| View previous topic :: View next topic |

| Author |

RUNNING WITH THE WOLVES |

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #1  Posted: Wed Feb 17, 2010 12:14 pm Post subject: RUNNING WITH THE WOLVES Posted: Wed Feb 17, 2010 12:14 pm Post subject: RUNNING WITH THE WOLVES |

|

|

Hi,

Recently got interested in Wolves Waves, studied a bit and found that this too is a good setup just like the one presented by Saikat namely NVK.

WW are easy to identify and easier to trade and it gives TGTs as well. The only issue is to find them.

I am posting by way of cut-paste from another forum some basic info about WW. This is regarding the simplest form of WW's. Hope people will find it interesting and follow up with their views and charts depicting WW wherever and whenever they happen to notice.

SHEKHAR

| Description: |

|

| Filesize: |

22.96 KB |

| Viewed: |

2854 Time(s) |

|

|

|

| Back to top |

|

|

|

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #2  Posted: Wed Feb 17, 2010 12:31 pm Post subject: Posted: Wed Feb 17, 2010 12:31 pm Post subject: |

|

|

quote

The Wolfwave is a natural pattern found in all of today’s markets. Its basic shape represents a struggle for balance between supply and demand in effort to reach equilibrium. This naturally occurring pattern was not invented but discovered as a means to predicting levels of supply and demand. The pattern itself is very versatile in terms of time length. Wolfwaves occur in a wide range of time frames such as minutes or even as long as weeks or months. The pattern is very accurate in predicting future price ceilings and bottoms when identified correctly. When correctly identified Wolfwaves are quite possibly the most effective trading technique in existence today.

The overriding factor in identifying the Wolfwave pattern is symmetry. As show below, the most accurate patterns exist where waves 1-3-5 have equal timing intervals between wave cycles.

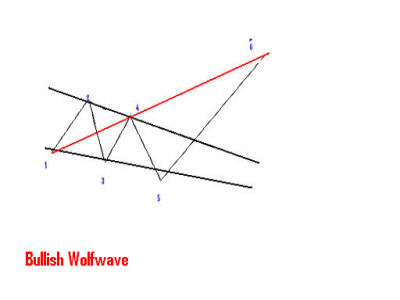

Figure 1: Bullish Wolfwave Pattern

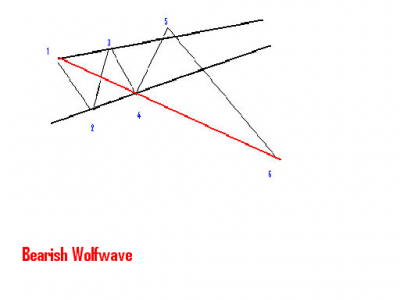

Figure 2: Bearish Wolfwave Pattern

Key Ingredients:

• Waves 3-4 must stay within the channel created by 1-2

• 1-2 = 3-4 (Symmetry)

• Wave 4 revisits the established channel of points1-2

• Regular timing intervals

• Waves 3 & 5 are usually 127% or 162% extensions of the previous point

Found In:

• Rising channels in an uptrend

• Falling channels in a downtrend

• Level channels during consolidation periods

Notice that point 5 shown on the diagram above is a move slightly above or below the channel created by waves 1-2 & 3-4. This move is usually a false breakout or breakdown of the original channel and is the best place to enter a stock long or short. The false action at point 5 occurs most of the time in the pattern but isn’t absolutely necessary. Point 6 is the target level from point 5 and is the most profitable part of the Wolfwave channel pattern. The target price (Point 6) is found by connecting points 1 and 4.

Here are a few examples of the pattern at work. Remember, Point 5 is an opportunity to take action with a short or long position while Point 6 is the target price.

To reinstate a key point that was touched on earlier. The reason this channeling technique is considered advanced lies in the difficulty of identifying the Wolfwave pattern itself. The hardest part of the pattern is identification. Determining the target price (point 6) is given for you. If the Wolfwave pattern is correctly identified, risk is cut substantially while profit potential is high.

In attempting to learn any trading strategy be sure to paper trade potential Wolfwave setups to gain experience and confidence before putting money behind the setup. Also remember to use stops in order to lessen risk when going live.

unquote

| Description: |

|

| Filesize: |

31.21 KB |

| Viewed: |

1715 Time(s) |

|

| Description: |

|

| Filesize: |

27.81 KB |

| Viewed: |

1584 Time(s) |

|

|

|

| Back to top |

|

|

sredhar

White Belt

Joined: 19 Jan 2008

Posts: 26

|

Post: #3  Posted: Wed Feb 17, 2010 2:48 pm Post subject: Wolfwave in Praj Posted: Wed Feb 17, 2010 2:48 pm Post subject: Wolfwave in Praj |

|

|

Hi Shekar,

Good to see that you have comeup with a new learning material.

Based on what you have added here, i browsed few charts and found that Praj had the Bearish Wave. Am attaching the chart.

Pls check and confirm if it indeed a WolfWave that we have started to discuss about.

Thanks

| Description: |

|

| Filesize: |

18.78 KB |

| Viewed: |

1943 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #4  Posted: Wed Feb 17, 2010 6:27 pm Post subject: Posted: Wed Feb 17, 2010 6:27 pm Post subject: |

|

|

Thnx, sredhar for posting.

Wave posted by you is a bit complex form of WW, met its targets. You need to draw the lines differently.

I intend to follow simplest wave, as was depicted in the daigram.

In Prajind I found a WW which currently running. Here also it is not exactly as per definition as the slope is slightly upwards in a downtrend. If ppl have seen my posting in SW thread it is exactly as the wave found on NF.

Stock was in downtrend and is consolidating now.

Can we pass it off as a level channel in consolidation ? Only the time will tell.

One can take entry here as the price has reentered the channel.

SHEKHAR

| Description: |

|

| Filesize: |

29.89 KB |

| Viewed: |

1769 Time(s) |

|

|

|

| Back to top |

|

|

src4771

White Belt

Joined: 02 Sep 2009

Posts: 1

|

Post: #5  Posted: Wed Feb 17, 2010 8:08 pm Post subject: Posted: Wed Feb 17, 2010 8:08 pm Post subject: |

|

|

dear shekharinvest,

Please check the ww drawn on nifty chart (15min), and give your opinion on this.

thanks.

| Description: |

|

Download |

| Filename: |

nf 17-2-10.doc |

| Filesize: |

82.5 KB |

| Downloaded: |

1503 Time(s) |

|

|

| Back to top |

|

|

sredhar

White Belt

Joined: 19 Jan 2008

Posts: 26

|

Post: #6  Posted: Wed Feb 17, 2010 8:53 pm Post subject: WW wave Posted: Wed Feb 17, 2010 8:53 pm Post subject: WW wave |

|

|

Hi Shekar,

Thanks for yr reply and insight.

I can see what you mean.

Can you advise how you are able to view Daily chart as you have illustrated for Praj. I dont get this using the EOD J charts.

Pls help.

Regards

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #7  Posted: Sat Feb 20, 2010 3:50 pm Post subject: Posted: Sat Feb 20, 2010 3:50 pm Post subject: |

|

|

src4771

Nicely drawn, seems likely, and probably moving down to its target as well - now as I write the post.

SHEKHAR

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #8  Posted: Sat Feb 20, 2010 3:55 pm Post subject: Posted: Sat Feb 20, 2010 3:55 pm Post subject: |

|

|

Hi,

Untill we find WW which can be traded.

Here is a bit of more cut paste.

Wedges arent the same as WWs, not even close...

WW's are slightly converging in channels unlike the wedge which forms an apex.

WW needs near perfect symmetry and timing...wedges have no target (1-4 line)

Wedges also dont have a point 5 or 6.

They dont have points 1,2,3,4 either...

Wedges are trend reversal indicators; ww's are not.

Wedges contain no measured moves.

Wedges rely on breakouts at the apex..

Wedges rely on balance while WW's rely on imbalance.

WW's work in almost any timeframe!

Most importantly, WW's (when correctly identified) have the highest success rate of any known trading pattern. (90%+)

I could go on and on...

SHEKHAR

| Description: |

|

| Filesize: |

20.5 KB |

| Viewed: |

1572 Time(s) |

|

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #9  Posted: Sat Feb 20, 2010 5:34 pm Post subject: Posted: Sat Feb 20, 2010 5:34 pm Post subject: |

|

|

Hi,

I have found a WW which has already run more than half of its course. Only if we could find one at point 5 !

Look at the the symmetry, nicely formed wave.

SHEKHAR

| Description: |

|

| Filesize: |

52.68 KB |

| Viewed: |

1441 Time(s) |

|

|

|

| Back to top |

|

|

girishhu1

White Belt

Joined: 17 Aug 2009

Posts: 316

|

Post: #10  Posted: Sun Feb 21, 2010 8:55 am Post subject: RUNNING WITH WOLVES Posted: Sun Feb 21, 2010 8:55 am Post subject: RUNNING WITH WOLVES |

|

|

HI SHEKHARJI,

I M ENCLOSING NEYVELLI CHART PL COMMENT FOR WW PATTERN, IF ANY.

| Description: |

|

| Filesize: |

64.87 KB |

| Viewed: |

1458 Time(s) |

|

|

|

| Back to top |

|

|

deepakpm82

White Belt

Joined: 17 Jan 2010

Posts: 14

|

Post: #11  Posted: Sun Feb 21, 2010 6:51 pm Post subject: Posted: Sun Feb 21, 2010 6:51 pm Post subject: |

|

|

Hi girish.. from the picture(Bullish wave) earlier posted , i assume for an upward breakout accoriding to wolfwave theory the current direction should be bearish. In this Neyveli chart, its already in an upward run a for a long time with UP/DOWN periodically.

I doubt , doesnt this chart form a double bottom? Waiting for valuable comments from seniors.

I m very new to this technical world, so waiting for all ur response.

Thanx

Deepak

|

|

| Back to top |

|

|

deepakpm82

White Belt

Joined: 17 Jan 2010

Posts: 14

|

Post: #12  Posted: Sun Feb 21, 2010 6:54 pm Post subject: Posted: Sun Feb 21, 2010 6:54 pm Post subject: |

|

|

| Again one more doubt.. doesnt it look like the begining of a "head and shoulders" pattern? So may be after a few lower trading session it may turn out to bullihs mode?!!

|

|

| Back to top |

|

|

shekharinvest

Yellow Belt

Joined: 21 Dec 2007

Posts: 549

|

Post: #13  Posted: Mon Feb 22, 2010 1:19 pm Post subject: Re: RUNNING WITH WOLVES Posted: Mon Feb 22, 2010 1:19 pm Post subject: Re: RUNNING WITH WOLVES |

|

|

| girishhu1 wrote: | HI SHEKHARJI,

I M ENCLOSING NEYVELLI CHART PL COMMENT FOR WW PATTERN, IF ANY. |

No,

SHEKHAR

|

|

| Back to top |

|

|

sredhar

White Belt

Joined: 19 Jan 2008

Posts: 26

|

Post: #14  Posted: Mon Feb 22, 2010 10:32 pm Post subject: WW in Tata steel Posted: Mon Feb 22, 2010 10:32 pm Post subject: WW in Tata steel |

|

|

Hi Shekar

Confirm this setup in Tatasteel pls.

Thanks

| Description: |

|

| Filesize: |

14.66 KB |

| Viewed: |

1443 Time(s) |

|

|

|

| Back to top |

|

|

rajamani

White Belt

Joined: 19 Sep 2008

Posts: 11

|

Post: #15  Posted: Tue Feb 23, 2010 10:30 am Post subject: Posted: Tue Feb 23, 2010 10:30 am Post subject: |

|

|

is this correct WW projection

senior `s kindly give me your views

regards

rajamani

| Description: |

|

| Filesize: |

34.7 KB |

| Viewed: |

1415 Time(s) |

|

|

|

| Back to top |

|

|

|