcomed.

|

|

| Back to top |

|

|

|

|

|

newinvestor

White Belt

Joined: 16 Feb 2010

Posts: 120

|

Post: #2  Posted: Sat Feb 01, 2014 3:36 pm Post subject: Posted: Sat Feb 01, 2014 3:36 pm Post subject: |

|

|

Its a good topic to discuss.

I have found RSI divergence as a good indication of a chance for reversal.

Also, candlestics ( Hammer etc) and candlestick patterns ( evening star, morning star etc)

|

|

| Back to top |

|

|

ktpillai

White Belt

Joined: 23 Nov 2007

Posts: 95

|

Post: #3  Posted: Sat Feb 01, 2014 5:29 pm Post subject: Re: How to catch early TREND REVERSAL Posted: Sat Feb 01, 2014 5:29 pm Post subject: Re: How to catch early TREND REVERSAL |

|

|

| systrader wrote: | There are various indicators and Moving averages Like MACD, STS, ATR SMA, EMA, DMA, WMA It seems often that they are lagging in nature and the main trend is judged/ catched only after the trend end's or about to end leads to significant loss or minor profit. So what is the solution for that Is there any possibility to catch the trend as it starts/Ends ?????

Yes,everybody says go with the trend but nobody is able to say whether the trend is bullish or bearish.

The answer:-

YES

But How?????

and which among them to given more importance.........

Views are welcomed. |

|

|

| Back to top |

|

|

Rebel

White Belt

Joined: 04 Sep 2013

Posts: 387

|

Post: #4  Posted: Sat Feb 01, 2014 8:01 pm Post subject: Posted: Sat Feb 01, 2014 8:01 pm Post subject: |

|

|

systrader,

i would like to add an option named heikin-ashi candle patterns.just plot them and try yourself....it helps alot to catch trends virtually.

|

|

| Back to top |

|

|

systrader

White Belt

Joined: 25 Apr 2013

Posts: 129

|

Post: #5  Posted: Sat Feb 01, 2014 9:52 pm Post subject: HELP NEW ONE Posted: Sat Feb 01, 2014 9:52 pm Post subject: HELP NEW ONE |

|

|

Please feel free to write which will help more and more new traders..

Its personal choice to adapt any one (These are which I personally experienced)

Moving Avg are lagging by nature they signals breakout and gives confirmation after moving few points and if market moves in range bound they leads to triggering SL many times they only helps when the market is in trending phase. another ones will be discussed step by step if any one have any doubt/query feel free to write/comment......

you can try any Mov Avg if it is smaller then leads to noice/useless and if higher enough early trend reversal catching is not possible. If you use smaller Mov Avg for catching the early reversal which may actually prove the retracement level.

However half of total Traders would use Movg avg for trading.

|

|

| Back to top |

|

|

preetsd

White Belt

Joined: 20 Jun 2013

Posts: 2

|

Post: #6  Posted: Sat Feb 01, 2014 10:43 pm Post subject: Price as a best indicator Posted: Sat Feb 01, 2014 10:43 pm Post subject: Price as a best indicator |

|

|

you have use some indicators in combination and observe what is happening with its price

but you gotta statistically tets the indicator back on time and then only you can confirm

[CONTENT REMOVED BY ADMIN]

|

|

| Back to top |

|

|

systrader

White Belt

Joined: 25 Apr 2013

Posts: 129

|

Post: #7  Posted: Sat Feb 01, 2014 11:34 pm Post subject: Mov Avg and Draw back Posted: Sat Feb 01, 2014 11:34 pm Post subject: Mov Avg and Draw back |

|

|

CHECK IT

| Description: |

|

Download |

| Filename: |

Movg Avg working.doc |

| Filesize: |

130 KB |

| Downloaded: |

1609 Time(s) |

|

|

| Back to top |

|

|

SwingTrader

Site Admin

Joined: 11 Aug 2006

Posts: 2903

Location: Hyderabad, India

|

Post: #8  Posted: Sun Feb 02, 2014 8:01 am Post subject: Posted: Sun Feb 02, 2014 8:01 am Post subject: |

|

|

preetsd,

Your forum access has been removed for posting your company advertisement.

_________________

Srikanth Kurdukar

@SwingTrader |

|

| Back to top |

|

|

pkholla

Black Belt

Joined: 04 Nov 2010

Posts: 2890

|

Post: #9  Posted: Sun Feb 02, 2014 9:41 am Post subject: Posted: Sun Feb 02, 2014 9:41 am Post subject: |

|

|

systrader: there is an IC provided indicator in J Ch Premium which is called DMA: displaced moving average.

Try the settings 8 periods MA and 3 periods displacement to the LEFT. Either arith or expon will do as per your appetite.

When the DMA cuts into the price line then trend is less and it MAY be an alert for you to exit the trade

Always use with other indicator/s that you trust

Prakash Holla

|

|

| Back to top |

|

|

drsureshbs

White Belt

Joined: 22 Oct 2008

Posts: 58

|

Post: #10  Posted: Sun Feb 02, 2014 1:57 pm Post subject: Posted: Sun Feb 02, 2014 1:57 pm Post subject: |

|

|

| Rebel wrote: | systrader,

i would like to add an option named heikin-ashi candle patterns.just plot them and try yourself....it helps alot to catch trends virtually. |

sir can u eloborate a little bit pl

|

|

| Back to top |

|

|

Rebel

White Belt

Joined: 04 Sep 2013

Posts: 387

|

Post: #11  Posted: Sun Feb 02, 2014 2:00 pm Post subject: Posted: Sun Feb 02, 2014 2:00 pm Post subject: |

|

|

| drsureshbs wrote: | | Rebel wrote: | systrader,

i would like to add an option named heikin-ashi candle patterns.just plot them and try yourself....it helps alot to catch trends virtually. |

sir can u eloborate a little bit pl |

drsureshbs,

heikin ashi is a type of candle stick that reflect trends clearly,just google it for more info.

|

|

| Back to top |

|

|

saumya12

Brown Belt

Joined: 21 Dec 2011

Posts: 1509

|

Post: #12  Posted: Mon Feb 03, 2014 12:14 am Post subject: Posted: Mon Feb 03, 2014 12:14 am Post subject: |

|

|

| Rebel wrote: | | drsureshbs wrote: | | Rebel wrote: | systrader,

i would like to add an option named heikin-ashi candle patterns.just plot them and try yourself....it helps alot to catch trends virtually. |

sir can u eloborate a little bit pl |

drsureshbs,

heikin ashi is a type of candle stick that reflect trends clearly,just google it for more info. |

Hi

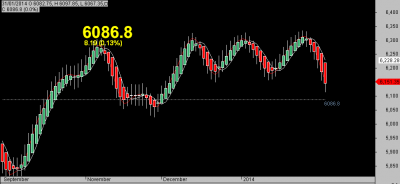

Posting below an Heiken Asji chart of NIFTY in daily tf

Can you please elaborate how to study it.

Thanks

| Description: |

|

| Filesize: |

23.97 KB |

| Viewed: |

1129 Time(s) |

|

|

|

| Back to top |

|

|

yoginishreyas

White Belt

Joined: 03 Dec 2012

Posts: 80

|

Post: #13  Posted: Mon Feb 03, 2014 9:02 am Post subject: Posted: Mon Feb 03, 2014 9:02 am Post subject: |

|

|

Hello,

This is good topic to discuss, new traders like me find it very difficult initially to plot where to enter or exit.

I draw my conclusion to enter at crossover of moving averages but it did not work when price move sideways but then in such cases I need to pivot points to find out s/l or entry point.

Personally i believe that their is nothing called perfect set up, if your strategy gives 60-70% probability then it is best strategy after all investment in stocks IS subject to market risk but then your logic works best in such cases. Main focus should be to earn much more returns then your bank can offer you without wiping out your coral capital.

If you don't bet, you can't win. If you lose all your chips, you can't bet.

Regards

Shreyas

|

|

| Back to top |

|

|

systrader

White Belt

Joined: 25 Apr 2013

Posts: 129

|

Post: #14  Posted: Wed Feb 05, 2014 12:13 pm Post subject: What is Fun for using Mov Avg on long TF Posted: Wed Feb 05, 2014 12:13 pm Post subject: What is Fun for using Mov Avg on long TF |

|

|

Moving Average Failure instead of gain it lead to loss Various indicators will be discussed step by step........ However Moving average have gained only 8% vote means lesser number of people are using them..

| Description: |

|

Download |

| Filename: |

Mov Avg not working.doc |

| Filesize: |

132.5 KB |

| Downloaded: |

859 Time(s) |

|

|

| Back to top |

|

|

singh.ravee

Yellow Belt

Joined: 12 Aug 2010

Posts: 678

|

Post: #15  Posted: Wed Feb 05, 2014 5:09 pm Post subject: Posted: Wed Feb 05, 2014 5:09 pm Post subject: |

|

|

as per my limited knowledge, price structure helps in catching trend early.

|

|

| Back to top |

|

|

|